海南大学2006-2007学年度第1学期《微观经济学》答案(4卷) 一、Please ex plain the following terms:(每题5分,共50分) 1 Strategic move Action that gives a player an advantage by constraining his behavior 2 Third-degree price discrimination Practice of dividing consumers into two or more.groups with separate demand curves and charging different prices to each group. 3 Utility possibilities frontier Curve showing all efficient allocations of resources measured in terms of the utility levels of two individuals. 4 Value of complete information Difference between the expectd value of a choice when there is complete information and the expected value when information is incomplete. 5.Transferable emissions permits System of marketable permits,allocated among firms,specifying the maximum level of emissions that can be generated. 6 Substitution effect Cha onsumption of a good associated with a change in its price,with the level of utility held constant 7 Sunk cost Expenditure that has been made and cannot be recovered. 8 Stackelberg mode Oligopoly model in which one firm sets its output before other firms do. 9Shirking mode that iffm pays them a market-clearing wage,because fired workers can be hired somewhere else for the same wage 10 Prospective sunk cost A cost that has not yet been incurred but that cannot be recovered once it is incurred 二、简答题:(共10分) 1.You are in the market for a new house and have deeided to bid for a house a auction.You believe that the value ofthe house is between $125,000 and $150,000. but you are uncertain as to where in the range it might be.You do know,however, that the seller has reserved the right to withdraw the house from the market ifthe winning bid is not satisfactory

海南大学 2006-2007 学年度第 1 学期《微观经济学》答案(A 卷) 一、 Please explain the following terms:(每题 5 分,共 50 分) 1 Strategic move Action that gives a player an advantage by constraining his behavior. 2 Third-degree price discrimination Practice of dividing consumers into two or more. groups with separate demand curves and charging different prices to each group. 3 Utility possibilities frontier Curve showing all efficient allocations of resources measured in terms of the utility levels of two individuals. 4 Value of complete information Difference between the expect6d value of a choice when there is complete information and the expected value when information is incomplete. 5.Transferable emissions permits System of marketable permits, allocated among firms, specifying the maximum level of emissions that can be generated. 6 Substitution effect Change in consumption of a good associated with a change in its price, with the level of utility held constant. 7 Sunk cost Expenditure that has been made and cannot be recovered. 8 Stackelberg model Oligopoly model in which one firm sets its output before other firms do. 9 Shirking model Principle that workers still have an incentive to shirk if a firm pays them a market-clearing wage, because fired workers can be hired somewhere else for the same wage. 10 Prospective sunk cost A cost that has not yet been incurred but that cannot be recovered once it is incurred. 二、简答题:(共 10 分) 1. You are in the market for a new house and have decided to bid for a house at auction. You believe that the value of the house is between $125,000 and $150,000, but you are uncertain as to where in the range it might be. You do know, however, that the seller has reserved the right to withdraw the house from the market if the winning bid is not satisfactory

Should you bid in this auction?Why or why not? Yes you should bid if you are confident about yourestimate of the value of the house and /or if you allow for the possibility of being wrong.To allow fr the possibility of being wrong,you reduce your high bid by an amount equal to the expected error of the winning bidder.If you have you will have information on ow likely youre enterawrong bid and can thenadjust your high bid accordingly. b.Suppose you are a building contractor.You plan to improve the house and then to resell it at a profit.How does this situation affect your answer to (a)? Does it depend on the extent to which your skills are uniquely suitable to improving this particular house? You need to be aware of the winner's curse which says that the winner is likely to be the person who most overestimated the value of the house.If there are a range of bids,some below the actual value and ome above the actual value,the winner will be the person with the largest overe estimate of the value.Again,you need to be very confident in yourestim of the value of the house and/or allow for the possibility of being wrong.If you have made many such bids in the past,you will be able to estimate how often you are wrng and adjust accordingly 三、Calculation:(每题16分,共32分) 1.We can think of the U.S.and Japanese trade policies as a prisoners'dilemma The two co untries are considering policies to open or close their t import markets Suppose the payoff matrix is JJapan Open Close Open 10,10 5,5 U.S. Close -100.5 1,1 a.Assume that each country knows the payoff matris and believes that the other untry will act in it own inter Does ith count try have a d min ant strategy?What will be the equilibrium policies ifeach country acts rationally to maximize its welfare? Choosing Open is a dominant strategy for both countries.If Japan chooses Open the US best by choosing Open.If Japan chooses Close,the U.S.does best by choosing Open. Therefore.the U.S.should choose Open.no matter what Japan does.If the U.S.chooses Open. Japan does best by choosing Open.If the U.S.chooses Close,Japan does best by choosing Open.Therefore,both countries will choose to have Open policies inequilibrium b.Now assume that Japan is not certain that the U.S.will behave rationally.In particular.Japan is concerned that U.S.politicians may want to penalize Japan even if that does not maximize U.S.welfare.How might this affect Japan's choice

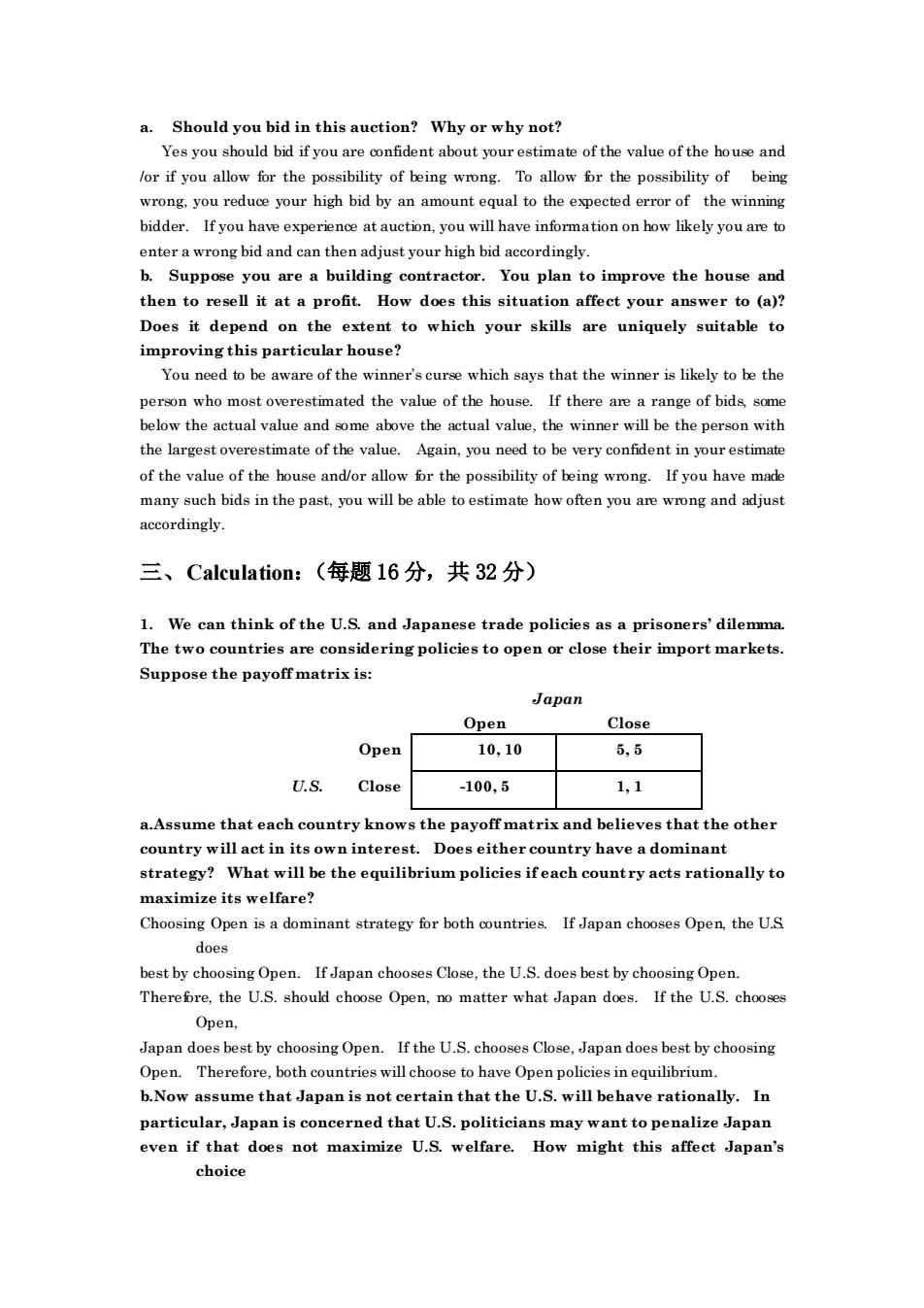

a. Should you bid in this auction? Why or why not? Yes you should bid if you are confident about your estimate of the value of the house and /or if you allow for the possibility of being wrong. To allow for the possibility of being wrong, you reduce your high bid by an amount equal to the expected error of the winning bidder. If you have experience at auction, you will have information on how likely you are to enter a wrong bid and can then adjust your high bid accordingly. b. Suppose you are a building contractor. You plan to improve the house and then to resell it at a profit. How does this situation affect your answer to (a)? Does it depend on the extent to which your skills are uniquely suitable to improving this particular house? You need to be aware of the winner’s curse which says that the winner is likely to be the person who most overestimated the value of the house. If there are a range of bids, some below the actual value and some above the actual value, the winner will be the person with the largest overestimate of the value. Again, you need to be very confident in your estimate of the value of the house and/or allow for the possibility of being wrong. If you have made many such bids in the past, you will be able to estimate how often you are wrong and adjust accordingly. 三、Calculation:(每题 16 分,共 32 分) 1. We can think of the U.S. and Japanese trade policies as a prisoners’ dilemma. The two countries are considering policies to open or close their import markets. Suppose the payoff matrix is: Japan Open Close Open 10, 10 5, 5 U.S. Close -100, 5 1, 1 a.Assume that each country knows the payoff matrix and believes that the other country will act in its own interest. Does either country have a dominant strategy? What will be the equilibrium policies if each country acts rationally to maximize its welfare? Choosing Open is a dominant strategy for both countries. If Japan chooses Open, the U.S. does best by choosing Open. If Japan chooses Close, the U.S. does best by choosing Open. Therefore, the U.S. should choose Open, no matter what Japan does. If the U.S. chooses Open, Japan does best by choosing Open. If the U.S. chooses Close, Japan does best by choosing Open. Therefore, both countries will choose to have Open policies in equilibrium. b.Now assume that Japan is not certain that the U.S. will behave rationally. In particular, Japan is concerned that U.S. politicians may want to penalize Japan even if that does not maximize U.S. welfare. How might this affect Japan’s choice

of strategy?How might this change the equilibrium? The irra nality of U.politicians could change theequilibrium to Close,Open).Ifthe U.S. wants to penalize Japan they will choose Close,but Japan's strategy will not be affected since 2.Consider two firms facing the demand curve P=50-5Q.where Q=Q+Q: The firms'cost functions are C(Q)=20+10Q1 and C2(Q)=10+12Q2. a.Suppose both firms have entered the industry.What is the joint profit maximizing level of output?How much will each firm produce?How would your answer change if the firms have not yet entered the industry? If both firms enter the market,and they collude,they will face a marginal revenue curve with twice the slope o ofthe demand c MR=50.10Q Setting marginal revenue equal to marginal cost (the marginal cost of Firm 1,since it is lower than that of Firm 2)to determine the profit-maximizing quantity. 50.10Q=10,0rQ=4 Substituting=4 into the demand function to determine price: P=50-5*4=$30. The queston now is how the firms will divide the total output of among themelves Since the two firms have different cost functions it will not be optimal for them to split the output evenly between them.The profit maximizing solution is for firm 1 to produce all of the output that the profit for Firm 1 will be: 1=(30)(④-(20+(10(4)=860 The profit for Firm 2 will be: 2=(800)·(10+(120)=-$10 Total industry profit will be: πr=π1+π2=60-10=s50. If they split the output evenly between them then total profit woul be $46($20 for firm 1 $26 for firm 2).If firm 2 preferred to earn a profit of $26 as opposed to $25 then firm 1 could give $1 to firm 2 and it would still have profit of $24,which is higher than the $20 it would earn if they split output.Note that if firm 2 supplied all the output then it would set marginal revenue equal to its marginal cost or 12 and earn a profit of 62.2.In this case,firm 1 would earna profit of20.so that total industry profit would be 42.2. If Firm 1 were the only entrant,its profits would be $60 and Firm 2's would

of strategy? How might this change the equilibrium? The irrationality of U.S. politicians could change the equilibrium to (Close, Open). If the U.S. wants to penalize Japan they will choose Close, but Japan’s strategy will not be affected since choosing Open is still Japan’s dominant strategy. 2. Consider two firms facing the demand curve P = 50 - 5Q, where Q = Q1 + Q2 . The firms’ cost functions are C1 (Q1 ) = 20 + 10Q1 and C2 (Q2 ) = 10 + 12Q2 . a.Suppose both firms have entered the industry. What is the joint profit maximizing level of output? How much will each firm produce? How would your answer change if the firms have not yet entered the industry? If both firms enter the market, and they collude, they will face a marginal revenue curve with twice the slope of the demand curve: MR = 50 - 10Q. Setting marginal revenue equal to marginal cost (the marginal cost of Firm 1, since it is lower than that of Firm 2) to determine the profit-maximizing quantity, Q: 50 - 10Q = 10, or Q = 4. Substituting Q = 4 into the demand function to determine price: P = 50 – 5*4 = $30. The question now is how the firms will divide the total output of 4 among themselves. Since the two firms have different cost functions, it will not be optimal for them to split the output evenly between them. The profit maximizing solution is for firm 1 to produce all of the output so that the profit for Firm 1 will be: 1 = (30)(4) - (20 + (10)(4)) = $60. The profit for Firm 2 will be: 2 = (30)(0) - (10 + (12)(0)) = -$10. Total industry profit will be: T = 1 + 2 = 60 - 10 = $50. If they split the output evenly between them then total profit would be $46 ($20 for firm 1 and $26 for firm 2). If firm 2 preferred to earn a profit of $26 as opposed to $25 then firm 1 could give $1 to firm 2 and it would still have profit of $24, which is higher than the $20 it would earn if they split output. Note that if firm 2 supplied all the output then it would set marginal revenue equal to its marginal cost or 12 and earn a profit of 62.2. In this case, firm 1 would earn a profit of –20, so that total industry profit would be 42.2. If Firm 1 were the only entrant, its profits would be $60 and Firm 2’s would

If Firm 2 were the only entrant,then it would equate marginal revenue with its marginal cost to determine its profit-maximizing quantity: 50-10Q2=12,orQ2=3.8 Substituting into the demand equation to determine price: P=50-5*3.8=$31. The profits for Firm 2 will be: 2=313.8)-10+(123.8》=62.20 b.What is each firm's equilibrium output an profit if they behave noncooperatively?Use the Cournot model.Draw the firms'reaction curves and show the equilibrium. In the Cournot model Firm 1 takes Firm 2's output as given and maximizes profits.The profit function derived in 2.a becomes π1=(50-5Q1-5Q2)Q1-(20+10Q1),0r π=40g-5g-5Q2-20. Setting the derivative of the pfit function with respect find FirmI's reaction function: ag, 40-10e-50=-0r2=4-(9》 Similarly,Firm 2s reaction function is 02=3.8- To find the Cournot equilibrium,we substitute Firm 2's reaction function into Firm I's reaction func =4- 38- ,orQ=2.8 Substituting this value for into the reaction function for Firm 2.we find 22=2.4. Substituting the values for and into the demand function to determine the equilibrium price: P=50-5(2.8+2.4)=$24 The profits for Firms 1 and 2 are equal to 1=(242.8)(20+(102.8=19.20and 元2=(2402.4)-(10+(122.4)=18.80 c.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not? In order to determine how much Firm 1 will be willing to pay to purchase Firm 2.we must compare Firm I's profits in the monopoly situation versus those in an oligopoly.The difference between the two will be what Firm 1 is willing to pay for Firm 2.From part a.profit of firm 1

be 0. If Firm 2 were the only entrant, then it would equate marginal revenue with its marginal cost to determine its profit-maximizing quantity: 50 - 10Q2 = 12, or Q2 = 3.8. Substituting Q2 into the demand equation to determine price: P = 50 – 5*3.8 = $31. The profits for Firm 2 will be: 2 = (31)(3.8) - (10 + (12)(3.8)) = $62.20. b.What is each firm’s equilibrium output and profit if they behave noncooperatively? Use the Cournot model. Draw the firms’ reaction curves and show the equilibrium. In the Cournot model, Firm 1 takes Firm 2’s output as given and maximizes profits. The profit function derived in 2.a becomes 1 = (50 - 5Q1 - 5Q2 )Q1 - (20 + 10Q1 ), or = 40Q1 − 5Q1 2 − 5Q1Q2 − 20. Setting the derivative of the profit function with respect to Q1 to zero, we find Firm 1’s reaction function: Q1 = 40 −10Q1 - 5Q2 =0, or Q1 = 4 - Q2 2 . Similarly, Firm 2’s reaction function is Q2 = 3.8 − Q1 2 . To find the Cournot equilibrium, we substitute Firm 2’s reaction function into Firm 1’s reaction function: Q1 = 4 − 1 2 3.8 − Q1 2 , or Q1 = 2.8. Substituting this value for Q1 into the reaction function for Firm 2, we find Q2 = 2.4. Substituting the values for Q1 and Q2 into the demand function to determine the equilibrium price: P = 50 – 5(2.8+2.4) = $24. The profits for Firms 1 and 2 are equal to 1 = (24)(2.8) - (20 + (10)(2.8)) = 19.20 and 2 = (24)(2.4) - (10 + (12)(2.4)) = 18.80. c.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not? In order to determine how much Firm 1 will be willing to pay to purchase Firm 2, we must compare Firm 1’s profits in the monopoly situation versus those in an oligopoly. The difference between the two will be what Firm 1 is willing to pay for Firm 2. From part a, profit of firm 1

when it set marginal revenue equal to its marginal cost was $60.This is what the firm would earn if it was a monopolist.From part b,profit was $19.20 for firm 1.Firm 1 would therefore be willing to pay up to $40.80 for firm 2

when it set marginal revenue equal to its marginal cost was $60. This is what the firm would earn if it was a monopolist. From part b, profit was $19.20 for firm 1. Firm 1 would therefore be willing to pay up to $40.80 for firm 2