CHAPTER 11 MORAL HAZARD

CHAPTER 11 MORAL HAZARD

WHAT IS MORAL HAZARD? Ch 11 Moral Hazard

Ch 11 | Moral Hazard WHAT IS MORAL HAZARD?

What is moral hazard? 。 Definition:Moral hazard is the tendency for insurance against loss to reduce incentives to prevent or minimize the cost of loss.1 This term has been used to distinguish between: natural hazards that cause losses(like lightning strikes) moral hazards like carelessness and fraud that can lead to losses and are the result of decisions by humans. 1Source:Baker(1996). Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics What is moral hazard? • Definition: Moral hazard is the tendency for insurance against loss to reduce incentives to prevent or minimize the cost of loss.1 • This term has been used to distinguish between: • natural hazards that cause losses (like lightning strikes) • moral hazards like carelessness and fraud that can lead to losses and are the result of decisions by humans. 1Source: Baker (1996)

Moral hazard with health insurance Insured people take risks with their health that similar uninsured people would not take,and demand more expensive treatment from their doctors when they get sick. Moral hazard is the downside of health insurance because it raises society's level of health care expenditures. Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Moral hazard with health insurance • Insured people take risks with their health that similar uninsured people would not take, and demand more expensive treatment from their doctors when they get sick. • Moral hazard is the downside of health insurance because it raises society’s level of health care expenditures

The moral hazard pattern An individual faces some risk of a bad event X,and his actions can increase or decrease its likelihood He holds an insurance contract that will help pay some or all of the costs of X,if it occurs.Thus his price of X is now lower. In response to the price distortion,he changes his behavior in a way that increases the chance of X or increases the costs of recovering from X. The insurance company cannot observe this behavior change- there is an information asymmetry.Otherwise the contract would have been written to discourage the riskier behavior. The individual's riskier behavior creates a social loss,because the costly event X occurs more than it would have without insurance. Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics The moral hazard pattern An individual faces some risk of a bad event X, and his actions can increase or decrease its likelihood He holds an insurance contract that will help pay some or all of the costs of X, if it occurs. Thus his price of X is now lower. In response to the price distortion, he changes his behavior in a way that increases the chance of X or increases the costs of recovering from X. The insurance company cannot observe this behavior change – there is an information asymmetry. Otherwise the contract would have been written to discourage the riskier behavior. The individual’s riskier behavior creates a social loss, because the costly event X occurs more than it would have without insurance

Ex antevs.Ex post Ex ante moral hazard:behavior changes that occur before an insured event happens and make that event more likely. leaving the stove on skipping the flu vaccine Ex post moral hazard:behavior changes that occur after an insured event happens and make recovering from that event more expensive. using expensive drugs instead of generics knee replacement surgery instead of painkillers Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Ex ante vs. Ex post Ex ante moral hazard: behavior changes that occur before an insured event happens and make that event more likely. leaving the stove on skipping the flu vaccine Ex post moral hazard: behavior changes that occur after an insured event happens and make recovering from that event more expensive. using expensive drugs instead of generics knee replacement surgery instead of painkillers

A GRAPHICAL REPRESENTATION OF MORAL HAZARD Ch 11 Moral hazard

Ch 11 | Moral hazard A GRAPHICAL REPRESENTATION OF MORAL HAZARD

How does moral hazard lead to social loss? Consider an individual who loves cheeseburgers but is at risk for a heart attack. Without health insurance:his cost for each cheeseburger includes both the price of the burger and the increased chance of a heart attack With health insurance:the cost of each cheeseburger declines,since the insurer picks up the costs of heart attack care. In this case,social loss takes the form of extra money, labor,time,and effort that others expend on caring for heart attacks caused by cheeseburger overconsumption Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics How does moral hazard lead to social loss? • Consider an individual who loves cheeseburgers but is at risk for a heart attack. • Without health insurance: his cost for each cheeseburger includes both the price of the burger and the increased chance of a heart attack • With health insurance: the cost of each cheeseburger declines, since the insurer picks up the costs of heart attack care. • In this case, social loss takes the form of extra money, labor, time, and effort that others expend on caring for heart attacks caused by cheeseburger overconsumption

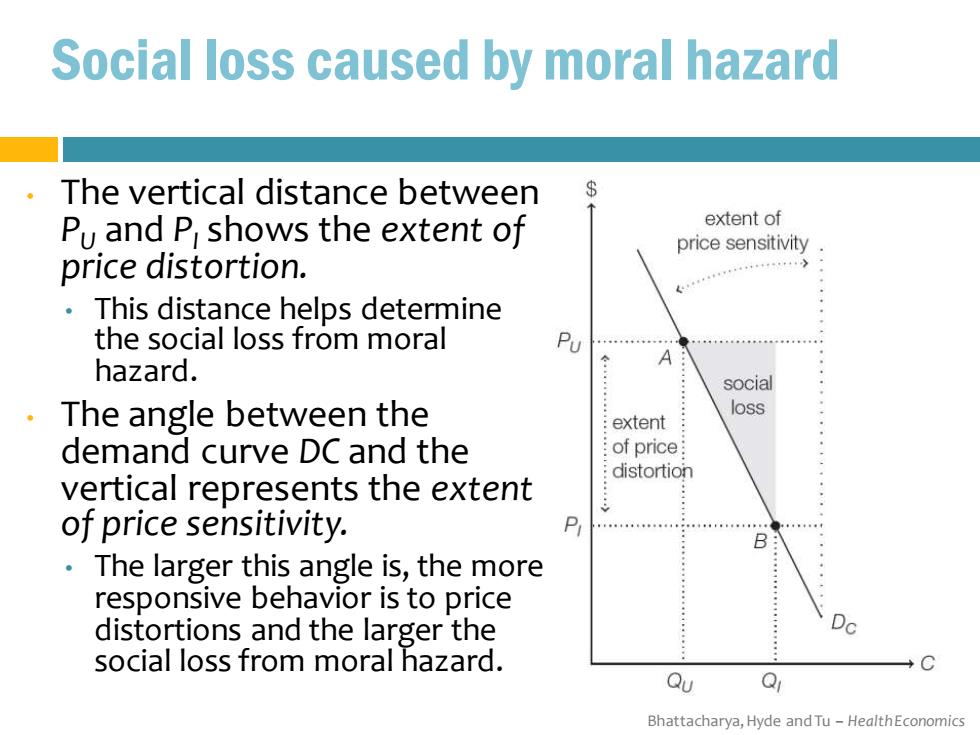

Social loss caused by moral hazard With insurance,the effective extent of price per cheeseburger falls price sensitivity from Pu to Pi,and his consumption spikes from Qu to Q. A social Point A is the socially efficient loss extent equilibrium,while Point B is of price: :distortion the outcome with insurance. ... 。 Extra cheeseburgers B consumed between points Qu and Q result in more costs Dc than they are worth. Qu Q Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Social loss caused by moral hazard • With insurance, the effective price per cheeseburger falls from PU to PI , and his consumption spikes from QU to QI . • Point A is the socially efficient equilibrium, while Point B is the outcome with insurance. • Extra cheeseburgers consumed between points QU and QI result in more costs than they are worth

Social loss caused by moral hazard The vertical distance between $ Pu and P shows the extent of extent of price sensitivity. price distortion. This distance helps determine : the social loss from moral Pu hazard. A : social The angle between the loss extent demand curve DC and the of price: distortion vertical represents the extent of price sensitivity. P …444…704… The larger this angle is,the more responsive behavior is to price distortions and the larger the Dc social loss from moral hazard. Qu Q1 Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Social loss caused by moral hazard • The vertical distance between PU and PI shows the extent of price distortion. • This distance helps determine the social loss from moral hazard. • The angle between the demand curve DC and the vertical represents the extent of price sensitivity. • The larger this angle is, the more responsive behavior is to price distortions and the larger the social loss from moral hazard