卧的贸易孝 1951 Chapter 7 The Effective Use of Capital

Chapter 7 Chapter 7 The Effective Use of The Effective Use of Capital Capital

The function of bank capital ▣Reduce bank risk. ▣Three basic ways: A cushion to absorb losses and remain solvent Increases the proportion of allowable problem assets that can default before equity is depleted. A ready access to financial markets and thus guards against liquidity problems Constrains growth and limits risk taking 爸封强的黄香+孝

The function of bank capital The function of bank capital Reduce bank risk. Three basic ways: A cushion to absorb losses and remain solvent Increases the proportion of allowable problem assets that can default before equity is depleted. A ready access to financial markets and thus guards against liquidity problems Constrains growth and limits risk taking

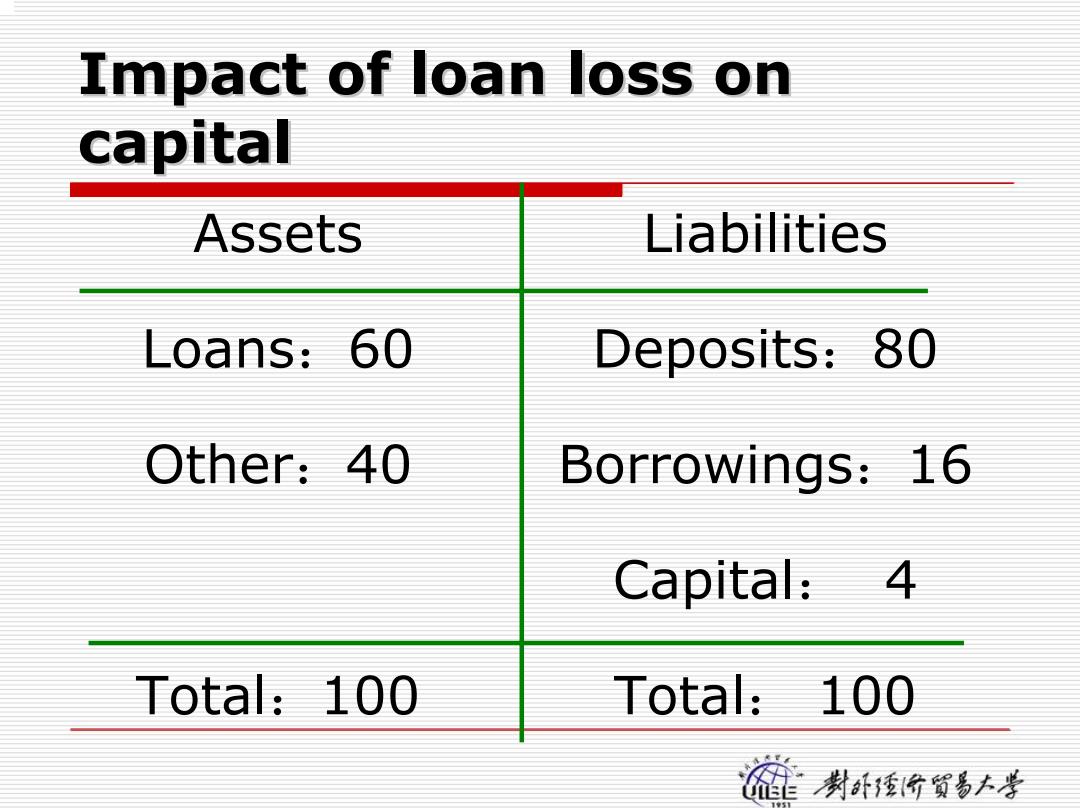

Impact of loan loss on capital Assets Liabilities Loans:60 Deposits:80 Other:40 Borrowings:16 Capital:4 Total:100 Total:100 藏的数香大孝

Impact of loan loss on Impact of loan loss on capital capital Capital : 4 Total :100 Total : 100 Other :40 Borrowings :16 Loans :60 Deposits :80 Assets Liabilities

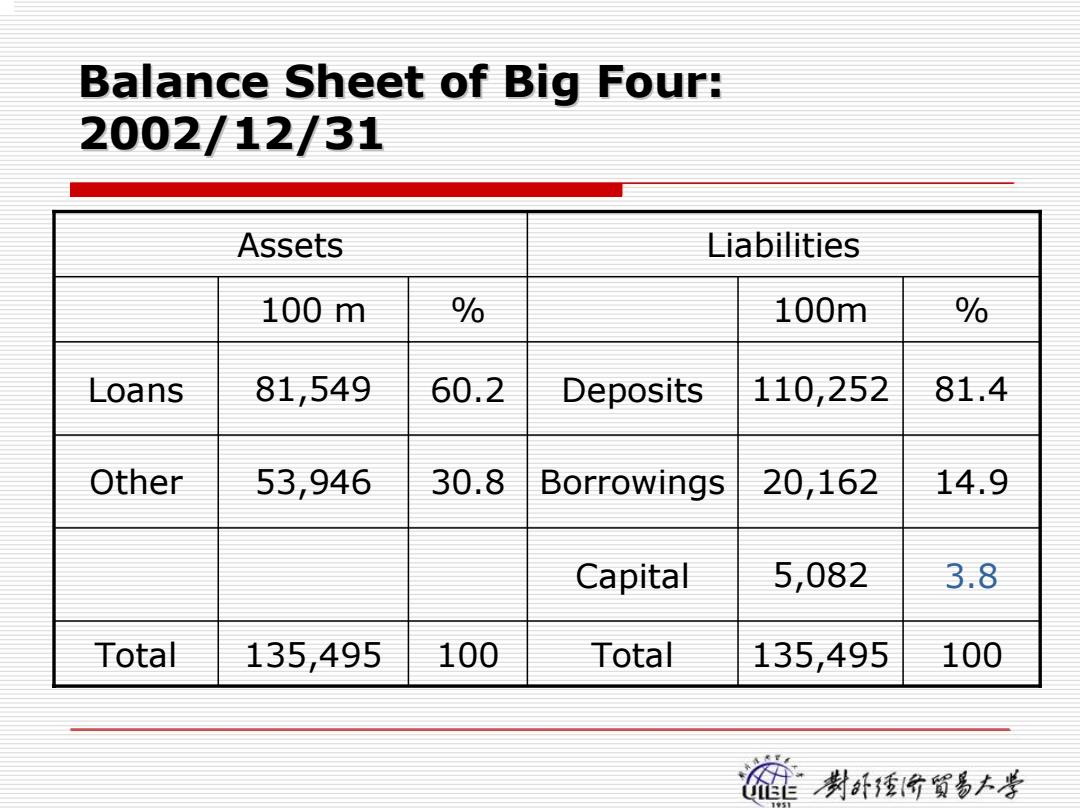

Balance Sheet of Big Four: 2002/12/31 Assets Liabilities 100m % 100m % Loans 81,549 60.2 Deposits 110,252 81.4 Other 53,946 30.8 Borrowings 20,162 14.9 Capital 5,082 3.8 Total 135,495 100 Total 135,495 100 猫剥1隆竹對+号

Balance Sheet of Big Four: Balance Sheet of Big Four: 2002/12/31 2002/12/31 Assets Liabilities 100 m % 100m % Loans 81,549 60.2 Deposits 110,252 81.4 Other 53,946 30.8 Borrowings 20,162 14.9 Capital 5,082 3.8 Total 135,495 100 Total 135,495 100

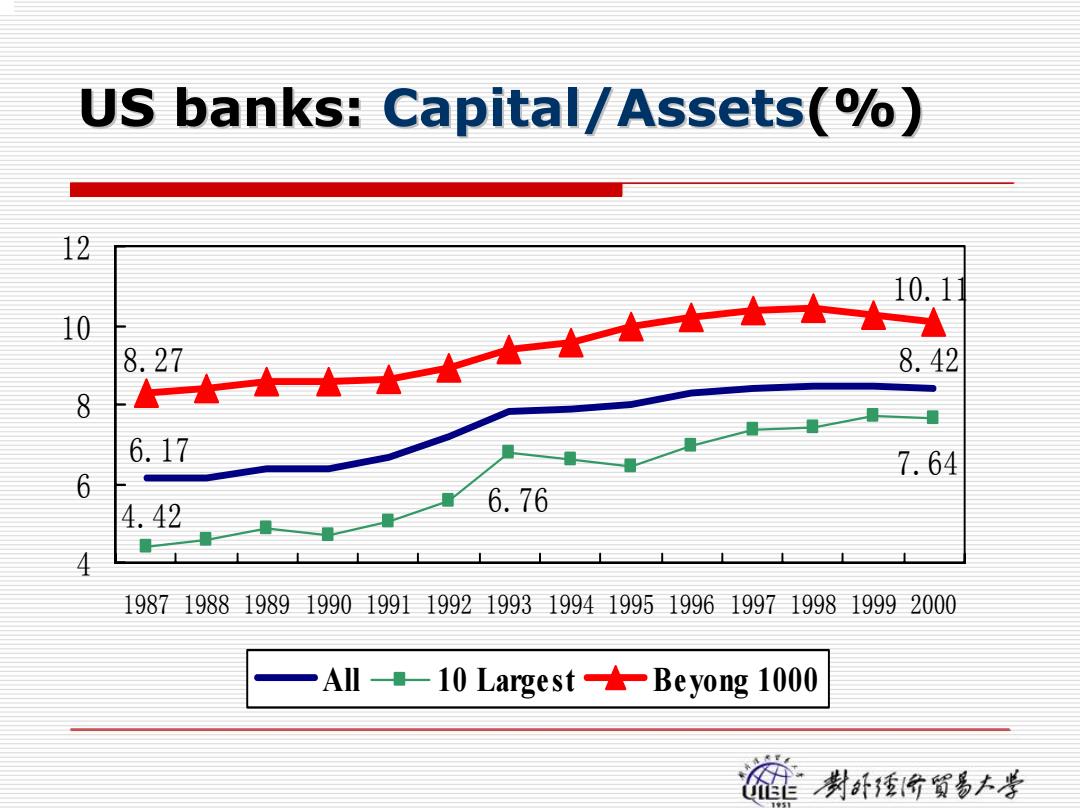

US banks:Capital/Assets(%) 12 10.1 10 8.27 8.42 8 6.17 7.64 6 4.42 6.76 19871988198919901991199219931994199519961997199819992000 -All-10 Largest-Beyong 1000 麓行贺影≠考

US banks: US banks: Capital/Assets Capital/Assets(%) 6.17 8.42 6.76 4.42 7.64 8.27 10.11 4 6 8 10 12 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 All 10 Largest Beyong 1000

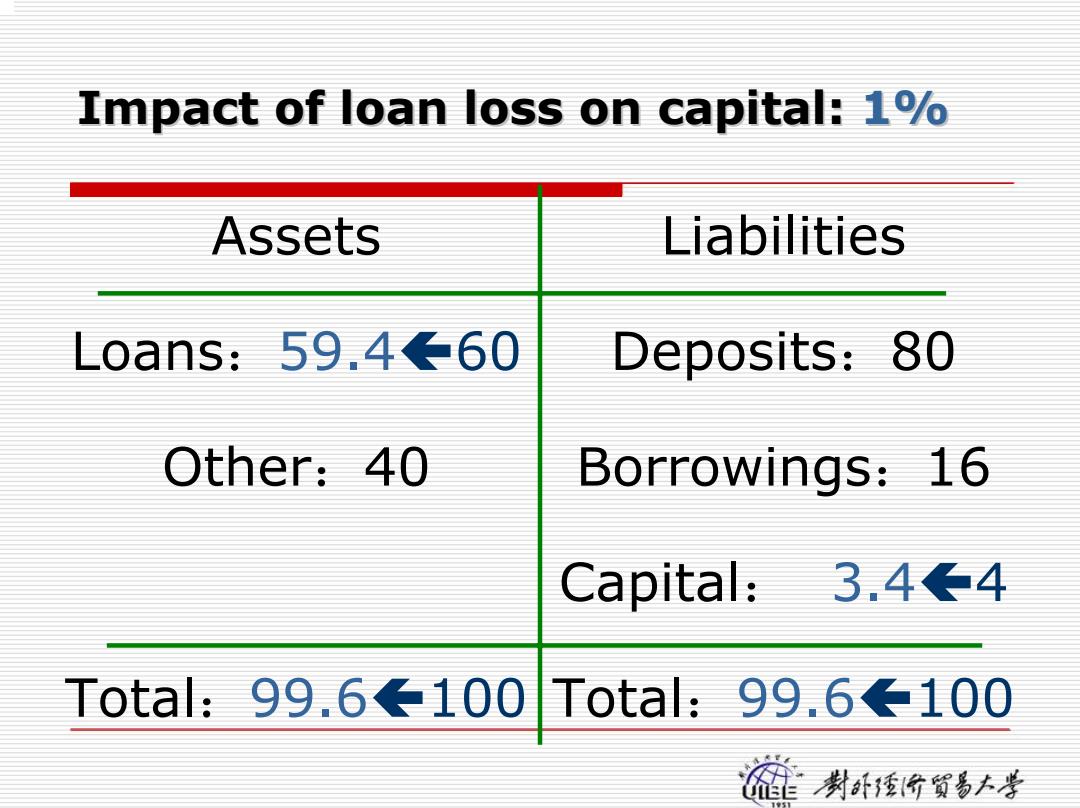

Impact of loan loss on capital:1% Assets Liabilities L0ans:59.4←60 Deposits:80 Other:40 Borrowings:16 Capital:3.4←4 Tota:99.6←100 Total:99.6←100 藏的数香大孝

Impact of loan loss on capital: Impact of loan loss on capital: 1% Capital : 3.4 Ã 4 Total :99.6 Ã100 Total :99.6 Ã100 Other :40 Borrowings :16 Loans :59.4 Ã60 Deposits :80 Assets Liabilities

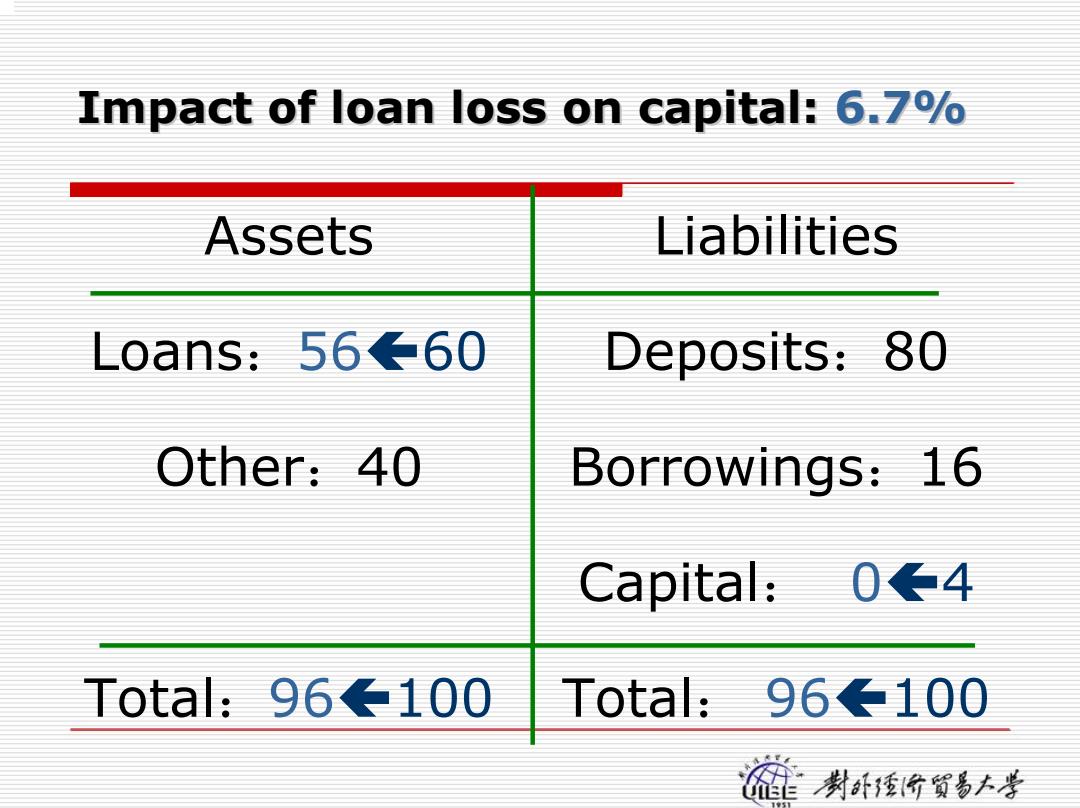

Impact of loan loss on capital:6.7% Assets Liabilities L0ans:56←60 Deposits:80 Other:40 Borrowings:16 Capital.0←4 Total:96←100 Total:96←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 6.7% Capital : 0 Ã 4 Total :96 Ã100 Total : 96 Ã100 Other :40 Borrowings :16 Loans :56 Ã60 Deposits :80 Assets Liabilities

Impact of loan loss on capital:10% Assets Liabilities L0ans:54←60 Deposits:80 Other:40 Borrowings:16 Capital:-2←4 Tota.94←100 Total:94←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 10% Capital :- 2 Ã 4 Total :94 Ã100 Total :94 Ã100 Other :40 Borrowings :16 Loans :54 Ã60 Deposits :80 Assets Liabilities

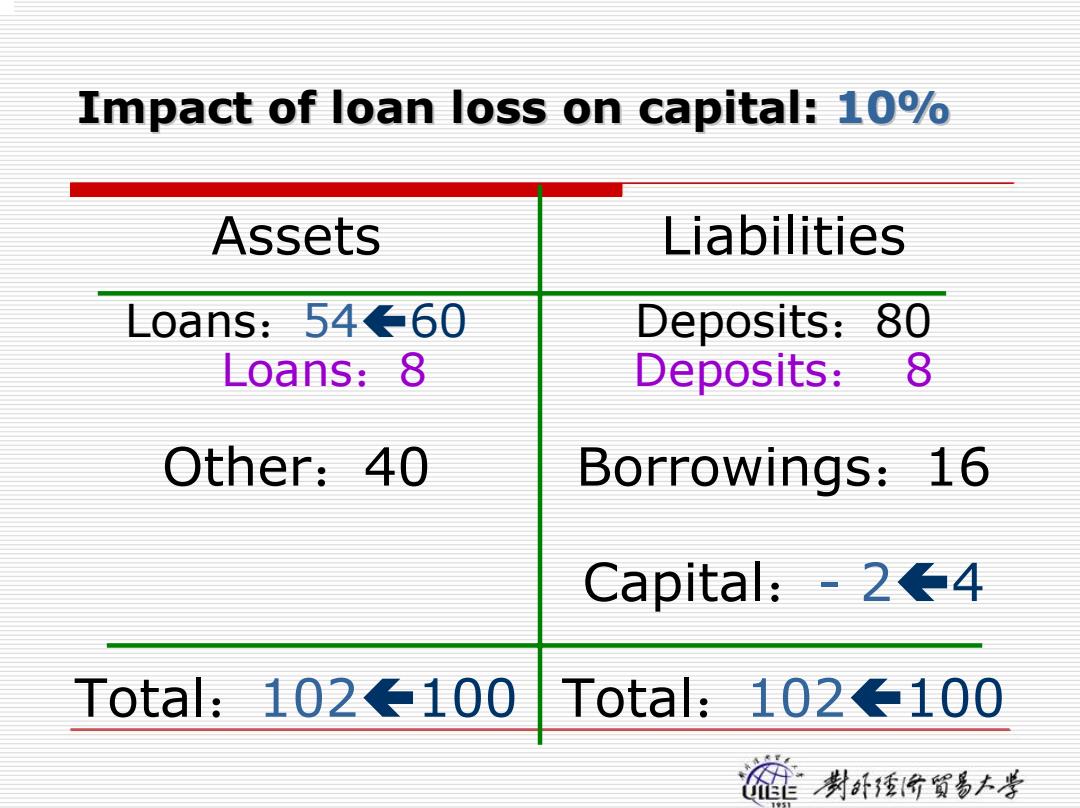

Impact of loan loss on capital:10% Assets Liabilities L0ans:54←60 Deposits:80 Loans:8 Deposits: 8 Other:40 Borrowings:16 Capital:-2←4 Tota:102←100 Tota:102←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 10% Capital :- 2 Ã 4 Total :102 Ã100 Total :102 Ã100 Other :40 Borrowings :16 Deposits:80 Deposits: 8 Loans:54 Ã60 Loans:8 Assets Liabilities

Ready access to financial markets Adequate bank capital minimizes operating problems by providing ready access to financial markets. As long as a bank's capital exceeds the regulatory minimums,it can stay open and has the potential to generate earnings to cover losses and expand. Failures are tied directly to market values,not accounting values. 行贺影小号

Ready access to financial Ready access to financial markets markets Adequate bank capital minimizes operating problems by providing ready access to financial markets. As long as a bank’s capital exceeds the regulatory minimums, it can stay open and has the potential to generate earnings to cover losses and expand. Failures are tied directly to market values, not accounting values