Unit 11 Making Investment Rationally 理性投资 √Learning objectives 1.In this unit students will learn words and expressions related to investment. 2.Students will be able to discuss the advantages and disadvantages of various investment tools. Background reading Notes: L.trading volume交易量 2.NANDAQ纳斯达克(Nasdag)是全美证券商协会自动报价系统(National Association of Securities Dealers Automated Quotations)英文缩'写,但目前己成 为纳斯达克股票市场的代名词。信息和服务业的兴起催生了纳斯达克。纳斯达 克始建于1971年,是一个完全采用电子交易、为新兴产业提供竞争舞台、自 我监管、面向全球的股票市场。纳斯达克是全美也是世界最大的股票电子交易 市场。 3.NYSE New York Stock Exchange纽约证券交易所是美国和世界上规模最大 的证券交易市场。1792年5月17日,24个从事股票交易的经纪人在纽约华尔 街和威廉街的西北角一咖啡馆门前的梧桐树下签订了“梧桐树协定”,这是纽 约交易所的前身。1863年改为现名,直到1865年交易所才拥有自己的大楼。 座落在纽约市华尔街11号的大楼是1903年启用的。交易所经营对象主要为股 票,其次为各种国内外债券。除节假日外,交易时间每周5天,每天5小时。 到目前为止,它仍然是美国全国性的证券交易所中规模最大、最具代表性的证 券交易所,也是世界上规模最大、组织最健全,设备最完善,管理最严密、对 世界经济有着重大影响的证券交易所。但这种传统的、真人互动的交易市场也 许就要成为历史纳斯达克从一开始就是完全电算化的,根本没有一般意义上 的交易大厅,而纽约股票交易所尽管按上市公司的市场价值衡量,仍然是世界 最大的股票市场,但长期以来市场占有率持续滑坡,这也是近期纽约股票交易 所收购经营电子交易平台的群岛控股(Archipelago Holdings)并改组为股份公 司背后的动因。 4.market capitalization市值,市场筹资额 5.broker经纪人,纽约证券交易所自成立以来,一直是自愿性的非法人组织, 而不是合伙人企业或股份公司。1971年2月8日,纽约证券交易所经过重组, 成为纽约州的一家非营利组织。从法律角度来看,这样做使纽约证券交易所在 面临财务困难时,避免被会员要求索赔。1972年,纽约证券交易所原有的管 理委员会被董事会所取代。1986年6月,董事会经过扩展形成了目前的组织 结构:24名外部董事12名来自证券业,12名来自公用事业,3名前事务 董事,即一位董事长、一位执行副总裁,一位总经理兼首席运营官。由于外部

Unit 11 Making Investment Rationally 理性投资 3 Learning objectives 1. In this unit students will learn words and expressions related to investment. 2. Students will be able to discuss the advantages and disadvantages of various investment tools. Background reading Notes: 1. trading volume 交易量 2. NANDAQ 纳斯达克(Nasdaq)是全美证券商协会自动报价系统(National Association of Securities Dealers Automated Quotations)英文缩写,但目前已成 为纳斯达克股票市场的代名词。信息和服务业的兴起催生了纳斯达克。纳斯达 克始建于 1971 年,是一个完全采用电子交易、为新兴产业提供竞争舞台、自 我监管、面向全球的股票市场。纳斯达克是全美也是世界最大的股票电子交易 市场。 3. NYSE New York Stock Exchange 纽约证券交易所是美国和世界上规模最大 的证券交易市场。1792 年 5 月 17 日,24 个从事股票交易的经纪人在纽约华尔 街和威廉街的西北角一咖啡馆门前的梧桐树下签订了“梧桐树协定”,这是纽 约交易所的前身。1863 年改为现名,直到 1865 年交易所才拥有自己的大楼。 座落在纽约市华尔街 11 号的大楼是 1903 年启用的。交易所经营对象主要为股 票,其次为各种国内外债券。除节假日外,交易时间每周 5 天,每天 5 小时。 到目前为止,它仍然是美国全国性的证券交易所中规模最大、最具代表性的证 券交易所,也是世界上规模最大、组织最健全,设备最完善,管理最严密、对 世界经济有着重大影响的证券交易所。但这种传统的、真人互动的交易市场也 许就要成为历史--纳斯达克从一开始就是完全电算化的,根本没有一般意义上 的交易大厅,而纽约股票交易所尽管按上市公司的市场价值衡量,仍然是世界 最大的股票市场,但长期以来市场占有率持续滑坡,这也是近期纽约股票交易 所收购经营电子交易平台的群岛控股(Archipelago Holdings)并改组为股份公 司背后的动因。 4. market capitalization 市值,市场筹资额 5. broker 经纪人,纽约证券交易所自成立以来,一直是自愿性的非法人组织, 而不是合伙人企业或股份公司。1971 年 2 月 8 日,纽约证券交易所经过重组, 成为纽约州的一家非营利组织。从法律角度来看,这样做使纽约证券交易所在 面临财务困难时,避免被会员要求索赔。1972 年,纽约证券交易所原有的管 理委员会被董事会所取代。1986 年 6 月,董事会经过扩展形成了目前的组织 结构:24 名外部董事 12 名来自证券业,12 名来自公用事业 ,3 名前事务 董事,即一位董事长、一位执行副总裁,一位总经理兼首席运营官。由于外部

董事包括一些上市公司的首席执行官,所以纽约股票交易所的董事会被认为可 以代表各方利益集团的意见,如大众投资者、上市公司、公用事业部门等等。 6.brokerage house经纪行,经纪公司7.commission broker佣金经纪人又称为代 理经纪人或场内经纪商。他们是投资银行或证券公司等金融单位的代表,或是 独立经营的证券经纪人。他们在交易大厅内工作,执行他们公司公共客户的委 托指令。他们专门代理客户买卖证券,他们的报酬来自于各个客户支付给他们 的佣金。佣金经纪人是纽约股票交易所各种正式会员中人数最多的一种,约 400人左右。 8.floor broker独立经纪人又称为“两美元经纪人”。他们或者是投资银行的代表, 或者是独立经营的经纪人,这种经纪人主要在交易所繁忙时接受其他会员的委 托而从事交易。独立经纪人从佣金经纪人或非正式会员那里收取佣金。由于在 一段时间内,独立经纪人曾对每100美元的股票交易中收取2美元的佣金,所 以,独立经纪人又被称为“两美元经纪人”。独立经纪人会员在纽约股票交易所 约有100人左右。 9.free lancer参照上条 l0.specialist专家经纪人在纽约股票交易所的交易活动中,通过提供流动性和阻 止那些有悖于投资公众利益的剧烈价格波动,为交易所乃至整个股票市场提供 一种极为重要的服务。专家集合他们的财力和专门知识形成“专家单位”。每个 专家单位负责为分派给其成员的股票维持一个公正有序的市场价格。 ll.trading post,纽约证券交易所是会员制的非法人团体,交易所的进入资格仅 仅属于会员,也就是说,只有交易所的会员才能进入纽约证券交易所的交易大 厅进行股票交易。自1953年以来,纽约股票交易所的正式会员一直都限定在 1366名,正式会员的身份通常用“席位”表示在纽约股票交易所成立之初, 每个会员都有一个“席位”,“席位”一词因此而沿用下来。交易所的会员全部 由个人组成,投资银行或经营证券业务的金融公司只能指派其股东或经营人员 代表其所在单位申请正式会员资格、参加交易所的场内交易活动,而会员所代 表的公司其他人员则没有行使场内交易的权利。按照交易所制定的法规,欲成 为交易所正式会员者,必须是年满21岁的美国公民,过去没有任何违反证券 法的行为及欺诈行为,并需要两名交易所的正式会员推荐,另外,申请者还必 须符合交易所规定的资金拥有量的要求。 12.dealer交易商,竞争性交易商又称为交易所自营商。这种会员在纽约股票交 易所内,用自己的账户为自己进行股票买卖的交易,并自己承担风险。他们以 当事人的身份参与股票交易,从买价和卖价的差额中赚取利润。竞争性交易商 必须满足一定的财务、交易、报告方面的要求,而且他们的交易还受到监管, 以防止他们同会员组织的公众客户的交易发生冲突。 l3.limit book限价订单登记薄):A record of unexecuted limit orders maintained by the specialist.The specialist has the responsibility to guarantee that the top priority order is executed before other orders in the book,and before other orders at an equal or worse price held or submitted by other traders on the floor(floor brokers,market makers,etc). 14.limit order限价单,当投资者想要以某一特定价格买/卖股票时,这种委托单 便被使用。通常专业经纪人会将此种委托单保留到特定价格出现时再执行。限 价委托单又分为二种形式:1.限价买单(Buy Limit Order)=>购买低于市场价 格。例:王小姐下了一张买100股通用汽车(GM)公司股票的订单当其股票价格

董事包括一些上市公司的首席执行官,所以纽约股票交易所的董事会被认为可 以代表各方利益集团的意见,如大众投资者、上市公司、公用事业部门等等。 6. brokerage house 经纪行,经纪公司 7. commission broker 佣金经纪人又称为代 理经纪人或场内经纪商。他们是投资银行或证券公司等金融单位的代表,或是 独立经营的证券经纪人。他们在交易大厅内工作,执行他们公司公共客户的委 托指令。他们专门代理客户买卖证券,他们的报酬来自于各个客户支付给他们 的佣金。佣金经纪人是纽约股票交易所各种正式会员中人数最多的一种,约 400 人左右。 8. floor broker 独立经纪人又称为“两美元经纪人”。他们或者是投资银行的代表, 或者是独立经营的经纪人,这种经纪人主要在交易所繁忙时接受其他会员的委 托而从事交易。独立经纪人从佣金经纪人或非正式会员那里收取佣金。由于在 一段时间内,独立经纪人曾对每 100 美元的股票交易中收取 2 美元的佣金,所 以,独立经纪人又被称为“两美元经纪人”。独立经纪人会员在纽约股票交易所 约有 100 人左右。 9. free lancer 参照上条 10. specialist 专家经纪人在纽约股票交易所的交易活动中,通过提供流动性和阻 止那些有悖于投资公众利益的剧烈价格波动,为交易所乃至整个股票市场提供 一种极为重要的服务。专家集合他们的财力和专门知识形成“专家单位”。每个 专家单位负责为分派给其成员的股票维持一个公正有序的市场价格。 11.trading post ,纽约证券交易所是会员制的非法人团体,交易所的进入资格仅 仅属于会员,也就是说,只有交易所的会员才能进入纽约证券交易所的交易大 厅进行股票交易。自 1953 年以来,纽约股票交易所的正式会员一直都限定在 1366 名,正式会员的身份通常用“席位”表示 在纽约股票交易所成立之初, 每个会员都有一个“席位”,“席位”一词因此而沿用下来 。交易所的会员全部 由个人组成,投资银行或经营证券业务的金融公司只能指派其股东或经营人员 代表其所在单位申请正式会员资格、参加交易所的场内交易活动,而会员所代 表的公司其他人员则没有行使场内交易的权利。按照交易所制定的法规,欲成 为交易所正式会员者,必须是年满 21 岁的美国公民,过去没有任何违反证券 法的行为及欺诈行为,并需要两名交易所的正式会员推荐,另外,申请者还必 须符合交易所规定的资金拥有量的要求。 12. dealer 交易商,竞争性交易商又称为交易所自营商。这种会员在纽约股票交 易所内,用自己的账户为自己进行股票买卖的交易,并自己承担风险。他们以 当事人的身份参与股票交易,从买价和卖价的差额中赚取利润。竞争性交易商 必须满足一定的财务、交易、报告方面的要求,而且他们的交易还受到监管, 以防止他们同会员组织的公众客户的交易发生冲突。 13. limit book 限价订单登记薄):A record of unexecuted limit orders maintained by the specialist. The specialist has the responsibility to guarantee that the top priority order is executed before other orders in the book, and before other orders at an equal or worse price held or submitted by other traders on the floor (floor brokers, market makers, etc). 14. limit order 限价单,当投资者想要以某一特定价格买/卖股票时,这种委托单 便被使用。通常专业经纪人会将此种委托单保留到特定价格出现时再执行。限 价委托单又分为二种形式: 1. 限价买单 (Buy Limit Order) =>购买低于市场价 格。例: 王小姐下了一张买 100 股通用汽车(GM)公司股票的订单当其股票价格

在美金$50元。如果当它的股价达到美金$50元或以下,这张订单将会执行。 2.限价卖单(Sell Limit Order)=>卖出高於市场价格。例:假设说王小姐今天 下的是一张卖100股通用汽车(GM)公司股票的订单当其股票价格在美金$50 元。只要这家公司的股票达到美金$50元或以上时,这张订单将会执行。 15.spread价差 16.list上市 17.delist摘牌 18.9:30EST美国东部时间九点半 19.ticker股票行情收录器 20.electronic display board电子显示屏 2l.radio pager无线寻呼 22.hand-held手持 23.laptop笔记本(电脑) 纽约证券交易所 创建于1792年的纽约证券交易所是世界上最大的证券交易所,尽管它的交 易量在二十世纪九十年代被纳斯达克超过,但是它的总市值是纳斯达克的五倍。 自从2005年四月和完全电子化的股票交易所阿齐帕乐各合并后,纽约证交所现 在是一个以赢利为宗旨的公司,总部在纽约的百老汇大街18号,华尔街的南边 拐角处。 大多数纽约证交所的会员都是客户的经纪人,为他们买卖证券,他们被称为 佣金经纪人,是经纪公司的成员,而场内经纪人是作为独立经纪人为佣金经纪人 处理过多的股票交易并分享他们的佣金,场内经纪人用自己的帐户交易,不用向 别人支付佣金。 专家经纪人占有纽约证交所大约25%的席位,他们被分到纽约证交所内不同 的交易位置,在这些专门的位置上处理一种或几种股票的交易,专家经纪人既是 经纪人,又是交易商,作为经纪人,他们持有一个限价定单登记簿,上面记录着 所有的限价委托,即投资者委托他们按照某一特定或更好的价格买卖股票的命 令,在指定的价格没有出现以前,这些命令不会被执行。有时候,佣金经纪人会 让专家经纪人自行决定交易的价格,因此专家经纪人拿取部分交易商费用。 专家经纪人也做交易商,买卖他们被指定交易的股票以维持一个有秩序的 市场,股票交易所的只要职能是持续交易,保证每个投资者几乎总能按照某一价 格买卖某一特定股票,假如公众的交易命令并不同时到达而使交易匹配的话,专 家经纪人会买入以使佣金经纪人可以卖出,然后卖出给那些持有买入命令的佣金 经纪人,并有可能从中赚取买卖价差。 纽约证交所要求专家经纪人在自己被分配到的股票交易上维持一个持续有 序的市场,而要维持一个持续交易的市场,专家经纪人就必须“逆市而为”,这 就需要有充足的资金。 纽约证交所对上市有一些具体的要求需要公司必须做到,各公司必须遵循初 次上市以及上市后的各项规定,否则会被摘牌,纽约证交所一旦认为哪家公司己 不适宜继续交易的话,就会立即停止该公司股票的交易或将其除名。纽约证交所 全球共有2800家挂牌公司,总市值约20万亿美圆,截止2004年7月,道琼斯 工业平均指数的30家成分公司中除了两家,英特儿和微软,其余都在纽约证券

在美金$50 元。如果当它的股价达到美金$50 元或以下,这张订单将会执行。 2. 限价卖单 (Sell Limit Order) => 卖出高於市场价格。例: 假设说王小姐今天 下的是一张卖 100 股通用汽车(GM)公司股票的订单当其股票价格在美金$50 元。只要这家公司的股票达到美金$50 元或以上时,这张订单将会执行。 15. spread 价差 16. list 上市 17. delist 摘牌 18. 9:30 EST 美国东部时间九点半 19. ticker 股票行情收录器 20. electronic display board 电子显示屏 21. radio pager 无线寻呼 22. hand-held 手持 23. laptop 笔记本(电脑) 纽约证券交易所 创建于 1792 年的纽约证券交易所是世界上最大的证券交易所,尽管它的交 易量在二十世纪九十年代被纳斯达克超过,但是它的总市值是纳斯达克的五倍。 自从 2005 年四月和完全电子化的股票交易所阿齐帕乐各合并后,纽约证交所现 在是一个以赢利为宗旨的公司,总部在纽约的百老汇大街 18 号,华尔街的南边 拐角处。 大多数纽约证交所的会员都是客户的经纪人,为他们买卖证券,他们被称为 佣金经纪人,是经纪公司的成员,而场内经纪人是作为独立经纪人为佣金经纪人 处理过多的股票交易并分享他们的佣金,场内经纪人用自己的帐户交易,不用向 别人支付佣金。 专家经纪人占有纽约证交所大约 25%的席位,他们被分到纽约证交所内不同 的交易位置,在这些专门的位置上处理一种或几种股票的交易,专家经纪人既是 经纪人,又是交易商,作为经纪人,他们持有一个限价定单登记簿,上面记录着 所有的限价委托,即投资者委托他们按照某一特定或更好的价格买卖股票的命 令,在指定的价格没有出现以前,这些命令不会被执行。有时候,佣金经纪人会 让专家经纪人自行决定交易的价格,因此专家经纪人拿取部分交易商费用。 专家经纪人也做交易商,买卖他们被指定交易的股票以维持一个有秩序的 市场,股票交易所的只要职能是持续交易,保证每个投资者几乎总能按照某一价 格买卖某一特定股票,假如公众的交易命令并不同时到达而使交易匹配的话,专 家经纪人会买入以使佣金经纪人可以卖出,然后卖出给那些持有买入命令的佣金 经纪人,并有可能从中赚取买卖价差。 纽约证交所要求专家经纪人在自己被分配到的股票交易上维持一个持续有 序的市场,而要维持一个持续交易的市场,专家经纪人就必须“逆市而为”,这 就需要有充足的资金。 纽约证交所对上市有一些具体的要求需要公司必须做到,各公司必须遵循初 次上市以及上市后的各项规定,否则会被摘牌,纽约证交所一旦认为哪家公司已 不适宜继续交易的话,就会立即停止该公司股票的交易或将其除名。纽约证交所 全球共有 2800 家挂牌公司,总市值约 20 万亿美圆,截止 2004 年 7 月,道琼斯 工业平均指数的 30 家成分公司中除了两家,英特儿和微软,其余都在纽约证券

交易所交易。 纽约证券交易所美国东部时间9:30开市,下午4点闭市,但是历年来有不 同的交易时间,从1887年到1952年,交易所从上午10点开到下午3点,甚至 周六还有一个交易时间段,从10点到3点,但在1952年被取消了。目前的交易 时段是1985年9月30日开始的,1991年9月13日开始又延长了时间,就有效 的交易时间而言,那以后是大大地增加了。 1867年交易所第一次安装了股票行情收录器,1878年首次有了电话,1883, 第一次交易所里第一次有了电灯,现在常见的挂在墙上的电子显示板和无线寻呼 机是1966年首次安装的,一个可以加速执行交易的高技术无线数据系统在199 年被引入,这使得交易可以通过一个场内交易员手持的笔记本电脑就可以进行。 Answer to comprehension questions: 1.The total market capitalization of the NYSE is five times that of NASDAQ 2.Specialists are both brokers and dealers.They are assigned to each of thetrading posts on the floor of the NYSE where they handle one or more of the stocks traded at that post. 3.They could be delisted from the exchange. 4.A highly technical wireless data system increasing the speed in which trades were executed was introduced in 1996.This allows for trading to be done with hand-held laptop-like computers carried by the floor traders. PartA First listening:listen for the gist What is the main idea of news item one? The authorities in China announced yesterday that the share merger reform would be extended to the whole market,sparking a smart rally on the Shanghai and Shenzhen bourses. What is the main idea of news item two? For those who fancy tucking a few million dollars into a select hedge fund,classified ads in newspapers will not do. What is the main idea of news item three? Singapore's central bank has imposed a $4.8m civil penalty on the Beijing-controlled parent of China Aviation Oil for insider trading during the city-state's worst financial scandal in a decade What is the main idea of news item four? BenQ,Taiwanese diversified electronics maker,acquired Siemens'mobile phone unit in June.It has reported sharply lower net profit in the first half of this year as competition hit sales in its key product lines. What is the main idea of news item five? Long Star,the US private equity group,is believed to have appointed Citigroup to sell

交易所交易。 纽约证券交易所美国东部时间 9:30 开市,下午 4 点闭市,但是历年来有不 同的交易时间,从 1887 年到 1952 年,交易所从上午 10 点开到下午 3 点,甚至 周六还有一个交易时间段,从 10 点到 3 点,但在 1952 年被取消了。目前的交易 时段是 1985 年 9 月 30 日开始的,1991 年 9 月 13 日开始又延长了时间,就有效 的交易时间而言,那以后是大大地增加了。 1867 年交易所第一次安装了股票行情收录器,1878 年首次有了电话,1883, 第一次交易所里第一次有了电灯,现在常见的挂在墙上的电子显示板和无线寻呼 机是 1966 年首次安装的,一个可以加速执行交易的高技术无线数据系统在 199 年被引入,这使得交易可以通过一个场内交易员手持的笔记本电脑就可以进行。 Answer to comprehension questions: 1. The total market capitalization of the NYSE is five times that of NASDAQ. 2. Specialists are both brokers and dealers. They are assigned to each of thetrading posts on the floor of the NYSE where they handle one or more of the stocks traded at that post. 3. They could be delisted from the exchange. 4. A highly technical wireless data system increasing the speed in which trades were executed was introduced in 1996. This allows for trading to be done with hand-held laptop-like computers carried by the floor traders. Part A First listening: listen for the gist What is the main idea of news item one? The authorities in China announced yesterday that the share merger reform would be extended to the whole market, sparking a smart rally on the Shanghai and Shenzhen bourses. What is the main idea of news item two? For those who fancy tucking a few million dollars into a select hedge fund, classified ads in newspapers will not do. What is the main idea of news item three? Singapore’s central bank has imposed a $4.8m civil penalty on the Beijing-controlled parent of China Aviation Oil for insider trading during the city-state’s worst financial scandal in a decade. What is the main idea of news item four? BenQ, Taiwanese diversified electronics maker, acquired Siemens’ mobile phone unit in June. It has reported sharply lower net profit in the first half of this year as competition hit sales in its key product lines. What is the main idea of news item five? Long Star, the US private equity group, is believed to have appointed Citigroup to sell

its controlling stake in Korea Exchange Bank,paving the way for a divestment that could value the country's sixth-largest bank at more than $6bn. Second listening:listen for specific information In this part the teacher has great freedom and flexibility to ask students questions,to clarify any difficult language points,to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. the share merger reform,spark a smart rally on,bourse,pilot project,tuck...into, coveted,niche market,insider trading,hit,divestment,pave the way for Ask students to do multiple matching exercise and blanks filling exercise.Compare answers.Explain the keys. Third listening:sentences imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening(Dictate then remember). 1.the share merger reform--The authorities in China announced yesterday that the share merger reform would be extended to the whole market,sparking a smart rally on the Shanghai and Shenzhen bourses. 2.spark a smart rally on--The authorities in China announced yesterday that the share merger reform would be extended to the whole market,sparking a smart rally on the Shanghai and Shenzhen bourses. 3.bourse--The authorities in China announced yesterday that the share merger reform would be extended to the whole market,sparking a smart rally on the Shanghai and Shenzhen bourses. 4.pilot project--Five State departments announced guidelines pushing the reform process ahead since the pilot projects on share mergers had proved successful and were well received by the markets. 5.tuck...into--For those who fancy tucking a few million dollars into a select hedge fund,classified ads in newspapers will not do. 6.coveted--HedgeBay is a website where serious investors take part in an online auction,finding and selling rare and coveted hedge funds that are closed to new Investors. 7.niche market--It began as a niche market in 1999,but its volume tripled in 2003 and now grows at an annualized rate of 20%. 8.insider trading--Singapore's central bank has imposed a $4.8m civil penalty on the Beijing-controlled parent of China Aviation Oil for insider trading during the city state's worst financial scandal in a decade. 9.hit--It has reported sharply lower net profit in the first half of this year as competition hit sales in its key product lines. 10.divestment-Long Star,the US private equity group,is believed to have appointed

its controlling stake in Korea Exchange Bank, paving the way for a divestment that could value the country’s sixth-largest bank at more than $6bn. Second listening: listen for specific information In this part the teacher has great freedom and flexibility to ask students questions, to clarify any difficult language points, to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. the share merger reform,spark a smart rally on,bourse,pilot project, tuck … into, coveted, niche market, insider trading, hit, divestment, pave the way for Ask students to do multiple matching exercise and blanks filling exercise. Compare answers. Explain the keys. Third listening: sentences imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening (Dictate then remember). 1. the share merger reform -- The authorities in China announced yesterday that the share merger reform would be extended to the whole market, sparking a smart rally on the Shanghai and Shenzhen bourses. 2. spark a smart rally on -- The authorities in China announced yesterday that the share merger reform would be extended to the whole market, sparking a smart rally on the Shanghai and Shenzhen bourses. 3. bourse-- The authorities in China announced yesterday that the share merger reform would be extended to the whole market, sparking a smart rally on the Shanghai and Shenzhen bourses. 4. pilot project -- Five State departments announced guidelines pushing the reform process ahead since the pilot projects on share mergers had proved successful and were well received by the markets. 5. tuck … into -- For those who fancy tucking a few million dollars into a select hedge fund, classified ads in newspapers will not do. 6. coveted -- HedgeBay is a website where serious investors take part in an online auction, finding and selling rare and coveted hedge funds that are closed to new investors. 7. niche market -- It began as a niche market in 1999, but its volume tripled in 2003 and now grows at an annualized rate of 20%. 8. insider trading -- Singapore’s central bank has imposed a $4.8m civil penalty on the Beijing-controlled parent of China Aviation Oil for insider trading during the city state’s worst financial scandal in a decade. 9. hit -- It has reported sharply lower net profit in the first half of this year as competition hit sales in its key product lines. 10. divestment –Long Star, the US private equity group, is believed to have appointed

Citigroup to sell its controlling stake in Korea Exchange Bank,paving the way for a divestment that could value the country's sixth-largest bank at more than $6bn. 11.pave the way for--Long Star,the US private equity group,is believed to have appointed Citigroup to sell its controlling stake in Korea Exchange Bank,paving the way for a divestment that could value the country's sixth-largest bank at more than $6bn. Part B First listening:listen for the gist What is the main idea of this listening? This is a discussion of economic boom,falling commodities prices and worth-buying stocks. Second listening:listen for specific information In this part the teacher has great freedom and flexibility to ask students questions,to clarify any difficult language points,to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. soar,sock,gush,pump out,swing,volatility Ask students to fill in the blanks.Compare answers. Ask students to answer the following questions.Compare answers. Third listening:sentence imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening(Dictate then remember). 1.soar--The prices of natural resources have been soaring lately,and everyone has been feeling the impact---from consumers socked at the gas pump to big manufacturers forced to absorb sharply higher costs for steel,copper,and aluminum. 2.sock--The prices of natural resources have been soaring lately,and everyone has been feeling the impact---from consumers socked at the gas pump to big manufacturers forced to absorb sharply higher costs for steel,copper,and aluminum. 3.gush--The average commodities mutual fund has gushed a 38%return 4.pump out--U.S.Global Investors fund manager Frank Holmes has pumped out even better results. 5.swing--How do swings in the dollar affect commodity prices? 6.volatility--You get better cash flow and less volatility when you have a mix. Part C First listening:listen for the gist

Citigroup to sell its controlling stake in Korea Exchange Bank, paving the way for a divestment that could value the country’s sixth-largest bank at more than $6bn. 11. pave the way for -- Long Star, the US private equity group, is believed to have appointed Citigroup to sell its controlling stake in Korea Exchange Bank, paving the way for a divestment that could value the country’s sixth-largest bank at more than $6bn. Part B First listening: listen for the gist What is the main idea of this listening? This is a discussion of economic boom, falling commodities prices and worth-buying stocks. Second listening: listen for specific information In this part the teacher has great freedom and flexibility to ask students questions, to clarify any difficult language points, to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. soar, sock, gush, pump out, swing, volatility Ask students to fill in the blanks. Compare answers. Ask students to answer the following questions. Compare answers. Third listening: sentence imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening (Dictate then remember). 1. soar -- The prices of natural resources have been soaring lately, and everyone has been feeling the impact---from consumers socked at the gas pump to big manufacturers forced to absorb sharply higher costs for steel, copper, and aluminum. 2. sock -- The prices of natural resources have been soaring lately, and everyone has been feeling the impact---from consumers socked at the gas pump to big manufacturers forced to absorb sharply higher costs for steel, copper, and aluminum. 3. gush -- The average commodities mutual fund has gushed a 38% return. 4. pump out -- U.S. Global Investors fund manager Frank Holmes has pumped out even better results. 5. swing -- How do swings in the dollar affect commodity prices? 6. volatility -- You get better cash flow and less volatility when you have a mix. Part C First listening: listen for the gist

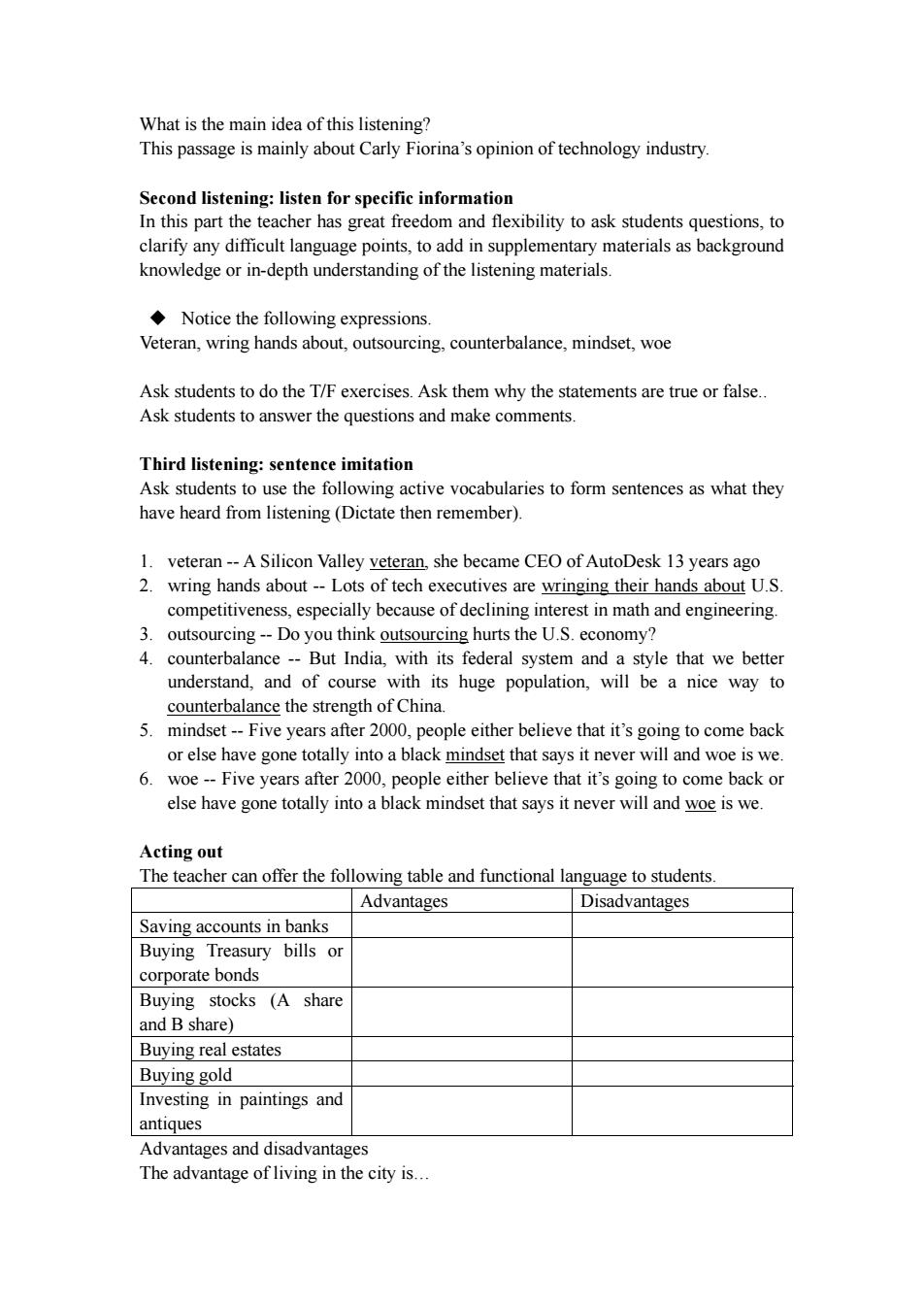

What is the main idea of this listening? This passage is mainly about Carly Fiorina's opinion of technology industry. Second listening:listen for specific information In this part the teacher has great freedom and flexibility to ask students questions,to clarify any difficult language points,to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. Veteran,wring hands about,outsourcing,counterbalance,mindset,woe Ask students to do the T/F exercises.Ask them why the statements are true or false.. Ask students to answer the questions and make comments. Third listening:sentence imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening(Dictate then remember). 1.veteran--A Silicon Valley veteran,she became CEO of AutoDesk 13 years ago 2.wring hands about--Lots of tech executives are wringing their hands about U.S competitiveness,especially because of declining interest in math and engineering. 3.outsourcing--Do you think outsourcing hurts the U.S.economy? 4.counterbalance --But India,with its federal system and a style that we better understand,and of course with its huge population,will be a nice way to counterbalance the strength of China. 5.mindset--Five years after 2000,people either believe that it's going to come back or else have gone totally into a black mindset that says it never will and woe is we. 6.woe--Five years after 2000,people either believe that it's going to come back or else have gone totally into a black mindset that says it never will and woe is we. Acting out The teacher can offer the following table and functional language to students. Advantages Disadvantages Saving accounts in banks Buying Treasury bills or corporate bonds Buying stocks (A share and B share) Buying real estates Buying gold Investing in paintings and antiques Advantages and disadvantages The advantage of living in the city is

What is the main idea of this listening? This passage is mainly about Carly Fiorina’s opinion of technology industry. Second listening: listen for specific information In this part the teacher has great freedom and flexibility to ask students questions, to clarify any difficult language points, to add in supplementary materials as background knowledge or in-depth understanding of the listening materials. Notice the following expressions. Veteran, wring hands about, outsourcing, counterbalance, mindset, woe Ask students to do the T/F exercises. Ask them why the statements are true or false.. Ask students to answer the questions and make comments. Third listening: sentence imitation Ask students to use the following active vocabularies to form sentences as what they have heard from listening (Dictate then remember). 1. veteran -- A Silicon Valley veteran, she became CEO of AutoDesk 13 years ago 2. wring hands about -- Lots of tech executives are wringing their hands about U.S. competitiveness, especially because of declining interest in math and engineering. 3. outsourcing -- Do you think outsourcing hurts the U.S. economy? 4. counterbalance -- But India, with its federal system and a style that we better understand, and of course with its huge population, will be a nice way to counterbalance the strength of China. 5. mindset -- Five years after 2000, people either believe that it’s going to come back or else have gone totally into a black mindset that says it never will and woe is we. 6. woe -- Five years after 2000, people either believe that it’s going to come back or else have gone totally into a black mindset that says it never will and woe is we. Acting out The teacher can offer the following table and functional language to students. Advantages Disadvantages Saving accounts in banks Buying Treasury bills or corporate bonds Buying stocks (A share and B share) Buying real estates Buying gold Investing in paintings and antiques Advantages and disadvantages The advantage of living in the city is…

X has the advantage of... One of the main advantages of... No one can deny the advantage of... The advantageous effect of X is obvious. The good thing about X is... It goes without saying that X is better than Y. It has the good impact of... One disadvantage of... Y has the disadvantage of... One of the main disadvantage of...is... The disadvantage of Y is obvious. The side effect of Y is... It has the bad impact of

X has the advantage of … One of the main advantages of … No one can deny the advantage of … The advantageous effect of X is obvious. The good thing about X is… It goes without saying that X is better than Y. It has the good impact of… One disadvantage of … Y has the disadvantage of… One of the main disadvantage of…is… The disadvantage of Y is obvious. The side effect of Y is… It has the bad impact of…