CHAPTER 10 ADVERSE SELECTION IN REAL MARKETS

CHAPTER 10 ADVERSE SELECTION IN REAL MARKETS

Intro Recall our example:a man walks into the office of a life insurance company. He wants to buy a $1 million life insurance policy for a term of one day.Your company will have to pay $1 million to his heirs if and only if he dies tomorrow. You know nothing else about this man. How much do you charge? Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Intro Recall our example: a man walks into the office of a life insurance company. He wants to buy a $1 million life insurance policy for a term of one day. Your company will have to pay $1 million to his heirs if and only if he dies tomorrow. You know nothing else about this man. How much do you charge?

PREDICTIONS OF ASYMMETRIC INFORMATION MODELS Ch 10|Adverse selection in real markets

Ch 10 | Adverse selection in real markets PREDICTIONS OF ASYMMETRIC INFORMATION MODELS

Asymmetric information models make three predictions about these markets )Positive correlation between risk and coverage 2 Bulk markups 3) Adverse selection death spiral Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Asymmetric information models make three predictions about these markets 1) Positive correlation between risk and coverage 2) Bulk markups 3) Adverse selection death spiral

1)Positive correlation between risk and coverage Recall Rothschild-Stiglitz: Separating equilibrium>high-risk types have full insurance (Q,),low-risk types have incomplete insurance() robust type zero-profit line 22 ------.UE UR frail type zero-profit line Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics 1) Positive correlation between risk and coverage Recall Rothschild-Stiglitz: Separating equilibrium→ high-risk types have full insurance (Ω1 ), low-risk types have incomplete insurance (Ω2 )

2)Bulk markups Bulk discounts-a lower per-unit price for a large purchase of a commodity Bulk markups-a higher per-unit price for large purchases of a commodity Insurance companies use bulk markups to protect themselves from risk customers who want a lot of insurance This is exactly what the Rothschild-Stiglitz model predicts Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics 2) Bulk markups Bulk discounts– a lower per-unit price for a large purchase of a commodity Bulk markups– a higher per-unit price for large purchases of a commodity Insurance companies use bulk markups to protect themselves from risk customers who want a lot of insurance This is exactly what the Rothschild-Stiglitz model predicts

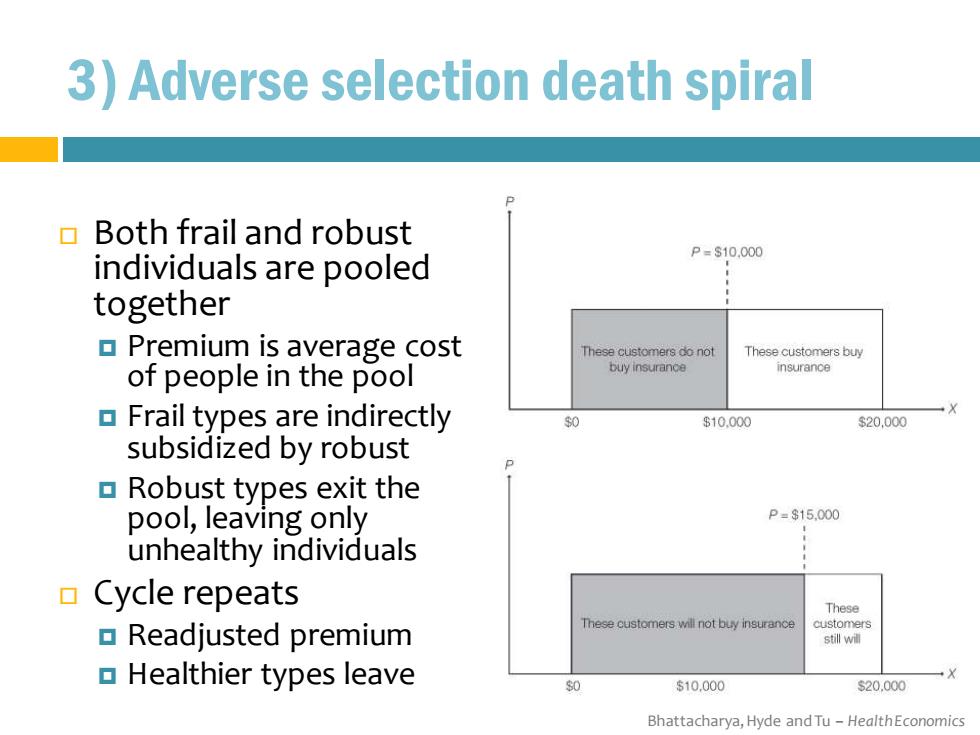

3)Adverse selection death spiral Both frail and robust P=s10.000 individuals are pooled together Premium is average cost These customere do not These customers buy of people in the pool buy insurance insurance Frail types are indirectly X $0 $10.000 $20,000 subsidized by robust Robust types exit the pool,leaving only P=$15,000 unhealthy individuals Cycle repeats These customers Readjusted premium These customers will not buy insurance st训w面 Healthier types leave $10,000 s20.000 Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics 3) Adverse selection death spiral Both frail and robust individuals are pooled together Premium is average cost of people in the pool Frail types are indirectly subsidized by robust Robust types exit the pool, leaving only unhealthy individuals Cycle repeats Readjusted premium Healthier types leave

ADVERSE SELECTION IN HEALTH INSURANCE Ch 10 Adverse Selection in Real Markets

Ch 10 | Adverse Selection in Real Markets ADVERSE SELECTION IN HEALTH INSURANCE

Empirical evidence foradverse selection in health insurance markets G RAND HIE Individuals are able to predict their health care costs for the year to a good degree of accuracy Specifically,they are able to predict health care costs more accurately than insurance companies Families with high predicted costs were more likely to want supplemental insurance Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Empirical evidence for adverse selection in health insurance markets RAND HIE Individuals are able to predict their health care costs for the year to a good degree of accuracy Specifically, they are able to predict health care costs more accurately than insurance companies Families with high predicted costs were more likely to want supplemental insurance

Empirical evidence foradverse selection in health insurance markets Several studies find a positive risk-coverage correlation in various markets Brown and Finkelstein 2009(elderly US Medicare beneficiaries) Van de Ven and van Vliet 1995(Dutch supplemental private insurance) Cutler and Zeckhauser 1998(Harvard professors) Spenkuch 2012(low-income Mexican families) Cardon and Hendel 2001(young graduates joining US workforce) Bhattacharya,Hyde and Tu-HealthEconomics

Bhattacharya, Hyde and Tu – Health Economics Empirical evidence for adverse selection in health insurance markets Several studies find a positive risk-coverage correlation in various markets Brown and Finkelstein 2009 (elderly US Medicare beneficiaries) Van de Ven and van Vliet 1995 (Dutch supplemental private insurance) Cutler and Zeckhauser1998 (Harvard professors) Spenkuch 2012 (low-income Mexican families) Cardon and Hendel 2001 (young graduates joining US workforce)