海南大学2007-08学年度第1学期试卷 科目:《微观经济学》试题(B卷) 姓名: 学号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 二三 四 六 八九 十 总分 得分 阅卷教师: 20年月日 考试说明:本课程为闭卷考试,可携带计算器一。 得分阅卷教师 Please explain the following terms (每题5分,共50分) 1 Degree of economies of scope 2 Depletable resource 3 Equilibrium in dominant strategies

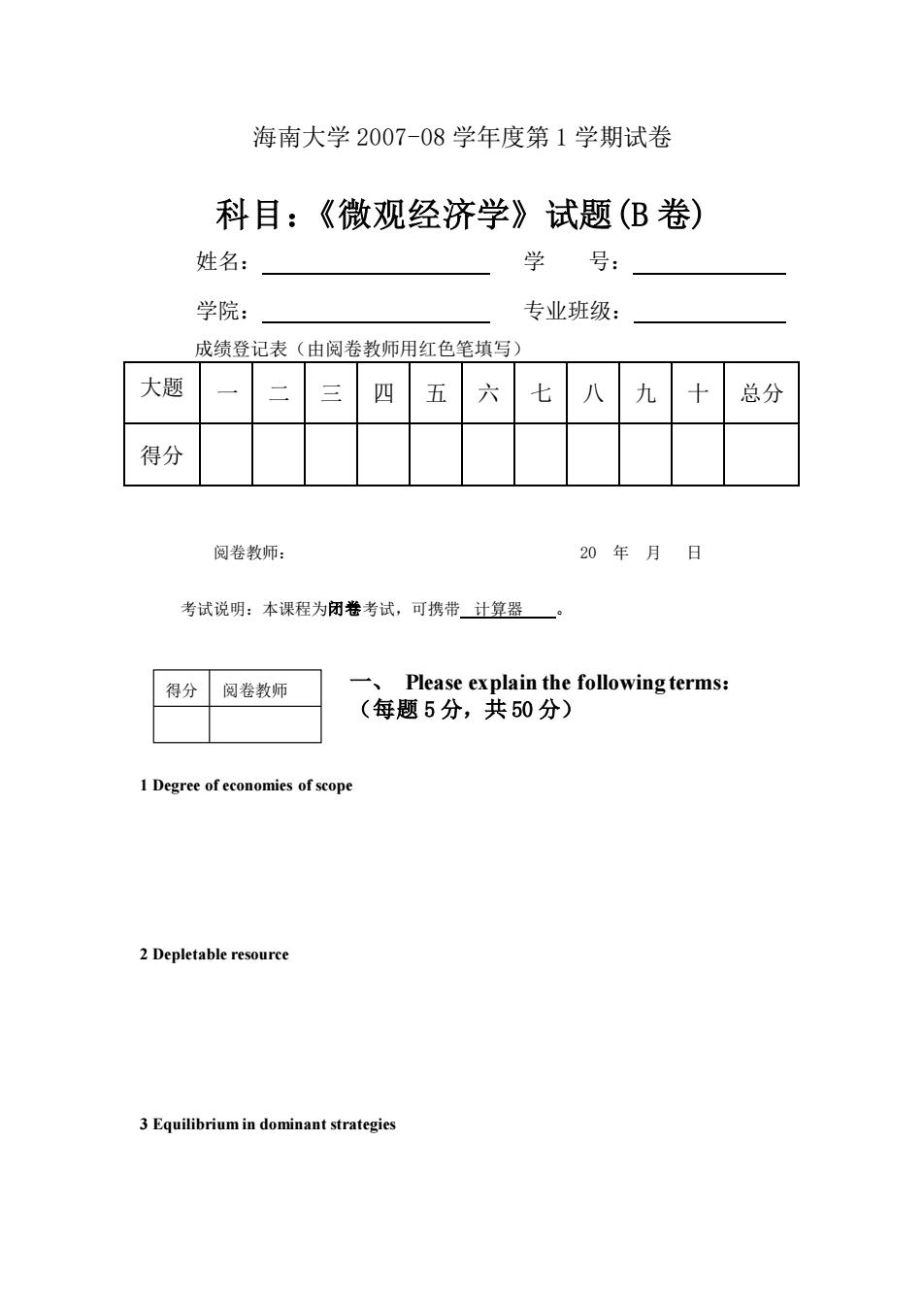

海南大学 2007-08 学年度第 1 学期试卷 科目:《微观经济学》试题(B 卷) 姓名: 学 号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 号 一 二 三 四 五 六 七 八 九 十 总分 得分 阅卷教师: 20 年 月 日 考试说明:本课程为闭卷考试,可携带 计算器 。 一、 Please explain the following terms: (每题 5 分,共 50 分) 1 Degree of economies of scope 2 Depletable resource 3 Equilibrium in dominant strategies 得分 阅卷教师

4 First theorem of welfare economics 5 General equilibrium analysis 6Giffen good 7Intertemporal price discrimination 8 Law of diminishing marginal returns 9Marginal rate of technical substitution 10 Publicgood 得分阅卷教师 二、简答题:(共10分) 1.An antique dealer regularly buys objects at home-town auctions whose bidders are limited to other dealers.Most of her successful bids turn out to be financially worthwhile.because she is able toresel the antiques for a profit.On occasion,however,she travels toa nearby town to bid in n ion that is openo the public She often finds that on the rar occasions in which she does bid successfully.she is disappointedthe antique cannot be sok

4 First theorem of welfare economics 5 General equilibrium analysis 6 Giffen good 7 Intertemporal price discrimination 8 Law of diminishing marginal returns 9 Marginal rate of technical substitution 10 Public good 二、简答题:(共 10 分) 1. An antique dealer regularly buys objects at home-town auctions whose bidders are limited to other dealers. Most of her successful bids turn out to be financially worthwhile, because she is able to resell the antiques for a profit. On occasion, however, she travels to a nearby town to bid in an auction that is open to the public. She often finds that on the rare occasions in which she does bid successfully, she is disappointed - the antique cannot be sold 得分 阅卷教师

at a profit.Can you explain the difference in her success between the two sets of circumstances? 得分阅卷教师 三、Calculation:(每题20分,共40分) 1.Two computer firms.A and B.are planning to market network systems for office information management.Each firm can develop either a fast,high-quality system (H).or a slower,low-quality system(L)Market indicates that the resulting profitsto eachfirm for the alternative given by the following payof matrix Firm B H L H 50,40 60,45 Firm A 55,55 15,20 a.If both firms make their decisions at the same time and follow maximin (low-risk) strategies, what will the outcome be? b.Suppose both firms try to maximize profits,but Firm A has a head start in planning,and can commit first.Now what will the outcome be?What will the outoome be if Firm B has a head start in planning and can commit first? c Getting a head start costs money (you have to gear up a large engineering team).Now consider the lwo-stage game in which first.each firm decides how much money to spend to speed up its planning.and second.it announces which product H or L)it will produce Which firm will I spend m re topeed up its planning? Ho much will it spend?Should the other firm spend anything to speed up its planning?Explain. 2.Two used car dealerships compete side by side on a main road.The first,Harrys Cars

at a profit. Can you explain the difference in her success between the two sets of circumstances? 三、Calculation:(每题 20 分,共 40 分) 1. Two computer firms, A and B, are planning to market network systems for office information management. Each firm can develop either a fast, high-quality system (H), or a slower, low-quality system (L). Market research indicates that the resulting profits to each firm for the alternative strategies are given by the following payoff matrix: Firm B H L H 50, 40 60, 45 Firm A L 55, 55 15, 20 a.If both firms make their decisions at the same time and follow maximin (low-risk) strategies, what will the outcome be? b.Suppose both firms try to maximize profits, but Firm A has a head start in planning, and can commit first. Now what will the outcome be? What will the outcome be if Firm B has a head start in planning and can commit first? c Getting a head start costs money (you have to gear up a large engineering team). Now consider the two-stage game in which first, each firm decides how much money to spend to speed up its planning, and second, it announces which product (H or L) it will produce. Which firm will spend more to speed up its planning? How much will it spend? Should the other firm spend anything to speed up its planning? Explain. 2. Two used car dealerships compete side by side on a main road. The first, Harry’s Cars, 得分 阅卷教师

always sells high-quality cars that it carefully inspects and,if necessary,services.On average,it Harry tobuyand erve ech ear that itll.The end dealership,Lews Motors,always sells bwer-quality cars.On average,it costs Lew on $5,000 for each car that it sells.If consumers knew the quality of the used cars they were buying.they would gladly pay $10.000 on average for Harry's cars,but only $7.000 on average for Lew's cars. Without more information consumers do not know the guality ofeach dealershin's cars In this e,cr that they h ve a 50-50 chance of ending up with a high-quality car,and are thus willing to a car. Harry has an idea:He will ofer a bumper-to-bumper warranty for all cars be sells He knows that a warranty lasting Y years will cost $500Y on average,and he also knows that if Lew tries to offer the same warranty,it will cost Lew $1000Y on average. (a) Suppose Harry offers a one-year warranty on all cars it sells (1)What is Lew's profit if it does not offer a one-year warranty?If it does offera one-vear warranty? (2)What is Harry's profit if Lew's does not offer a one-year warranty?If it does offer a one-year warranty? (3)Will Lew's match Harry's one-year warranty? (4)Is it a good idea for Harry's to offer a one-year warranty? ) What if Harry offers a two-year warranty?Will this generate a credible signalof quality?What about a three-year warranty? (c)If you were advising Harry,how long a warranty would you urge him to offer? Explain why

always sells high-quality cars that it carefully inspects and, if necessary, services. On average, it costs Harry $8,000 to buy and service each car that it sells. The second dealership, Lew’s Motors, always sells lower-quality cars. On average, it costs Lew only $5,000 for each car that it sells. If consumers knew the quality of the used cars they were buying, they would gladly pay $10,000 on average for Harry’s cars, but only $7,000 on average for Lew’s cars. Without more information, consumers do not know the quality of each dealership’s cars. In this case, consumers would figure that they have a 50-50 chance of ending up with a high-quality car, and are thus willing to pay $8,500 for a car. Harry has an idea: He will offer a bumper-to-bumper warranty for all cars he sells. He knows that a warranty lasting Y years will cost $500Y on average, and he also knows that if Lew tries to offer the same warranty, it will cost Lew $1000Y on average. (a) Suppose Harry offers a one-year warranty on all cars it sells. (1) What is Lew’s profit if it does not offer a one-year warranty? If it does offer a one-year warranty? (2) What is Harry’s profit if Lew’s does not offer a one-year warranty? If it does offer a one-year warranty? (3) Will Lew’s match Harry’s one-year warranty? (4) Is it a good idea for Harry’s to offer a one-year warranty? (b) What if Harry offers a two-year warranty? Will this generate a credible signal of quality? What about a three-year warranty? (c) If you were advising Harry, how long a warranty would you urge him to offer? Explain why