CHAPTER EIGHTEEN Money Supply and Monetary Policy macroeconomics N.Gregory Mankiw College of Management,HUST

macroeconomics N. Gregory Mankiw macro College of Management, HUST CHAPTER EIGHTEEN Money Supply and Monetary Policy

Chapter objectives ■Money supply how the banking system "creates"money three ways the Fed can control the money supply why the Fed can't control it precisely Theories of money demand a portfolio theory -a transactions theory:the Baumol-Tobin model CHAPTER 18 Money Supply and Money Demand slide 1

CHAPTER 18 Money Supply and Money Demand slide 1 Chapter objectives ▪ Money supply – how the banking system “creates” money – three ways the Fed can control the money supply – why the Fed can’t control it precisely ▪ Theories of money demand – a portfolio theory – a transactions theory: the Baumol-Tobin model

Content 1.Money creation in banking system 2.The money multiplier 3.Instruments of monetary policy 4.Case study 5.Financial innovation and near money 6.Chapter summary CHAPTER 18 Money Supply and Money Demand slide 2

CHAPTER 18 Money Supply and Money Demand slide 2 Content 1. Money creation in banking system 2. The money multiplier 3. Instruments of monetary policy 4. Case study 5. Financial innovation and near money 6. Chapter summary

1 Banks'role in the money supply ■ The money supply equals currency plus demand(checking account经常账户)deposits: M=C+D Since the money supply includes demand deposits,the banking system plays an important role. CHAPTER 18 Money Supply and Money Demand slide 3

CHAPTER 18 Money Supply and Money Demand slide 3 Banks’ role in the money supply ▪ The money supply equals currency plus demand (checking account 经常账户) deposits: M = C + D ▪ Since the money supply includes demand deposits, the banking system plays an important role. 1

1 A few preliminaries Reserves (R):the portion of deposits that banks have not lent. To a bank,liabilities include deposits, assets include reserves and outstanding loans 100-percent-reserve banking:a system in which banks hold all deposits as reserves. Fractional-reserve banking: a system in which banks hold a fraction of their deposits as reserves. CHAPTER 18 Money Supply and Money Demand slide 4

CHAPTER 18 Money Supply and Money Demand slide 4 A few preliminaries ▪ Reserves (R ): the portion of deposits that banks have not lent. ▪ To a bank, liabilities include deposits, assets include reserves and outstanding loans ▪ 100-percent-reserve banking: a system in which banks hold all deposits as reserves. ▪ Fractional-reserve banking: a system in which banks hold a fraction of their deposits as reserves. 1

SCENARIO 1:No Banks With no banks, D=0andM=C=$1000. CHAPTER 18 Money Supply and Money Demand slide 5

CHAPTER 18 Money Supply and Money Demand slide 5 SCENARIO 1: No Banks With no banks, D = 0 and M = C = $1000. 1

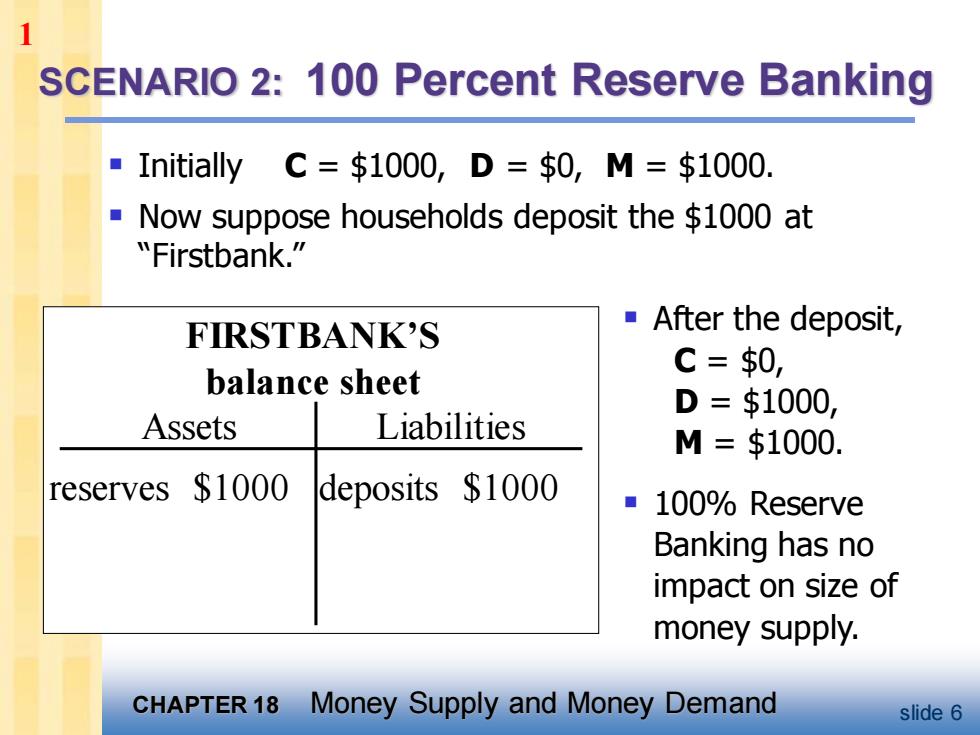

SCENARIO 2:100 Percent Reserve Banking ·Initially C=$1000,D=$0,M=$1000. Now suppose households deposit the $1000 at "Firstbank." FIRSTBANK'S After the deposit, balance sheet C=$0, D=$1000, Assets Liabilities M=$1000. reserves $1000 deposits $1000 ■100%Reserve Banking has no impact on size of money supply. CHAPTER 18 Money Supply and Money Demand slide 6

CHAPTER 18 Money Supply and Money Demand slide 6 SCENARIO 2: 100 Percent Reserve Banking ▪ After the deposit, C = $0, D = $1000, M = $1000. ▪ 100% Reserve Banking has no impact on size of money supply. FIRSTBANK’S balance sheet Assets Liabilities reserves $1000 deposits $1000 ▪ Initially C = $1000, D = $0, M = $1000. ▪ Now suppose households deposit the $1000 at “Firstbank.” 1

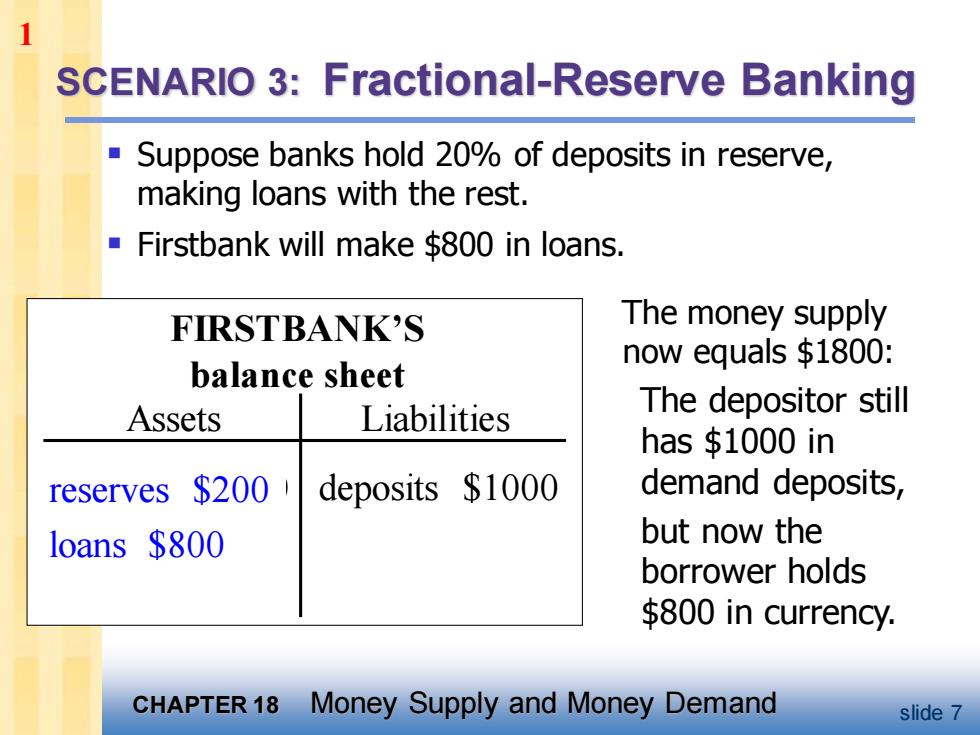

SCENARIO 3:Fractional-Reserve Banking Suppose banks hold 20%of deposits in reserve, making loans with the rest. Firstbank will make $800 in loans. FIRSTBANK'S The money supply now equals $1800: balance sheet Assets Liabilities The depositor still has $1000 in reserves $200 deposits $1000 demand deposits, loans $800 but now the borrower holds $800 in currency. CHAPTER 18 Money Supply and Money Demand slide 7

CHAPTER 18 Money Supply and Money Demand slide 7 SCENARIO 3: Fractional-Reserve Banking The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities deposits $1000 ▪ Suppose banks hold 20% of deposits in reserve, making loans with the rest. ▪ Firstbank will make $800 in loans. reserves $1000 reserves $200 loans $800 1

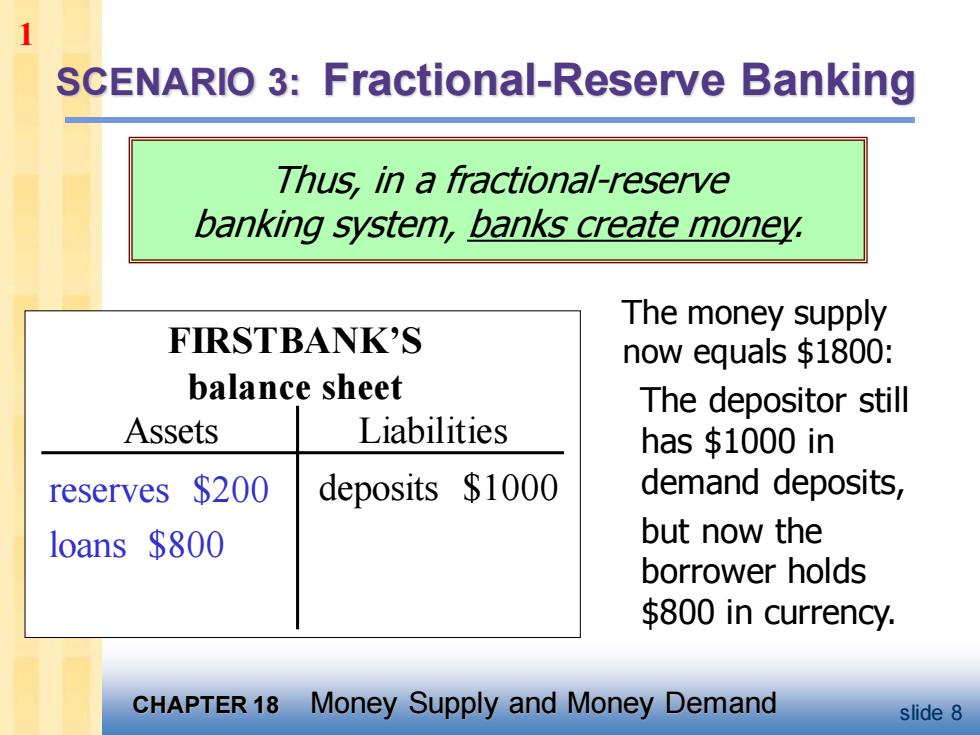

SCENARIO 3:Fractional-Reserve Banking Thus,in a fractional-reserve banking system,banks create money. The money supply FIRSTBANK'S now equals $1800: balance sheet The depositor still Assets Liabilities has $1000 in reserves $200 deposits $1000 demand deposits, loans $800 but now the borrower holds $800 in currency. CHAPTER 18 Money Supply and Money Demand slide 8

CHAPTER 18 Money Supply and Money Demand slide 8 SCENARIO 3: Fractional-Reserve Banking The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities reserves $200 loans $800 deposits $1000 Thus, in a fractional-reserve banking system, banks create money. 1

1 SCENARIO 3:Fractional-Reserve Banking ■ Suppose the borrower deposits the $800 in Secondbank. Initially,Secondbank's balance sheet is: SECONDBANK'S ■But then balance sheet Secondbank will loan 80%of this Assets Liabilities deposit reserves $160 deposits $800 and its balance loans $640 sheet will look like this: CHAPTER 18 Money Supply and Money Demand slide 9

CHAPTER 18 Money Supply and Money Demand slide 9 SCENARIO 3: Fractional-Reserve Banking ▪ But then Secondbank will loan 80% of this deposit ▪ and its balance sheet will look like this: SECONDBANK’S balance sheet Assets Liabilities reserves $800 loans $0 deposits $800 ▪ Suppose the borrower deposits the $800 in Secondbank. ▪ Initially, Secondbank’s balance sheet is: reserves $160 loans $640 1