链典4矮降贸多大 高级商务英语阅读 Supplementary Reading for Chapter 5 Fast Track to Lost Jobs (1) US trade deficits and foreign debt:problems or symptoms? Gerard Jackson Monday 10 May 2004 The size of the U.S.deficit is causing alarm among some commentators who are using it to draw attention to America's foreign debt.Even though mercantilist fallacies are lurking behind these warning that is no reason to dismiss them outright. However,this is basically what optimists are doing when they assure the public that there is nothing to worry about because the country is borrowing to expand its productive capacity.As evidence of this view they point out that the US stock market has risen relative to the rest of the world,inferring that this rise is a reflection of increased investment. They also correctly point out that the US had deficits throughout the nineteenth century.In fact, from the end of the War of Independence in 1784 right up to 1914 America was a debtor nation, running an annual deficit on its balance of trade until the 1870s",even though she had built a tariff wall.(Protectionists argue that tariffs cure the alleged ills of trade deficits). How could this be?The answer is simple:most of the debt was incurred by individuals who used it to import capital goods,mainly from Britain.In other words,American entrepreneurs used British savings to expand America's productive capacity.During this period thousands of these entrepreneurs repaid their British loans,others took out new loans while thousands more borrowed for the first time. And so it went on,decade after decade and each decade saw the American economy expand and living standards rise.Of course,some entrepreneurs failed.But the consequences of failure were 第1页共7页

高级商务英语阅读 Supplementary Reading for Chapter 5 Fast Track to Lost Jobs (1) US trade deficits and foreign debt: problems or symptoms? Gerard Jackson Monday 10 May 2004 The size of the U.S. deficit is causing alarm among some commentators who are using it to draw attention to America's foreign debt. Even though mercantilist fallacies are lurking behind these warning that is no reason to dismiss them outright. However, this is basically what optimists are doing when they assure the public that there is nothing to worry about because the country is borrowing to expand its productive capacity. As evidence of this view they point out that the US stock market has risen relative to the rest of the world, inferring that this rise is a reflection of increased investment. They also correctly point out that the US had deficits throughout the nineteenth century. In fact, from the end of the War of Independence in 1784 right up to 1914 America was a debtor nation, running an annual deficit on its balance of trade until the 1870s*, even though she had built a tariff wall. (Protectionists argue that tariffs cure the alleged ills of trade deficits). How could this be? The answer is simple: most of the debt was incurred by individuals who used it to import capital goods, mainly from Britain. In other words, American entrepreneurs used British savings to expand America's productive capacity. During this period thousands of these entrepreneurs repaid their British loans, others took out new loans while thousands more borrowed for the first time. And so it went on, decade after decade and each decade saw the American economy expand and living standards rise. Of course, some entrepreneurs failed. But the consequences of failure were 第 1 页 共 7 页

碰男降贸多大是 高级商务英语阅读 shared between the American borrower and the British investor and not their respective governments. It ought to be clear that the so-called debt problem is really a non-problem in the sense that what really matters is not debt but how it is acquired.Therefore,running a trade surplus is not necessarily a sign of economic health.Those who think otherwise have forgotten that during the depressed 1930s when tariffs were strongly defended and unemployment averaged 17 per cent America was a creditor nation with a trade surplus. But what the optimists overlook is that the gold was king during the nineteenth century,which meant that countries that deviated from the standard soon found themselves having to make the necessary monetary corrections. The importance of the gold standard lies in the fact that when the US borrowed from,for example, British investors it was borrowing real savings and not phony back deposits.That is to say,these saving actually consisted of deferred consumption. Once Keynes persuaded politicians to abandon gold,that "barbaric relic",as he called it,countries had to rely entirely on fiat money.This created unprecedented inflation on a global scale.It also generated bad deficits.These occur when central banks let loose with the money supply,usually through our old enemy credit expansion,the same process that triggers booms and inflates asset values. But there is another side to credit expansion and that is its effect on the trade balance.Monetary expansion inflates domestic spending which in turn raises the demand for imports.This demand continues to grow until the deficit reaches a point where the central bank sees it as another warning signal that monetary policy needs to be tightened. Now the central bank brings about credit expansion by forcing down interest rates.This eventually causes businesses expand their demand for loans for investment purposes.There is no reason that some of these loans should not be used to import capital goods. 第2页共7页

高级商务英语阅读 shared between the American borrower and the British investor and not their respective governments. It ought to be clear that the so-called debt problem is really a non-problem in the sense that what really matters is not debt but how it is acquired. Therefore, running a trade surplus is not necessarily a sign of economic health. Those who think otherwise have forgotten that during the depressed 1930s when tariffs were strongly defended and unemployment averaged 17 per cent America was a creditor nation with a trade surplus. But what the optimists overlook is that the gold was king during the nineteenth century, which meant that countries that deviated from the standard soon found themselves having to make the necessary monetary corrections. The importance of the gold standard lies in the fact that when the US borrowed from, for example, British investors it was borrowing real savings and not phony back deposits. That is to say, these saving actually consisted of deferred consumption. Once Keynes persuaded politicians to abandon gold, that "barbaric relic", as he called it, countries had to rely entirely on fiat money. This created unprecedented inflation on a global scale. It also generated bad deficits. These occur when central banks let loose with the money supply, usually through our old enemy credit expansion, the same process that triggers booms and inflates asset values. But there is another side to credit expansion and that is its effect on the trade balance. Monetary expansion inflates domestic spending which in turn raises the demand for imports. This demand continues to grow until the deficit reaches a point where the central bank sees it as another warning signal that monetary policy needs to be tightened. Now the central bank brings about credit expansion by forcing down interest rates. This eventually causes businesses expand their demand for loans for investment purposes. There is no reason that some of these loans should not be used to import capital goods. 第 2 页 共 7 页

能男华经降贸多大星 高级商务英语阅读 These imports would be seen by the optimists as evidence that the deficit didn't matter because it was adding to the nation's productive capacity.As the Keynesians say,it merely shows that investment exceeds savings.This view only demonstrates that they are oblivious to the fact that investment in excess of savings is just another way of saying that the country is suffering from inflation. Therefore,what the optimists call evidence of a healthy demand for capital goods is really a symptom of an inflationary process. So is the US deficit a symptom of a loose monetary policy that is misdirecting production or a sign of healthy economic growth?At this point I think we should let the monetary facts speak for themselves. Using the Austrian definition of the money supply,from January 2001 to March 2004 money supply increased by more than 22 per cent,an annual average increase of over 7 per cent. The problem,therefore,is not foreign debt or trade deficits but a loose monetary policy,a policy that is laying the foundations for another recession. (2) The U.S.Trade Deficit and Jobs:The Real Story Free Trade Bulletin No.3 February,2003 by Dan Griswold,associate director,Center for Trade Policy Studies,Cato Institute On February 20,2003,the U.S.Department of Commerce reported that the U.S.trade deficit reached a new record in 2002.For the calendar year,imports of goods into the United States exceeded exports by $484.4 billion.When that figure is combined with an overall surplus in services of $49.1 billion,the 2002 deficit in goods and services was $435.2 billion,the largest in U.S.history.If the past is any guide,the record deficit will be misused by opponents of free trade to 第3页共7页

高级商务英语阅读 These imports would be seen by the optimists as evidence that the deficit didn't matter because it was adding to the nation's productive capacity. As the Keynesians say, it merely shows that investment exceeds savings. This view only demonstrates that they are oblivious to the fact that investment in excess of savings is just another way of saying that the country is suffering from inflation. Therefore, what the optimists call evidence of a healthy demand for capital goods is really a symptom of an inflationary process. So is the US deficit a symptom of a loose monetary policy that is misdirecting production or a sign of healthy economic growth? At this point I think we should let the monetary facts speak for themselves. Using the Austrian definition of the money supply, from January 2001 to March 2004 money supply increased by more than 22 per cent, an annual average increase of over 7 per cent. The problem, therefore, is not foreign debt or trade deficits but a loose monetary policy, a policy that is laying the foundations for another recession. (2) The U.S. Trade Deficit and Jobs: The Real Story Free Trade Bulletin No. 3 February, 2003 by Dan Griswold, associate director, Center for Trade Policy Studies, Cato Institute On February 20, 2003, the U.S. Department of Commerce reported that the U.S. trade deficit reached a new record in 2002. For the calendar year, imports of goods into the United States exceeded exports by $484.4 billion. When that figure is combined with an overall surplus in services of $49.1 billion, the 2002 deficit in goods and services was $435.2 billion, the largest in U.S. history. If the past is any guide, the record deficit will be misused by opponents of free trade to 第 3 页 共 7 页

碰男将多大是 高级商务英语阅读 claim that it depresses production and destroys jobs in the U.S.economy. The argument of the trade critics is simple but misleading:If exports create jobs,then imports must destroy jobs.Thus,a trade deficit by its very nature causes a net loss of jobs in the U.S.economy, and the bigger the deficit,the more jobs lost. The leading proponent of this sort of analysis is the Economic Policy Institute,a pro-union, left-of-center nonprofit organization in Washington that routinely publishes studies claiming to show specific job losses,including state-by-state totals,as a result of trade deficits.Those numbers are then repeated by labor union leaders and trade opponents in Congress to warn against further trade liberalization. As the author of one EPI study explains:"When the United States exports 1,000 cars to Germany or Mexico,plants in this country employ U.S.workers in their production.If,however,the U.S. imports 1,000 cars from Germany or Mexico rather than building them domestically,then a similar number of U.S.workers who would have otherwise been employed in the auto industry will have to find other work.Ignoring imports and counting only exports is like balancing a checkbook by counting only deposits but not withdrawals." To determine the number of jobs or potential jobs "eliminated"by the trade deficit,the EPI model compares actual U.S.employment to what it would supposedly be if the U.S.trade deficit were zero and the economy's overall growth rate unchanged.Fewer imported cars,steel slabs,shoes. toys,shirts,and other goods are then translated into more domestic production of those items and hence more jobs if exports equaled imports.In other words,every widget not imported translates into a widget produced at home and more widget workers employed. Within this model,the rising imports and trade deficits of recent years can only be bad news for output and employment.As EPI concludes,"The toll on U.S.employment has been heavy:from 1994 to 2000,growing trade deficits eliminated a net total of 3.0 million actual and potential jobs from the U.S.economy." 第4页共7页

高级商务英语阅读 claim that it depresses production and destroys jobs in the U.S. economy. The argument of the trade critics is simple but misleading: If exports create jobs, then imports must destroy jobs. Thus, a trade deficit by its very nature causes a net loss of jobs in the U.S. economy, and the bigger the deficit, the more jobs lost. The leading proponent of this sort of analysis is the Economic Policy Institute, a pro-union, left-of-center nonprofit organization in Washington that routinely publishes studies claiming to show specific job losses, including state-by-state totals, as a result of trade deficits. Those numbers are then repeated by labor union leaders and trade opponents in Congress to warn against further trade liberalization. As the author of one EPI study explains: "When the United States exports 1,000 cars to Germany or Mexico, plants in this country employ U.S. workers in their production. If, however, the U.S. imports 1,000 cars from Germany or Mexico rather than building them domestically, then a similar number of U.S. workers who would have otherwise been employed in the auto industry will have to find other work. Ignoring imports and counting only exports is like balancing a checkbook by counting only deposits but not withdrawals." To determine the number of jobs or potential jobs "eliminated" by the trade deficit, the EPI model compares actual U.S. employment to what it would supposedly be if the U.S. trade deficit were zero and the economy's overall growth rate unchanged. Fewer imported cars, steel slabs, shoes, toys, shirts, and other goods are then translated into more domestic production of those items and hence more jobs if exports equaled imports. In other words, every widget not imported translates into a widget produced at home and more widget workers employed. Within this model, the rising imports and trade deficits of recent years can only be bad news for output and employment. As EPI concludes, "The toll on U.S. employment has been heavy: from 1994 to 2000, growing trade deficits eliminated a net total of 3.0 million actual and potential jobs from the U.S. economy." 第 4 页 共 7 页

链勇经份贸多大圣 高级商务英语阅读 The attempt to blame trade deficits for a loss of jobs founders in theory and in practice.First,the model ignores the role of international investment flows.The flip side of America's trade deficit is the net inflow of foreign investment.The extra $435 billion that Americans spent on imports over and above exports last year was not stuffed into mattresses overseas.Those dollars quickly returned to the United States to buy U.S.assets,such as stocks,bank deposits,commercial and Treasury bonds,or as direct investment in factories and real estate.A principal reason why the United States runs a trade deficit with the rest of the world year after year is that foreign savers continue to find the U.S.economy an attractive place to invest. The EPI model ignores the growth and jobs created by the offsetting inflow of net foreign investment into the U.S.economy that the trade deficit accommodates.That net surplus of investment capital buys new machinery,expands productive capacity,funds new research and development,and keeps interest rates lower than they would otherwise be.EPI counts the jobs supposedly lost when we import cars but ignores the jobs created when BMW or Toyota builds an automobile factory in the United States that employs thousands of Americans in good-paying jobs. So it is the critics of trade who are guilty of counting the withdrawals but not the deposits in our national balance of payments account. Second,the central assumption of the EPI model-that rising imports directly displace domestic output-collides headlong with empirical reality.In fact,imports and domestic output typically rise together in response to rising domestic demand.During much of the 1990s,when imports and trade deficits were both rising rapidly,so too was domestic employment and manufacturing output. Between 1994 and 2000,when deficits supposedly claimed a "heavy toll"on U.S.employment, civilian employment in the U.S.economy rose by a net 12 million and the unemployment rate fell from 6.1 percent to 4.0 percent.During that same period,U.S.manufacturing output rose by 40 percent even though the volume of imported manufactured goods doubled. Manufacturing took a nosedive in 2001-2002,but rising imports were not the culprit.While manufacturing output was falling 4.1 percent in 2001 from the year before,real imports of manufactured goods were falling 5.4 percent after four straight years of double-digit increases.The same domestic recession that put the kibosh on domestic manufacturing output also curbed 第5页共7页

高级商务英语阅读 The attempt to blame trade deficits for a loss of jobs founders in theory and in practice. First, the model ignores the role of international investment flows. The flip side of America's trade deficit is the net inflow of foreign investment. The extra $435 billion that Americans spent on imports over and above exports last year was not stuffed into mattresses overseas. Those dollars quickly returned to the United States to buy U.S. assets, such as stocks, bank deposits, commercial and Treasury bonds, or as direct investment in factories and real estate. A principal reason why the United States runs a trade deficit with the rest of the world year after year is that foreign savers continue to find the U.S. economy an attractive place to invest. The EPI model ignores the growth and jobs created by the offsetting inflow of net foreign investment into the U.S. economy that the trade deficit accommodates. That net surplus of investment capital buys new machinery, expands productive capacity, funds new research and development, and keeps interest rates lower than they would otherwise be. EPI counts the jobs supposedly lost when we import cars but ignores the jobs created when BMW or Toyota builds an automobile factory in the United States that employs thousands of Americans in good-paying jobs. So it is the critics of trade who are guilty of counting the withdrawals but not the deposits in our national balance of payments account. Second, the central assumption of the EPI model—that rising imports directly displace domestic output—collides headlong with empirical reality. In fact, imports and domestic output typically rise together in response to rising domestic demand. During much of the 1990s, when imports and trade deficits were both rising rapidly, so too was domestic employment and manufacturing output. Between 1994 and 2000, when deficits supposedly claimed a "heavy toll" on U.S. employment, civilian employment in the U.S. economy rose by a net 12 million and the unemployment rate fell from 6.1 percent to 4.0 percent. During that same period, U.S. manufacturing output rose by 40 percent even though the volume of imported manufactured goods doubled. Manufacturing took a nosedive in 2001-2002, but rising imports were not the culprit. While manufacturing output was falling 4.1 percent in 2001 from the year before, real imports of manufactured goods were falling 5.4 percent after four straight years of double-digit increases. The same domestic recession that put the kibosh on domestic manufacturing output also curbed 第 5 页 共 7 页

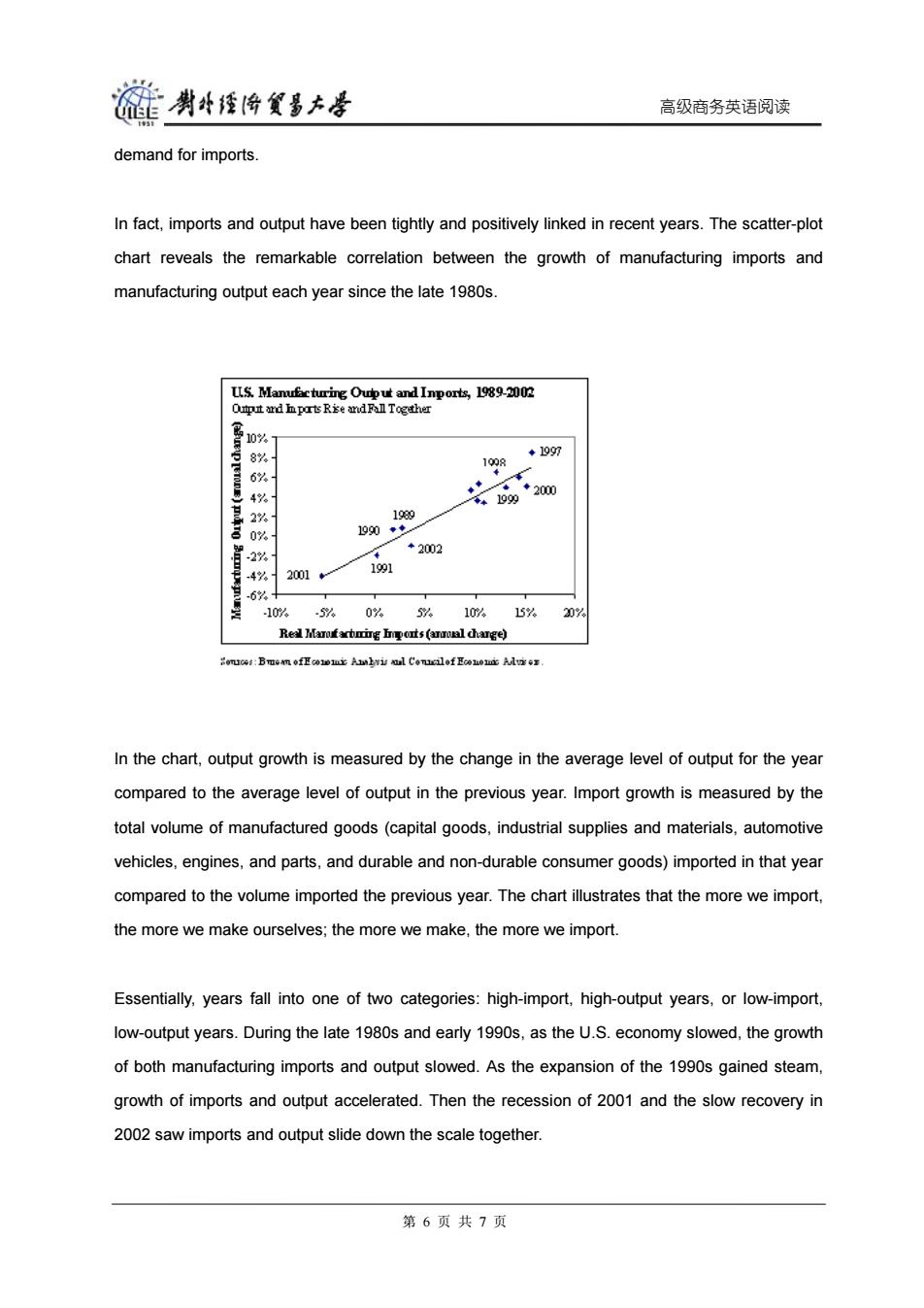

雒州4经降貿昌大是 高级商务英语阅读 demand for imports. In fact,imports and output have been tightly and positively linked in recent years.The scatter-plot chart reveals the remarkable correlation between the growth of manufacturing imports and manufacturing output each year since the late 1980s US.Manuficturing Ouiput and Inports,1989-2002 Qt中t证dnpt老Rise and Fall Together 10% 8% ◆1097 198 6% 4% 云m0 2% 198o 1090◆◆】 -2%1 ◆2002 .4% 2001 191 10%。 5。 0以 5Y410/% 15% 20 Re]重rt立gots(anroal charge) In the chart,output growth is measured by the change in the average level of output for the year compared to the average level of output in the previous year.Import growth is measured by the total volume of manufactured goods(capital goods,industrial supplies and materials,automotive vehicles,engines,and parts,and durable and non-durable consumer goods)imported in that year compared to the volume imported the previous year.The chart illustrates that the more we import, the more we make ourselves;the more we make,the more we import. Essentially,years fall into one of two categories:high-import,high-output years,or low-import, low-output years.During the late 1980s and early 1990s,as the U.S.economy slowed,the growth of both manufacturing imports and output slowed.As the expansion of the 1990s gained steam, growth of imports and output accelerated.Then the recession of 2001 and the slow recovery in 2002 saw imports and output slide down the scale together. 第6页共7页

高级商务英语阅读 demand for imports. In fact, imports and output have been tightly and positively linked in recent years. The scatter-plot chart reveals the remarkable correlation between the growth of manufacturing imports and manufacturing output each year since the late 1980s. In the chart, output growth is measured by the change in the average level of output for the year compared to the average level of output in the previous year. Import growth is measured by the total volume of manufactured goods (capital goods, industrial supplies and materials, automotive vehicles, engines, and parts, and durable and non-durable consumer goods) imported in that year compared to the volume imported the previous year. The chart illustrates that the more we import, the more we make ourselves; the more we make, the more we import. Essentially, years fall into one of two categories: high-import, high-output years, or low-import, low-output years. During the late 1980s and early 1990s, as the U.S. economy slowed, the growth of both manufacturing imports and output slowed. As the expansion of the 1990s gained steam, growth of imports and output accelerated. Then the recession of 2001 and the slow recovery in 2002 saw imports and output slide down the scale together. 第 6 页 共 7 页

链剥将发多大是 高级商务英语阅读 If the trade critics were right,the recent plunge in import growth should have stimulated an increase in domestic output as U.S.factories sought to fill the gap left by the missing imports.According to the EPI model,in other words,the relation should be negative and the trend line should slope downward and not upward.Once again,reality intrudes on the protectionist story. There is no basis,in theory or experience,for the persistent allegation that trade deficits,and more specifically imports,mean fewer jobs in the U.S.economy.The reality is more nearly the opposite. As a reflection of continued domestic demand and the desire of foreign investors to acquire U.S. assets,large trade deficits are typically associated with more output and more jobs. In America today,trade and prosperity are a package deal.The more we trade,the more we prosper,and the more we prosper,the more we trade.By seeking to curb imports of manufactured goods,opponents of trade will only undermine the ability of the U.S.economy to expand output and create jobs. 第7页共7页

高级商务英语阅读 If the trade critics were right, the recent plunge in import growth should have stimulated an increase in domestic output as U.S. factories sought to fill the gap left by the missing imports. According to the EPI model, in other words, the relation should be negative and the trend line should slope downward and not upward. Once again, reality intrudes on the protectionist story. There is no basis, in theory or experience, for the persistent allegation that trade deficits, and more specifically imports, mean fewer jobs in the U.S. economy. The reality is more nearly the opposite. As a reflection of continued domestic demand and the desire of foreign investors to acquire U.S. assets, large trade deficits are typically associated with more output and more jobs. In America today, trade and prosperity are a package deal. The more we trade, the more we prosper, and the more we prosper, the more we trade. By seeking to curb imports of manufactured goods, opponents of trade will only undermine the ability of the U.S. economy to expand output and create jobs. 第 7 页 共 7 页