Questions on Tuesday Class?

Questions on Tuesday Class?

Two Senses of Utility Philosopher's Sense (Bentham) How happy it makes me feel Only "happy"is too simple How much I get what I value What utilitarians want to maximize ·Economist's sense ·What I prefer As shown by what I choose

Two Senses of Utility • Philosopher’s Sense (Bentham) • How happy it makes me feel • Only “happy” is too simple • How much I get what I value • What utilitarians want to maximize • Economist’s sense • What I prefer • As shown by what I choose

Why? The more i have of something,the less valuable one more is Because I spend money first on what is most important,so each additional dollar is buying a good I value less Neither of these is rigorously true The fourth tire for my car is worth more than the third There might be something very valuable,the cure for the disease that is killing me,that costs $50,000.So I would value $50,000 over S40,000 by more than $40,000 over S30,000

Why? • The more I have of something, the less valuable one more is • Because I spend money first on what is most important, so each additional dollar is buying a good I value less • Neither of these is rigorously true The fourth tire for my car is worth more than the third There might be something very valuable, the cure for the disease that is killing me, that costs $50,000. So I would value $50,000 over $40,000 by more than $40,000 over $30,000

So if I had S40,000,I would be willing to bet $10,000 on a coin flip

• So if I had $40,000, I would be willing to bet $10,000 on a coin flip

Which gets us to Von Neumann Utility A gambler who will make the same bet many times accepts it if the expected value in money is positive-on average it is a winning gamble. Von Neumann generalized the idea to: An individual faced with a gamble accepts it if the expected value in utility is positive Risk Averse:Prefer a certain outcome to a gamble with the same expected value. Which means that declining marginal utility of income risk aversion

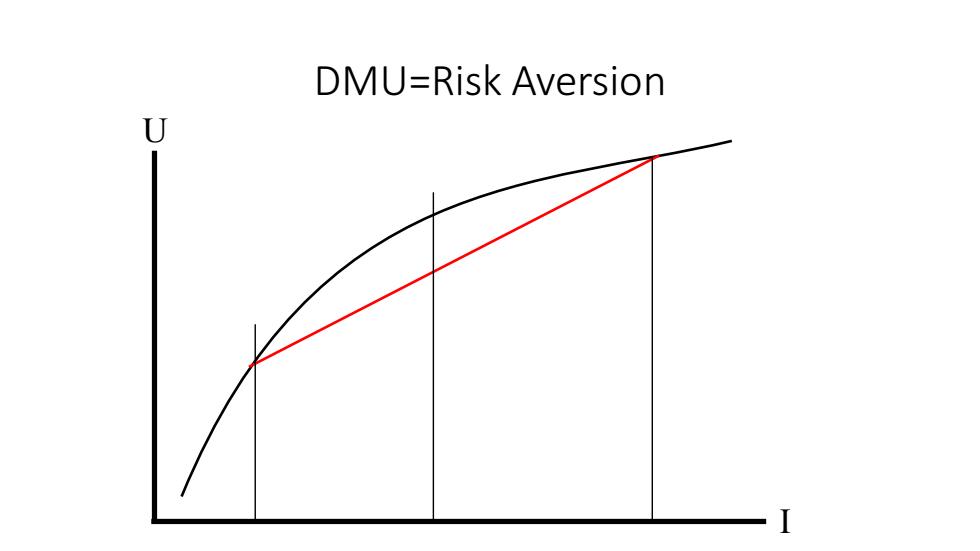

Which gets us to Von Neumann Utility • A gambler who will make the same bet many times accepts it if the expected value in money is positive–on average it is a winning gamble. • Von Neumann generalized the idea to: An individual faced with a gamble accepts it if the expected value in utility is positive • Risk Averse: Prefer a certain outcome to a gamble with the same expected value. Which means that declining marginal utility of income = risk aversion

DMU=Risk Aversion

DMU=Risk Aversion U I

"Risk Aversion"=DMU(I)=Risk Aversion in Income One might be risk averse in income,risk preferring in length of life

“Risk Aversion”=DMU(I)=Risk Aversion in Income •One might be risk averse in income, risk preferring in length of life

If You Find This Stuff Really Interesting Chapter 13 of my Price Theory is Webbed

If You Find This Stuff Really Interesting • Chapter 13 of my Price Theory is Webbed

DMU and Income Redistribution If marginal utility of income is lower the higher one's income A transfer from rich to poor raises total utility Which,for a utilitarian,is an argument for income redistribution ●But

DMU and Income Redistribution •If marginal utility of income is lower the higher one’s income • A transfer from rich to poor raises total utility • Which, for a utilitarian, is an argument for income redistribution • But …

Two Problems With that Argument The argument for DMU does not apply that the marginal utility of the rich man is lower than the poor man because they are different people and might have different utility functions Redistribution is not costless

Two Problems With that Argument • The argument for DMU does not apply that the marginal utility of the rich man is lower than the poor man because they are different people and might have different utility functions • Redistribution is not costless