卧的贸易孝 1951 Chapter 2 Analyzing E Bank Performance

Chapter 2 Chapter 2 Analyzing Bank Performance Analyzing Bank Performance

Balance Sheet It is a statement of financial position listing assets owned,liabilities owed, and owner's equity as of a specific date. Assets Liabilities Equity. Balance sheet figures are calculated at a particular point in time and thus represent stock values. 猫的资6+孝

Balance Sheet Balance Sheet It is a statement of financial position listing assets owned, liabilities owed, and owner’s equity as of a specific date. Assets = Liabilities + Equity. Balance sheet figures are calculated at a particular point in time and thus represent stock values

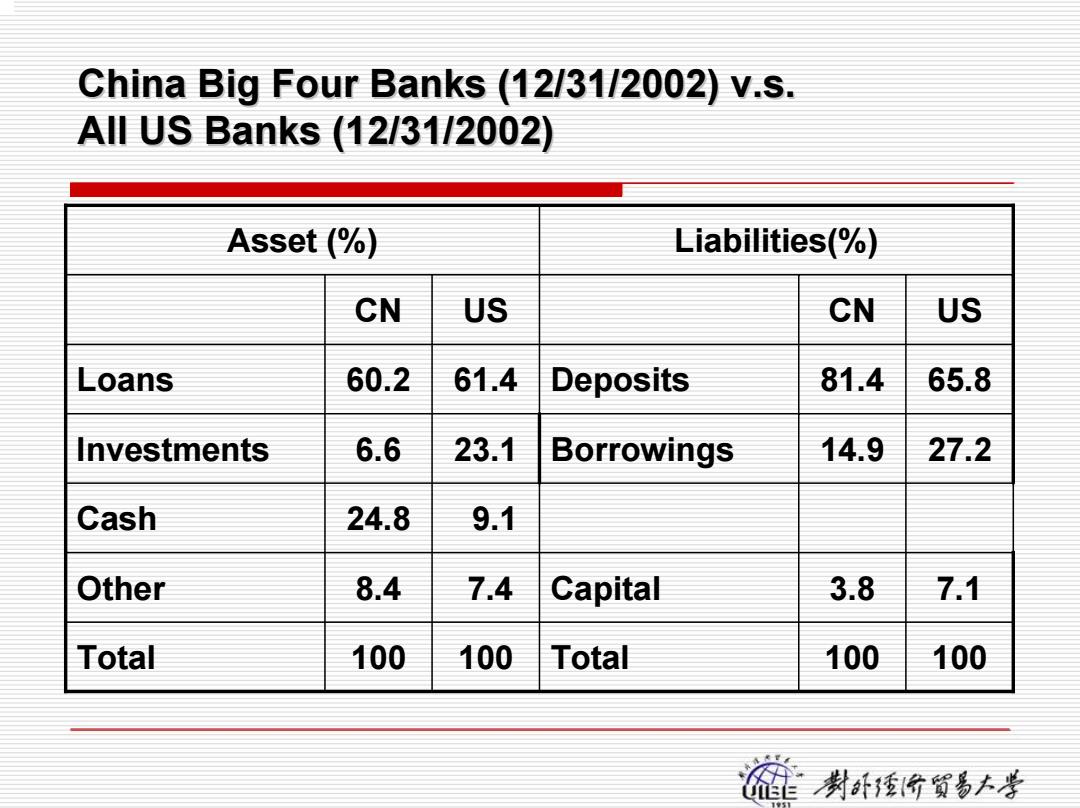

China Big Four Banks(12/31/2002)v.s. All US Banks (12/31/2002) Asset (% Liabilities(%)) CN US CN US Loans 60.2 61.4 Deposits 81.4 65.8 Investments 6.6 23.1 Borrowings 14.9 27.2 Cash 24.8 9.1 Other 8.4 7.4 Capital 3.8 7.1 Total 100 100 Total 100 100 爸数+号

China Big Four Banks (12/31/2002) v.s. China Big Four Banks (12/31/2002) v.s. All US Banks (12/31/2002) All US Banks (12/31/2002) Asset (%) Liabilities(%) CN US CN US Loans 60.2 61.4 Deposits 81.4 65.8 23.1 27.2 7.1 100 9.1 7.4 100 Investments 6.6 Borrowings 14.9 Cash 24.8 Other 8.4 Capital 3.8 Total 100 Total 100

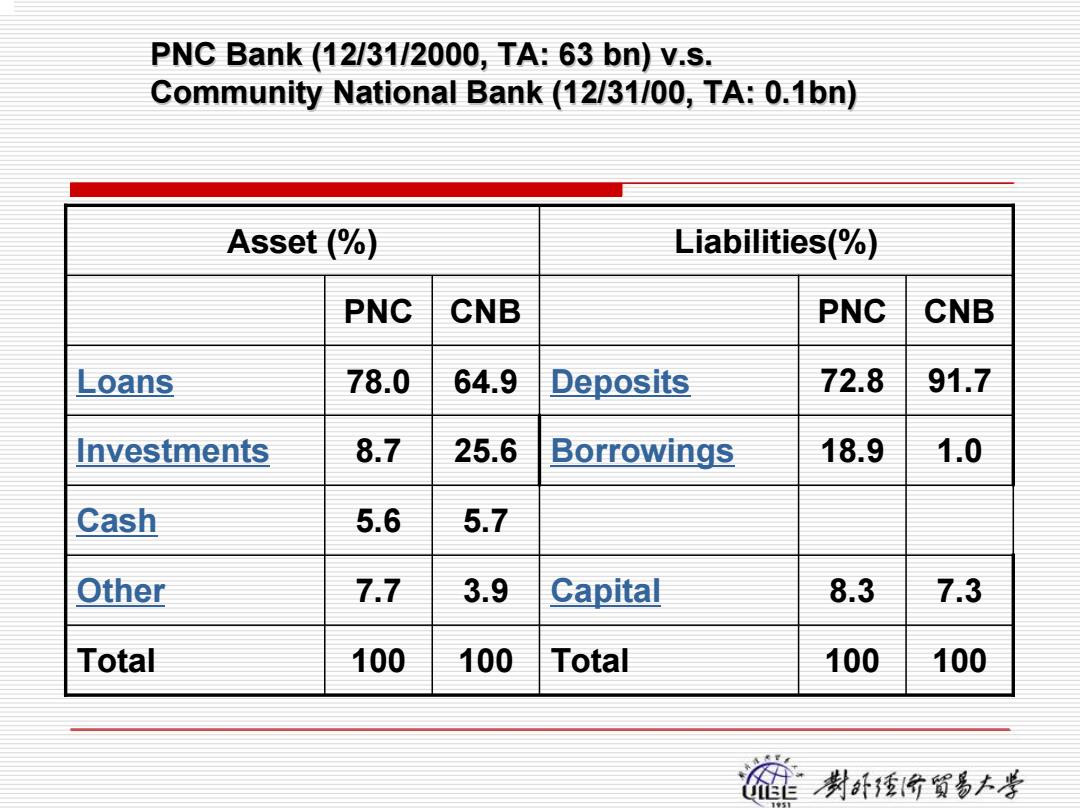

PNC Bank(12/31/2000,TA:63 bn)v.s. Community National Bank (12/31/00,TA:0.1bn) Asset (% Liabilities(%) PNC CNB PNC CNB Loans 78.0 64.9 Deposits 72.8 91.7 Investments 8.7 25.6 Borrowings 18.9 1.0 Cash 5.6 5.7 Other 7.7 3.9 Capital 8.3 7.3 Total 100 100 Total 100 100 的贸毒手

PNC Bank (12/31/2000, TA: 63 PNC Bank (12/31/2000, TA: 63 bn) v.s. Community National Bank (12/31/00, TA: 0.1bn) Community National Bank (12/31/00, TA: 0.1bn) Asset (%) Liabilities(%) PNC CNB PNC CNB Loans 78.0 64.9 Deposits 72.8 91.7 25.6 1.0 7.3 100 5.7 3.9 100 Investments 8.7 Borrowings 18.9 Cash 5.6 Other 7.7 Capital 8.3 Total 100 Total 100

Bank Assets:Loans Loans are the major asset in most banks'portfolios and generate the greatest amount of income before expenses and taxes. They also exhibit the highest default risk and are relatively illiquid 封酥的贸易+孝

Bank Assets: Loans Bank Assets: Loans Loans are the major asset in most banks’ portfolios and generate the greatest amount of income before expenses and taxes. They also exhibit the highest default risk and are relatively illiquid

Loans:Categories ▣Real estate loans ▣Commercial loans ▣Loans to individuals ▣Agricultural loans Other loans in domestic offices Loans and leases in foreign offices ▣Three adjustments Leases;Unearned income;Loss allowance 爸封强的黄香+孝

Loans: Categories Loans: Categories Real estate loans Commercial loans Loans to individuals Agricultural loans Other loans in domestic offices Loans and leases in f oreign offices Three adjustments Leases; Unearned income; Loss allowance

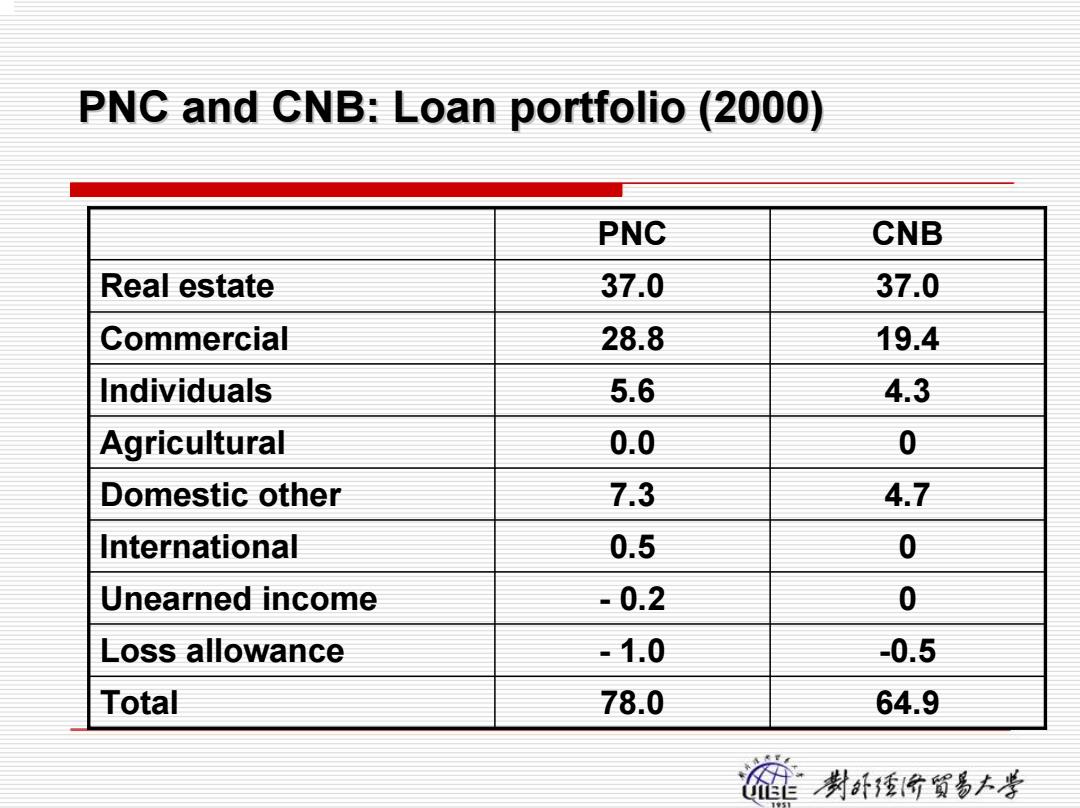

PNC and CNB:Loan portfolio (2000) PNC CNB Real estate 37.0 37.0 Commercial 28.8 19.4 Individuals 5.6 4.3 Agricultural 0.0 0 Domestic other 7.3 4.7 International 0.5 0 Unearned income -0.2 0 Loss allowance -1.0 0.5 Total 78.0 64.9 猫卧管+手

PNC and CNB: Loan portfolio (2000) PNC and CNB: Loan portfolio (2000) PNC CNB Real estate 37.0 37.0 Commercial 28.8 19.4 Individuals 5.6 4.3 Agricultural 0.0 0 Domestic other 7.3 4.7 International 0.5 0 Unearned income - 0.2 0 Loss allowance - 1.0 -0.5 Total 78.0 64.9

Bank Assets:Investment securities Investment securities are held to earn interest, ■ help meet liquidity needs ■ speculate on interest rate movements ■ serve as part of a bank's dealer functions. The administration and transaction costs are extremely low. 猫f的贺6号

Bank Assets: Bank Assets: Investment securities Investment securities Investment securities are held to earn interest, help meet liquidity needs speculate on interest rate movements serve as part of a bank’s dealer functions. The administration and transaction costs are extremely low

Bank Assets:Investment securities Short-term investments Interest-bearing bank balances (deposits due from other banks) ■ federal funds sold securities purchased under agreement to resell (RPs) Treasury bills municipal tax warrants Long-term investment:notes and bonds ■Treasury securities Obligations of federal agencies Mortgage-backed,foreign,and corporate 爸封强的黄香+孝

Bank Assets: Bank Assets: Investment securities Investment securities Short-term investments Interest-bearing bank balances (deposits due from other banks) federal funds sold securities purchased under agreement to resell (RPs) Treasury bills municipal tax warrants Long-term investment: notes and bonds Treasury securities Obligations of federal agencies Mortgage-backed, foreign, and corporate

Bank Assets: Noninterest cash and due from banks ▣It consists of vault cash, ■ deposits held at Federal Reserve Banks ■ deposits held at other financial institutions ■ cash items in the process of collection These assets are held to ■ meet customer withdrawal needs meet legal reserve requirements assist in check clearing and wire transfers effect the purchase and sale of Treasury securities 麓的贫香小手

Bank Assets: Bank Assets: Noninterest Noninterest cash and due from banks cash and due from banks It consists of vault cash, deposits held at Federal Reserve Banks deposits held at other financial institutions cash items in the process of collection These assets are held to meet customer withdrawal needs meet legal reserve requirements assist in check clearing and wire transfers effect the purchase and sale of Treasury securities