卧的贸易孝 1951 Chapter 5 Managing Interest Rate Risk:Duration Gap and Market Value of Equity

Chapter 5 Chapter 5 Managing Interest Rate Managing Interest Rate Risk: Duration Gap and Risk: Duration Gap and Market Value of Equity Market Value of Equity

Duration and price volatility Maturity simply identifies how much time elapses until final payment. 目 It ignores all information about the timing and magnitude of interim payments. Duration is a measure of effective maturity that incorporates the timing and size of a security's cash flows. 目 Duration captures the combined impact of market rate,the size of interim payments and maturity on a security's price volatility. 爸封强的黄香+孝

Duration and price volatility Duration and price volatility Maturity simply identifies how much time elapses until final payment. It ignores all information about the timing and magnitude of interim payments. Duration is a measure of effective maturity that incorporates the timing and size of a security's cash flows. Duration captures the combined impact of market rate, the size of interim payments and maturity on a security’s price volatility

Duration versus maturity 1.)1000 loan,principal interest paid in 20 years. 2.)1000oan, 900 principal in 1 year, 100 principal in 20 years. 1000+int 10 20 900+int 100 +int 2 1 10 20 爸封强的黄香+孝

Duration versus maturity Duration versus maturity 1.) 1000 loan, principal + interest paid in 20 years. 2.) 1000 loan, 900 principal in 1 year, 100 principal in 20 years. 1000 + int |-------------------|-----------------| 0 10 20 900+int 100 + int |----|--------------|-----------------| 0 1 10 20 1 2

Duration ...approximate measure of the price elasticity of demand Price elasticity of demand =%A in quantity demanded /%4 in price ▣Price(vaue)changes Longer duration>larger changes in price for a given change in i-rates. ■ Larger coupon>smaller change in price for a given change in i-rates. 猫行贺影小号

Duration Duration …approximate measure of the approximate measure of the price elasticity of demand price elasticity of demand Price elasticity of demand = %∆ in quantity demanded / %∆ in price Price (value) changes Longer duration → larger changes in price for a given change in i-rates. Larger coupon → smaller change in price for a given change in i-rates

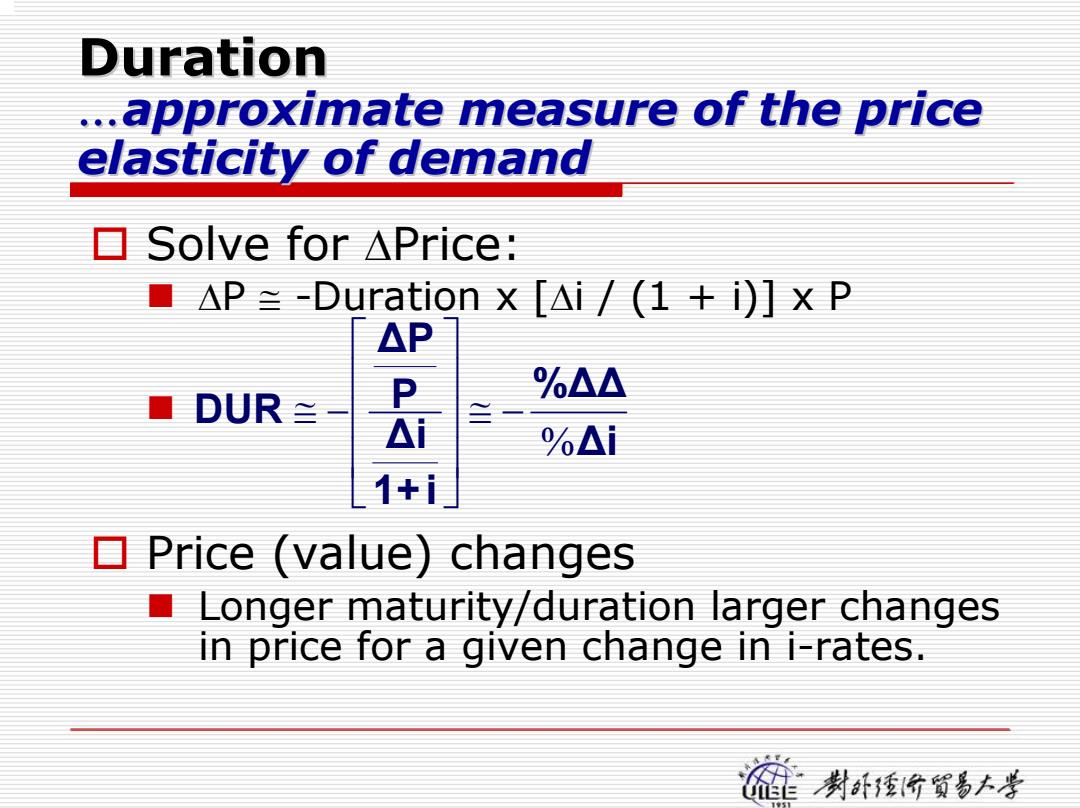

Duration ..approximate measure of the price elasticity of demand ▣Solve for△Price: ■△P≈-Duration x[△i/(1+i)]xP △P %△△ ■DUR≥ △ %△1 1+i Price (value)changes Longer maturity/duration larger changes in price for a given change in i-rates. 爸封强的黄香+孝

Duration Duration …approximate measure of the price approximate measure of the price elasticity of demand elasticity of demand Solve for ∆Price: ∆P ≅ -Duration x [ ∆i / (1 + i)] x P Price (value) changes Longer maturity/duration larger changes in price for a given change in i-rates. ∆i %∆∆ 1 +i ∆i P ∆ P DUR % ≅ − ⎥ ⎥ ⎥ ⎦ ⎤ ⎢ ⎢ ⎢ ⎣ ⎡ ≅ −

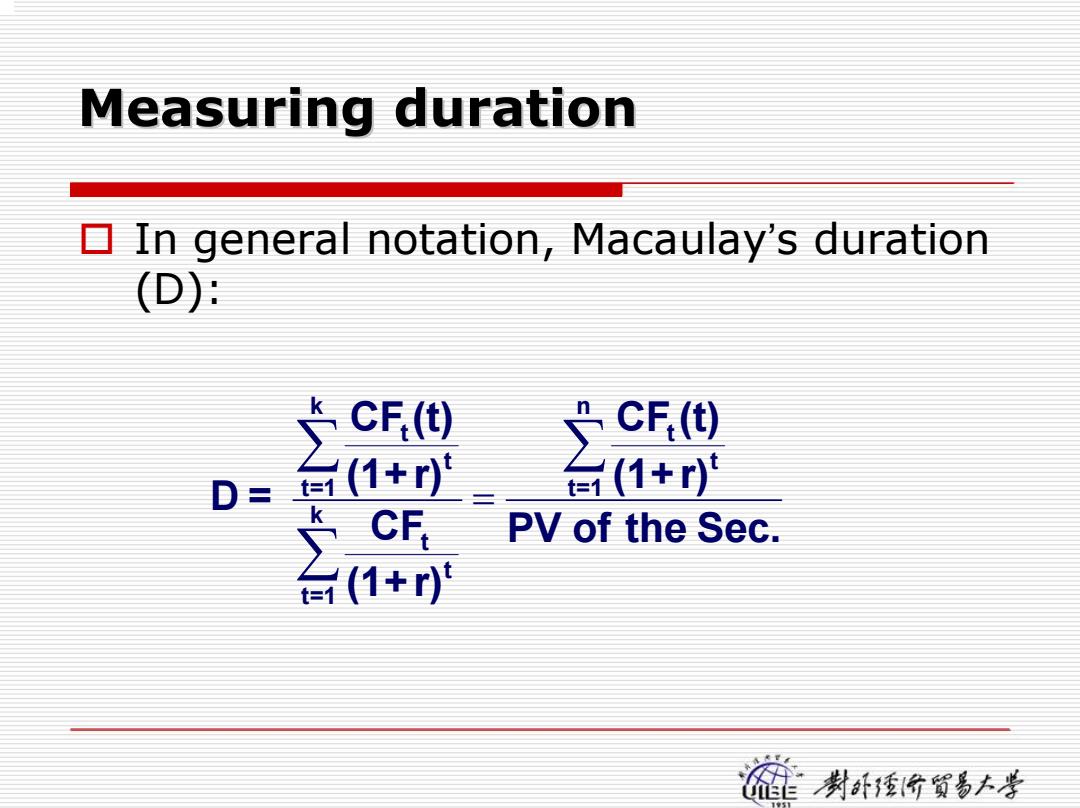

Measuring duration In general notation,Macaulay's duration (D): CF(t) D 含8州 CF PV of the Sec. 猫f的贺6号

Measuring duration Measuring duration In general notation, Macaulay’s duration (D): PV of the Sec. (1 +r) CF (t) (1 +r) CF (1 +r) CF (t) D = n t = 1 t t k t = 1 t t k t = 1 t t ∑ ∑ ∑ =

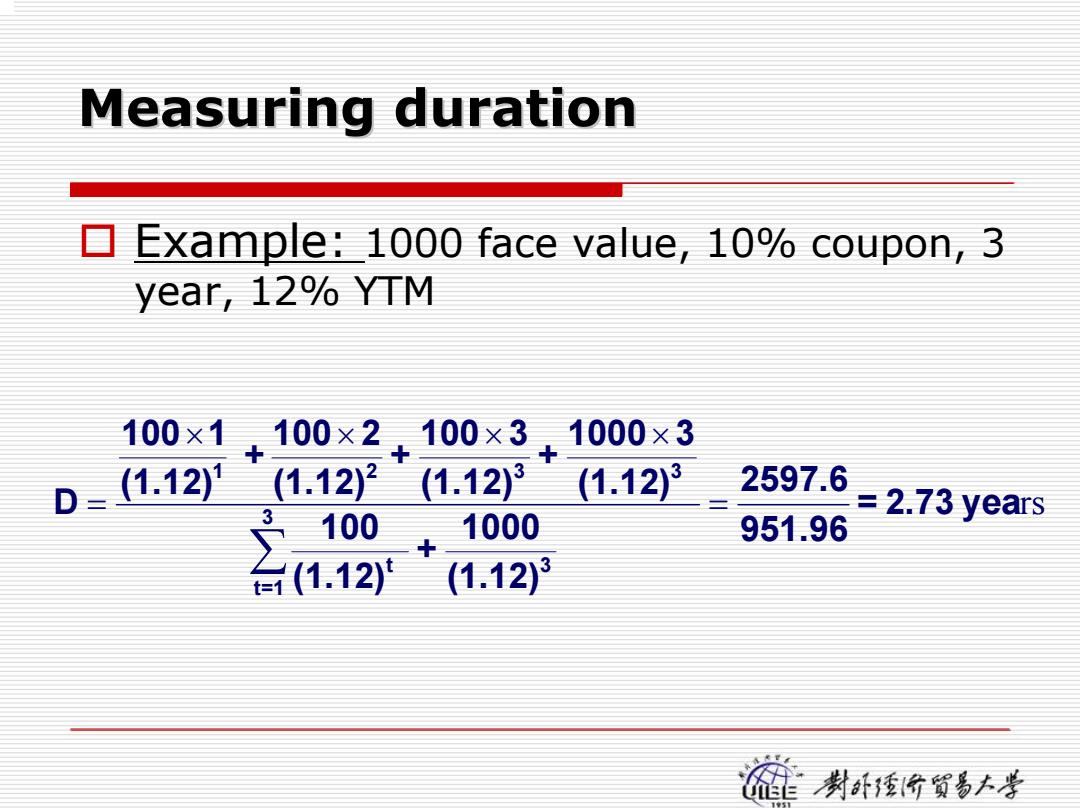

Measuring duration Example:1000 face value,10%coupon,3 year,12%YTM 100×1 +100×2 ,100×3,1000×3 (1.12)1 (1.122(1.123 (1.123 2597.6 3100 2.73 years 1000 951.96 (1.12)3 的资5+号

Measuring duration Measuring duration Example: 1000 face value, 10% coupon, 3 year, 12% YTM = 2.73 years 951.96 2597.6 (1.12) 1000 + (1.12) 100 (1.12) 1000 3 + (1.12) 100 3 + (1.12) 100 2 + (1.12) 100 1 D 3 t=1 t 3 1 2 3 3 = × × × × = ∑

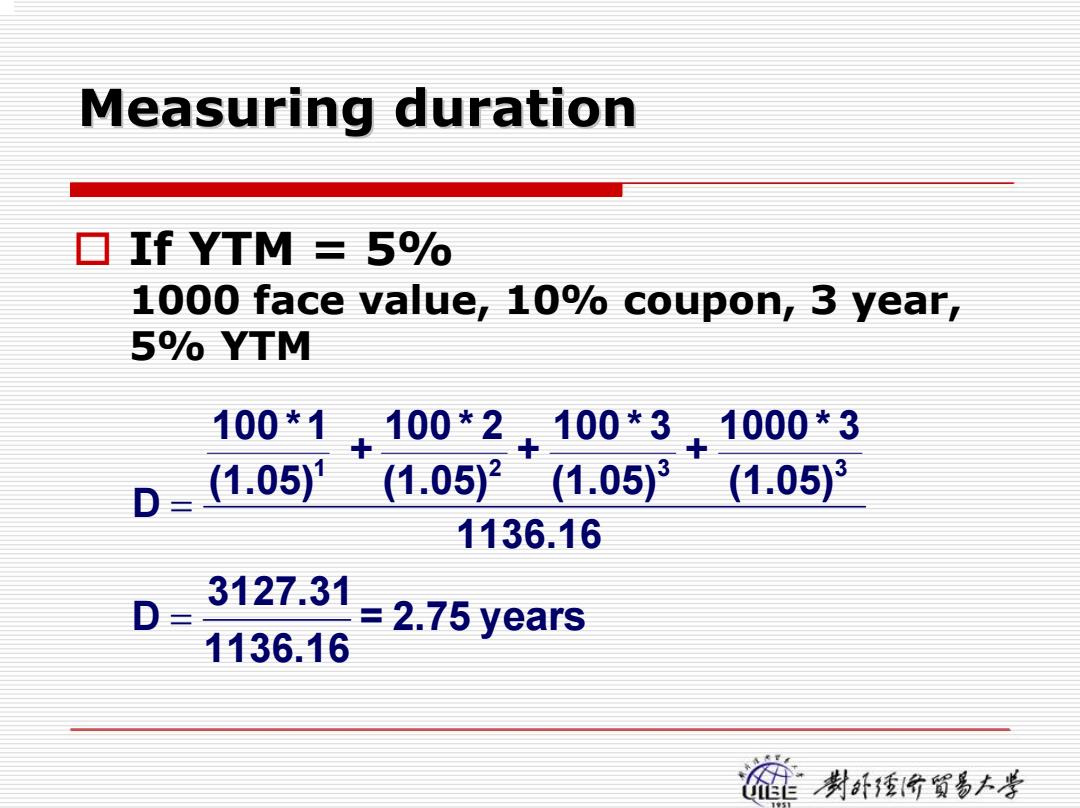

Measuring duration ▣If YTM=5/O 1000 face value,10%coupon,3 year, 5%%YTM 100*1 +100*2+100*3+1000*3 (1.05) (1.05)2(1.05)3 (1.05)3 1136.16 3127.31 D 三 2.75 years 1136.16 行贺影小号

Measuring duration Measuring duration If YTM = 5% 1000 face value, 10% coupon, 3 year, 5% YTM 1136.16 (1.05) 1000 * 3 + (1.05) 100 * 3 + (1.05) 100 * 2 + (1.05) 100 * 1 D 1 2 3 3 = = 2.75 years 1136.16 3127.31 D =

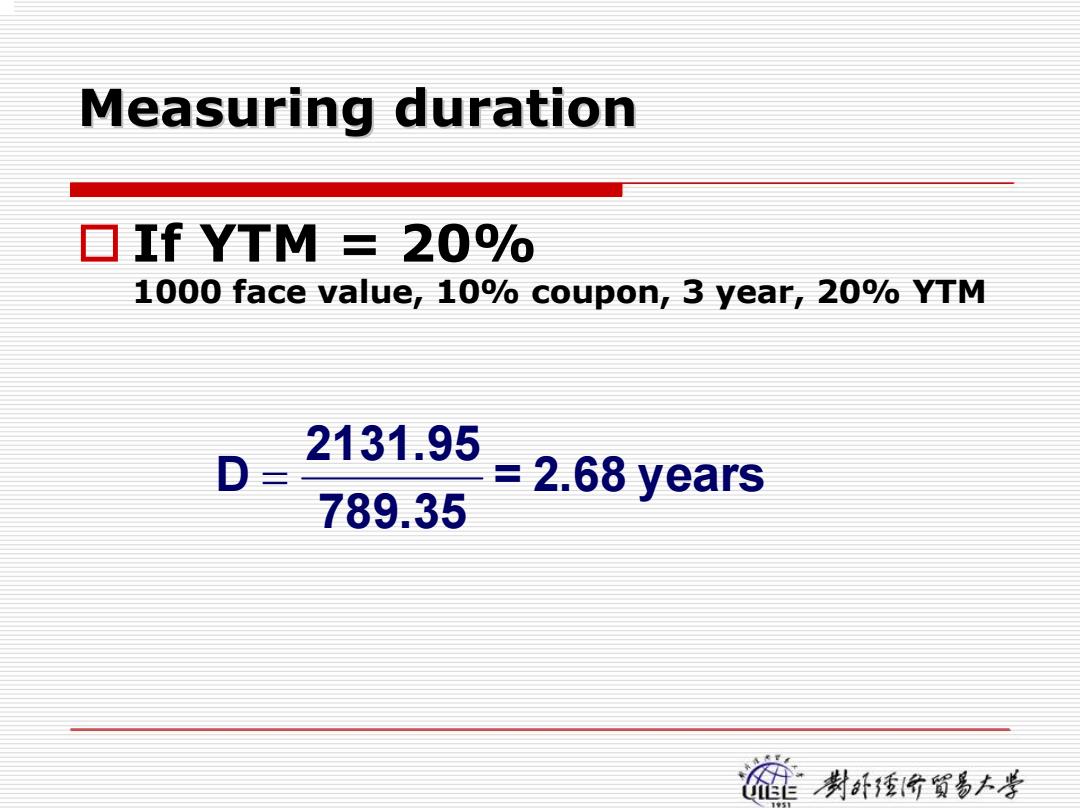

Measuring duration ▣If YTM=20O 1000 face value,10%coupon,3 year,20%YTM 2131.95 D 三 2.68 years 789.35 猫f的贺6号

Measuring duration Measuring duration If YTM = 20% 1000 face value, 10% coupon, 3 yea r, 20% YTM = 2.68 years 789.35 2131.95 D =

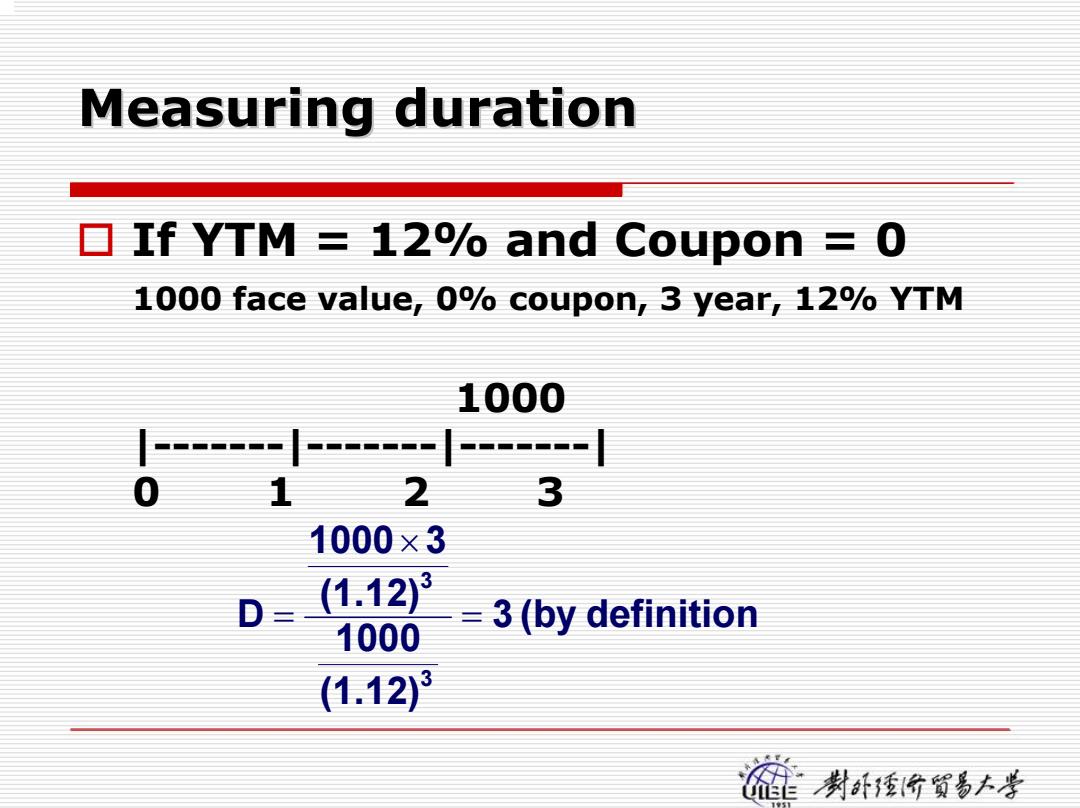

Measuring duration If YTM 12%and Coupon =0 1000 face value,0%coupon,3 year,12%YTM 1000 1000×3 D 三 (1.12)3 3(by definition 1000 (1.12 猫1的對香+手

Measuring duration Measuring duration If YTM = 12% and Coupon = 0 1000 face value, 0% coupon, 3 yea r, 12% YTM 1000 |-------|-------|-------| 0 1 2 3 3 (by definition (1.12) 1000 (1.12) 1000 3 D 3 3 = × =