海南大学2006-2007学年度第1学期试卷 科目:《微观经济学》试题(B卷) 姓名: 学号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 三四五六 七八九十 总分 得分 阅卷教师: 20年月日 考试说明:本课程为闭卷考试,可携带计算器。 得分阅卷教师 一、Please explain the following terms: (每题5分,共50分) 1 Accounting profi 2Adverse selection 3Antitrust law 4 Asymmetric information

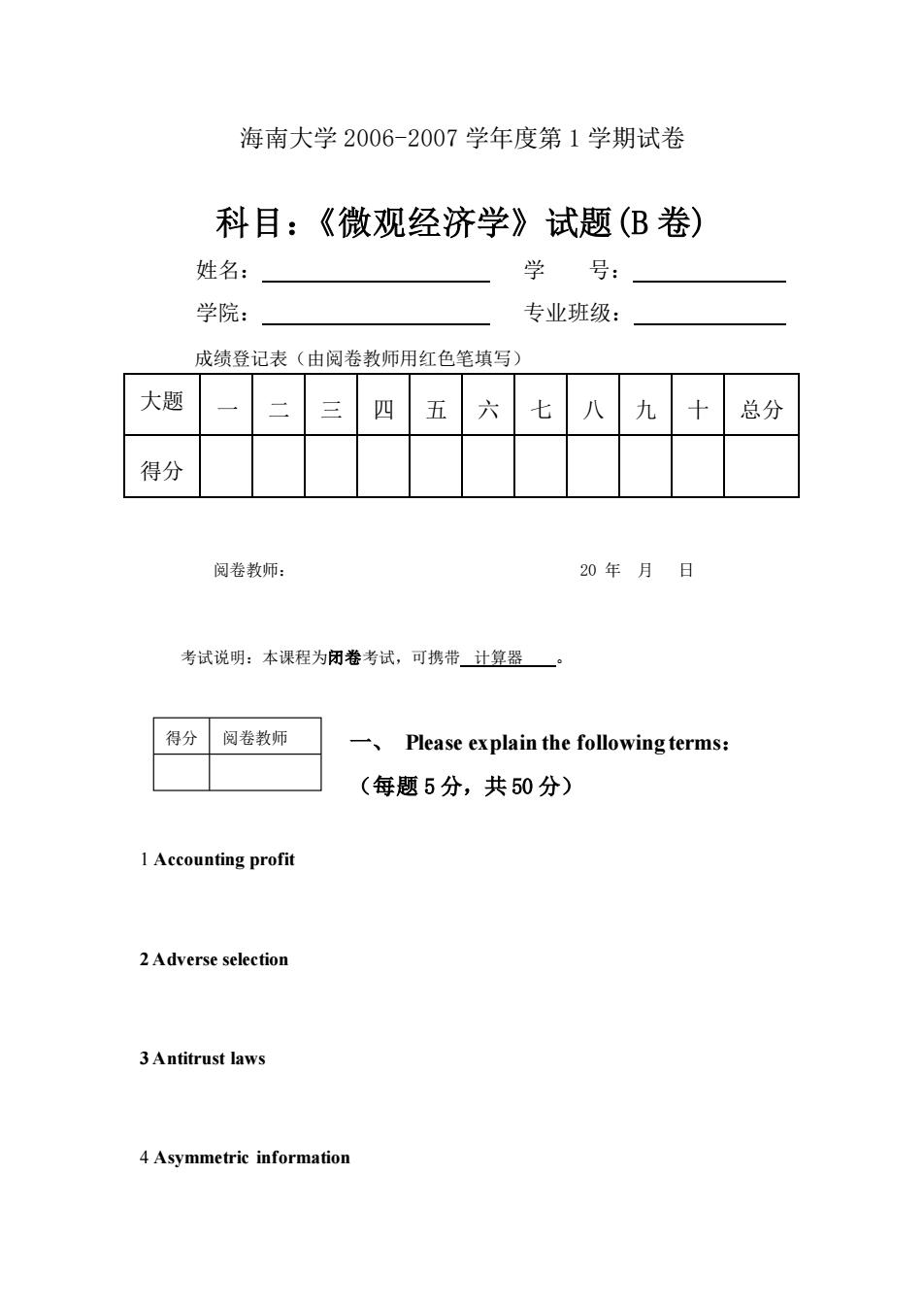

海南大学 2006-2007 学年度第 1 学期试卷 科目:《微观经济学》试题(B 卷) 姓名: 学 号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 号 一 二 三 四 五 六 七 八 九 十 总分 得分 阅卷教师: 20 年 月 日 考试说明:本课程为闭卷考试,可携带 计算器 。 一、 Please explain the following terms: (每题 5 分,共 50 分) 1 Accounting profit 2 Adverse selection 3 Antitrust laws 4 Asymmetric information 得分 阅卷教师

5 Backward-bending labor supply curve 6 Ceiling price 7 Coase theorem 8 Contract curve 10 Price support 得分阅卷教师 二、简答题:(共10分) 1.Public goods are both nonrival and nonexclusive.Explain each of these terms and show clearly how they differ from each other

5 Backward-bending labor supply curve 6 Ceiling price 7 Coase theorem 8 Contract curve 9 Diversifiable risk 10 Price support 二、简答题:(共 10 分) 1. Public goods are both nonrival and nonexclusive. Explain each of these terms and show clearly how they differ from each other. 得分 阅卷教师

得分阅卷教师 三、Calculation:(每题20分,共40分) 1.Two major networks are competing for viewer ratings in the 8:00-9:00 P and-10:0PM.slots on a given weeknight. Each has two shows to fill this time period and is juggling its lineup.Each can choose to put its "bigger"show first or to place it second in the 9:00-10:00 P.M.slot.The combination of decisions leads to the following"ratings points"results: First Second First 15.15 30.10 Second 20,30 18,18 a.Find the Nash equilibria for this game,assuming that both networks make their decisions at the same time. b.Ifeach network is risk averse and uses a maximin strategy,what will be the r ng equilibrium? c.What will be the equilibrium if Network 1 can makes its selection first?If Network 2 goes first? d.Suppose the network managers meet to coordinate schedules and Netw rk 1 promises to schedule its big show first.Is this promise credible?What would be the likely outcome?

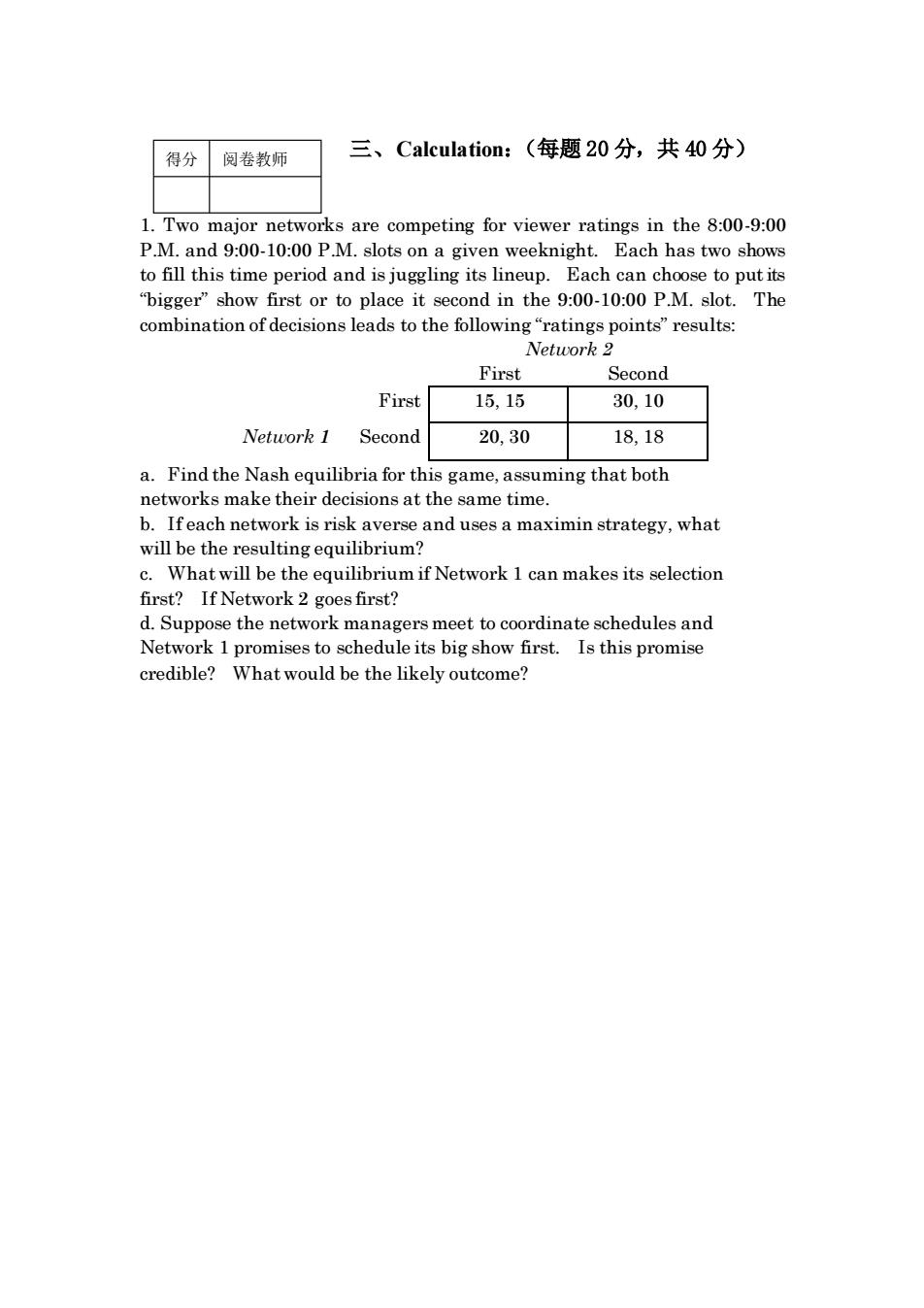

三、Calculation:(每题 20 分,共 40 分) 1. Two major networks are competing for viewer ratings in the 8:00-9:00 P.M. and 9:00-10:00 P.M. slots on a given weeknight. Each has two shows to fill this time period and is juggling its lineup. Each can choose to put its “bigger” show first or to place it second in the 9:00-10:00 P.M. slot. The combination of decisions leads to the following “ratings points” results: Network 2 First Second First 15, 15 30, 10 Network 1 Second 20, 30 18, 18 a. Find the Nash equilibria for this game, assuming that both networks make their decisions at the same time. b. If each network is risk averse and uses a maximin strategy, what will be the resulting equilibrium? c. What will be the equilibrium if Network 1 can makes its selection first? If Network 2 goes first? d. Suppose the network managers meet to coordinate schedules and Network 1 promises to schedule its big show first. Is this promise credible? What would be the likely outcome? 得分 阅卷教师

2.Two used car dealerships compete side by side on a main road.The first, Harry's Cars,always sells high-quality cars that it carefully inspects and,if necessary,services.On average,it costs Harry S8,000 to buy and service each car that it sells.The second dealership,Lew's Motors,always sells lower-quality cars.On average,it costs Lew only $5,000 for each car that it sells.If co ners knew the e quality of the used cars they were buyin they would gladly pay1000naverage for Harry'cars but ony7000 on average for Lew's cars. Without more information,consumers do not know the quality of each dealership's ca rs In this c mer would figure that they have 50-50 chance of ending up with a high-quality car,and are thus willing to pay $8,500 for a car. Harry has an idea:He will offer a bumper-to-bumper warranty for all cars he sells.He knows that a warranty lasting Y years will cost $500Yon average,and he also knows that if Lew tries to offer the same warranty,it will cost Lew $1000Y on average. (a)Suppose Harry offers a one-year warranty on all cars it sells. (1)What is Lew's profit ifit does not offer a one-year warranty?Ifit does offer a one-year warranty? (2)What is Harry's profit if Lew's does not offer a one-year warranty? Ifit does offer a one-year warranty? (3)Will Lew's match Harry's one-year warranty? (4)Is it a good idea for Harry's to offer a one-year warranty? (b)What if Harry offers a two-year warranty?Will this generate a credible signal of quality?What about a three-year warranty? (c)If you were advising Harry,how long a warranty would you urge him to offer Explain why

2. Two used car dealerships compete side by side on a main road. The first, Harry’s Cars, always sells high-quality cars that it carefully inspects and, if necessary, services. On average, it costs Harry $8,000 to buy and service each car that it sells. The second dealership, Lew’s Motors, always sells lower-quality cars. On average, it costs Lew only $5,000 for each car that it sells. If consumers knew the quality of the used cars they were buying, they would gladly pay $10,000 on average for Harry’s cars, but only $7,000 on average for Lew’s cars. Without more information, consumers do not know the quality of each dealership’s cars. In this case, consumers would figure that they have a 50-50 chance of ending up with a high-quality car, and are thus willing to pay $8,500 for a car. Harry has an idea: He will offer a bumper-to-bumper warranty for all cars he sells. He knows that a warranty lasting Y years will cost $500Y on average, and he also knows that if Lew tries to offer the same warranty, it will cost Lew $1000Y on average. (a) Suppose Harry offers a one-year warranty on all cars it sells. (1) What is Lew’s profit if it does not offer a one-year warranty? If it does offer a one-year warranty? (2) What is Harry’s profit if Lew’s does not offer a one-year warranty? If it does offer a one-year warranty? (3) Will Lew’s match Harry’s one-year warranty? (4) Is it a good idea for Harry’s to offer a one-year warranty? (b) What if Harry offers a two-year warranty? Will this generate a credible signal of quality? What about a three-year warranty? (c) If you were advising Harry, how long a warranty would you urge him to offer ? Explain why