CHAPTER TWELVE Aggregate Demand in the Open Economy macroeconomics N.Gregory Mankiw College of Management,HUST

macroeconomics N. Gregory Mankiw m a c r o College of Management, HUST CHAPTER TWELVE Aggregate Demand in the Open Economy

Learning objectives ■ The Mundell-Fleming model: IS-LM for the small open economy Causes and effects of interest rate differentials Arguments for fixed vs.floating exchange rates The aggregate demand curve for the small open economy CHAPTER 12 Aggregate Demand in the Open Economy slide 1

slide 1 § The Mundell-Fleming model: IS-LM for the small open economy § Causes and effects of interest rate differentials § Arguments for fixed vs. floating exchange rates § The aggregate demand curve for the small open economy

Content 1.The Mundell-Fleming model 2.Policy analysis under floating exchange rates 3.Policy analysis under fixed exchange rates 4.Interest rate differentials 5.Mundell-Fleming model as an AD theory 6.Case study 7.Chapter summary CHAPTER 12 Aggregate Demand in the Open Economy slide 2

slide 2 1. The Mundell-Fleming model 2. Policy analysis under floating exchange rates 3. Policy analysis under fixed exchange rates 4. Interest rate differentials 5. Mundell-Fleming model as an AD theory 6. Case study 7. Chapter summary

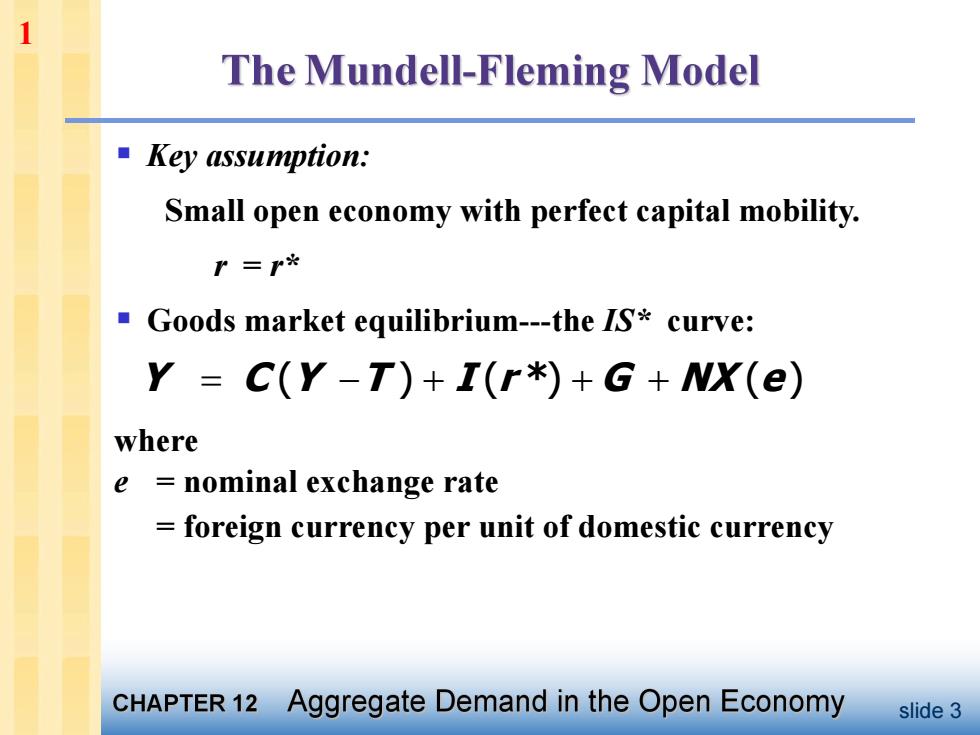

1 The Mundell-Fleming Model ■Key assumption: Small open economy with perfect capital mobility. P=r必 ■( Goods market equilibrium-the IS*curve: Y =C(Y-T)+I(r*)+G+NX(e) where e nominal exchange rate foreign currency per unit of domestic currency CHAPTER 12 Aggregate Demand in the Open Economy slide 3

slide 3 § Key assumption: Small open economy with perfect capital mobility. r = r* § Goods market equilibrium-the IS* curve: Y C (Y T ) I (r *) G NX (e) where e = nominal exchange rate = foreign currency per unit of domestic currency 1

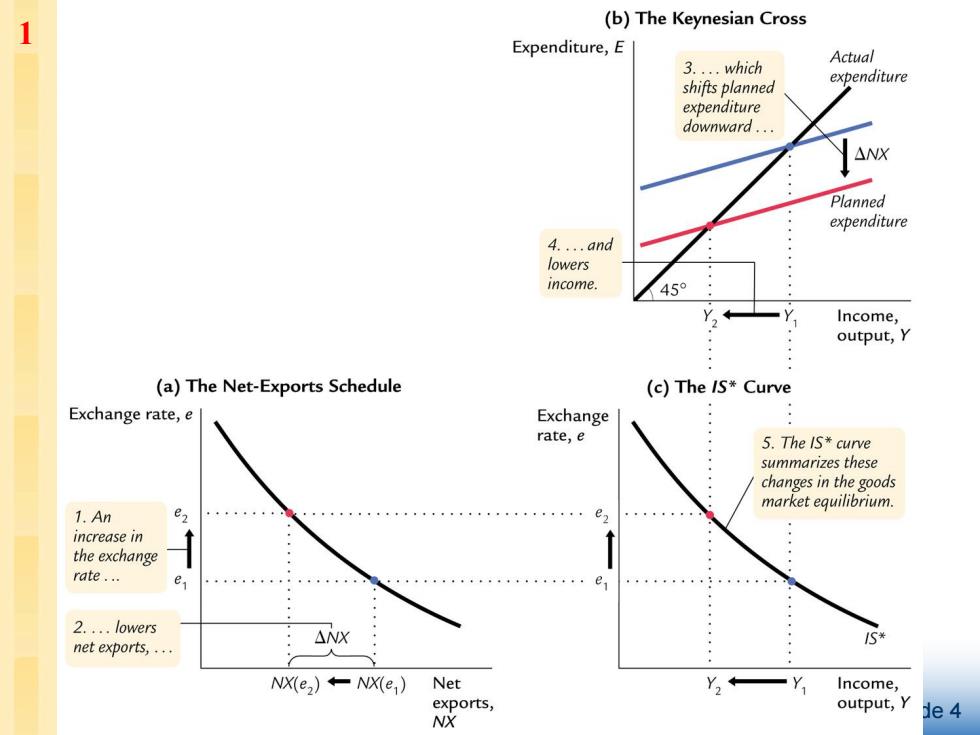

1 (b)The Keynesian Cross Expenditure,E 3.which Actual expenditure shifts planned expenditure downward. △NX Planned expenditure 4.and lowers income. 45° Income, output,Y (a)The Net-Exports Schedule (c)The /S*Curve Exchange rate,e Exchange rate,e 5.The IS*curve summarizes these changes in the goods market equilibrium. 1.An e2 increase in the exchange rate. e e 2.lowers net exports,. : △NX 5* NX(e2)+-NX(e;) Net Y+ 一Y Income, exports, output,y 1e4 NX

slide 4 1

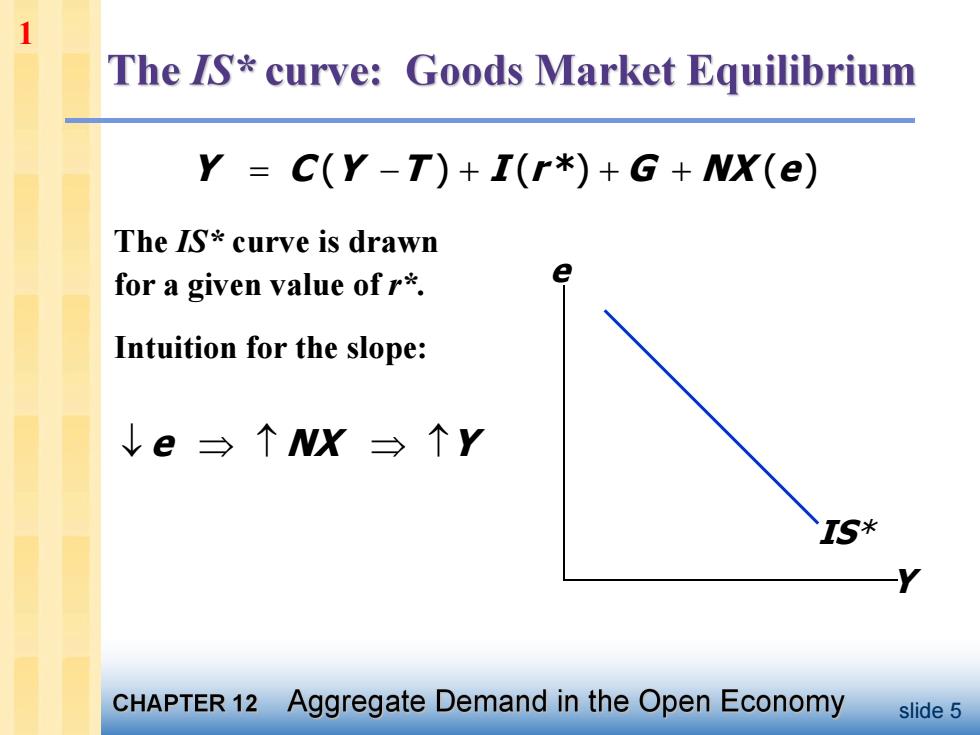

1 The IS*curve:Goods Market Equilibrium Y C(Y-T)+I(r*)+G+NX(e) The IS*curve is drawn for a given value of r*. Intuition for the slope: ↓e三↑NX三个Y IS* CHAPTER 12 Aggregate Demand in the Open Economy slide 5

slide 5 The IS* curve is drawn for a given value of r*. Intuition for the slope: Y e IS* Y C (Y T ) I (r *) G NX (e) e NX Y 1

Interest rate,r 1 LA 1.The money market equilibrium condition,·- 2.·and the world interest rate . Income,output,Y (b)The LM米Curve Exchange rate,e 3.determine the level of income. Income,output,y CHAPTER 12 Aggregate Demand in the Open Economy slide 6

slide 6 1

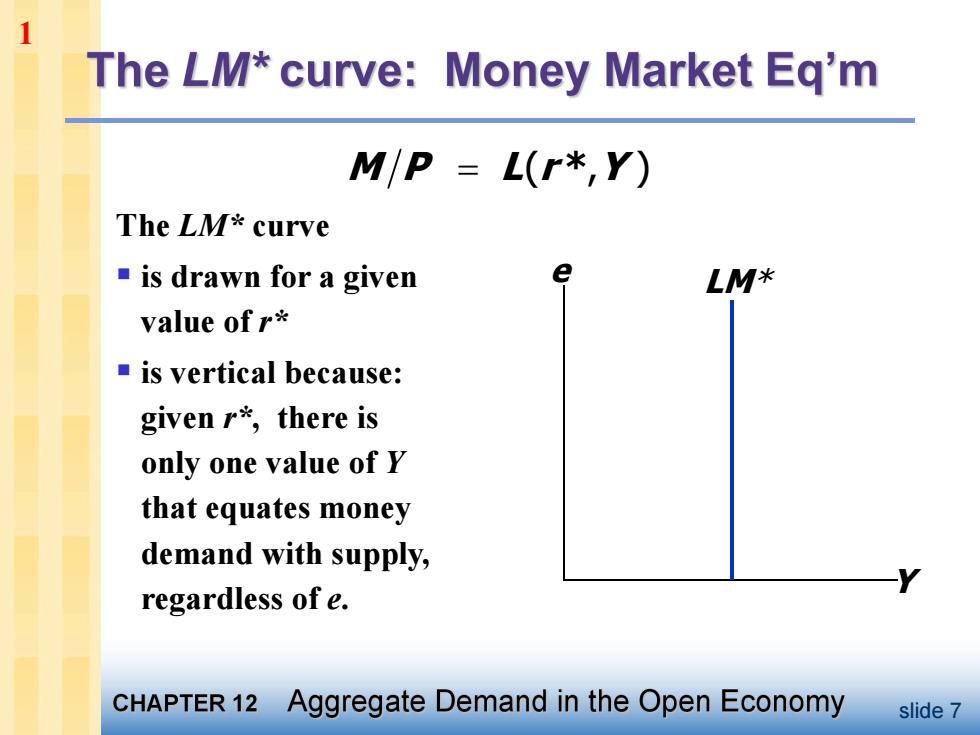

The LM*curve:Money Market Eq'm M/P L(r*,Y) The LM*curve ■is drawn for a given LM* value of r* ■is vertical because: given r*,there is only one value of r that equates money demand with supply, regardless of e. CHAPTER 12 Aggregate Demand in the Open Economy slide 7

slide 7 The LM* curve § is drawn for a given value of r* § is vertical because: given r* , there is only one value of Y that equates money demand with supply, regardless of e. Y e LM* M P L(r * ,Y ) 1

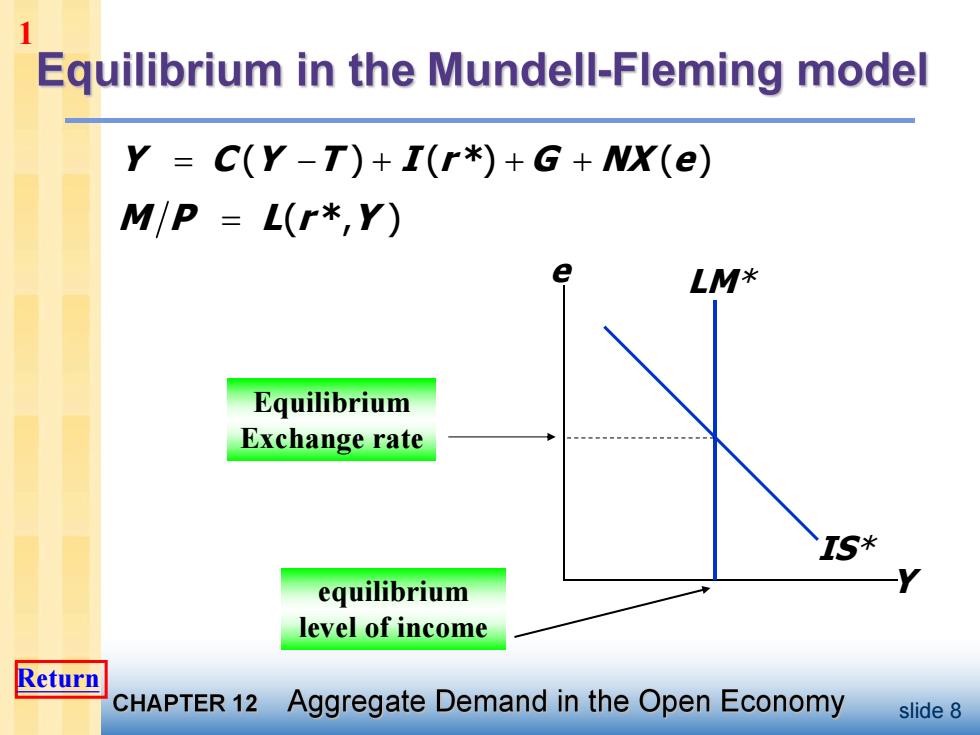

1 Equilibrium in the Mundell-Fleming model Y =C(Y-T)+I(r*)+G+NX(e) M/P L(r*,Y) e LM* Equilibrium Exchange rate TS* equilibrium level of income Return CHAPTER 12 Aggregate Demand in the Open Economy slide 8

slide 8 Y e LM* M P L(r * ,Y ) IS* Y C (Y T ) I (r *) G NX (e) Equilibrium Exchange rate equilibrium level of income 1 Return

2 Floating fixed exchange rates In a system of floating exchange rates,e is allowed to fluctuate in response to changing economic conditions. In contrast,under fixed exchange rates,the central bank trades domestic for foreign currency at a predetermined price(trades A for B用A换B). We now consider fiscal,monetary,and trade policy: first in a floating exchange rate system,then in a fixed exchange rate system. CHAPTER 12 Aggregate Demand in the Open Economy slide 9

slide 9 § In a system of floating exchange rates, e is allowed to fluctuate in response to changing economic conditions. § In contrast, under fixed exchange rates, the central bank trades domestic for foreign currency at a predetermined price (trades A for B 用A换B). § We now consider fiscal, monetary, and trade policy: first in a floating exchange rate system, then in a fixed exchange rate system. 2