Chapter 8-Profit Maximization and Competitive Supply Chapter Outline Perfectly Competitive Markets Profit Maximization Marginal Revenue,Marginal Cost,and Profit Maximization >Choosing Output in the Short Run The Competitive Firm's Short-Run Supply Curve The Short-Run Market Supply Curve >Choosing Output in the Long Run The Industry's Long-Run Supply Curve

Chapter 8—Profit Maximization and Competitive Supply Chapter Outline ➢ Perfectly Competitive Markets ➢ Profit Maximization ➢ Marginal Revenue, Marginal Cost, and Profit Maximization ➢ Choosing Output in the Short Run ➢ The Competitive Firm’s Short-Run Supply Curve ➢ The Short-Run Market Supply Curve ➢ Choosing Output in the Long Run ➢ The Industry’s Long-Run Supply Curve

8.1 Perfectly Competitive Markets Many firms compete in the market,and therefore each firm faces a significant number of direct competitors for its products. Because each individual firm sell a sufficiently small proportion of total market output,its decisions have no impact on market price.Thus each firm takes the market price as given. In short,firms in perfectly competitive markets are price takers

8.1 Perfectly Competitive Markets ❑ Many firms compete in the market, and therefore each firm faces a significant number of direct competitors for its products. Because each individual firm sell a sufficiently small proportion of total market output, its decisions have no impact on market price. Thus each firm takes the market price as given. In short, firms in perfectly competitive markets are price takers

Price-taking behavior typically occurs in markets where firms produce identical,or nearly identical,product. when the products of all of the firms in a market are perfectly substitutable with one another-that is,when they are homogeneous,no firm can raise the price of its product above the price of other firms without losing most or all of its business. Free entry(exit)-When there are no special costs that make it difficult for a firm to enter(or exit)an industry

❑ Price-taking behavior typically occurs in markets where firms produce identical, or nearly identical, product. when the products of all of the firms in a market are perfectly substitutable with one another– that is, when they are homogeneous, no firm can raise the price of its product above the price of other firms without losing most or all of its business. ❑ Free entry (exit) - When there are no special costs that make it difficult for a firm to enter (or exit) an industry

8.2 Profit Maximization Profit maximization-The goal of a firm;it is achieved when the marginal revenue of the firm is equal to the marginal cost of production (MR=MC). To be more exact,maximizing the market value of the firm is a more appropriate goal than profit maximization because market value includes the stream of profits that the firm earns over time.It is the stream of current and future profits that is of direct interest(影响,重要性)to the stockholders

8.2 Profit Maximization ❑ Profit maximization - The goal of a firm; it is achieved when the marginal revenue of the firm is equal to the marginal cost of production (MR=MC). ❑ To be more exact, maximizing the market value of the firm is a more appropriate goal than profit maximization because market value includes the stream of profits that the firm earns over time. It is the stream of current and future profits that is of direct interest (影响,重要性) to the stockholders

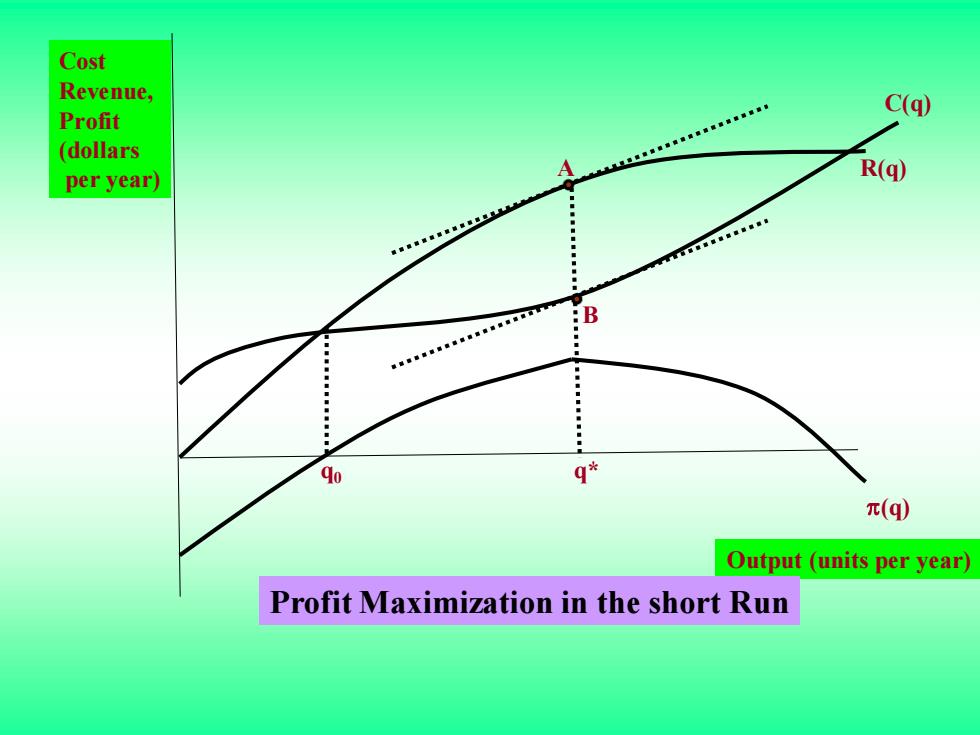

8.3 Marginal Revenue,Marginal Cost, and Profit Maximization Profit-Difference between total revenue and total cost. 元=R(q)-C(q) Marginal revenue-Change in revenue resulting from a 1 unit increase in output. A firm chooses output q*,so that profit,the difference AB between revenue R and cost C,is maximized. At that output,marginal revenue (the slope of the revenue curve) is equal to marginal cost (the slope of the cost curve)

8.3 Marginal Revenue, Marginal Cost, and Profit Maximization ❑ Profit - Difference between total revenue and total cost. = R(q) – C(q) Marginal revenue-Change in revenue resulting from a 1 unit increase in output. A firm chooses output q*, so that profit, the difference AB between revenue R and cost C, is maximized. At that output, marginal revenue (the slope of the revenue curve) is equal to marginal cost (the slope of the cost curve)

Cost Revenue, C(q) Profit (dollars A per year) R(q) 90 9¥ 元(q) Output (units per year) Profit Maximization in the short Run

(q) q0 q* R(q) C(q) Output (units per year) Profit Maximization in the short Run Cost Revenue, Profit (dollars per year) B A

Managers can operate in accordance with a complex set of objectives and under various constraints. However,we can assume that firms act as if they are maximizing long-run profit

Managers can operate in accordance with a complex set of objectives and under various constraints. However, we can assume that firms act as if they are maximizing long-run profit

The principle that profit is maximized when marginal revenue is equal to marginal cost holds for all firms,whether competitive or not. Profit,n=R-C,is maximized at the point at which an additional increment to output leaves profit unchanged: △π/△q=△R/△q-△C/△q=0 Thus we conclude that profit is maximized when MR-MC=0, so that MR(q)=MC(q)

The principle that profit is maximized when marginal revenue is equal to marginal cost holds for all firms, whether competitive or not. Profit, = R – C, is maximized at the point at which an additional increment to output leaves profit unchanged: /q = R/q - C/q = 0 Thus we conclude that profit is maximized when MR – MC = 0, so that MR(q)= MC(q)

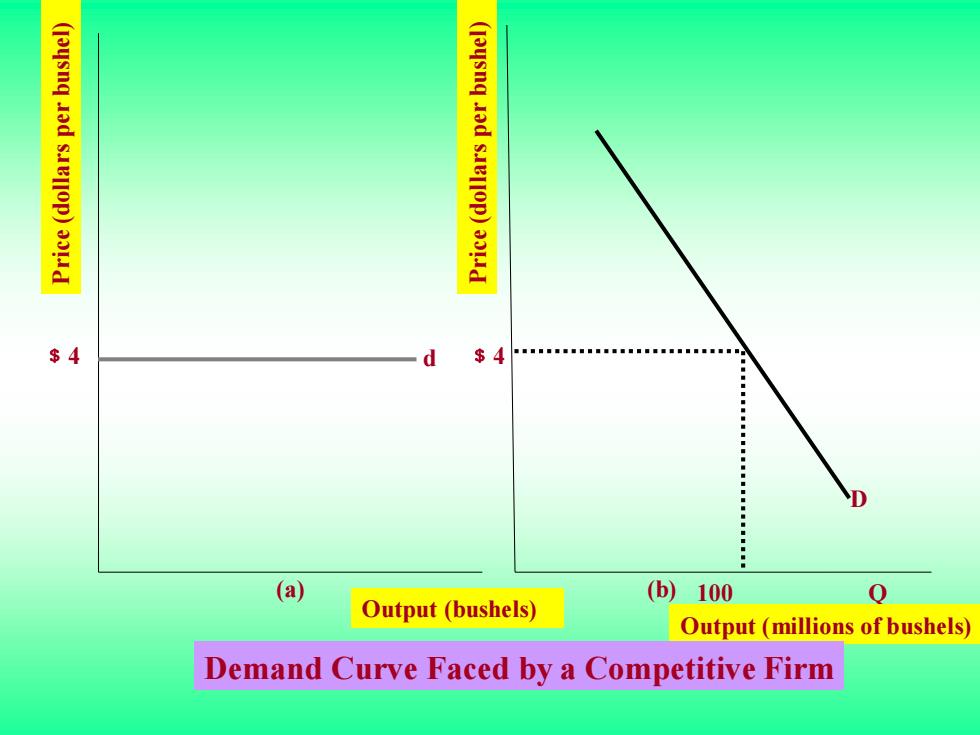

$4 (a) (b)100 Q Output(bushels) Output(millions of bushels) Demand Curve Faced by a Competitive Firm

D 100 Q ﹩4 Output (millions of bushels) Output (bushels) Price (dollars per bushel) Price (dollars per bushel) Demand Curve Faced by a Competitive Firm ﹩4 d (a) (b)

A competitive firm supplies only a small portion of the total output of all the firms in an industry. Therefore the firm takes the market price of the product as given,choosing its output on the assumption that the price will be unaffected by the output choice

A competitive firm supplies only a small portion of the total output of all the firms in an industry. Therefore the firm takes the market price of the product as given, choosing its output on the assumption that the price will be unaffected by the output choice