溢 制卧爱分贸多本考 银行管理学 对外经济贸易大学 2004-2005学年第一学期 《银行管理学》期末考试试卷(A卷) 课程代码及课序号:CUR302-1 学号: 姓名: 班级: 成绩: Note:This is a bilingual examination.You can answer in either English or Chinese. You can even answer part of one question in English and the rest in Chinese.If you answer ALL the questions ALL in English,you will get a bonus of 3 points. 为双语考试试卷,可用英文回答,也可用中文回答,也可部分英文、部分中文: 如全部使用英文回答,可获得3分的额外奖励。) 第一部分:必答题。合计40分。以下数据是三家银行2003年12月31日的资产 负债表数据和2003年度的损益表数据,这三家银行分别是中国工商银行(ICBC)、 美国富国银行(WF)、美国社区国民银行(CNB)。根据这些数据回答下列全部 .Part I.Required questions:You are required to answer all of the following questions.The following are the balance sheet data (on Dec.31,2003)and income statement data (fore the year of 2003)for one Chinese Bank (Industrial and Commercial Bank of China,ICBC)and two American banks (Wells Fargo,WF,and Community National Bank,CNB). (1)请根据下表数据计算三家银行的资产利润率和资本利润率(请注明公式)。 4.Please calculate ROA and ROE for three banks using the above data. (2)请根据下表数据计算中国工商银行(ICBC)的如下比率(请注明公式)。6 Please calculate the following ratios for ICBC using the above data. a)股权乘数Equity Multiplier b)费用比率Expense Ratio c)资产利用比率Asset Utilization Ratio d利差Spread e)负担比率Burden Ratio f)效率比率Efficiency Ratio (3)以中国工商银行的上述数据为例,说明如下比率之间的关系,用上述结论 加以验证,并说明运用这种关系进行分析的作用.6分.Using ICBC as an example, explain the relationship among the following ratios and use the above results to prove it.Then explain how we can use such relationship in analysis a)资产利润率Return on Assets(ROA) b)资本利润率Return on Equity(ROE) c)股权乘数Equity Multiplier d)费用比率Expense Ratio e)资产利用比率Asset Utilization Ratio 第1页共3页

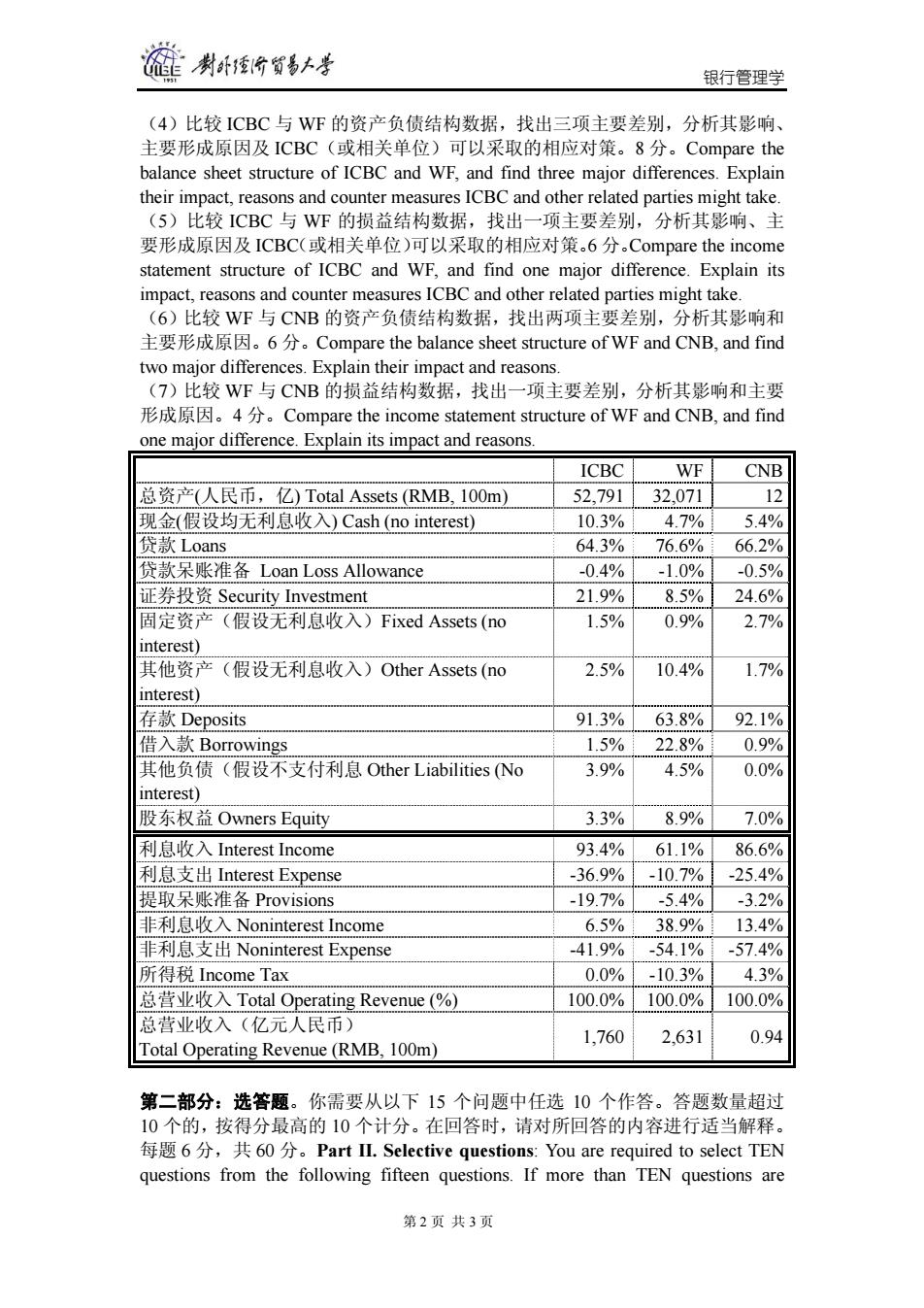

银行管理学 对外经济贸易大学 2004─2005学年第一学期 《银行管理学》期末考试试卷(A卷) 课程代码及课序号:CUR302-1 学号: 姓名: 班级: 成绩: Note: This is a bilingual examination. You can answer in either English or Chinese. You can even answer part of one question in English and the rest in Chinese. If you answer ALL the questions ALL in English, you will get a bonus of 3 points. (本试卷 为双语考试试卷,可用英文回答,也可用中文回答,也可部分英文、部分中文; 如全部使用英文回答,可获得 3 分的额外奖励。) 第一部分:必答题。合计 40 分。以下数据是三家银行 2003 年 12 月 31 日的资产 负债表数据和2003年度的损益表数据,这三家银行分别是中国工商银行(ICBC)、 美国富国银行(WF)、美国社区国民银行(CNB)。根据这些数据回答下列全部 问题。Part I. Required questions: You are required to answer all of the following questions. The following are the balance sheet data (on Dec. 31, 2003) and income statement data (fore the year of 2003) for one Chinese Bank (Industrial and Commercial Bank of China, ICBC) and two American banks (Wells Fargo, WF, and Community National Bank, CNB). (1)请根据下表数据计算三家银行的资产利润率和资本利润率(请注明公式)。 4 分。Please calculate ROA and ROE for three banks using the above data. (2)请根据下表数据计算中国工商银行(ICBC)的如下比率(请注明公式)。6 分。Please calculate the following ratios for ICBC using the above data. a) 股权乘数 Equity Multiplier b) 费用比率 Expense Ratio c) 资产利用比率 Asset Utilization Ratio d) 利差 Spread e) 负担比率 Burden Ratio f) 效率比率 Efficiency Ratio (3)以中国工商银行的上述数据为例,说明如下比率之间的关系,用上述结论 加以验证,并说明运用这种关系进行分析的作用。6 分。Using ICBC as an example, explain the relationship among the following ratios and use the above results to prove it. Then explain how we can use such relationship in analysis. a) 资产利润率 Return on Assets (ROA) b) 资本利润率 Return on Equity (ROE) c) 股权乘数 Equity Multiplier d) 费用比率 Expense Ratio e) 资产利用比率 Asset Utilization Ratio 第 1 页 共 3 页

制卧爱分贸多本学 银行管理学 (4)比较ICBC与WF的资产负债结构数据,找出三项主要差别,分析其影响、 主要形成原因及ICBC(或相关单位)可以采取的相应对策。8分。Compare the balance sheet structure of ICBC and WF,and find three major differences.Explain their impact,reasons and counter measures ICBC and other related parties might take. (5)比较ICBC与WF的损益结构数据,找出一项主要差别,分析其影响、主 要形成原因及ICBC(或相关单位)可以采取的相应对策.6分。Compare the income statement structure of ICBC and WF,and find one major difference.Explain its impact,reasons and counter measures ICBC and other related parties might take. (6)比较WF与CNB的资产负债结构数据,找出两项主要差别,分析其影响和 主要形成原因。6分。Compare the balance sheet structure of WF and CNB,and find two major differences.Explain their impact and reasons. (7)比较WF与CNB的损益结构数据,找出一项主要差别,分析其影响和主要 形成原因。4分。Compare the income statement structure of WF and CNB,and find one major difference.Explain its impact and reasons ICBC WF CNB 总资产(人民币,亿)Total Assets(RMB,100m) 52,791 32,071 12 现金(假设均无利息收入)Cash(no interest) 10.3% 4.7% 5.4% 贷款Loans 64.3% 76.6% 66.2% 贷款呆账准备Loan Loss Allowance -0.4% -1.0% -0.5% 证券投资Security Investment 21.9% 8.5% 24.6% 固定资产(假设无利息收入)Fixed Assets(no 1.5% 0.9% 2.7% interest) 其他资产(假设无利息收入)Other Assets(no 2.5% 10.4% 1.7% interest) 存款Deposits 91.3% 63.8% 92.1% 借入款Borrowings 1.5% 22.8% 0.9% 其他负债(假设不支付利息Other Liabilities (No 3.9% 4.5% 0.0% interest) 股东权益Owners Equity 3.3% 8.9% 7.0% 利息收入Interest Income 93.4% 61.1% 86.6% 利息支出Interest Expense -36.9% -10.7% -25.4% 提取呆账准备Provisions -19.7% -5.4% -3.2% 非利息收入Noninterest Income 6.5% 38.9% 13.4% 非利息支出Noninterest Expense -41.9% -54.1% -57.4% 所得税Income Tax 0.0% -10.3% 4.3% 总营业收入Total Operating Revenue(%) 100.0% 100.0% 100.0% 总营业收入(亿元人民币) 1,760 2,631 0.94 Total Operating Revenue(RMB,100m) 第二部分:选答题。你需要从以下15个问题中任选10个作答。答题数量超过 10个的,按得分最高的10个计分。在回答时,请对所回答的内容进行适当解释。 每题6分,共60分。Part II.Selective questions:You are required to select TEN questions from the following fifteen questions.If more than TEN questions are 第2页共3页

银行管理学 (4)比较 ICBC 与 WF 的资产负债结构数据,找出三项主要差别,分析其影响、 主要形成原因及 ICBC(或相关单位)可以采取的相应对策。8 分。Compare the balance sheet structure of ICBC and WF, and find three major differences. Explain their impact, reasons and counter measures ICBC and other related parties might take. (5)比较 ICBC 与 WF 的损益结构数据,找出一项主要差别,分析其影响、主 要形成原因及 ICBC(或相关单位)可以采取的相应对策。6 分。Compare the income statement structure of ICBC and WF, and find one major difference. Explain its impact, reasons and counter measures ICBC and other related parties might take. (6)比较 WF 与 CNB 的资产负债结构数据,找出两项主要差别,分析其影响和 主要形成原因。6 分。Compare the balance sheet structure of WF and CNB, and find two major differences. Explain their impact and reasons. (7)比较 WF 与 CNB 的损益结构数据,找出一项主要差别,分析其影响和主要 形成原因。4 分。Compare the income statement structure of WF and CNB, and find one major difference. Explain its impact and reasons. ICBC WF CNB 总资产(人民币,亿) Total Assets (RMB, 100m) 52,791 32,071 12 现金(假设均无利息收入) Cash (no interest) 10.3% 4.7% 5.4% 贷款 Loans 64.3% 76.6% 66.2% 贷款呆账准备 Loan Loss Allowance -0.4% -1.0% -0.5% 证券投资 Security Investment 21.9% 8.5% 24.6% 固定资产(假设无利息收入)Fixed Assets (no interest) 1.5% 0.9% 2.7% 其他资产(假设无利息收入)Other Assets (no interest) 2.5% 10.4% 1.7% 存款 Deposits 91.3% 63.8% 92.1% 借入款 Borrowings 1.5% 22.8% 0.9% 其他负债(假设不支付利息 Other Liabilities (No interest) 3.9% 4.5% 0.0% 股东权益 Owners Equity 3.3% 8.9% 7.0% 利息收入 Interest Income 93.4% 61.1% 86.6% 利息支出 Interest Expense -36.9% -10.7% -25.4% 提取呆账准备 Provisions -19.7% -5.4% -3.2% 非利息收入 Noninterest Income 6.5% 38.9% 13.4% 非利息支出 Noninterest Expense -41.9% -54.1% -57.4% 所得税 Income Tax 0.0% -10.3% 4.3% 总营业收入 Total Operating Revenue (%) 100.0% 100.0% 100.0% 总营业收入(亿元人民币) Total Operating Revenue (RMB, 100m) 1,760 2,631 0.94 第二部分:选答题。你需要从以下 15 个问题中任选 10 个作答。答题数量超过 10 个的,按得分最高的 10 个计分。在回答时,请对所回答的内容进行适当解释。 每题 6 分,共 60 分。Part II. Selective questions: You are required to select TEN questions from the following fifteen questions. If more than TEN questions are 第 2 页 共 3 页

制卧价贸易+考 银行管理学 answered,the ones with the highest scores will be counted.In answering,please explain the main points. l.影响银行业变化的五个基本因素是什么?What are the fundamental forces of changes in Banking? 2.评估商业贷款申请的四个步骤是什么?What is the four-part process in evaluating a commercial loan request? 3.在评估消费者贷款申请时,运用评分体系的优势和劣势主要是什么?I evaluating consumer loan requests,what are the major advantages and disadvantages of using credit scoring system? 4. 银行持有现金资产的四个目标是什么?What are the four objectives of holding cash assets by banks? 5. 银行流动性、盈利性与风险三者之间存在什么样的关系?What is the relationship among liquidity,profitability and risk in a bank? 6. What are the major risks a bank face in its operation?Explain each risk briefly. 行经营中面临的主要风险有哪些?简要解释每一种风险。 7.银行资本的主要功能是什么?资本是如何实现这一功能的?What is the function of bank capital?How does it achieve this function? 8. 在评估消费者贷款时,什么是好贷款的5个C?。In evaluating consumer loan requests,what are the five Cs? 9.1 简要比较商业贷款申请的评估与消费者贷款申请的评估。Compare the credit analysis of commercial loan requests and consumer loan requests. l0.处置抵押品显然并不是获得贷款偿还的最佳方法。为什么?Liquidating collateral is clearly a second best source of repayment.Why? 11.试说明并比较中间业务与表外业务的概念,同时说明这两类业务主要都包括 哪些y业务。Explain and compare the concepts of Fee-based Business and Off-Balance-Sheet Items.And explain the specific types of business included in these two categories. 12.从2004年10月29日起,金融机构(不含城乡信用社)的贷款利率原则上 不再设定上限,这对我国商业银行有什么样的影响?Starting from October29 2004,the ceiling on the loans of financial institutions(excluding urban and rural credit unions)is eliminated in principle.What is its impact on Chinese banks? l3.简要说明不良贷款定价的特殊性及其主要方法。Why is pricing non-performing loans(NPLs)special?What are the main ways to price NPLs? I4.简要阐述银行风险管理过程的四个基本环节。What are the four steps banks employee in managing risks? 15.什么是利率敏感性缺口?商业银行在经营管理过程中如何运用利率敏感性 缺▣战略?What is an interest rate sensitive gap?How does a bank use interest rate sensitive gap strategy? 第3页共3页

银行管理学 answered, the ones with the highest scores will be counted. In answering, please explain the main points. 1. 影响银行业变化的五个基本因素是什么?What are the fundamental forces of changes in Banking? 2. 评估商业贷款申请的四个步骤是什么?What is the four-part process in evaluating a commercial loan request? 3. 在评估消费者贷款申请时,运用评分体系的优势和劣势主要是什么?In evaluating consumer loan requests, what are the major advantages and disadvantages of using credit scoring system? 4. 银行持有现金资产的四个目标是什么?What are the four objectives of holding cash assets by banks? 5. 银行流动性、盈利性与风险三者之间存在什么样的关系?What is the relationship among liquidity, profitability and risk in a bank? 6. What are the major risks a bank face in its operation? Explain each risk briefly.银 行经营中面临的主要风险有哪些?简要解释每一种风险。 7. 银行资本的主要功能是什么?资本是如何实现这一功能的?What is the function of bank capital? How does it achieve this function? 8. 在评估消费者贷款时,什么是好贷款的 5 个 C?。In evaluating consumer loan requests, what are the five Cs? 9. 简要比较商业贷款申请的评估与消费者贷款申请的评估。Compare the credit analysis of commercial loan requests and consumer loan requests. 10. 处置抵押品显然并不是获得贷款偿还的最佳方法。为什么?Liquidating collateral is clearly a second best source of repayment. Why? 11. 试说明并比较中间业务与表外业务的概念,同时说明这两类业务主要都包括 哪些业务。Explain and compare the concepts of Fee-based Business and Off-Balance-Sheet Items. And explain the specific types of business included in these two categories. 12. 从 2004 年 10 月 29 日起,金融机构(不含城乡信用社)的贷款利率原则上 不再设定上限,这对我国商业银行有什么样的影响?Starting from October 29, 2004, the ceiling on the loans of financial institutions (excluding urban and rural credit unions) is eliminated in principle. What is its impact on Chinese banks? 13. 简要说明不良贷款定价的特殊性及其主要方法。Why is pricing non-performing loans (NPLs) special? What are the main ways to price NPLs? 14. 简要阐述银行风险管理过程的四个基本环节。What are the four steps banks employee in managing risks? 15. 什么是利率敏感性缺口?商业银行在经营管理过程中如何运用利率敏感性 缺口战略?What is an interest rate sensitive gap? How does a bank use interest rate sensitive gap strategy? 第 3 页 共 3 页