金融学院本科课程教学大纲 《会计英语》教学大纲 一、基本信息 课程名称 会计英通 课程编号BA330 课程类型专业基础 ☐实验学时 分 2 其瑞今计时合计 计学 的原板会计学教材为蓝本 公计核算的基本理论、基木要 、基本方法以及英文会计报表的 果程简介 、长期负债 所有者权益的性质、特点及账务处理,并介绍了每一种会计要素的内部控制程序。 该课程详细介绍了英文的会计专业术语,为同学们能够熟练地阅读专业文献、对外交流 对外资企业的会计业务进行核算英定良好的专业基础. 二、教学目标及任务 使同学们能够 会贯 学习会计学的基本原理、原则和方法及会 基本原则 学专业才 语表达万 根据具 加以应用 5.了解公认会计准则对我国会 三、学时分配 教学课时分配 章节 章节内容 讲课 实骏 实践 奇计 Unit I. Accounting:ageneral introduction Unit 2 The Accounting Process Unit 3 Financial Statement Unit 4 Current Assets Unit 5 Non-Current Assets 4 UNIT6 Liabilities UNIT7 Owner's Equity UNIT 8 Revenue and Expense UNIT9 Purchase and Sales 2 UNIT10 Advanced Topics on financial accounting UNITI Cost Accountine 2 2 UNIT 12 Managerial accounting UNIT13 Audit Accounting UNIT 14 International Accounting 合计 36 四、教学内容及教学要求 Lesson1 Accounting

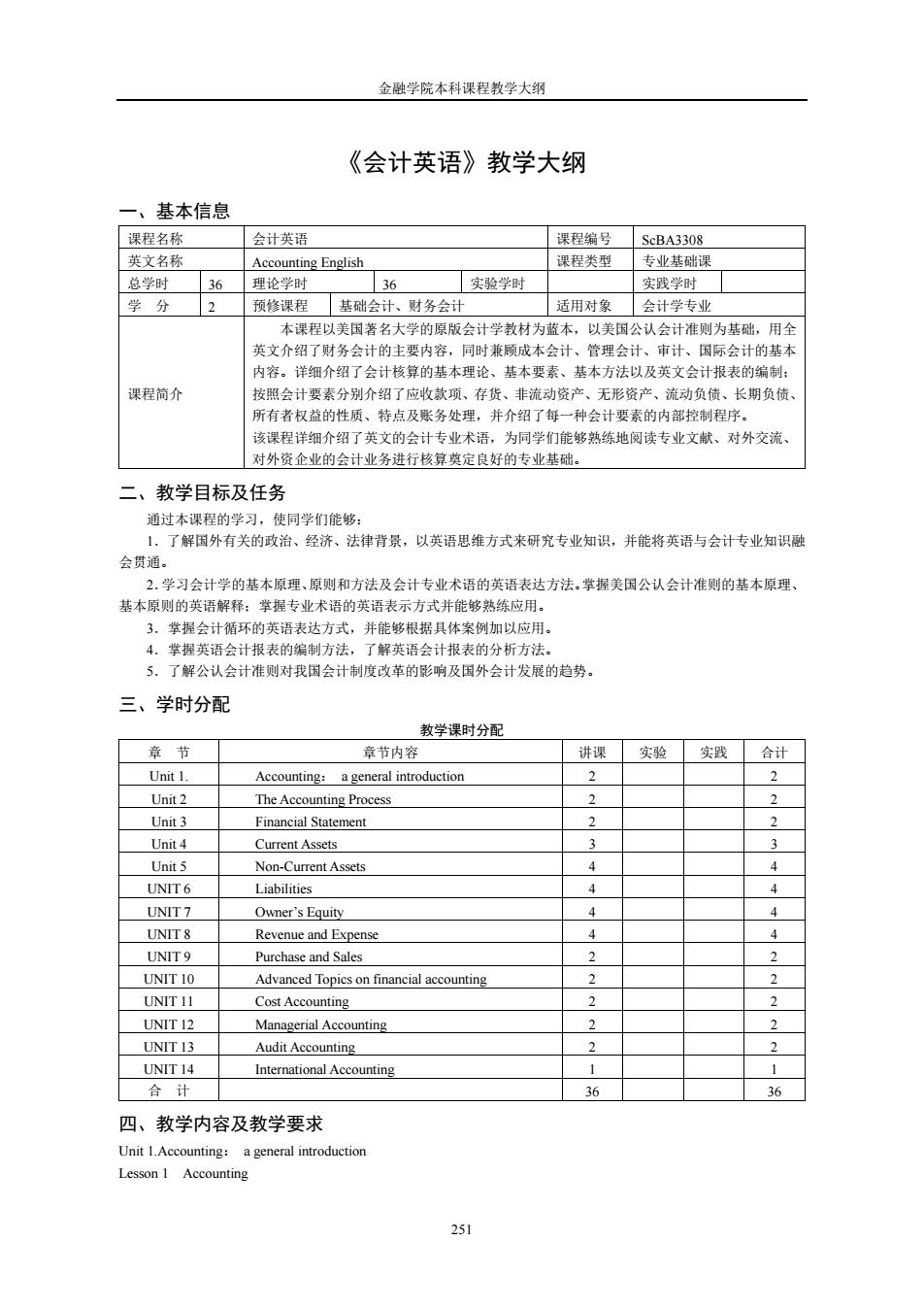

金融学院本科课程教学大纲 251 《会计英语》教学大纲 一、基本信息 课程名称 会计英语 课程编号 ScBA3308 英文名称 Accounting English 课程类型 专业基础课 总学时 36 理论学时 36 实验学时 实践学时 学 分 2 预修课程 基础会计、财务会计 适用对象 会计学专业 课程简介 本课程以美国著名大学的原版会计学教材为蓝本,以美国公认会计准则为基础,用全 英文介绍了财务会计的主要内容,同时兼顾成本会计、管理会计、审计、国际会计的基本 内容。详细介绍了会计核算的基本理论、基本要素、基本方法以及英文会计报表的编制; 按照会计要素分别介绍了应收款项、存货、非流动资产、无形资产、流动负债、长期负债、 所有者权益的性质、特点及账务处理,并介绍了每一种会计要素的内部控制程序。 该课程详细介绍了英文的会计专业术语,为同学们能够熟练地阅读专业文献、对外交流、 对外资企业的会计业务进行核算奠定良好的专业基础。 二、教学目标及任务 通过本课程的学习,使同学们能够: 1.了解国外有关的政治、经济、法律背景,以英语思维方式来研究专业知识,并能将英语与会计专业知识融 会贯通。 2.学习会计学的基本原理、原则和方法及会计专业术语的英语表达方法。掌握美国公认会计准则的基本原理、 基本原则的英语解释;掌握专业术语的英语表示方式并能够熟练应用。 3.掌握会计循环的英语表达方式,并能够根据具体案例加以应用。 4.掌握英语会计报表的编制方法,了解英语会计报表的分析方法。 5.了解公认会计准则对我国会计制度改革的影响及国外会计发展的趋势。 三、学时分配 教学课时分配 章 节 章节内容 讲课 实验 实践 合计 Unit 1. Accounting: a general introduction 2 2 Unit 2 The Accounting Process 2 2 Unit 3 Financial Statement 2 2 Unit 4 Current Assets 3 3 Unit 5 Non-Current Assets 4 4 UNIT 6 Liabilities 4 4 UNIT 7 Owner’s Equity 4 4 UNIT 8 Revenue and Expense 4 4 UNIT 9 Purchase and Sales 2 2 UNIT 10 Advanced Topics on financial accounting 2 2 UNIT 11 Cost Accounting 2 2 UNIT 12 Managerial Accounting 2 2 UNIT 13 Audit Accounting 2 2 UNIT 14 International Accounting 1 1 合 计 36 36 四、教学内容及教学要求 Unit 1.Accounting: a general introduction Lesson 1 Accounting

念融学院本科课程教学大纲 .ofaccounting Distinction between and bookkeeping ounting chapt ntrodcesconl 本章习D h)在 ounting prin 2.The goi nption 5 The congisto 6.The ntion 8 The materiality consention 9 The match convention 10 The historical convention 11.The full disclosure 本章教y要求,_This chapter reflects up-io-date trends by a brief description of the curren accounting methods for ring and reporting. 本章重点、难点:_the going concem convention、the monetary convention、the objectivity convention、the materiality convention Lesson3The Accounting System 1.The basic elements 2.Accounting equatio 本教学要 This chapter introduces ac 本事习题要点: hegcguation 1 Source doc Lesson 5Accounting Cycle (2) 1 loumals 2.Ledgers 3 The trial balance 4 Cash basis and accrual hasis accounting 本妻数学要求:_preparingatriabalance、uses and limitations of the trial balance 本t重点、建点:general ledger、.subsidiary ledger、.advantages of using joumals、special joumals preparing a trial balance,uses and limitations of the trial balance 本童习题要点:preparingarial balance,the pplictonofedger and the choice ofoting basis Unit 3Financial Statement Lesson 6 Balance Sheet 1.Nature and purpose of balance

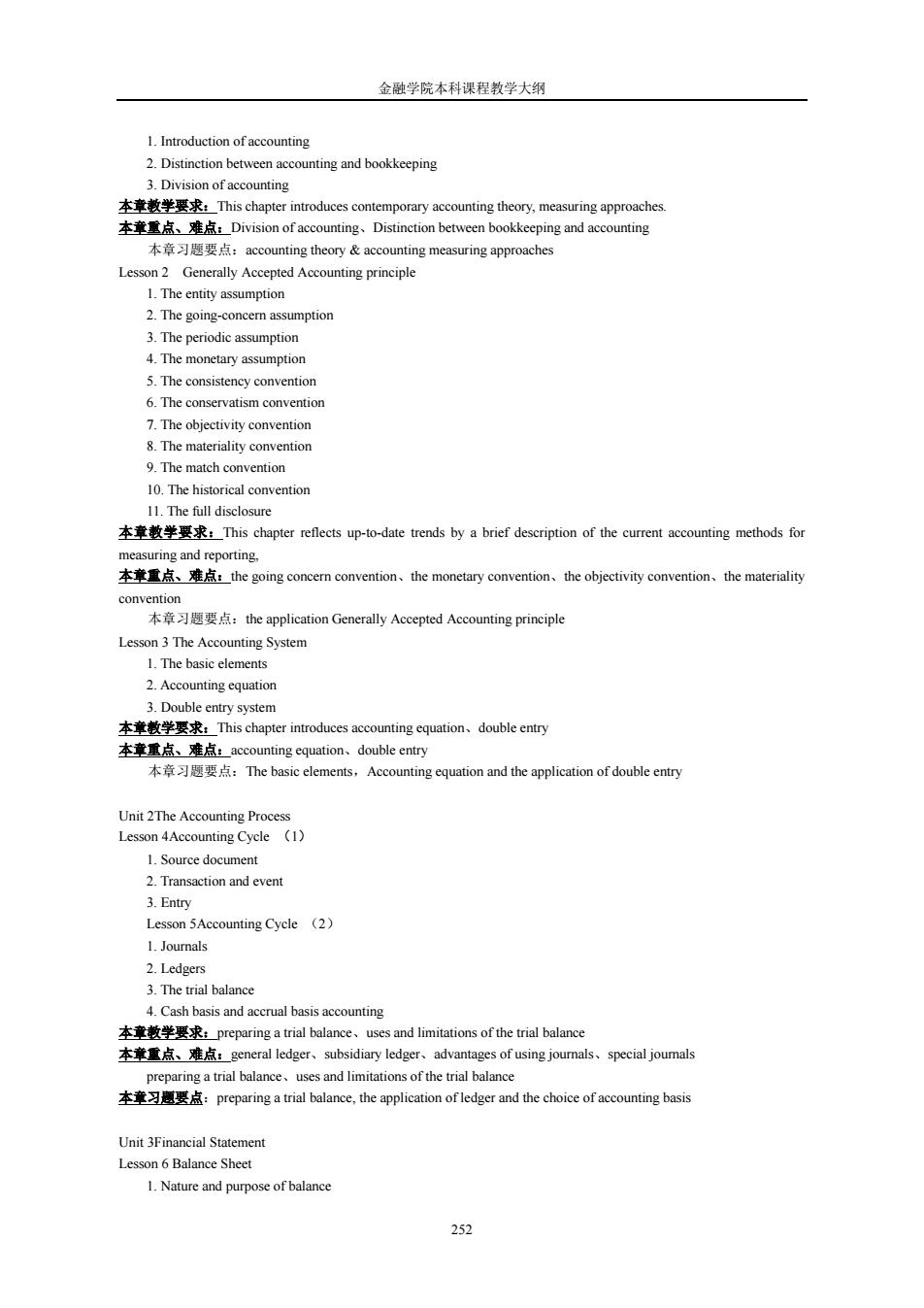

金融学院本科课程教学大纲 252 1. Introduction of accounting 2. Distinction between accounting and bookkeeping 3. Division of accounting 本章教学要求:This chapter introduces contemporary accounting theory, measuring approaches. 本章重点、难点:Division of accounting、Distinction between bookkeeping and accounting 本章习题要点:accounting theory & accounting measuring approaches Lesson 2 Generally Accepted Accounting principle 1. The entity assumption 2. The going-concern assumption 3. The periodic assumption 4. The monetary assumption 5. The consistency convention 6. The conservatism convention 7. The objectivity convention 8. The materiality convention 9. The match convention 10. The historical convention 11. The full disclosure 本章教学要求:This chapter reflects up-to-date trends by a brief description of the current accounting methods for measuring and reporting, 本章重点、难点:the going concern convention、the monetary convention、the objectivity convention、the materiality convention 本章习题要点:the application Generally Accepted Accounting principle Lesson 3 The Accounting System 1. The basic elements 2. Accounting equation 3. Double entry system 本章教学要求:This chapter introduces accounting equation、double entry 本章重点、难点:accounting equation、double entry 本章习题要点:The basic elements,Accounting equation and the application of double entry Unit 2The Accounting Process Lesson 4Accounting Cycle (1) 1. Source document 2. Transaction and event 3. Entry Lesson 5Accounting Cycle (2) 1. Journals 2. Ledgers 3. The trial balance 4. Cash basis and accrual basis accounting 本章教学要求:preparing a trial balance、uses and limitations of the trial balance 本章重点、难点:general ledger、subsidiary ledger、advantages of using journals、special journals preparing a trial balance、uses and limitations of the trial balance 本章习题要点:preparing a trial balance, the application of ledger and the choice of accounting basis Unit 3Financial Statement Lesson 6 Balance Sheet 1. Nature and purpose of balance

金融学院本科课程教学大纲 2.Format of balance men re and purpose of balance Lesson cash flow statement 本章学要求:learn abou ture and p balance sheet balance 本章重点、难点: nature and pu se ofbalance sheet,classified balance sheet,multiple-step income statement nature and purnose of income statement classification of cash flows.hasic ap oach to prenaration 本章习愿要点:nature and purpsofsheet、Income Statement and cash flows statement Prenaring those sheets Unit 4 Current assets Lesson 9 Cash and Tem rary Investment 1.Definition ofcash 2.Internal control over the cash 3.Bank statement and bank reconciliation 4.Petty cash fund 5.Temporary investment Lesson 10Accounts Receivable 1.Significant of Accounts receivable 2.Allowance for doubtful accounts 3.Internal control over account receivable Lesson 11 Inventory kground of inventory rpetual inventory system I inventory ature of cash.ter estment,significant of Account eceivable allowance for ant n: 本章重点、难点:nature of cash、temporary nts.significant of in ntory Pric 本章习题要点:nature of cash,temporary investment,significant of Accounts receivable,allowance for doubtful accounts and Preparing Accounting entries about them Unit 5 Non-Current assets Lesson 12 Plant and Equinment 1.Nature of plant and equipment 2.Maior categorics of plant and equipment 3.Determining the cost of plant and equipment 4.Capital expenditure and revenue expenditure Lesson 13 Depreciation 1.Introduction 2.Cause of depreciation 3.Method of computing depreciation Lesson 14 Intangible Assets 1.Introduction 253

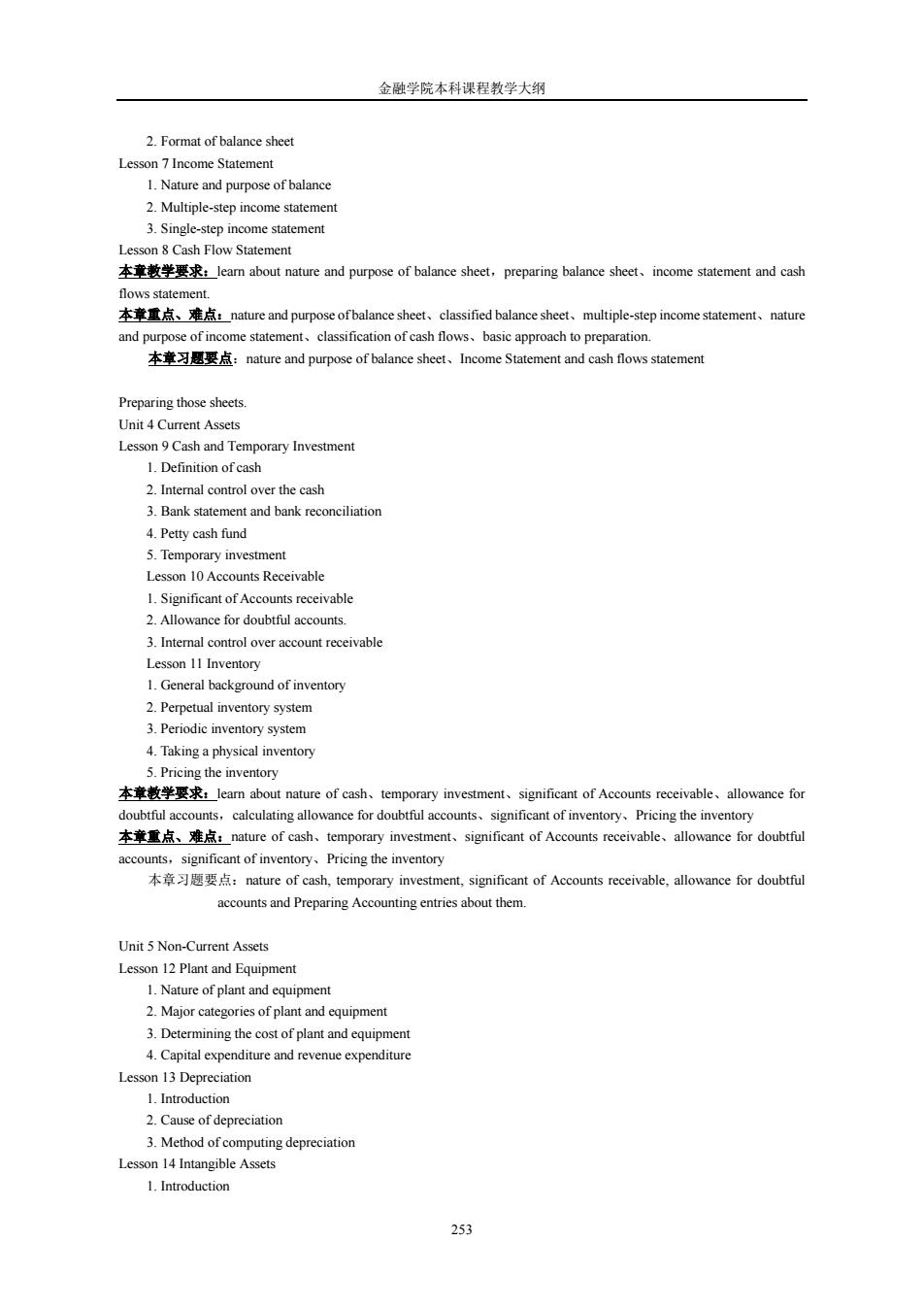

金融学院本科课程教学大纲 253 2. Format of balance sheet Lesson 7 Income Statement 1. Nature and purpose of balance 2. Multiple-step income statement 3. Single-step income statement Lesson 8 Cash Flow Statement 本章教学要求:learn about nature and purpose of balance sheet,preparing balance sheet、income statement and cash flows statement. 本章重点、难点:nature and purpose of balance sheet、classified balance sheet、multiple-step income statement、nature and purpose of income statement、classification of cash flows、basic approach to preparation. 本章习题要点:nature and purpose of balance sheet、Income Statement and cash flows statement Preparing those sheets. Unit 4 Current Assets Lesson 9 Cash and Temporary Investment 1. Definition of cash 2. Internal control over the cash 3. Bank statement and bank reconciliation 4. Petty cash fund 5. Temporary investment Lesson 10 Accounts Receivable 1. Significant of Accounts receivable 2. Allowance for doubtful accounts. 3. Internal control over account receivable Lesson 11 Inventory 1. General background of inventory 2. Perpetual inventory system 3. Periodic inventory system 4. Taking a physical inventory 5. Pricing the inventory 本章教学要求:learn about nature of cash、temporary investment、significant of Accounts receivable、allowance for doubtful accounts,calculating allowance for doubtful accounts、significant of inventory、Pricing the inventory 本章重点、难点:nature of cash、temporary investment、significant of Accounts receivable、allowance for doubtful accounts,significant of inventory、Pricing the inventory 本章习题要点:nature of cash, temporary investment, significant of Accounts receivable, allowance for doubtful accounts and Preparing Accounting entries about them. Unit 5 Non-Current Assets Lesson 12 Plant and Equipment 1. Nature of plant and equipment 2. Major categories of plant and equipment 3. Determining the cost of plant and equipment 4. Capital expenditure and revenue expenditure Lesson 13 Depreciation 1. Introduction 2. Cause of depreciation 3. Method of computing depreciation Lesson 14 Intangible Assets 1. Introduction

金融学院本科课程教学大纲 2.Goodwil Patents 4.Trademarks and trade names Franchise oles and def e(RD costs 1 Measurine reporting in vestment in Common Shares 本章教学要求:c 本章重点、难点:Method of computing depreciation.Measuring&Reporting Investment 本章习题要点:Determining the cost of plant and cquipment,Methd of computing depreeiation,Measuring& Reporting Investment UNIT 6 Liabilities Lesson 16 Current Liabilities 1.Account payable 2 Notes pavable Lesson 17Long-tem Liabilities 1.Bonds pavable 2.Morigage noes payable 3.Pension plans 4.Estimated liabilities 5.Contingent liabilities 本童教学要 outMajorcaiegoriesofliabilitiesandascountineliabilities 本華 3 Trea 19Retained Earnings and Dividend 1 Retained eaming 2 Cash dividend 本章教学要求:_leam about Owners'equity in corporation and single proprietorships、Changes of owners'equity 本章重点、难点:_Cash dividend、Stock dividend 本章习想要点:Preparing Accounting enries about Cash dividend and Stock dividend UNIT 8 Revenue and Expense Lesson 20 Revenues 1.Commission revenue 2.Interest revenue 3.Service revenue Lesson21Expenses 1.Salary expense 2.Advertising expense 254

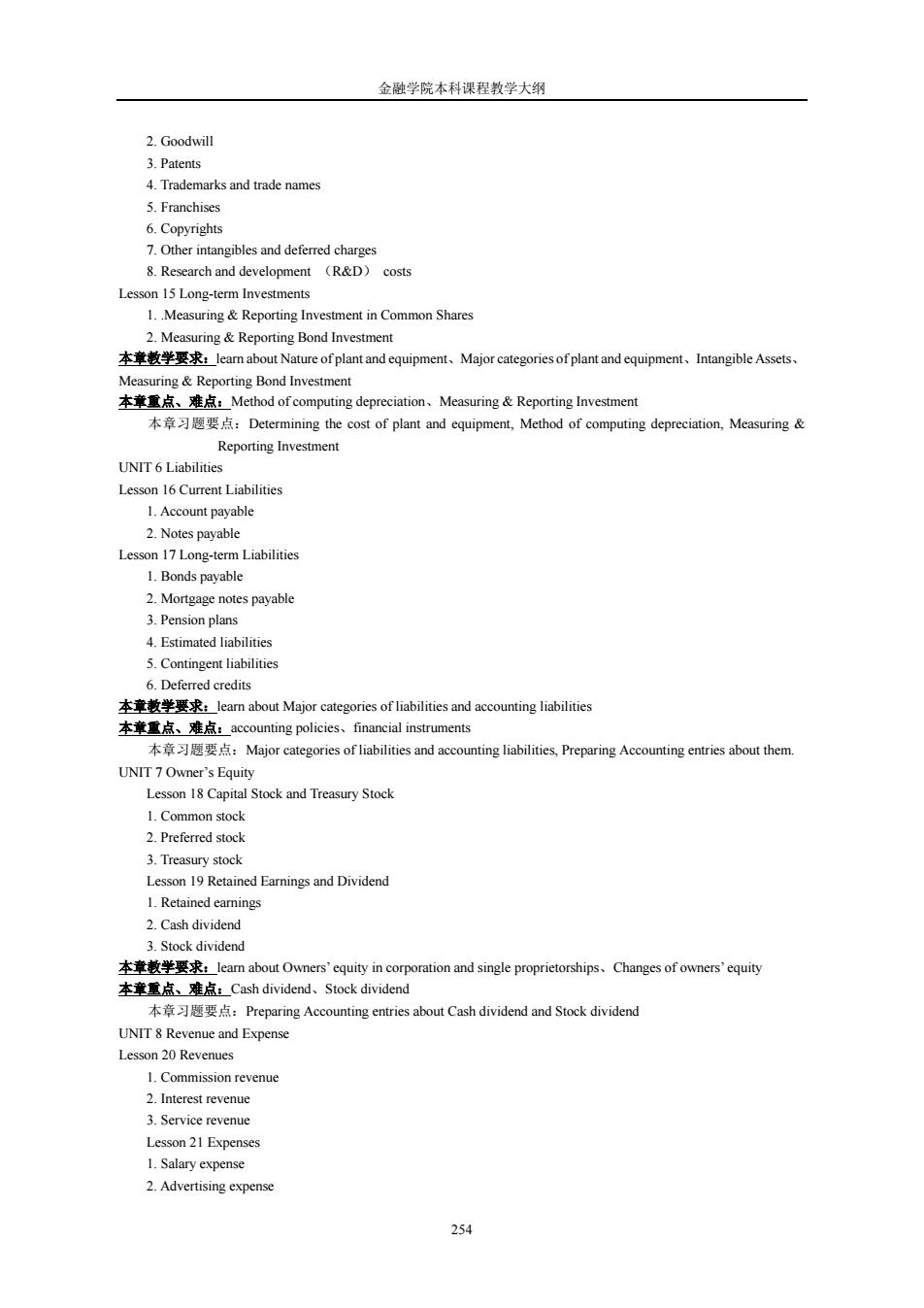

金融学院本科课程教学大纲 254 2. Goodwill 3. Patents 4. Trademarks and trade names 5. Franchises 6. Copyrights 7. Other intangibles and deferred charges 8. Research and development (R&D) costs Lesson 15 Long-term Investments 1. .Measuring & Reporting Investment in Common Shares 2. Measuring & Reporting Bond Investment 本章教学要求:learn about Nature of plant and equipment、Major categories of plant and equipment、Intangible Assets、 Measuring & Reporting Bond Investment 本章重点、难点:Method of computing depreciation、Measuring & Reporting Investment 本章习题要点:Determining the cost of plant and equipment, Method of computing depreciation, Measuring & Reporting Investment UNIT 6 Liabilities Lesson 16 Current Liabilities 1. Account payable 2. Notes payable Lesson 17 Long-term Liabilities 1. Bonds payable 2. Mortgage notes payable 3. Pension plans 4. Estimated liabilities 5. Contingent liabilities 6. Deferred credits 本章教学要求:learn about Major categories of liabilities and accounting liabilities 本章重点、难点:accounting policies、financial instruments 本章习题要点:Major categories of liabilities and accounting liabilities, Preparing Accounting entries about them. UNIT 7 Owner’s Equity Lesson 18 Capital Stock and Treasury Stock 1. Common stock 2. Preferred stock 3. Treasury stock Lesson 19 Retained Earnings and Dividend 1. Retained earnings 2. Cash dividend 3. Stock dividend 本章教学要求:learn about Owners’ equity in corporation and single proprietorships、Changes of owners’ equity 本章重点、难点:Cash dividend、Stock dividend 本章习题要点:Preparing Accounting entries about Cash dividend and Stock dividend UNIT 8 Revenue and Expense Lesson 20 Revenues 1. Commission revenue 2. Interest revenue 3. Service revenue Lesson 21 Expenses 1. Salary expense 2. Advertising expense

金融学院本科课程教学大纲 3.Rent expense 本重点、点,R 本章习题要点:Re expense recog unit o purchase and sales uisition Purchase order 3 Invoice d receiving renor 5.Invoice register 6 Back orders 7.Bill of lading 8.Debit and credit memoranda Lesson 23 Sales 1.Sales for cash 2.Sales on credit 3.Sales on approval 4.COD sales 5.Sales on consignment 6.Installment sale Trade and cash discount 本率 安2 se req 本习要点: Acoming for g a variety of sales methods and Purchase atement Analyse 4 Profitability ratio 2 Two transaction n Lesson 26 Accounting for Inflation 1 Current cost 2.Replacement cost 本章教学要求:compr心 end Accounting for foreign currency transaction and translationAccounting for Iflation mastery analyses of financial statement 本事重点、走点:Liquidity ratios、Effcieney ratios、Profitabiityratios,Current cost 本章习艺要点:Calculation of indicators,Accounting for foreign curreny transaction and Inflation UNIT 11 Cost Accounting Lesson 27The Classification of Cost 1.The cost of a manufactured products 2.Period costs Lesson28 Product Costing System 1.Process costing 255

金融学院本科课程教学大纲 255 3. Rent expense 4. Utilities expense 5. Depreciation 本章教学要求:Definition of revenue、The earning process of revenue、Revenue recognition criteria 本章重点、难点:Revenue and expense recognition criteria 本章习题要点:Revenue and expense recognition criteria, Preparing Accounting entries about Revenues and Expenses UNIT 9 Purchase and Sales Lesson 22 Purchases 1. Purchase requisition 2. Purchase order 3. Invoice 4. Receiving report 5. Invoice register 6. Back orders 7. Bill of lading 8. Debit and credit memoranda Lesson 23 Sales 1. Sales for cash 2. Sales on credit 3. Sales on approval 4. COD sales 5. Sales on consignment 6. Installment sales 7. Trade and cash discounts 本章教学要求:Purchase requisition、Purchase order、Invoice、Receiving report、Invoice register 本章重点、难点:Accounting for Purchase and Sales 本章习题要点:Accounting for a variety of sales methods and Purchase UNIT 10 Advanced Topics on financial accounting Lesson 24 Financial Statement Analyses 1. Liquidity ratios 2. Financial leverage ratios 3. Efficiency ratios 4. Profitability ratios Lesson 25 Accounting for foreign currency transaction and translation 1. Single transaction perspective 2. Two transaction perspective Lesson 26 Accounting for Inflation 1. Current cost 2. Replacement cost 本章教学要求:comprehend Accounting for foreign currency transaction and translation、Accounting for Inflation、mastery analyses of financial statement 、 本章重点、难点:Liquidity ratios、Efficiency ratios、Profitability ratios、Current cost 本章习题要点:Calculation of indicators, Accounting for foreign currency transaction and Inflation UNIT 11 Cost Accounting Lesson 27 The Classification of Cost 1. The cost of a manufactured products 2. Period costs Lesson 28 Product Costing System 1. Process costing

念融学院本科课程教学大纲 der costing 本点。点 and ng of The cost of a ma factured products Relevant Costs For Decision Making 1.Direct and indirect cos 2.Product costs and period costs 3 Variable and fixed costs 4.Incremental and sunk costs 5.Avoidable cost and unavoidable costs 6.Opportunity costs Lesson 31 Responsibility Accounting 1.Responsibility center 2.Investment center 3.Profit center 4.Cost center 本章教学要求,comprehend Cost--Volume-Profit Analyses、Relevant Costs For Decision Making、Responsibility Accounting nting for Break-even point ation of Break-even point and all kinds of cos UNTT 13 Audit A Lesson 32 Introduc n to Auditing Nature of al ting 3.Evaluate the intemal conro 4 pr 6 Form and n34 Audit Reporting 2 Adverse oninion 3 Clean opinion 本妻数学要求:_comprehend Nature of auditing、auditing process、and audit reporting 本章重点、建点:auditing process 本章习要要点:Evaluate the internal control and Prepare the report of internal control UNIT 14 International Accounting Lesson35 Overview of International Accounting 1.World accounting 2.International Accounting 3.Accounting for foreign subsidiaries

金融学院本科课程教学大纲 256 2. Job-order costing 本章教学要求:comprehend Process costing、Job-order costing,mastery Accounting for The cost of a manufactured products 本章重点、难点:Accounting for The cost of a manufactured products 本章习题要点:Calculation and Accounting of The cost of a manufactured products UNIT 12 Managerial Accounting Lesson 29 Cost-Volume-Profit Analyses 1. Break-even point 2. Unit contribution method 3. Contribution Lesson 30 Relevant Costs For Decision Making 1. Direct and indirect cost 2. Product costs and period costs 3. Variable and fixed costs 4. Incremental and sunk costs 5. Avoidable cost and unavoidable costs 6. Opportunity costs Lesson 31 Responsibility Accounting 1. Responsibility center 2. Investment center 3. Profit center 4. Cost center 本章教学要求:comprehend Cost-Volume-Profit Analyses、Relevant Costs For Decision Making、Responsibility Accounting 本章重点、难点:Accounting for Break-even point 本章习题要点:Calculation of Break-even point and all kinds of costs UNIT 13 Audit Accounting Lesson 32 Introduction to Auditing 1. Nature of auditing 2. Types of audits Lesson 33 Auditing Process 1. Prepare the working paper 2. Conduct test 3. Evaluate the internal control 4. Prepare the report of internal control 5. Perform other auditing procedures 6. Form a opinion and issue the audit report Lesson 34 Audit Reporting 1. Qualified opinion 2. Adverse opinion 3. Clean opinion 本章教学要求:comprehend Nature of auditing、auditing process、and audit reporting 本章重点、难点:auditing process 本章习题要点:Evaluate the internal control and Prepare the report of internal control UNIT 14 International Accounting Lesson 35 Overview of International Accounting 1. World accounting 2. International Accounting 3. Accounting for foreign subsidiaries

金融学院本科课程教学大纲 Comparative Accounting System The ma The micro ramework A 本童量点、难点:A 五、考核方式及要求 本课程考核方式主要是闭卷笔试,侧重考核学生利用所学知识综合分析和解决实际问题的能力。为了更好地 发挥考枝的导向作用,是高 学 考核9 的40%(包括平时作业20%。 到课半10%及课堂表现10% 期末考试成锁课程总成锁 六、推荐教材及教学参考书 教材 《财务会计》,Harrison.Homgren编著,清华大学出版社,2012年,标准书号:lSBN7-302-04176-2F-327. 《会计学》,卡尔-S-沃伦、詹姆斯-E.菲斯编著,中国人民大学出版社,2013年,标准书号:1SBN9787-300 07969-1/F-2728. 七、说明 本课程要求学生具有较好的会计基础,英语语言水平应达到中级。在教学中,要求学生做到课前预习,以便 快速掌提英文会计术语,提高语言技巧:同时更好地掌程美因会计与中国会计之间的区别。 大纲修订人:汤颍梅 大纲审定人:丁胜红

金融学院本科课程教学大纲 257 Lesson 36 Comparative Accounting System 1. The macroeconomic framework 2. The microeconomic framework 3. The independent discipline framework 4. The uniform accounting framework 本章教学要求:Comprehend the nature of International Accounting 本章重点、难点:Accounting for foreign subsidiaries 本章习题要点:Basic knowledge about International Accounting 五、考核方式及要求 本课程考核方式主要是闭卷笔试, 侧重考核学生利用所学知识综合分析和解决实际问题的能力。为了更好地 发挥考核的导向作用,提高同学学们的学习积极性和学习效果,本课程侧重平时考核环节。考核成绩考核分为平 时作业、到课率和课堂表现以及期末考试三部分,其中平时考核成绩占课程总成绩的 40%(包括平时作业 20%、 到课率 10%及课堂表现 10%),期末考试成绩占课程总成绩的 60%。 六、推荐教材及教学参考书 教 材: 《财务会计》,Harrison, Horngren 编著,清华大学出版社,2012 年,标准书号:ISBN 7-302-04176-2/F-327。 参考书: 《会计学》,卡尔-S-沃伦、詹姆斯-E-菲斯编著,中国人民大学出版社,2013 年,标准书号:ISBN 978-7-300- 07969-1/F-2728。 七、说明 本课程要求学生具有较好的会计基础,英语语言水平应达到中级。在教学中,要求学生做到课前预习,以便 快速掌握英文会计术语,提高语言技巧;同时更好地掌握美国会计与中国会计之间的区别。 大纲修订人: 汤颖梅 大纲审定人: 丁胜红