”制卧份贸易+考 银行管理学 对外经济贸易大学 2003一2004学年第二学期 《银行管理学》期末考试试卷(A卷) 课程代码及课序号:CUR302一1 参考答案及评分标准 Part I.Required questions:You are required to answer all of the following questions.. 分:必答题。合计50分)The following are the balance sheet data(on Dec..3l,2003)and income statement data(fore the year of2003)for ABC Bank.以下数据是ABC银行2003年l2月31日 的资产负债表数据和2003年度的损益表数据。 l)Workout a balance sheet and income statement for the ABC Bank。(20分)编写ABC银行 的资产负债表和损益表。 2)Translate all items into Chinese(10分)将所有项目翻译成中文(直接翻译在题中所列项 目的后面:错一个扣0.5分)。 3)Calculate the following ratios (please indicate all detailed steps and formulas 8;explain each ratio briefly (8);explain the main relationship between these ratios,and use the calculated results to prove these relationship(4分)。计算如下比例(列明详细步骤和公式): 简要解释每个比例:说明这些比例之间的主要关系,并运用计算结果证明这种关系。 Balance Sheet for ABC Bank As of 12/31/2003,in 100 millions Assets Loans: Real estate loans 370 Commercial loans 310 Individual loans 120 Agricultural loans 10 Other LN&LS in domestic off. 0 LN&LS in foreign off. 0 Less:Unearned Income -10 Loan Lease loss Allowance -10 Investments: U.S.Treasury Agency securities 50 All other securities 50 Interest bearing bank balances 10 Fed funds sold resales 10 Trading account assets 10 Nonint Cash Due from banks 60 Premises,fixed assets capital leases 20 Total Assets 1000 第1页共4页

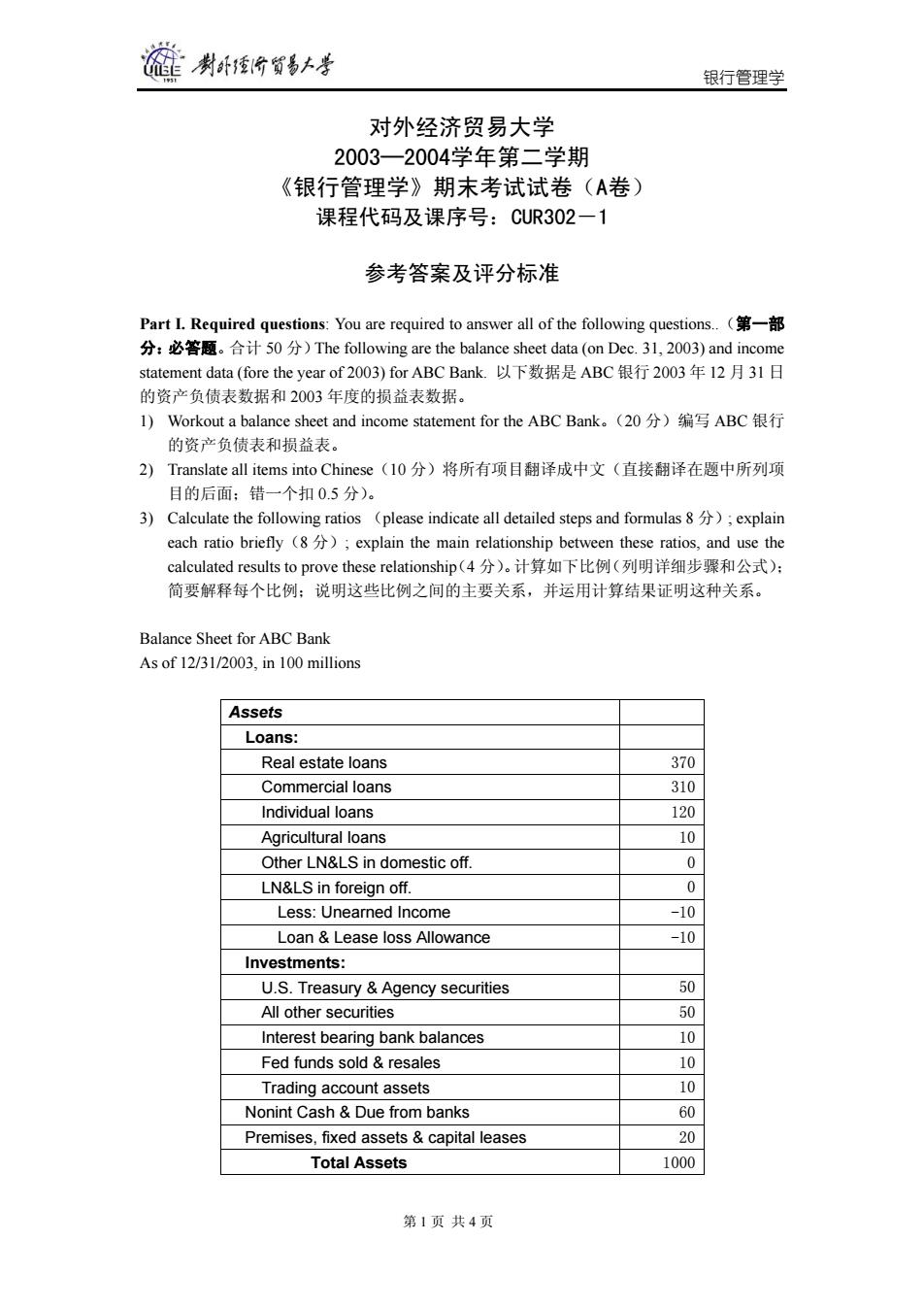

银行管理学 对外经济贸易大学 2003─2004学年第二学期 《银行管理学》期末考试试卷(A卷) 课程代码及课序号:CUR302-1 参考答案及评分标准 Part I. Required questions: You are required to answer all of the following questions..(第一部 分:必答题。合计 50 分)The following are the balance sheet data (on Dec. 31, 2003) and income statement data (fore the year of 2003) for ABC Bank. 以下数据是 ABC 银行 2003 年 12 月 31 日 的资产负债表数据和 2003 年度的损益表数据。 1) Workout a balance sheet and income statement for the ABC Bank。(20 分)编写 ABC 银行 的资产负债表和损益表。 2) Translate all items into Chinese(10 分)将所有项目翻译成中文(直接翻译在题中所列项 目的后面;错一个扣 0.5 分)。 3) Calculate the following ratios (please indicate all detailed steps and formulas 8 分); explain each ratio briefly(8 分); explain the main relationship between these ratios, and use the calculated results to prove these relationship(4 分)。计算如下比例(列明详细步骤和公式); 简要解释每个比例;说明这些比例之间的主要关系,并运用计算结果证明这种关系。 Balance Sheet for ABC Bank As of 12/31/2003, in 100 millions Assets Loans: Real estate loans 370 Commercial loans 310 Individual loans 120 Agricultural loans 10 Other LN&LS in domestic off. 0 LN&LS in foreign off. 0 Less: Unearned Income -10 Loan & Lease loss Allowance -10 Investments: U.S. Treasury & Agency securities 50 All other securities 50 Interest bearing bank balances 10 Fed funds sold & resales 10 Trading account assets 10 Nonint Cash & Due from banks 60 Premises, fixed assets & capital leases 20 Total Assets 1000 第 1 页 共 4 页

”肉卧价贸多本学 银行管理学 Liabilities Demand deposits 120 All NOW ATS Accounts 40 Money market deposit accounts 320 Other savings deposits 30 Time deposits under $100M 200 Time deposits of $100M or more 80 Deposits held in foreign offices 40 Fed funds purchased resale 30 Other borrowings 40 Sub.Notes Debentures 20 common equity 60 preferred Equity 20 Total Liabilities Capital 1000 Income Statement:ABC Bank 2003,in 100 millions Interest Income: Interest and fees on loans 62 Income from lease financing Investment Interest Income(TE) 6 Interest on due from banks 1 Total interest income(TE) 73 Interest Expense: interest on deposits held in foreign offices 2 Interest on CD's over $100M 4 Interest on All Other Deposits: 25 Interest on Fed funds purchased resale 2 Interest on Trad Liab Oth Borrowings 7 Interest on subbordinates and debentures 2 Total interest expense 42 Net interest income(TE) 31 Noninterest Income: Fiduciary Activities 13 Deposit service charges 5 Trading revenue 1 Other noninterest income 9 Total noninterest income 28 Adjusted Operating Income(TE) 59 Non-Interest Expenses: Personnel expenses 16 Occupancy expense 5 第2页共4页

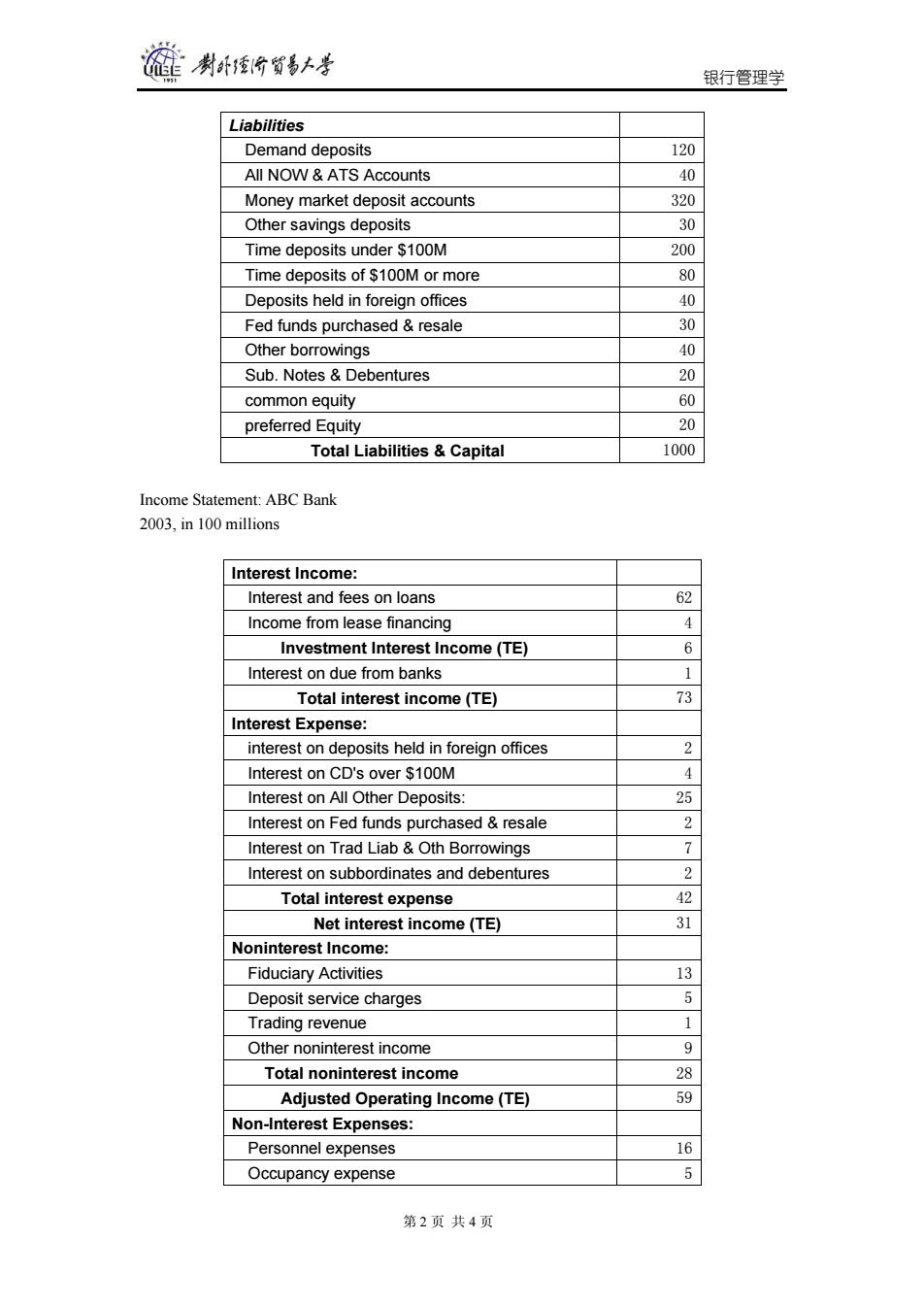

银行管理学 Liabilities Demand deposits 120 All NOW & ATS Accounts 40 Money market deposit accounts 320 Other savings deposits 30 Time deposits under $100M 200 Time deposits of $100M or more 80 Deposits held in foreign offices 40 Fed funds purchased & resale 30 Other borrowings 40 Sub. Notes & Debentures 20 common equity 60 preferred Equity 20 Total Liabilities & Capital 1000 Income Statement: ABC Bank 2003, in 100 millions Interest Income: Interest and fees on loans 62 Income from lease financing 4 Investment Interest Income (TE) 6 Interest on due from banks 1 Total interest income (TE) 73 Interest Expense: interest on deposits held in foreign offices 2 Interest on CD's over $100M 4 Interest on All Other Deposits: 25 Interest on Fed funds purchased & resale 2 Interest on Trad Liab & Oth Borrowings 7 Interest on subbordinates and debentures 2 Total interest expense 42 Net interest income (TE) 31 Noninterest Income: Fiduciary Activities 13 Deposit service charges 5 Trading revenue 1 Other noninterest income 9 Total noninterest income 28 Adjusted Operating Income (TE) 59 Non-Interest Expenses: Personnel expenses 16 Occupancy expense 5 第 2 页 共 4 页

麓肉价货多大考 银行管理学 Other operating expense (incl.intangibles) 15 Total Noninterest Expenses 36 Provision:Loan Lease Losses 2 Pretax Operating Income(TE) 21 Realized G/L Hld-to-Maturity Sec. 2 Realized G/L Avail-for-Sale Sec. Pretax Net Operating Income(TE) 23 Applicable Income Taxes 8 Net Income 15 ROE 18.8%;ROA 1.5%;Equity Multiplier 12.50;Expense Ratio 8.0%;asset utilization 10.3%spread 3.4%;burden ratio 8.0%;efficiency ratio 61.0% Part II l.What are the major risks a bank face in its operation?Explain each risk briefly.银行经营中 面临的主要风险有哪些?简要解释每一种风险。 a)Credit risk b)Liquidity risk c)Market risk d)Operational risk e)Reputation risk f)Legal risk. 2.What is CAMESL rating system?Explain each item briefly.什么是CAMELS评级体系? 简要解释每一个项目。 a))Capital b)Asset quality c)Management quality d) Earnings e)Liquidity f)Sensitivity to market risk 3.What is the function of bank capital?How does it achieve this function?银行资本的主要功 能是什么?资本是如何实现这一功能的? a)Reduce bank risk. b)A cushion to absorb losses and remain solvent c)A ready access to financial markets and thus guards against liquidity problems d)Constrains growth and limits risk taking 4.In evaluating consumer loan requests,.what are the five Cs?Explain each briefly..在评估消 费者贷款时,什么是好贷款的5个C?简要解释每一个C。 a)Character:honesty and trustworthiness. b)Capital:wealth position measured by financial soundness and market standing. c) Collateral:secondary source of repayment or security in the case of default. d)Customer relationships e) Competition 第3页共4页

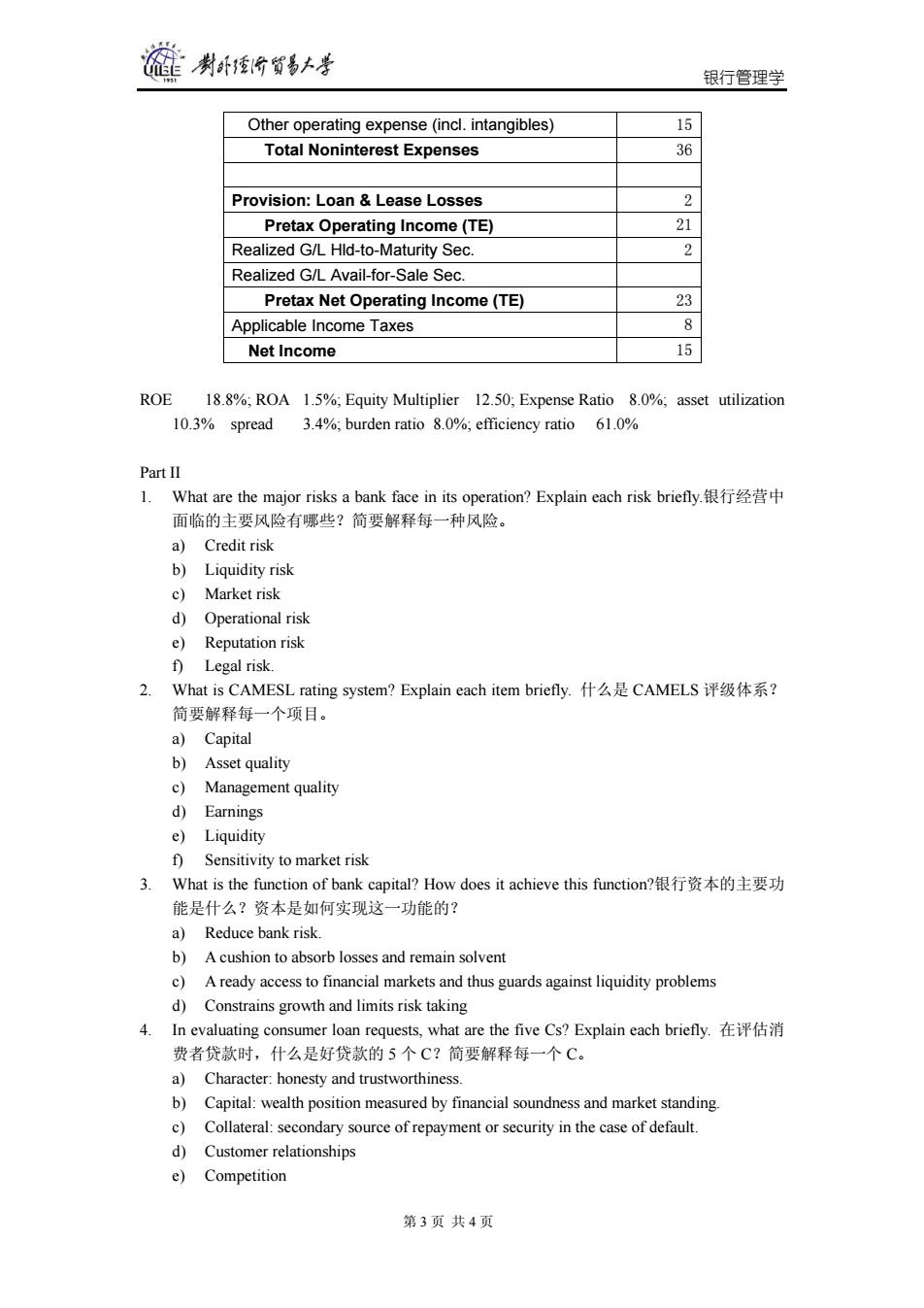

银行管理学 Other operating expense (incl. intangibles) 15 Total Noninterest Expenses 36 Provision: Loan & Lease Losses 2 Pretax Operating Income (TE) 21 Realized G/L Hld-to-Maturity Sec. 2 Realized G/L Avail-for-Sale Sec. Pretax Net Operating Income (TE) 23 Applicable Income Taxes 8 Net Income 15 ROE 18.8%; ROA 1.5%; Equity Multiplier 12.50; Expense Ratio 8.0%; asset utilization 10.3% spread 3.4%; burden ratio 8.0%; efficiency ratio 61.0% Part II 1. What are the major risks a bank face in its operation? Explain each risk briefly.银行经营中 面临的主要风险有哪些?简要解释每一种风险。 a) Credit risk b) Liquidity risk c) Market risk d) Operational risk e) Reputation risk f) Legal risk. 2. What is CAMESL rating system? Explain each item briefly. 什么是 CAMELS 评级体系? 简要解释每一个项目。 a) Capital b) Asset quality c) Management quality d) Earnings e) Liquidity f) Sensitivity to market risk 3. What is the function of bank capital? How does it achieve this function?银行资本的主要功 能是什么?资本是如何实现这一功能的? a) Reduce bank risk. b) A cushion to absorb losses and remain solvent c) A ready access to financial markets and thus guards against liquidity problems d) Constrains growth and limits risk taking 4. In evaluating consumer loan requests, what are the five Cs? Explain each briefly. 在评估消 费者贷款时,什么是好贷款的 5 个 C?简要解释每一个 C。 a) Character: honesty and trustworthiness. b) Capital: wealth position measured by financial soundness and market standing. c) Collateral: secondary source of repayment or security in the case of default. d) Customer relationships e) Competition 第 3 页 共 4 页

制卧价贸易上考 银行管理学 5.What are five fundamental issues in evaluating commercial loan request?Explain each briefly.在评估商业贷款时,需要考察的五个基本因素是什么?简要解释每一个因素。 a)Character and data quality b)Use of loan proceeds c)Loan amount d)Source and timing of repayment e)Collateral 6.Compare the credit analysis of commercial loan requests and consumer loan requests. 比较商业贷款申请的评估与消费者贷款申请的评估。) a)Analysis of consumer loans differ from that of commercial loans:When evaluating measurable aspects of requests,banks are addressing the same issues.Banks have to deal with a large number of distinct borrowers with different personalities and financial characteristics. b)Consumer loans differ so much in design that no comprehensive analytical format applies to all loans.For most consumer loans,there is no formal analysis of individual borrower characteristics unless a credit scoring model is used.Installment loans are treated much like commercial loans.The quality of financial data is lower:Unaudited. The primary source of repayment is current income,which may be highly volatile.The net effect is that character is more difficult to assess,but extremely important. 7.Liquidating collateral is clearly a second best source of repayment..Why?(处置抵押品显然 并不是获得贷款偿还的最佳方法。为什么?) a)There are three reasons: b) There are significant transactions costs associated with foreclosure.Time,money. c)Bankruptcy laws allow borrowers to retain possession of the collateral long after they have defaulted. d)When the bank takes possession of the collateral,it deprives the borrower of the opportunity to salvage the company. 8.How to determine the minimum capital requirements for a bank to be adequately capitalized? 如何确定一家银行保持充足的资本化所需要达到的最低资本金要求? a)Classify assets into one of four risk categories b)Convert off-balance sheet commitments and guarantees c)Multiply by weight d)Multiply by 4%or 8% 第4页共4页

银行管理学 5. What are five fundamental issues in evaluating commercial loan request? Explain each briefly. 在评估商业贷款时,需要考察的五个基本因素是什么?简要解释每一个因素。 a) Character and data quality b) Use of loan proceeds c) Loan amount d) Source and timing of repayment e) Collateral 6. Compare the credit analysis of commercial loan requests and consumer loan requests.(简要 比较商业贷款申请的评估与消费者贷款申请的评估。) a) Analysis of consumer loans differ from that of commercial loans: When evaluating measurable aspects of requests, banks are addressing the same issues. Banks have to deal with a large number of distinct borrowers with different personalities and financial characteristics. b) Consumer loans differ so much in design that no comprehensive analytical format applies to all loans. For most consumer loans, there is no formal analysis of individual borrower characteristics unless a credit scoring model is used. Installment loans are treated much like commercial loans. The quality of financial data is lower: Unaudited. The primary source of repayment is current income, which may be highly volatile. The net effect is that character is more difficult to assess, but extremely important. 7. Liquidating collateral is clearly a second best source of repayment. Why?(处置抵押品显然 并不是获得贷款偿还的最佳方法。为什么?) a) There are three reasons: b) There are significant transactions costs associated with foreclosure. Time, money. c) Bankruptcy laws allow borrowers to retain possession of the collateral long after they have defaulted. d) When the bank takes possession of the collateral, it deprives the borrower of the opportunity to salvage the company. 8. How to determine the minimum capital requirements for a bank to be adequately capitalized? 如何确定一家银行保持充足的资本化所需要达到的最低资本金要求? a) Classify assets into one of four risk categories b) Convert off-balance sheet commitments and guarantees c) Multiply by weight d) Multiply by 4% or 8% 第 4 页 共 4 页