正在加载图片...

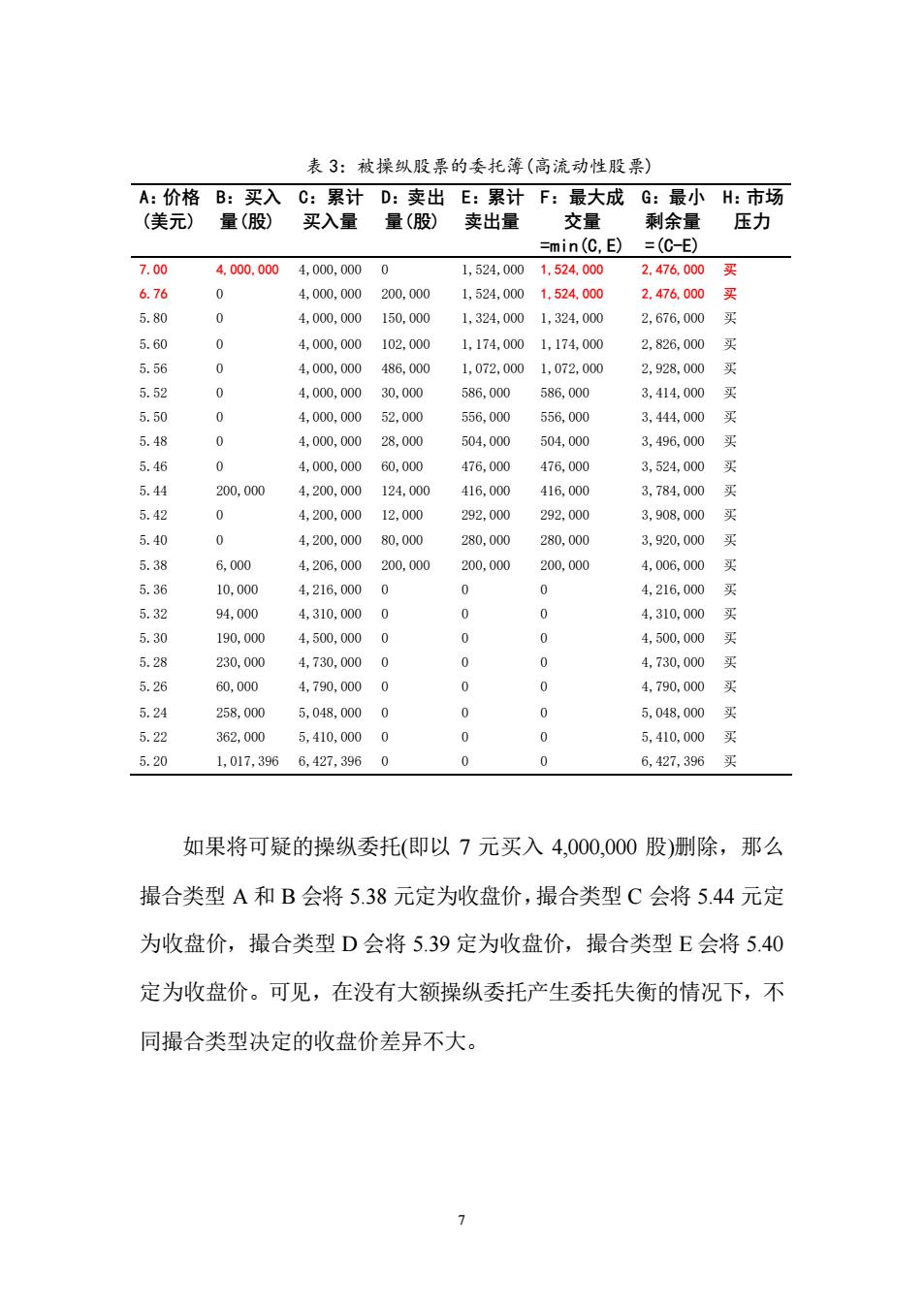

表3:被操纵股票的委托簿(高流动性股票) A:价格B:买入 C:累计D:卖出E:累计F:最大成 G:最小H:市场 (美元) 量(股) 买入量 量(股) 卖出量 交量 剩余量 压力 =min(C,E) =(C-E) 7.00 4.000.000 4.000.000 0 1,524,000 1,524,000 2.476,000 买 6.76 0 4,000,000 200,000 1.524,0001.524.000 2.476.000 买 5.80 0 4,000,000 150,000 1.324,0001,324,000 2,676,000 买 5.60 0 4,000,000 102,000 1,174,0001,174,000 2,826,000 乎 5.56 0 4,000,000 486,000 1,072,000 1,072,000 2,928,000 5.52 0 4,000,00030,000 586,000 586,000 3,414,000 买 5.50 0 4,000,000 52,000 556,000 556,000 3,444,000 买 5.48 0 4,000,00028,000 504,000 504,000 3,496,000 平 5.46 0 4.000.000 60,000 476,000 476,000 3,524,000 买 5.44 200,000 4,200,000 124,000 416,000 416,000 3,784,000 买 5.42 0 4,200,000 12,000 292,000 292,000 3,908,000 买 5.40 0 4,200,000 80,000 280,000 280,000 3,920,000 米 5.38 6,000 4,206,000 200.000 200,000 200,000 4,006,000 平 5.36 10,000 4,216,0000 0 0 4.216.000 买 5.32 94,000 4,310,000 0 0 0 4,310,000 买 5.30 190,000 4.500.0000 0 0 4,500,000 买 5.28 230,000 4,730,000 0 0 0 4,730,000 买 5.26 60,000 4,790.0000 0 0 4,790,000 买 5.24 258,000 5,048,0000 0 0 5,048,000买 5.22 362,000 5,410,0000 0 0 5,410,000买 5.20 1,017,3966,427,396 0 0 0 6,427,396买 如果将可疑的操纵委托(即以7元买入4,000,000股)删除,那么 撮合类型A和B会将5.38元定为收盘价,撮合类型C会将5.44元定 为收盘价,撮合类型D会将539定为收盘价,撮合类型E会将5.40 定为收盘价。可见,在没有大额操纵委托产生委托失衡的情况下,不 同撮合类型决定的收盘价差异不大。 >7 表 3:被操纵股票的委托簿(高流动性股票) A:价格 (美元) B:买入 量(股) C:累计 买入量 D:卖出 量(股) E:累计 卖出量 F:最大成 交量 =min(C,E) G:最小 剩余量 =(C-E) H:市场 压力 7.00 4,000,000 4,000,000 0 1,524,000 1,524,000 2,476,000 买 6.76 0 4,000,000 200,000 1,524,000 1,524,000 2,476,000 买 5.80 0 4,000,000 150,000 1,324,000 1,324,000 2,676,000 买 5.60 0 4,000,000 102,000 1,174,000 1,174,000 2,826,000 买 5.56 0 4,000,000 486,000 1,072,000 1,072,000 2,928,000 买 5.52 0 4,000,000 30,000 586,000 586,000 3,414,000 买 5.50 0 4,000,000 52,000 556,000 556,000 3,444,000 买 5.48 0 4,000,000 28,000 504,000 504,000 3,496,000 买 5.46 0 4,000,000 60,000 476,000 476,000 3,524,000 买 5.44 200,000 4,200,000 124,000 416,000 416,000 3,784,000 买 5.42 0 4,200,000 12,000 292,000 292,000 3,908,000 买 5.40 0 4,200,000 80,000 280,000 280,000 3,920,000 买 5.38 6,000 4,206,000 200,000 200,000 200,000 4,006,000 买 5.36 10,000 4,216,000 0 0 0 4,216,000 买 5.32 94,000 4,310,000 0 0 0 4,310,000 买 5.30 190,000 4,500,000 0 0 0 4,500,000 买 5.28 230,000 4,730,000 0 0 0 4,730,000 买 5.26 60,000 4,790,000 0 0 0 4,790,000 买 5.24 258,000 5,048,000 0 0 0 5,048,000 买 5.22 362,000 5,410,000 0 0 0 5,410,000 买 5.20 1,017,396 6,427,396 0 0 0 6,427,396 买 如果将可疑的操纵委托(即以 7 元买入 4,000,000 股)删除,那么 撮合类型 A 和 B 会将 5.38 元定为收盘价,撮合类型 C 会将 5.44 元定 为收盘价,撮合类型 D 会将 5.39 定为收盘价,撮合类型 E 会将 5.40 定为收盘价。可见,在没有大额操纵委托产生委托失衡的情况下,不 同撮合类型决定的收盘价差异不大