正在加载图片...

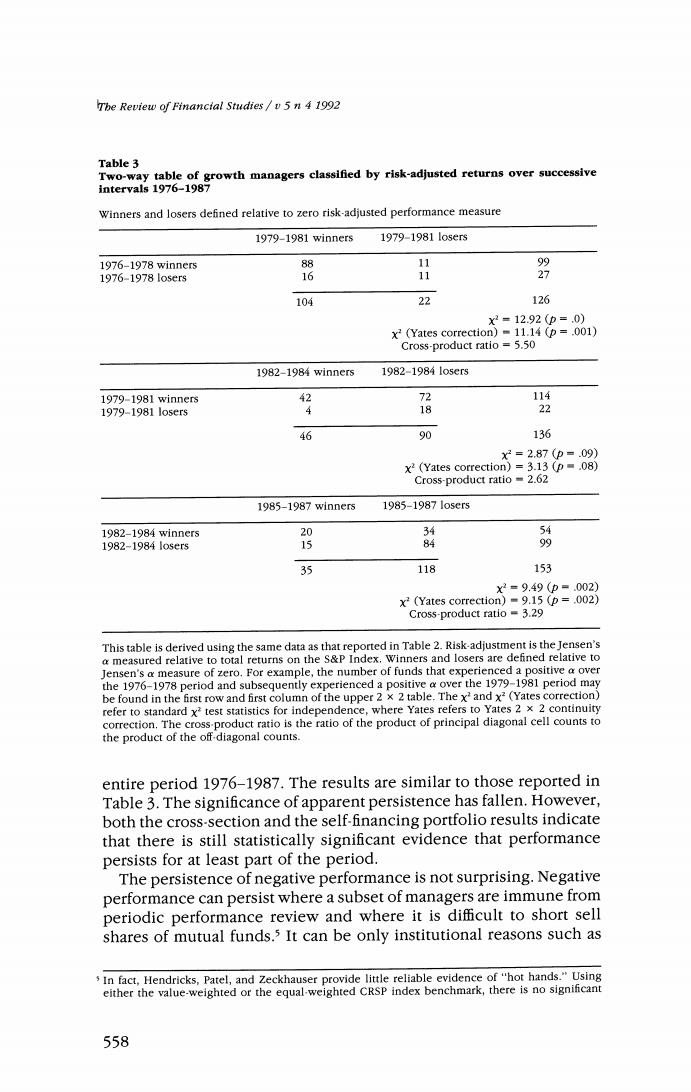

The Review of Financial Studies /v 5 n 4 1992 Table 3 Two-way table of growth managers classified by risk-adjusted returns over successive intervals 1976-1987 Winners and losers defined relative to zero risk-adjusted performance measure 1979-1981 winners 1979-19811o5ers 1976-1978 winner5 88 11 1976-1978lo5ers 16 11 27 104 22 126 x2=12.92(p=.0) x2 (Yates correction)=11.14 (p=.001) Cross-product ratio =5.50 1982-1984 winners 1982-19841o5er5 1979-1981 winners 2 72 114 1979-1981o5ers 18 22 46 90 136 xX2=2.87(p-.09) x2(Yates correction)=3.13 (p=.08) Cross-product ratio 2.62 1985-1987 winners 1985-19871osr5 1982-1984 winners 20 4 河 1982-19841o5er5 15 84 35 118 153 x2=9.49(p=.002) x2 (Yates correction)=9.15(p=.002) Cross-product ratio -3.29 This table is derived using the same data as that reported in Table 2.Risk-adjustment is the Jensen's a measured relative to total returns on the S&P Index.Winners and losers are defined relative to Jensen's a measure of zero.For example,the number of funds that experienced a positive a over the 1976-1978 period and subsequently experienced a positive a over the 1979-1981 period may be found in the first row and first column of the upper 2 x 2 table.The x'and x2(Yates correction) refer to standard x'test statistics for independence,where Yates refers to Yates 2 x 2 continuity correction.The cross-product ratio is the ratio of the product of principal diagonal cell counts to the product of the off-diagonal counts. entire period 1976-1987.The results are similar to those reported in Table 3.The significance of apparent persistence has fallen.However, both the cross-section and the self-financing portfolio results indicate that there is still statistically significant evidence that performance persists for at least part of the period. The persistence of negative performance is not surprising.Negative performance can persist where a subset of managers are immune from periodic performance review and where it is difficult to short sell shares of mutual funds.3 It can be only institutional reasons such as In fact,Hendricks,Patel,and Zeckhauser provide little reliable evidence of"hot hands."Using either the value-weighted or the equal-weighted CRSP index benchmark,there is no significant 558