海南大学2007-08学年度第1学期《微观经济学》答案(B卷) 一、Please explain the following terms:(每题5分,共50分) 1 Degree of economies of scope (SC)Percentage of cost savings resulting when two or more products are produced jointly rather than individually 2 Depletable resource A natural resource,such as oil or copper,which if produced today is unavailable for future production 3 Equilibrium in dominant strategies Outcome of a game in which each firm is doing the best it can regardless of what its competitors are doing. 4 First theorem of welfare economics If everyone trades in the competitive marketplace,all mutually beneficial trades will be completed and the resulting equilibrium allocation of resources will be economically efficient. 5 General ea quilibri m analysis Simultand ous determination of the prices and quantities in all relevaflt markets,taking feedback effects into account 6 Giffen good Good whose demand curve slopes upward because the (positive) income effect is larger than the(negative)substitution effect. 7 Intertemporal price discrimination Practice of separating consumers with different demand functions into different groups by charging different prices at different points in time. 8 Law of diminishing marginal returns Principle that as the use of an input with other inputs fied.the resulting addtons to output will eventually 9 Marginal rate of technical substitution (MRTS)Amount by which the quantity of one input can be reduced when one extra unit of another input is used,so that output remains constant. 10 Publie good Nonexclusive and nonrival good:the marginal cost of provision to an additional consumer is zero and people cannot be excluded from consuming it. 二、简答题:(共10分) 1.An antique dealer regularly buys objects at home-town auctions whose bidders are limited to other dealers.Most of her successful bids tu out to be financially

海南大学 2007-08 学年度第 1 学期《微观经济学》答案(B 卷) 一、 Please explain the following terms:(每题 5 分,共 50 分) 1 Degree of economies of scope (SC) Percentage of cost savings resulting when two or more products are produced jointly rather than individually 2 Depletable resource A natural resource, such as oil or copper, which if produced today is unavailable for future production. 3 Equilibrium in dominant strategies Outcome of a game in which each firm is doing the best it can regardless of what its competitors are doing. 4 First theorem of welfare economics If everyone trades in the competitive marketplace, all mutually beneficial trades will be completed and the resulting equilibrium allocation of resources will be economically efficient. 5 General equilibrium analysis Simultaneous determination of the prices and quantities in all relevaflt markets, taking feedback effects into account. 6 Giffen good Good whose demand curve slopes upward because the (positive) income effect is larger than the (negative) substitution effect. 7 Intertemporal price discrimination Practice of separating consumers with different demand functions into different groups by charging different prices at different points in time. 8 Law of diminishing marginal returns Principle that as the use of an input increases with other inputs fixed, the resulting additions to output will eventually decrease. 9 Marginal rate of technical substitution (MRTS) Amount by which the quantity of one input can be reduced when one extra unit of another input is used, so that output remains constant. 10 Public good Nonexclusive and nonrival good: the marginal cost of provision to an additional consumer is zero and people cannot be excluded from consuming it. 二、简答题:(共 10 分) 1. An antique dealer regularly buys objects at home-town auctions whose bidders are limited to other dealers. Most of her successful bids turn out to be financially

worthwhile,because she is able to resell the antiques for a profit.On occasion, er, avels to arby town to bid in an auctio hati public open to the She often finds that on the rare occasions in which she does bid successfully,she is disappointed-the antique cannot be sold at a profit. Can you explain the difference in her success between the two sets of circumstances? When she bids at the home-town auction that is limited to other dealers,she is bidding against people who are all going to resell the antique if they win the bid.In this case,all of the bidd are limiting their will tend d to eamn them a profit rational dealer will not place a bid ey can expect to resell the antique for.Given that all dealers are rational,the winning bid will tend to be below the expected resale price. When she bids in the auction that is open to the public she is bidding against the people who are likely to come into her shop.You can assume that local antique lovers will frequent these auctions as well as the local antique shops.In the case where she wins the bid at one of the se oper s the other participants have decided that the price is too high.In this case,they will not come into her shop and pay any higher price which would eamn her a profit.She will only tend to profit in this case if she is able to resell to a customer from out of the area,or who was not at the auction,and who has a sufficiently high reservation price.In any event,the winning bid price will terd to be higher because she was bidding against customers rather than dealers 三、Calculation:(每题20分,共40分) 1.Two computer firms,A and B,are planning to market network systems for office information management.Each firm can develop either a fast,high-quality system (H),or a slower,low-quality system(L).Market research indicates that the resulting profits to each firm for the alternative strategies are given by the following payoff matrix: FirmB H H 50,40 60,45 FirmA 55,55 15,20 a.If both firms make their decisions at the same time and follow maximin (low-risk)strategies,what will the outcome be? With a maximin strategy.a firm determines the worst outcome for each option,then chooses the option that maximizes the payoff among the worst outcomes.If Fim A

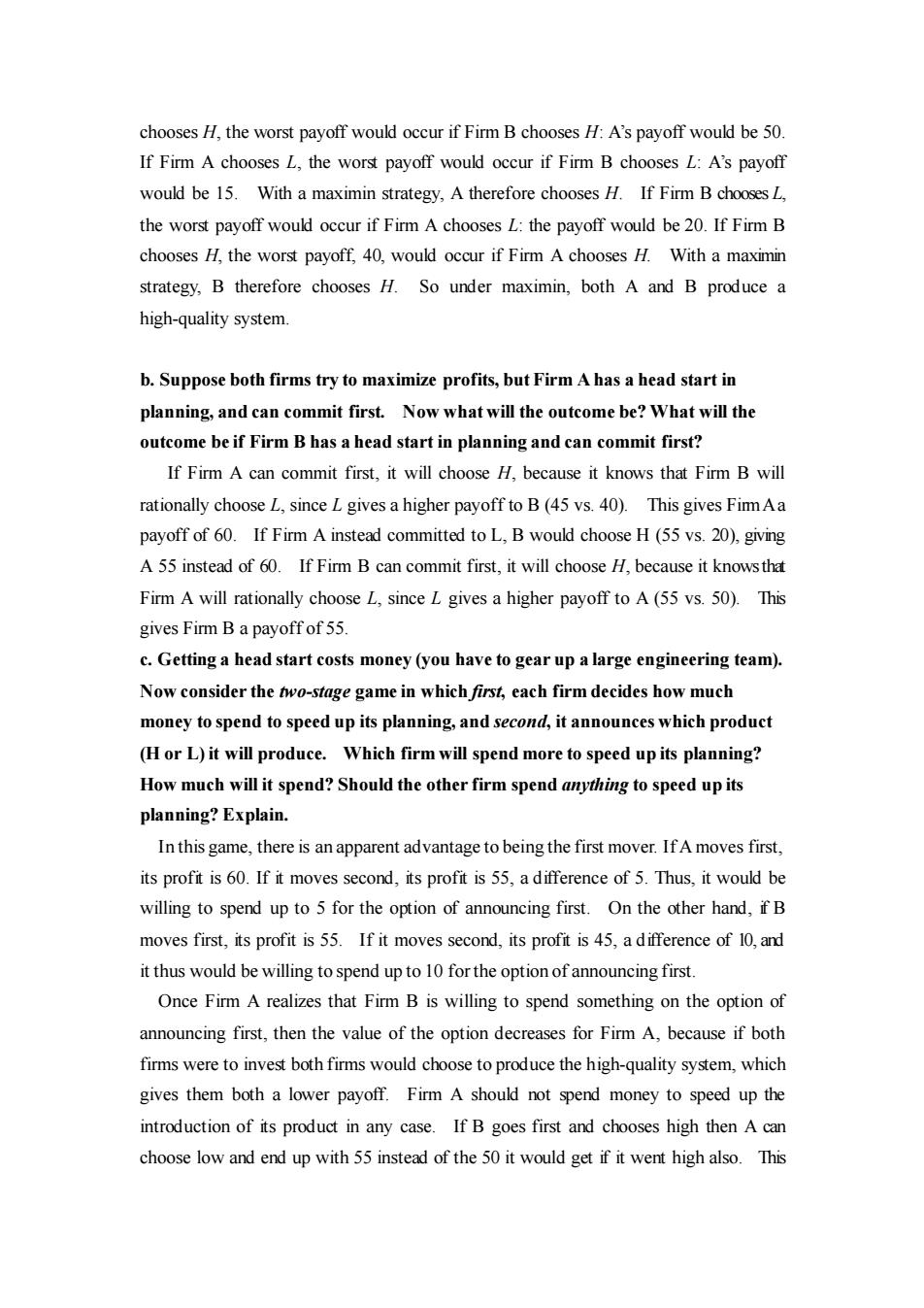

worthwhile, because she is able to resell the antiques for a profit. On occasion, however, she travels to a nearby town to bid in an auction that is open to the public. She often finds that on the rare occasions in which she does bid successfully, she is disappointed - the antique cannot be sold at a profit. Can you explain the difference in her success between the two sets of circumstances? When she bids at the home-town auction that is limited to other dealers, she is bidding against people who are all going to resell the antique if they win the bid. In this case, all of the bidders are limiting their bids to prices that will tend to earn them a profit. A rational dealer will not place a bid which is higher than the price they can expect to resell the antique for. Given that all dealers are rational, the winning bid will tend to be below the expected resale price. When she bids in the auction that is open to the public she is bidding against the people who are likely to come into her shop. You can assume that local antique lovers will frequent these auctions as well as the local antique shops. In the case where she wins the bid at one of these open auctions, the other participants have decided that the price is too high. In this case, they will not come into her shop and pay any higher price which would earn her a profit. She will only tend to profit in this case if she is able to resell to a customer from out of the area, or who was not at the auction, and who has a sufficiently high reservation price. In any event, the winning bid price will tend to be higher because she was bidding against customers rather than dealers. 三、Calculation:(每题 20 分,共 40 分) 1. Two computer firms, A and B, are planning to market network systems for office information management. Each firm can develop either a fast, high-quality system (H), or a slower, low-quality system (L). Market research indicates that the resulting profits to each firm for the alternative strategies are given by the following payoff matrix: Firm B H L H 50, 40 60, 45 Firm A L 55, 55 15, 20 a. If both firms make their decisions at the same time and follow maximin (low-risk) strategies, what will the outcome be? With a maximin strategy, a firm determines the worst outcome for each option, then chooses the option that maximizes the payoff among the worst outcomes. If Firm A

chooses H,the worst payoff would occur if Firm B chooses H:A's payoff would be 50. If Firm A chooses L,the worst payoff would occur if Firm B chooses L:A's payoff would be 15.With a maximin strategy,A therefore chooses H.If Firm BchooesL the worst payoff woul occur if Firm A chooses L:the payoff would be 20.If Firm B chooses H,the worst payoff,40,would occur if Firm A chooses H.With a maximin strategy.B therefore chooses H.So under maximin,both A and B produce a high-quality system. b.Suppose both firms try to maximize profits,but Firm A has a head start in planning,and can commit first.Now what will the outcome be?What will the outcome be if Firm B has a head start in planning and can commit first? If Firm A can commit first,it will choose H,because it knows that Firm B wil rationally choose L,since Lgives a higher payoff to B(45 vs.40).This gives FimAa payoff of 60.If Firm A instead committed toL,B would choose H(55 vs.20).giving A 55 instead of 60.If Firm B can commit first,it will choose H,because it knowsthat Firm A will rationally choose L,since L gives a higher payoff to A(55 vs.50).This gives Fim B a payoff of 55 c.Getting a head start costs money (you have to gear up a large engineering team) Now consider the o-stage game in which first,each firm decides how much money to spend to speed up its planning,and second,it announces which product (H or L)it will produce.Which firm will spend more to speed up its planning? How much will it spend?Should the other firm spend anything to speed up its planning?Explain. Inthis game,there is an apparent advantage to being the first mover.IfA moves first. its profit is 60.If it moves second,its profit is 55,a difference of 5.Thus,it would be willing to spend up to 5 for the option of announcing first.On the other hand,fB moves first,its profit is 55.If it moves second,its profit is 45,a difference of 10,and it thus would be willing to spend up to10 for the option of announcing first Once Firm A realizes that Firm B is willing to spend something on the option of announcing first,then the value of the option decreases for Firm A,because if both firms were to invest both firms would choose to produce the high-quality system,which gives them both a lower payoff.Firm A should not spend money to speed up the introduction of its product in any case.If B goes first and chooses high then Acan choose low and end up with 55 instead of the 50 it would get if it went high also.This

chooses H, the worst payoff would occur if Firm B chooses H: A’s payoff would be 50. If Firm A chooses L, the worst payoff would occur if Firm B chooses L: A’s payoff would be 15. With a maximin strategy, A therefore chooses H. If Firm B chooses L, the worst payoff would occur if Firm A chooses L: the payoff would be 20. If Firm B chooses H, the worst payoff, 40, would occur if Firm A chooses H. With a maximin strategy, B therefore chooses H. So under maximin, both A and B produce a high-quality system. b. Suppose both firms try to maximize profits, but Firm A has a head start in planning, and can commit first. Now what will the outcome be? What will the outcome be if Firm B has a head start in planning and can commit first? If Firm A can commit first, it will choose H, because it knows that Firm B will rationally choose L, since L gives a higher payoff to B (45 vs. 40). This gives Firm A a payoff of 60. If Firm A instead committed to L, B would choose H (55 vs. 20), giving A 55 instead of 60. If Firm B can commit first, it will choose H, because it knows that Firm A will rationally choose L, since L gives a higher payoff to A (55 vs. 50). This gives Firm B a payoff of 55. c. Getting a head start costs money (you have to gear up a large engineering team). Now consider the two-stage game in which first, each firm decides how much money to spend to speed up its planning, and second, it announces which product (H or L) it will produce. Which firm will spend more to speed up its planning? How much will it spend? Should the other firm spend anything to speed up its planning? Explain. In this game, there is an apparent advantage to being the first mover. If A moves first, its profit is 60. If it moves second, its profit is 55, a difference of 5. Thus, it would be willing to spend up to 5 for the option of announcing first. On the other hand, if B moves first, its profit is 55. If it moves second, its profit is 45, a difference of 10, and it thus would be willing to spend up to 10 for the option of announcing first. Once Firm A realizes that Firm B is willing to spend something on the option of announcing first, then the value of the option decreases for Firm A, because if both firms were to invest both firms would choose to produce the high-quality system, which gives them both a lower payoff. Firm A should not spend money to speed up the introduction of its product in any case. If B goes first and chooses high then A can choose low and end up with 55 instead of the 50 it would get if it went high also. This

is best for B also because if B goes high and A low,B ends up with 55 instead of 40,so even if it spends the 10 it is still ahead by 5.Ashould let B go first.Finally,notetha even though B is better off if A goes first and chooses high(45 vs 40),B is still best off if it goes first.Overall,it is worthwhile for B to spend the money and announce but it is not worthwhile for A to spend any money. 2.Two used car dealerships compete side by side on a main road.The first, Harry's Cars,always sells high-quality cars that it carefully inspects and,if necessary,services.On average,it costs Harry $8,000 to buy and service each car that it sells.The second dealership,Lew's Motors,always sells lower-quality cars. On average,it costs Lew only $5,000 for each car that it sells.If consumers knew the quality of the used cars they were buying,they would gladly pay $10,000 on average for Harry's cars,but only $7,000 on average for Lew's cars. Without more information,consumers do not know the quality of each dealership's cars.In this case,consumers would figure that they have a 50-50 chance of ending up with a high-quality car,and are thus willing to pay $8,500 for a car Harry has an idea:He will offer a bumper-to-bumper warranty for all cars he sells.He knows that a warranty lasting Y years will cost S500Y on average and he also knows that if Lew tries to offer the same warranty,it will cost Lew S1000Y on average. (a)Suppose Harry offers a one-year warranty on all cars it sells (1)What is Lew's profit if it does not offer a one-year warranty?If it does offer a one-year warranty? (2)What is Harry's profit if Lew's does not offer a one-year warranty?If it does offer a one-year warranty? (3)Will Lew's match Harry's one-year warranty? (4)Is it a good idea for Harry's to offer a one-year warranty? Without offering the warranty,Lew's is able to make $2,000 per car(7000-5000).If it were to offer the warranty,each car will now cost Lew's $6,000,but as consumers will not be able todetermine the quality of the cars they will be willing to pay $8500 for a car,and Lew's will make $2,500 per car(8500-6000) If Lew's does not offer a one-year warranty then Harry'scan buy its cars for 8.000 sell the cars for $10.000,and make a profit of $1,500 per car after the $500 warranty

is best for B also because if B goes high and A low, B ends up with 55 instead of 40, so even if it spends the 10 it is still ahead by 5. A should let B go first. Finally, note that even though B is better off if A goes first and chooses high (45 vs. 40), B is still best off if it goes first. Overall, it is worthwhile for B to spend the money and announce but it is not worthwhile for A to spend any money. 2. Two used car dealerships compete side by side on a main road. The first, Harry’s Cars, always sells high-quality cars that it carefully inspects and, if necessary, services. On average, it costs Harry $8,000 to buy and service each car that it sells. The second dealership, Lew’s Motors, always sells lower-quality cars. On average, it costs Lew only $5,000 for each car that it sells. If consumers knew the quality of the used cars they were buying, they would gladly pay $10,000 on average for Harry’s cars, but only $7,000 on average for Lew’s cars. Without more information, consumers do not know the quality of each dealership’s cars. In this case, consumers would figure that they have a 50-50 chance of ending up with a high-quality car, and are thus willing to pay $8,500 for a car. Harry has an idea: He will offer a bumper-to-bumper warranty for all cars he sells. He knows that a warranty lasting Y years will cost $500Y on average, and he also knows that if Lew tries to offer the same warranty, it will cost Lew $1000Y on average. (a) Suppose Harry offers a one-year warranty on all cars it sells. (1) What is Lew’s profit if it does not offer a one-year warranty? If it does offer a one-year warranty? (2) What is Harry’s profit if Lew’s does not offer a one-year warranty? If it does offer a one-year warranty? (3) Will Lew’s match Harry’s one-year warranty? (4) Is it a good idea for Harry’s to offer a one-year warranty? Without offering the warranty, Lew’s is able to make $2,000 per car (7000-5000). If it were to offer the warranty, each car will now cost Lew’s $6,000, but as consumers will not be able to determine the quality of the cars they will be willing to pay $8,500 for a car, and Lew’s will make $2,500 per car (8500-6000). If Lew’s does not offer a one-year warranty then Harry’s can buy its cars for $8,000, sell the cars for $10,000, and make a profit of $1,500 per car after the $500 warranty

cost.If Lew's does offer a one year warranty then Harry's will only be able to sell its cars for $8500 and the company will not make any profit. Lew's will match Harry's warranty because if it does then its profit increases from $2.000to$2,500 per car. Harry's should not offer the one-year warranty unless it thinks that Lew's will act irrationally and not offer the one-year warranty.Given Lew's will match the wamanty. Harry's is better off not offering the warranty. (b)What if Harry offers a two-year warranty?Will this generate a credible signal of quality?What about a three-year warranty? If Harry's offers a two-year warranty each car will cost $9,000.It will earn $1,000 per car as consumers will recognize the higher quality of its cars.Lew's will not offer a two year warranty because if they do they will only eam profit of $1,500 per car, which is less than the $2.000 they would eamn without offering the warranty.The two year warranty is a credible signal. With a three-year warranty Harry's would be making $500 per car,the same that it would have made had it not signaled the higher quality of its cars with a warranty Therefore.Hary's would not offer a three-year warranty. (c)If you were advising Harry,how long a warranty would you urge him to offer? Explain why. Harry's will need to offer a warranty of sufficient length such that Lew's will not find it profitable to match the warranty.Let i denote the number of years of the warrarty. then Lew's will offer a warranty according to the following inequality: 7000-5000≤8500-5000-1000t,ort≤1.5. Therefore,I would advise Harry's to offera 1.5 year warranty on his cars as Lew's will not find it profitable to match the warranty

cost. If Lew’s does offer a one year warranty then Harry’s will only be able to sell its cars for $8,500 and the company will not make any profit. Lew’s will match Harry’s warranty because if it does then its profit increases from $2,000 to $2,500 per car. Harry’s should not offer the one-year warranty unless it thinks that Lew’s will act irrationally and not offer the one-year warranty. Given Lew’s will match the warranty, Harry’s is better off not offering the warranty. (b) What if Harry offers a two-year warranty? Will this generate a credible signal of quality? What about a three-year warranty? If Harry’s offers a two-year warranty each car will cost $9,000. It will earn $1,000 per car as consumers will recognize the higher quality of its cars. Lew’s will not offer a two year warranty because if they do they will only earn profit of $1,500 per car, which is less than the $2,000 they would earn without offering the warranty. The two year warranty is a credible signal. With a three-year warranty Harry’s would be making $500 per car, the same that it would have made had it not signaled the higher quality of its cars with a warranty. Therefore, Harry’s would not offer a three-year warranty. (c) If you were advising Harry, how long a warranty would you urge him to offer? Explain why. Harry’s will need to offer a warranty of sufficient length such that Lew’s will not find it profitable to match the warranty. Let t denote the number of years of the warranty, then Lew’s will offer a warranty according to the following inequality: 7000-5000 8500-5000-1000t, or t 1.5. Therefore, I would advise Harry’s to offer a 1.5 year warranty on his cars as Lew’s will not find it profitable to match the warranty