正在加载图片...

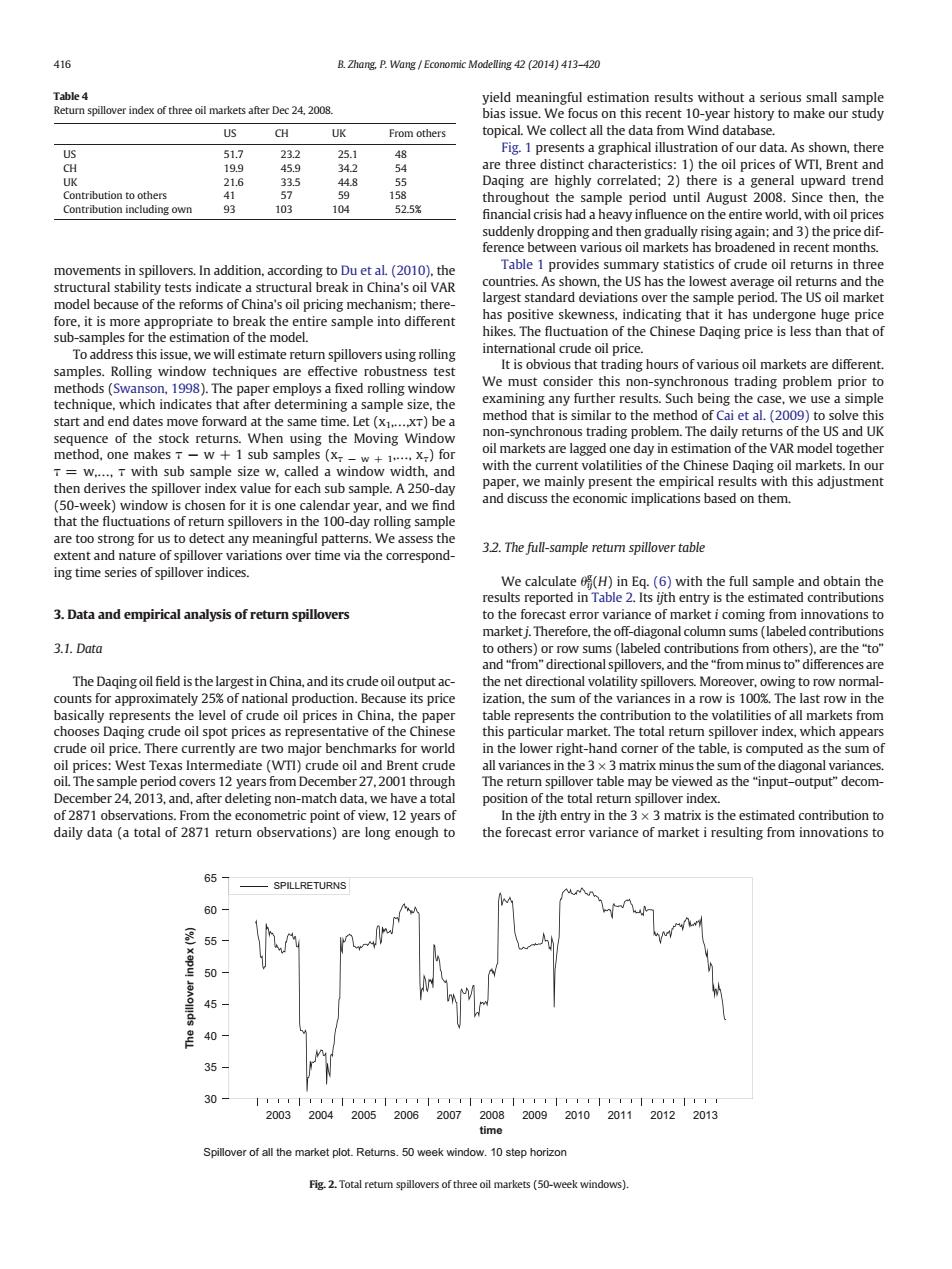

416 B.Zhang.P.Wang Economic Modelling 42 (2014)413-420 Table4 yield meaningful estimation results without a serious small sample Return spillover index of three oil markets after Dec 24.2008. bias issue.We focus on this recent 10-year history to make our study 你 CH UK From others topical.We collect all the data from Wind database US 51.7 23.2 25.1 48 Fig.1 presents a graphical illustration of our data.As shown,there CH 19.9 45.9 34.2 54 are three distinct characteristics:1)the oil prices of WTI,Brent and UK 21.6 33.5 448 55 Daqing are highly correlated:2)there is a general upward trend Contribution to others 41 57 59 158 throughout the sample period until August 2008.Since then,the Contribution including own 93 103 104 52.5% financial crisis had a heavy influence on the entire world,with oil prices suddenly dropping and then gradually rising again;and 3)the price dif- ference between various oil markets has broadened in recent months. movements in spillovers.In addition,according to Du et al.(2010),the Table 1 provides summary statistics of crude oil returns in three structural stability tests indicate a structural break in China's oil VAR countries.As shown,the US has the lowest average oil returns and the model because of the reforms of China's oil pricing mechanism;there- largest standard deviations over the sample period.The US oil market fore,it is more appropriate to break the entire sample into different has positive skewness,indicating that it has undergone huge price sub-samples for the estimation of the model. hikes.The fluctuation of the Chinese Daqing price is less than that of To address this issue,we will estimate return spillovers using rolling international crude oil price. samples.Rolling window techniques are effective robustness test It is obvious that trading hours of various oil markets are different. methods (Swanson,1998).The paper employs a fixed rolling window We must consider this non-synchronous trading problem prior to technique,which indicates that after determining a sample size,the examining any further results.Such being the case,we use a simple start and end dates move forward at the same time.Let (x1....xT)be a method that is similar to the method of Cai et al.(2009)to solve this sequence of the stock returns.When using the Moving Window non-synchronous trading problem.The daily returns of the US and UK method,one makes T-w 1 sub samples (x -w+1.....x)for oil markets are lagged one day in estimation of the VAR model together =w.....T with sub sample size w.called a window width,and with the current volatilities of the Chinese Daging oil markets.In our then derives the spillover index value for each sub sample.A 250-day paper,we mainly present the empirical results with this adjustment (50-week)window is chosen for it is one calendar year,and we find and discuss the economic implications based on them that the fluctuations of return spillovers in the 100-day rolling sample are too strong for us to detect any meaningful patterns.We assess the extent and nature of spillover variations over time via the correspond- 3.2.The full-sample return spillover table ing time series of spillover indices. We calculate (H)in Eq.(6)with the full sample and obtain the results reported in Table 2.Its ijth entry is the estimated contributions 3.Data and empirical analysis of return spillovers to the forecast error variance of market i coming from innovations to market j.Therefore,the off-diagonal column sums(labeled contributions 3.1.Data to others)or row sums(labeled contributions from others),are the "to" and "from"directional spillovers,and the "from minus to"differences are The Daging oil field is the largest in China,and its crude oil output ac- the net directional volatility spillovers.Moreover,owing to row normal- counts for approximately 25%of national production.Because its price ization,the sum of the variances in a row is 100%.The last row in the basically represents the level of crude oil prices in China,the paper table represents the contribution to the volatilities of all markets from chooses Daqing crude oil spot prices as representative of the Chinese this particular market.The total return spillover index,which appears crude oil price.There currently are two major benchmarks for world in the lower right-hand corner of the table,is computed as the sum of oil prices:West Texas Intermediate (WTl)crude oil and Brent crude all variances in the 3 x 3 matrix minus the sum of the diagonal variances. oil.The sample period covers 12 years from December 27,2001 through The return spillover table may be viewed as the "input-output"decom- December 24,2013,and,after deleting non-match data,we have a total position of the total return spillover index. of 2871 observations.From the econometric point of view,12 years of In the ijth entry in the 3 x 3 matrix is the estimated contribution to daily data (a total of 2871 return observations)are long enough to the forecast error variance of market i resulting from innovations to 65 SPILLRETURNS 60 55 50 45 40 35 30 T1111111111111111111111111111 2003 2004”200520062007200820092010201120122013 time Spillover of all the market plot.Retums.50 week window.10 step horizon Fig.2.Total retumn spillovers of three oil markets(50-week windows).movements in spillovers. In addition, according to Du et al. (2010), the structural stability tests indicate a structural break in China's oil VAR model because of the reforms of China's oil pricing mechanism; therefore, it is more appropriate to break the entire sample into different sub-samples for the estimation of the model. To address this issue, we will estimate return spillovers using rolling samples. Rolling window techniques are effective robustness test methods (Swanson, 1998). The paper employs a fixed rolling window technique, which indicates that after determining a sample size, the start and end dates move forward at the same time. Let (x1,…,xτ) be a sequence of the stock returns. When using the Moving Window method, one makes τ − w + 1 sub samples (xτ − w+1,…, xτ) for τ = w,…, τ with sub sample size w, called a window width, and then derives the spillover index value for each sub sample. A 250-day (50-week) window is chosen for it is one calendar year, and we find that the fluctuations of return spillovers in the 100-day rolling sample are too strong for us to detect any meaningful patterns. We assess the extent and nature of spillover variations over time via the corresponding time series of spillover indices. 3. Data and empirical analysis of return spillovers 3.1. Data The Daqing oil field is the largest in China, and its crude oil output accounts for approximately 25% of national production. Because its price basically represents the level of crude oil prices in China, the paper chooses Daqing crude oil spot prices as representative of the Chinese crude oil price. There currently are two major benchmarks for world oil prices: West Texas Intermediate (WTI) crude oil and Brent crude oil. The sample period covers 12 years from December 27, 2001 through December 24, 2013, and, after deleting non-match data, we have a total of 2871 observations. From the econometric point of view, 12 years of daily data (a total of 2871 return observations) are long enough to yield meaningful estimation results without a serious small sample bias issue. We focus on this recent 10-year history to make our study topical. We collect all the data from Wind database. Fig. 1 presents a graphical illustration of our data. As shown, there are three distinct characteristics: 1) the oil prices of WTI, Brent and Daqing are highly correlated; 2) there is a general upward trend throughout the sample period until August 2008. Since then, the financial crisis had a heavy influence on the entire world, with oil prices suddenly dropping and then gradually rising again; and 3) the price difference between various oil markets has broadened in recent months. Table 1 provides summary statistics of crude oil returns in three countries. As shown, the US has the lowest average oil returns and the largest standard deviations over the sample period. The US oil market has positive skewness, indicating that it has undergone huge price hikes. The fluctuation of the Chinese Daqing price is less than that of international crude oil price. It is obvious that trading hours of various oil markets are different. We must consider this non-synchronous trading problem prior to examining any further results. Such being the case, we use a simple method that is similar to the method of Cai et al. (2009) to solve this non-synchronous trading problem. The daily returns of the US and UK oil markets are lagged one day in estimation of the VAR model together with the current volatilities of the Chinese Daqing oil markets. In our paper, we mainly present the empirical results with this adjustment and discuss the economic implications based on them. 3.2. The full-sample return spillover table We calculate θij g (H) in Eq. (6) with the full sample and obtain the results reported in Table 2. Its ijth entry is the estimated contributions to the forecast error variance of market i coming from innovations to market j. Therefore, the off-diagonal column sums (labeled contributions to others) or row sums (labeled contributions from others), are the “to” and “from” directional spillovers, and the “from minus to” differences are the net directional volatility spillovers. Moreover, owing to row normalization, the sum of the variances in a row is 100%. The last row in the table represents the contribution to the volatilities of all markets from this particular market. The total return spillover index, which appears in the lower right-hand corner of the table, is computed as the sum of all variances in the 3 × 3 matrix minus the sum of the diagonal variances. The return spillover table may be viewed as the “input–output” decomposition of the total return spillover index. In the ijth entry in the 3 × 3 matrix is the estimated contribution to the forecast error variance of market i resulting from innovations to Table 4 Return spillover index of three oil markets after Dec 24, 2008. US CH UK From others US 51.7 23.2 25.1 48 CH 19.9 45.9 34.2 54 UK 21.6 33.5 44.8 55 Contribution to others 41 57 59 158 Contribution including own 93 103 104 52.5% Spillover of all the market plot. Returns. 50 week window. 10 step horizon time The spillover index (%) 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 30 35 40 45 50 55 60 65 SPILLRETURNS Fig. 2. Total return spillovers of three oil markets (50-week windows). 416 B. Zhang, P. Wang / Economic Modelling 42 (2014) 413–420