Chapter 17-Markets with Asymmetric Information Chapter Outline Quality Uncertainty and the Market for Lemons ▣Market Signaling ▣Moral Hazard The Principal-Agent Problem Managerial Incentives in an Integrated Firm Asymmetric Information in Labor Markets: Efficiency Wage Theory

Chapter 17 — Markets with Asymmetric Information Chapter Outline ❑ Quality Uncertainty and the Market for Lemons ❑ Market Signaling ❑ Moral Hazard ❑ The Principal-Agent Problem ❑ Managerial Incentives in an Integrated Firm ❑ Asymmetric Information in Labor Markets: Efficiency Wage Theory

1 Quality Uncertainty and the Market for Lemons Asymmetric Information-situation in which a buyer and seller possess different information about a transaction. George A.Akerlof:The Market for 'Lemons': Quality Uncertainty and the Market Mechanism published by Quarterly Journal of Economics(1970)

1 Quality Uncertainty and the Market for Lemons Asymmetric Information — situation in which a buyer and seller possess different information about a transaction. George A. Akerlof: The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism published by Quarterly Journal of Economics(1970)

PH SH $10,000 DH DM $5,000 PL DLM 25,000 50,000 QH 50,000 75,000QL (a)High-Quality Cars (b)Low-Quality Cars The Market for Used Car

The Market for Used Car

When sellers of products have better information about product quality than buyers,a "lemons problem"may arise in which low-quality goods drive out high-quality goods. In (a)the demand curve for high-quality cars is DH.However, as buyers lower their expectations about the average quality of cars on the market,their perceived demand shifts to Dv

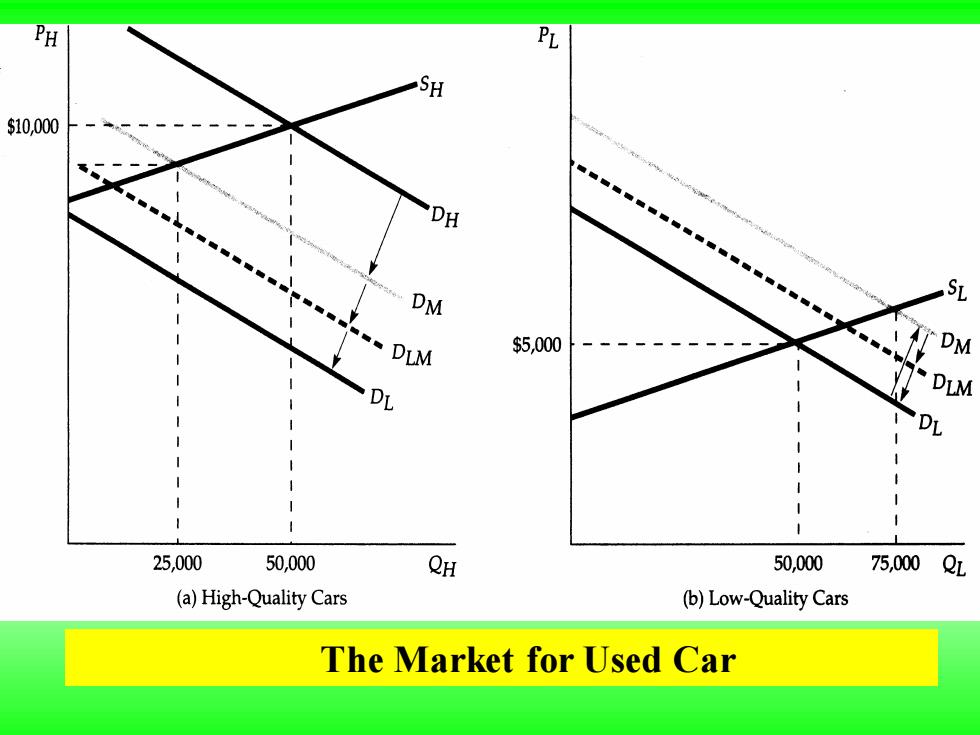

When sellers of products have better information about product quality than buyers, a “lemons problem” may arise in which low-quality goods drive out high-quality goods. In (a) the demand curve for high-quality cars is DH. However, as buyers lower their expectations about the average quality of cars on the market, their perceived demand shifts to DM

Likewise,in (b)the perceived demand curve for low-quality cars shifts from DL to DM. As a result,the quantity of high-quality cars sold falls from 50,000 to 25,000,and the quantity of low-quality cars sold increases from50.000to75.000. Eventually,only low-quality cars are sold

Likewise, in (b) the perceived demand curve for low-quality cars shifts from DL to DM. As a result, the quantity of high-quality cars sold falls from 50,000 to 25,000, and the quantity of low-quality cars sold increases from 50.000 to 75.000. Eventually, only low-quality cars are sold

Implications of Asymmetric Information Adverse selection-form of market failure resulting from asymmetric information:if insurance companies must charge a single premium because they can not distinguish between high-risk and low-risk individuals,more high-risk individuals will insure,making it unprofitable to sell insurance

Implications of Asymmetric Information Adverse selection - form of market failure resulting from asymmetric information: if insurance companies must charge a single premium because they can not distinguish between high-risk and low-risk individuals, more high-risk individuals will insure, making it unprofitable to sell insurance

2 Market Signaling Market Signaling-Process by which sellers send signals to buyers conveying information about product quality. Note:Michael Spence:Market Signaling(1974)

2 Market Signaling Market Signaling– Process by which sellers send signals to buyers conveying information about product quality. Note: Michael Spence: Market Signaling(1974)

$200000 $20,000 C1)=$40,00y S100000 000 $10,000 CT)=$20,000y B(w) By) 0 123 45 Years of Colleg Optimal Choice of y for group I Optimal Choice ofy for group II Signaling

$200000 $100000 Optimal Choice of y for group I Optimal Choice of y for group II y* Years of College y* Signaling

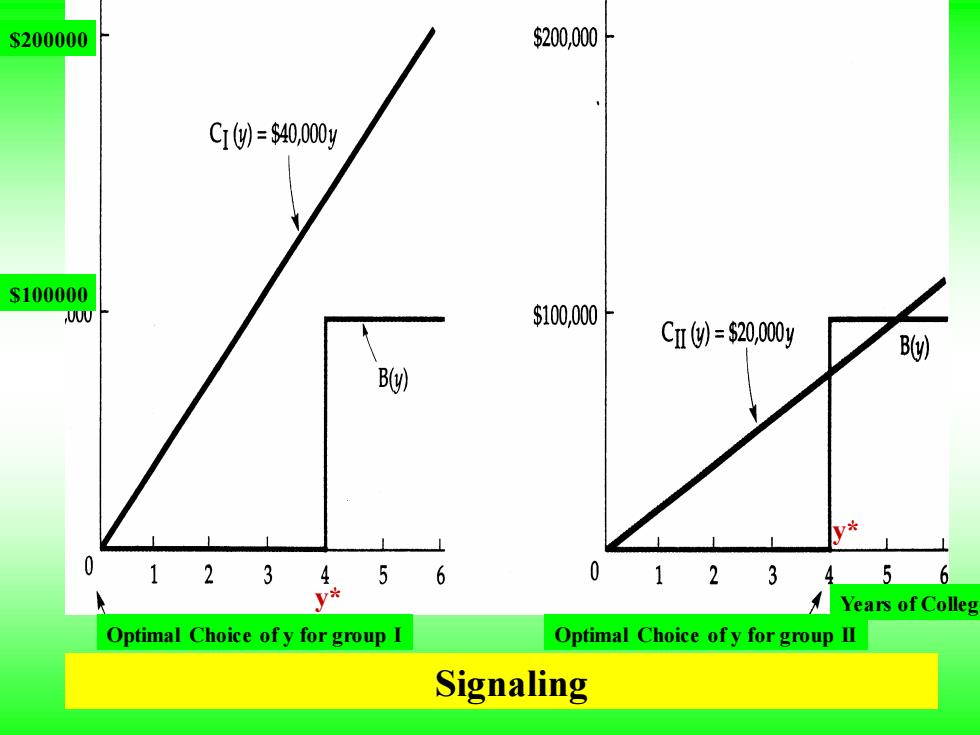

Education can be a useful signal of the high productivity of a group of workers if education is easier to obtain for this group than for a low-productivity group. In (a),the low-productivity group will choose an education level of y=0 because the cost of education is greater than the increased earnings resulting from education. However in (b),the high-productivity group will choose an education level of y*=4 because the gain in earnings is greater than the cost

Education can be a useful signal of the high productivity of a group of workers if education is easier to obtain for this group than for a low-productivity group. In (a), the low-productivity group will choose an education level of y = 0 because the cost of education is greater than the increased earnings resulting from education. However in (b), the high-productivity group will choose an education level of y* = 4 because the gain in earnings is greater than the cost

3 Moral hazard Moral hazard-when an insured party whose actions are unobserved can affect the probability or magnitude of a payment associated with an event

3 Moral hazard Moral hazard – when an insured party whose actions are unobserved can affect the probability or magnitude of a payment associated with an event