Financial Econometrics Chapter 7.Difference-in-difference Model 1 Jin Ling School of Finance,Zhongnan University of Economics and Law

Financial Econometrics Chapter 7. Difference-in-difference Model 1 Jin Ling School of Finance, Zhongnan University of Economics and Law 1

Outline The Difference-in-difference (DID)Model The Condition for DID Model The Steps to estimate DID Model 2

• The Difference-in-difference (DID) Model • The Condition for DID Model • The Steps to estimate DID Model 2 Outline

The DID Model The methodology for causal inference: Experiment Design:Empirical study is based on observed data. ·Natural experiment:个体接受的干预来自其面临环境的变化,使得干预就像随机可控实验中 那样具有随机性。 Natural experiment does not equal randomized experiment:Unconfoundedness. The assignment mechanism in natural experiment:Potential outcomes will not response to treatment before the treatment period;Observation is not selected. Natural experiment(Randomized)and quasi-natural experiment (Not strictly randomized) 3

• The methodology for causal inference: • Experiment Design: Empirical study is based on observed data. • Natural experiment: 个体接受的干预来自其面临环境的变化,使得干预就像随机可控实验中 那样具有随机性。 • Natural experiment does not equal randomized experiment: Unconfoundedness. • The assignment mechanism in natural experiment: Potential outcomes will not response to treatment before the treatment period; Observation is not selected. • Natural experiment (Randomized) and quasi-natural experiment (Not strictly randomized). 3 The DID Model

The DID Model How to estimate causal effect under natural experiment: Treatment and control groups. The difference in potential outcomes for treatment and control groups. Which potential outcomes? Treatment and control groups before and after treatment period

• How to estimate causal effect under natural experiment: • Treatment and control groups. • The difference in potential outcomes for treatment and control groups. • Which potential outcomes? • Treatment and control groups before and after treatment period. 4 The DID Model

The DID Model ·The example: Stimulus program in 2008-2009 ·Firm investment. Firm investment for treatment group in 2007(/m). Firm investment for control group in 2007 (Invoo). Firm investment for treatment group in 2010(/m). Firm investment for control group in 2010(Invo). 5

• The example: • Stimulus program in 2008-2009. • Firm investment. • Firm investment for treatment group in 2007 (Inv10). • Firm investment for control group in 2007 (Inv00). • Firm investment for treatment group in 2010 (Inv11). • Firm investment for control group in 2010 (Inv01). 5 The DID Model

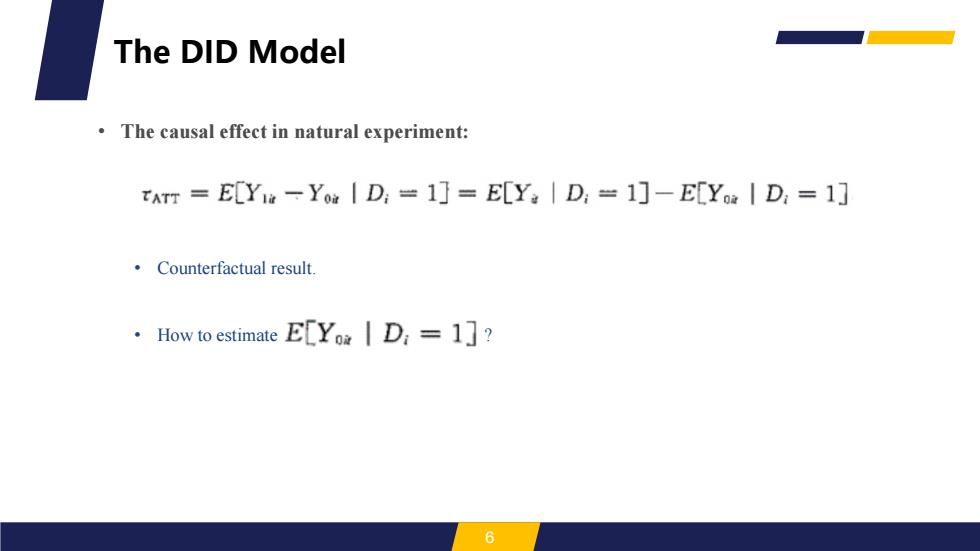

The DID Model The causal effect in natural experiment: TATT E[YiYox I D:=1]=E[Y D:=1]-E[Yor D:=1] Counterfactual result. How to estimate E[Yoz I Di=1]? 6

• The causal effect in natural experiment: • Counterfactual result. • How to estimate ? 6 The DID Model

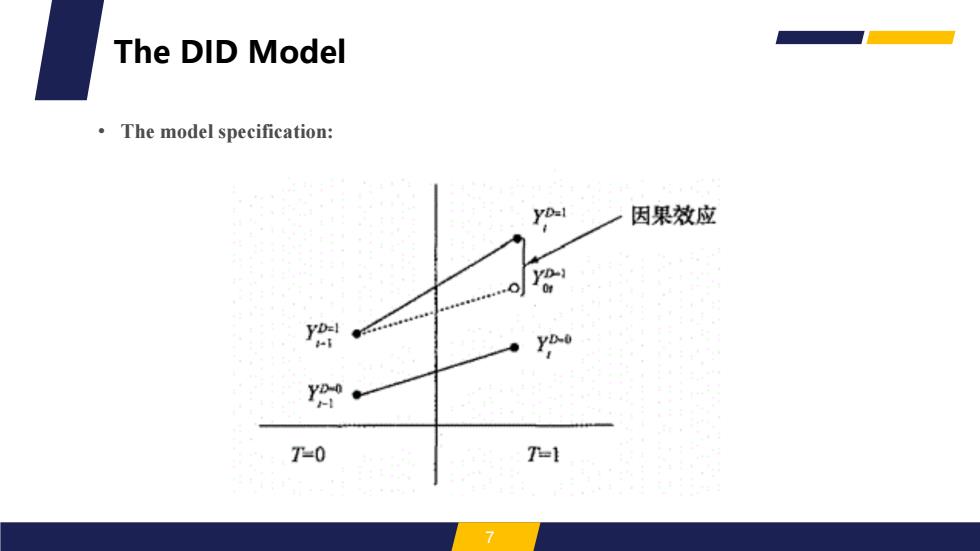

The DID Model The model specification: 因果效应 VD】 yDel Yoo T=0 T-1 7

• The model specification: 7 The DID Model

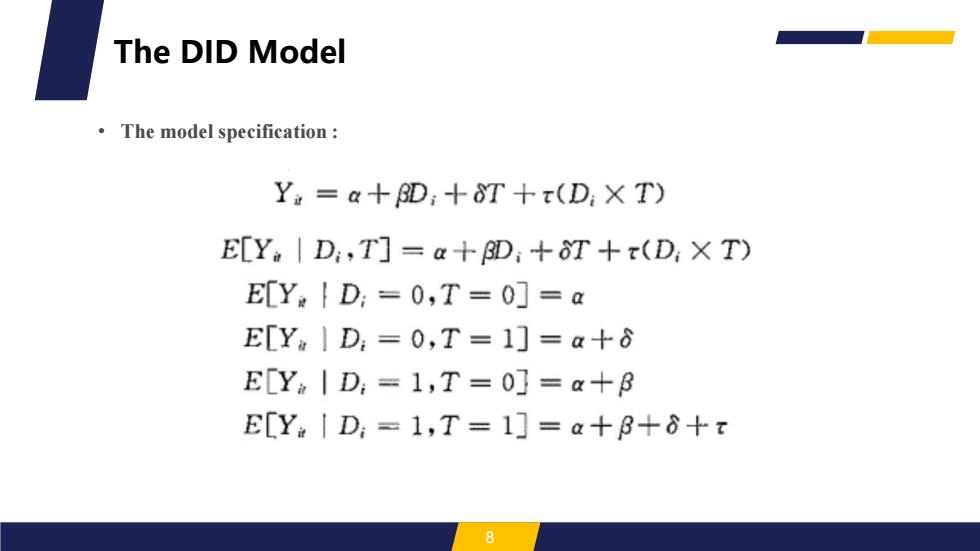

The DID Model The model specification Yi=a+BD;+8T+r(DiX T) E[Y。|D:,T]=a十D,+T+r(DXT) EYg{D:=0,T=0]=a E[Ym1D,=0,T=1]=a+8 E[Ya|D,=1,T=0]=a+3 E[Y.ID:=1,T=1]=a+B+8+t

• The model specification : 8 The DID Model

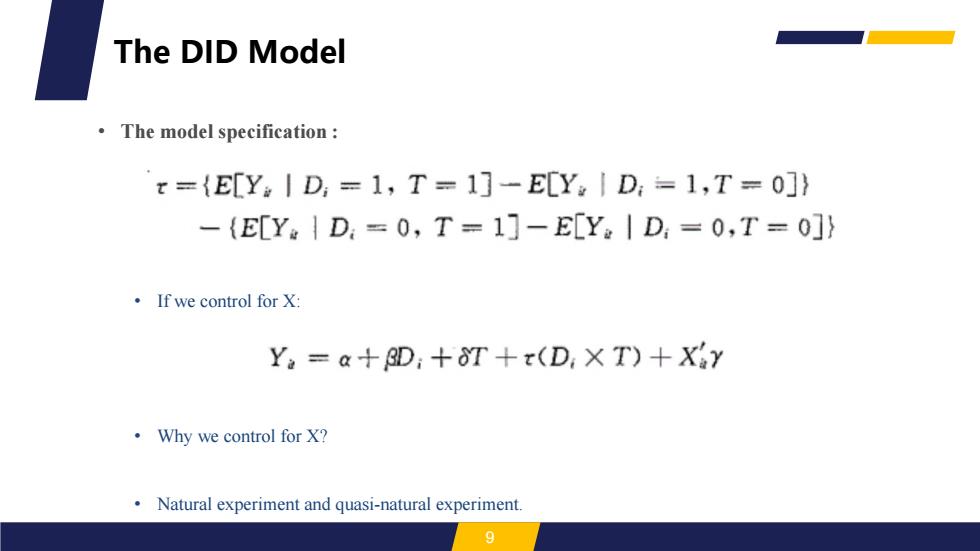

The DID Model The model specification x={E[Y。ID=1,T=1]-E[YgID,=1,T=0]} -{E[Y。1D:=0,T=1]-E[Y。|D=0,T=0]} ·If we control for X Ya=a+8D;+8T+r(D:X T)+X3Y ·Why we control for X? Natural experiment and quasi-natural experiment. 9

• The model specification : • If we control for X: • Why we control for X? • Natural experiment and quasi-natural experiment. 9 The DID Model

The DID Model The prevalence of DID model: Currie et al.(2020):Technology and Big Data Are Changing Economics:Mining Text to Track Methods Panel A.Difference-in-differences Panel B.Regression discontinuity 20.25 201 02 音5 0.1 50.05 0 0 19801985199018952000200520102015 19801905198019952000200520102015 Panel C.Event study Panel D.Bunching 0.06 0.0 0.02 0.02 0 19801965199019952000200520102015 1990198519901952000200520102015 NBER working papers Top-tive joumals FIGURE 4.QUASI-EXPERIMENTAL METHODS 10

• The prevalence of DID model: • Currie et al. (2020): Technology and Big Data Are Changing Economics: Mining Text to Track Methods. 10 The DID Model