Chapter 7 Hedging with Spreads

Chapter 7 Hedging with Spreads

What is hedging? When a businessperson uses the futures market to protect against adverse price movements,the process is called hedging. Hedging involves taking a position in the futures market that is opposite to the position held in the cash or spot market

What is hedging? ◼ When a businessperson uses the futures market to protect against adverse price movements, the process is called hedging. ◼ Hedging involves taking a position in the futures market that is opposite to the position held in the cash or spot market

Selling Hedge If a businessperson buys a commodity in the cash market,he or she would then hedge that position by selling an equivalent quantity in the futures market

If a businessperson buys a commodity in the cash market, he or she would then hedge that position by selling an equivalent quantity in the futures market. Selling Hedge

Buying Hedge The buying hedge is used by a businessperson who anticipates buying a commodity at a future date and wants protection from a possible price increase. This person is said to be short the cash market and so would take a long position in the futures market (be a buyer)

◼ The buying hedge is used by a businessperson who anticipates buying a commodity at a future date and wants protection from a possible price increase. ◼ This person is said to be short the cash market and so would take a long position in the futures market (be a buyer). Buying Hedge

Conclusion: Hedging not only protects against the possible losses from adverse price movement;it also takes away the possibility of windfall profits that can accrue as the result of favorable price moves

Hedging not only protects against the possible losses from adverse price movement; it also takes away the possibility of windfall profits that can accrue as the result of favorable price moves. Conclusion:

The Basis 基差 The difference between the futures price and the spot price is known as the basis

The Basis 基差 The difference between the futures price and the spot price is known as the basis

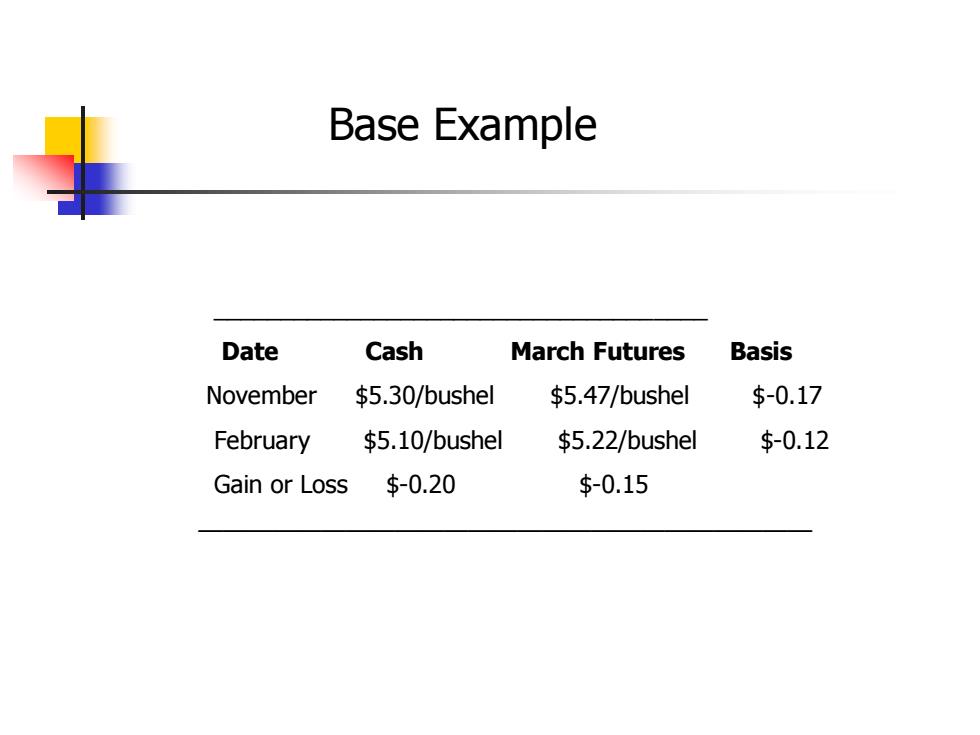

Base Example Date Cash March Futures Basis November $5.30/bushel $5.47/bushel $-0.17 February $5.10/bushel $5.22/bushel $-0.12 Gain or Loss $-0.20 $-0.15

_ Date Cash March Futures Basis November $5.30/bushel $5.47/bushel $-0.17 February $5.10/bushel $5.22/bushel $-0.12 Gain or Loss $-0.20 $-0.15 ————————————————————————— Base Example

SPREADS AND STRADDLES (套利和对冲) A spread is simply the simultaneous buying of one contract and selling of another. The price difference between two related markets or commodities. The purchase of one futures delivery month against the sale of another futures delivery month of the same commodity;

SPREADS AND STRADDLES (套利和对冲) ◼ A spread is simply the simultaneous buying of one contract and selling of another. ◼ The price difference between two related markets or commodities. ◼ The purchase of one futures delivery month against the sale of another futures delivery month of the same commodity;

SPREADS AND STRADDLES 套利和对冲 A spread can also apply to options.It involves buying one futures contract and selling another futures contract. The purpose is to profit from an unexpected change in the relationship between the purchase price of one and the selling price of the other

A spread can also apply to options. It involves buying one futures contract and selling another futures contract. The purpose is to profit from an unexpected change in the relationship between the purchase price of one and the selling price of the other. SPREADS AND STRADDLES 套利和对冲

SPREADS AND STRADDLES 套利和对冲 Because gains and losses occur only as the result of a change in the price difference- rather than as a result of a change in the overall level of futures prices spreads are often considered more conservative and less risky than having an outright long or short futures position

Because gains and losses occur only as the result of a change in the price difference – rather than as a result of a change in the overall level of futures prices - spreads are often considered more conservative and less risky than having an outright long or short futures position . SPREADS AND STRADDLES 套利和对冲