《商务英语高级阅读》课程教学大纲 一、课程基本信息 课程代码:18360703 课程名称:商务英语高级阅读 英文名称:Advanced Reading of Business English 课程类别:留学生必修课、商务英语本科生必修课 时:48 学 分:3 适用对象:留学生、本科生 考核方式:考试 先修课程:商务英语中级阅读 二、课程简介 高级商务英语阅读是我校商务英语方向本科生和留学生的一门基础课程,国际商 务英语有其自身特点和基本要求。本课程主要力求使学生进一步打好语言基础,了解 更多商务背景,学会在常见商务场景如Meeting、Business Negotiation、Report、 Presentation的口语表达,通过学习将能够在不同的商务场合中可以就常见的商业话 题和生活话题进行地道、流畅地交流。了解商务写作规则,能写出简洁、规范的商务 文体,如:商务沟通提高语言理解和运用商务英语语言的能力。要求学生了解和掌握商 务英语方面的相关知识掌握文章中出现的词语和专业术语能顺利阅读并正确理 解国际商务活动题材、语言难度中等及以上的文章。 三、课程性质与教学目的 课程性质: 本课程教学内容主要包括:经济、经济全球化及其引发的经营和管理理念的变化、 战略管理、国际贸易、电子商务、金融、世界贸易组织、合资企业、法律法规、市场 营销、人力公关、商务文化等。通过学习有关商务活动的语言材料,学生可以熟悉和 掌握当代商务理念和国际商务惯例,了解英语国家的社会和商业文化。 课程目的: 1.通过学习有关商务活动的语言材料,培养学生掌握阅读和理解商务英语文章 的基本获取商务信息的基本能力,为进一步学习后续的商务英语课程,毕业后成为适 应社会需要的应用型涉外商务工作者打下坚实的基础 2.通过学习有关商务活动的实用语言材料,学生可以熟悉主要的英语文章类型 提高阅读商务文章的能力。 3.课程思政元素:在授课过程中,引导学生了解中国国内的经济发展现况,了

1 《商务英语高级阅读》课程教学大纲 一、课程基本信息 课程代码:18360703 课程名称:商务英语高级阅读 英文名称:Advanced Reading of Business English 课程类别:留学生必修课、商务英语本科生必修课 学 时:48 学 分:3 适用对象: 留学生、本科生 考核方式:考试 先修课程:商务英语中级阅读 二、课程简介 高级商务英语阅读是我校商务英语方向本科生和留学生的一门基础课程,国际商 务英语有其自身特点和基本要求。本课程主要力求使学生进一步打好语言基础,了解 更多商务背景,学会在常见商务场景如 Meeting、Business Negotiation、Report、 Presentation 的口语表达,通过学习将能够在不同的商务场合中可以就常见的商业话 题和生活话题进行地道、流畅地交流。了解商务写作规则,能写出简洁、规范的商务 文体,如:商务沟通提高语言理解和运用商务英语语言的能力。要求学生了解和掌握商 务英语方面的相关知识 掌握文章中出现的词语和专业术语 能顺利阅读并正确理 解国际商务活动题材、语言难度中等及以上的文章。 三、课程性质与教学目的 课程性质: 本课程教学内容主要包括:经济、经济全球化及其引发的经营和管理理念的变化、 战略管理、国际贸易、电子商务、金融、世界贸易组织、合资企业、法律法规、市场 营销、人力公关、商务文化等。通过学习有关商务活动的语言材料,学生可以熟悉和 掌握当代商务理念和国际商务惯例,了解英语国家的社会和商业文化。 课程目的: 1. 通过学习有关商务活动的语言材料,培养学生掌握阅读和理解商务英语文章 的基本获取商务信息的基本能力,为进一步学习后续的商务英语课程,毕业后成为适 应社会需要的应用型涉外商务工作者打下坚实的基础。 2. 通过学习有关商务活动的实用语言材料,学生可以熟悉主要的英语文章类型 提高阅读商务文章的能力。 3. 课程思政元素:在授课过程中,引导学生了解中国国内的经济发展现况,了

解国内经济政策,引导学生正确认识中国在国际贸易中起到的积极作用。坚持对外开 放的基本国策,把‘引进来和‘走出去’更好地结合起来。同时,引导学生全面 客观认识当代中国、看待外部世界,善于在批判鉴别中明辨是非。在了解英 语国家的社会和商业文化的同时,学习和掌握中国传统文化中的思想精华 坚持和发展中国特色社会主义、建设社会主义现代化强国。 四、教学内容及要求 Orientation:the business,tax,and financial environments (一)目的与要求 1.Learning the four basic forms of business organizations 2.Discussing the different characteristics of each business and their advantages/disadvantages 3.思政元素:本部分介绍了四种基本的商业组织形式,并讨论了各种形式的 优缺点,讲解时可以将其主要内容与我国因情相结合,分析国内各商业组 织形式占比的合理性,培养学生对建设高质量中国经济的敏锐度。 (When introducing four basic forms of business organization and discussing the advantages and disadvantages of each form,lecturer should connect them with China's national conditions during the class and analyze the rationality of the proportion of domestic business organization forms to cultivate students'acuity to the construction of high-quality Chinese economy. (二)教学内容 1.主要内容 (1)Four basic forms of business organizations: Sole proprietorships (one owner) Partnerships (general and limited) Corporations Limited liability companies (LLCs) (2)The different characteristics of each business and their advantages/disadvantages: Advantages: Owned by one person (100%profit,easy to operate,make all decisions,more fast reactions to outside changes,flexible) Owner has unlimited liability for all debts incurred (what does that mean?) Tax efficient:add profits/deduct losses from business

2 解国内经济政策,引导学生正确认识中国在国际贸易中起到的积极作用。坚持对外开 放的基本国策,把‘引进来’和‘走出去’更好地结合起来。同时,引导学生全面 客观认识当代中国、看待外部世界,善于在批判鉴别中明辨是非。在了解英 语国家的社会和商业文化的同时,学习和掌握中国传统文化中的思想精华, 坚持和发展中国特色社会主义、建设社会主义现代化强国。 四、教学内容及要求 Orientation:the business, tax, and financial environments (一)目的与要求 1.Learning the four basic forms of business organizations 2.Discussing the different characteristics of each business and their advantages/disadvantages 3.思政元素:本部分介绍了四种基本的商业组织形式,并讨论了各种形式的 优缺点,讲解时可以将其主要内容与我国国情相结合,分析国内各商业组 织形式占比的合理性,培养学生对建设高质量中国经济的敏锐度。 (When introducing four basic forms of business organization and discussing the advantages and disadvantages of each form, lecturer should connect them with China’s national conditions during the class and analyze the rationality of the proportion of domestic business organization forms to cultivate students’ acuity to the construction of high-quality Chinese economy.) (二)教学内容 1.主要内容 (1) Four basic forms of business organizations: Sole proprietorships (one owner) Partnerships (general and limited) Corporations Limited liability companies (LLCs) (2) The different characteristics of each business and their advantages/disadvantages: Advantages: Owned by one person (100% profit, easy to operate, make all decisions, more fast reactions to outside changes, flexible) Owner has unlimited liability for all debts incurred (what does that mean?) Tax efficient: add profits/ deduct losses from business

Very easy to create (usually) Disadvantages: Unlimited liability (all responsibilities) Difficult to raise capital Certain tax disadvantages (Fringe benefits:medical coverage, group insurance) Difficult to transfer the ownership Hard to scale Lack resources 2+owners. All owners have unlimited liability (unless they are limited partners) If someone is a limited partner what does that mean? It means if the business fails,they only lose what they invested. They are investors only (shareholder)and do not help operate the business. No double taxations Raise a greater amount of capital than sole trader (3)Limited liability and unlimited liability 2.基本概念和知识点 Sole proprietorships (one owner) Partnerships (general and limited) Corporations Limited liability companies (LLCs) Limited liability and unlimited liability double taxations 3.问题与应用(能力要求》 (1 What are the definitions of Four basic forms of business organizations? (2)What are the differences of limited liability and unlimited liability? (三)思考与实践 1.Discuss the different characteristics of each business and their advantages/disadvantages. (四)教学方法与手段 3

3 Very easy to create (usually) Disadvantages: Unlimited liability (all responsibilities) Difficult to raise capital Certain tax disadvantages (Fringe benefits: medical coverage, group insurance) Difficult to transfer the ownership Hard to scale Lack resources 2+ owners. All owners have unlimited liability (unless they are limited partners) If someone is a limited partner what does that mean? It means if the business fails, they only lose what they invested. They are investors only (shareholder) and do not help operate the business. No double taxations Raise a greater amount of capital than sole trader (3)Limited liability and unlimited liability 2.基本概念和知识点 Sole proprietorships (one owner) Partnerships (general and limited) Corporations Limited liability companies (LLCs) Limited liability and unlimited liability double taxations 3.问题与应用(能力要求) (1) What are the definitions of Four basic forms of business organizations? (2) What are the differences of limited liability and unlimited liability? (三)思考与实践 1.Discuss the different characteristics of each business and their advantages/disadvantages. (四)教学方法与手段

介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教学、分组讨论、 课堂讨论等。 Topic One:Marketing 1 Blue ocean strategy (一)目的与要求 1.Reading business article about marketing strategy 2.Knowing some business knowledge about marketing 3.Understanding the differences between Red Ocean and Blue Ocean strategy 4.思政元素:本部分介绍营销策略,相关的商业知识以及红海战略和蓝海战 略区别,讲解时可以将其主要内容与我国的市场营销策略进行比较,进而 引导学生了解我国的市场营销策略的特征:引导学生加强对知识营销、网 络营销和绿色营销的重视。 This part introduces marketing strategy,business knowledge about marketing and the differences between Red Ocean and Blue Ocean strategy.During this lesson,the information above can be compared with Chinese marketing strategy,so as to guide students to understand the characteristic of Chinese marketing strategy. Lecturer should guide students to pay attention on knowledge marketing,network marketing and green marketing. (仁) 教学内容 (1)主要内容 Blue and Red oceans a snapshot of blue ocean creation The Paradox of Strategy Toward Blue Ocean Strategy The Defining Characteristics Barriers to Imitation The Simultaneous Pursuit of Differentiation and Low Cost A Consistent pattern (②)基本概念和知识点 Red Ocean Versus Blue Ocean Strategy The imperatives for red ocean and blue ocean strategy are starkly different. A

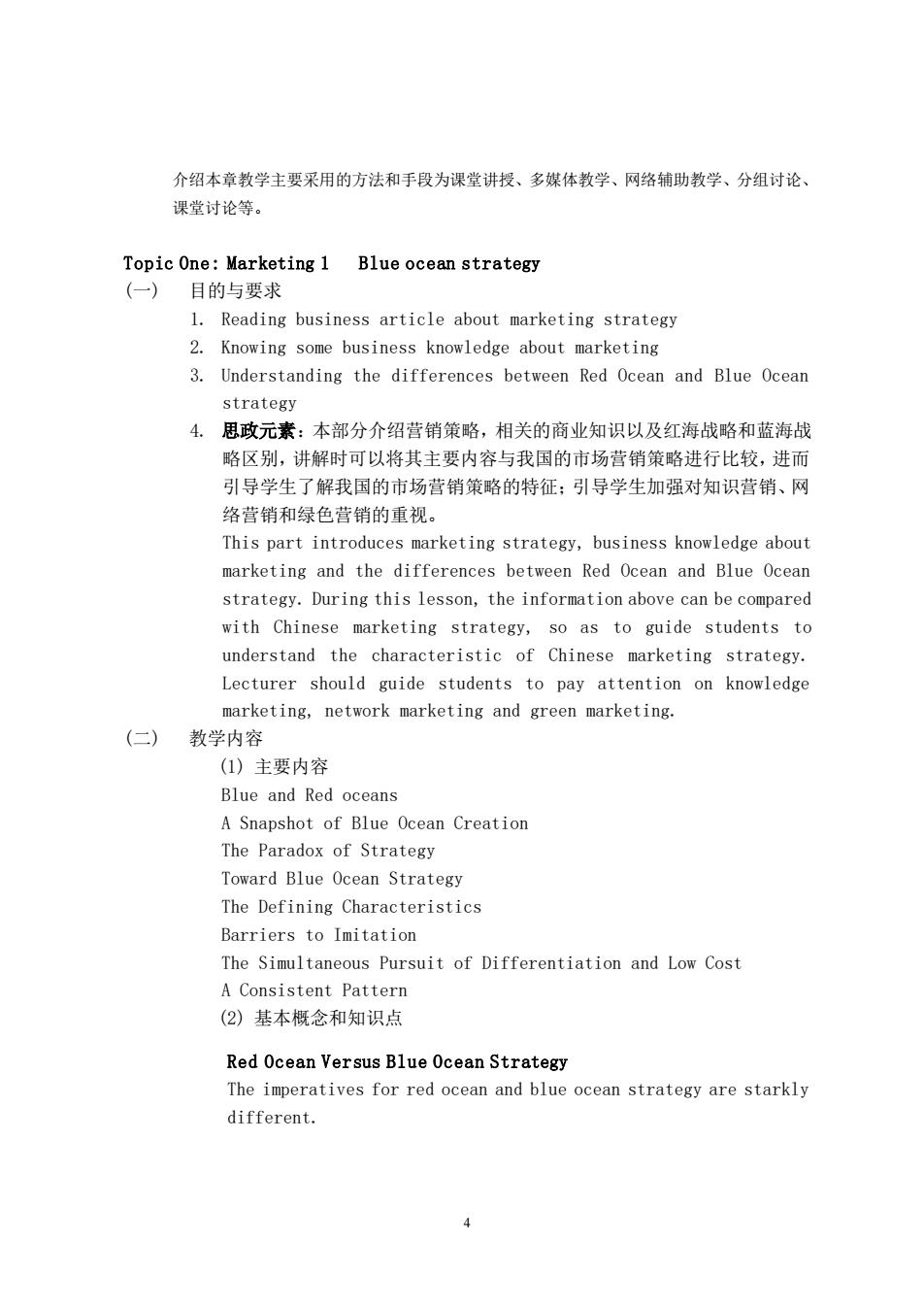

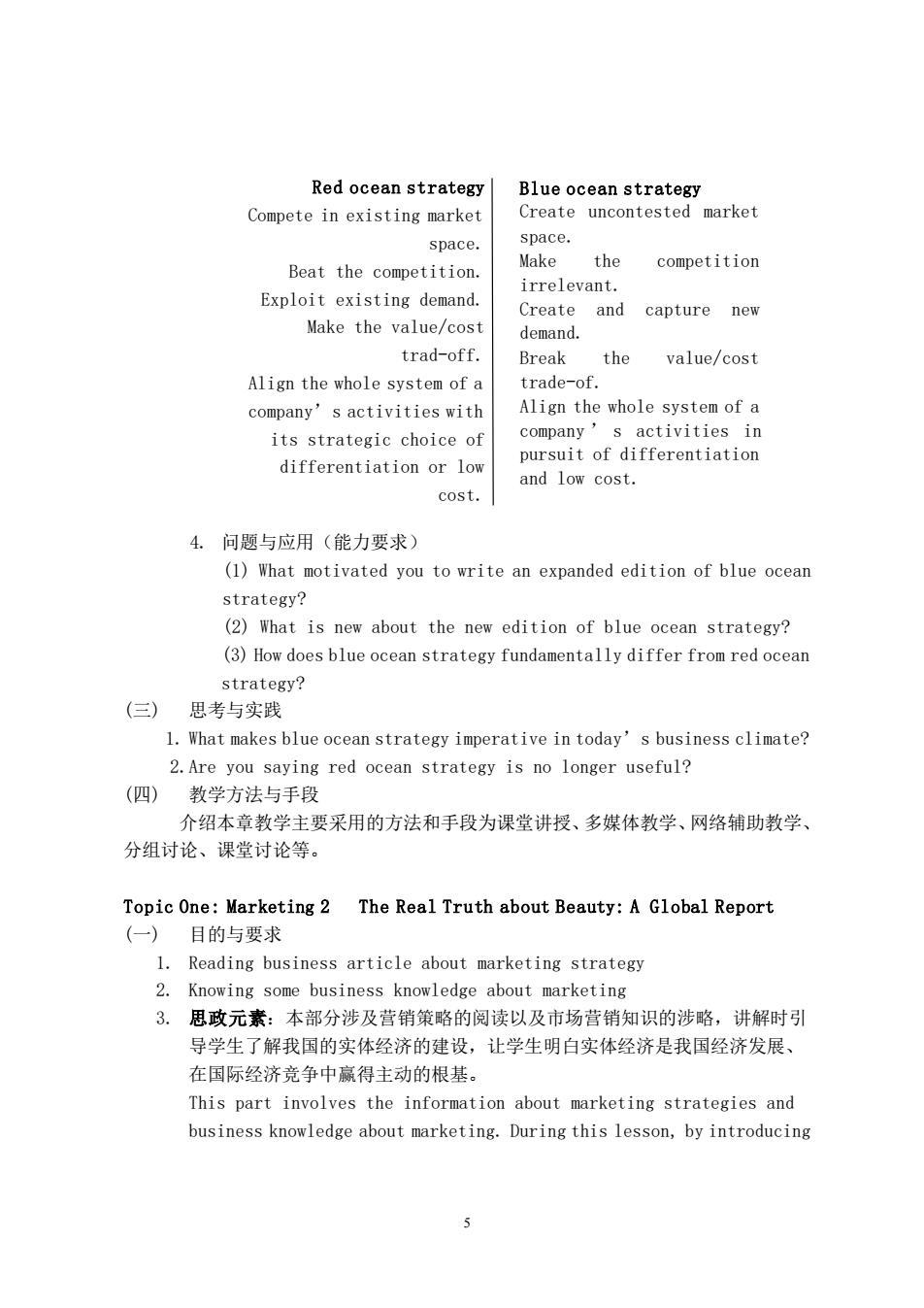

4 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教学、分组讨论、 课堂讨论等。 Topic One: Marketing 1 Blue ocean strategy (一) 目的与要求 1. Reading business article about marketing strategy 2. Knowing some business knowledge about marketing 3. Understanding the differences between Red Ocean and Blue Ocean strategy 4. 思政元素:本部分介绍营销策略,相关的商业知识以及红海战略和蓝海战 略区别,讲解时可以将其主要内容与我国的市场营销策略进行比较,进而 引导学生了解我国的市场营销策略的特征;引导学生加强对知识营销、网 络营销和绿色营销的重视。 This part introduces marketing strategy, business knowledge about marketing and the differences between Red Ocean and Blue Ocean strategy. During this lesson, the information above can be compared with Chinese marketing strategy, so as to guide students to understand the characteristic of Chinese marketing strategy. Lecturer should guide students to pay attention on knowledge marketing, network marketing and green marketing. (二) 教学内容 (1) 主要内容 Blue and Red oceans A Snapshot of Blue Ocean Creation The Paradox of Strategy Toward Blue Ocean Strategy The Defining Characteristics Barriers to Imitation The Simultaneous Pursuit of Differentiation and Low Cost A Consistent Pattern (2) 基本概念和知识点 (3) 问题与应用(能力要求) Red Ocean Versus Blue Ocean Strategy The imperatives for red ocean and blue ocean strategy are starkly different

Red ocean strategy blue ocean strategy Compete in existing market Create uncontested market space. space. Make Beat the competition the competition irrelevant. Exploit existing demand. Create and capture new Make the value/cost demand. trad-off. Break the value/cost Align the whole system of a trade-of. company's activities with Align the whole system of a its strategic choice of company activities in differentiation or low pursuit of differentiation and low cost. cost. 4.问题与应用(能力要求)》 (1)What motivated you to write an expanded edition of blue ocean strategy? (2)What is new about the new edition of blue ocean strategy? (3)How does blue ocean strategy fundamentally differ from red ocean strategy? (三)思考与实践 1.What makes blue ocean strategy imperative in today's business climate? 2.Are you saying red ocean strategy is no longer useful? (四) 教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教学、 分组讨论、课堂讨论等 Topic One:Marketing 2 The Real Truth about Beauty:A Global Report (一)目的与要求 1.Reading business article about marketing strategy 2.Knowing some business knowledge about marketing 3. 思政元素:本部分涉及营销策略的阅读以及市场营销知识的涉略,讲解时引 导学生了解我国的实体经济的律设,让学生明白实体经济是我国经济发展、 在国际经济竞争中赢得主动的根基。 This part involves the information about marketing strategies and business knowledge about marketing.During this lesson,by introducing 5

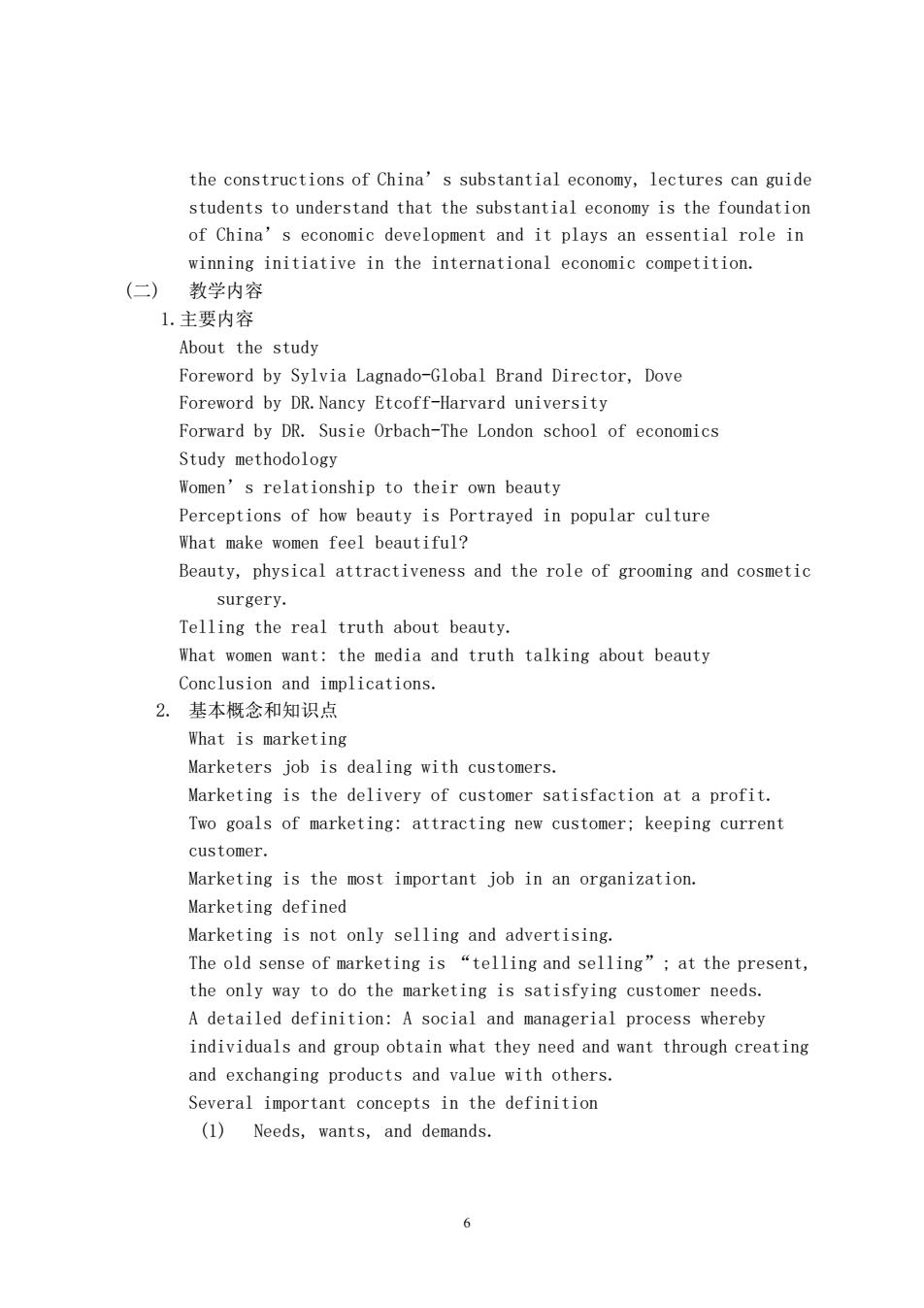

5 4. 问题与应用(能力要求) (1) What motivated you to write an expanded edition of blue ocean strategy? (2) What is new about the new edition of blue ocean strategy? (3) How does blue ocean strategy fundamentally differ from red ocean strategy? (三) 思考与实践 1. What makes blue ocean strategy imperative in today’s business climate? 2.Are you saying red ocean strategy is no longer useful? (四) 教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教学、 分组讨论、课堂讨论等。 Topic One: Marketing 2 The Real Truth about Beauty: A Global Report (一) 目的与要求 1. Reading business article about marketing strategy 2. Knowing some business knowledge about marketing 3. 思政元素:本部分涉及营销策略的阅读以及市场营销知识的涉略,讲解时引 导学生了解我国的实体经济的建设,让学生明白实体经济是我国经济发展、 在国际经济竞争中赢得主动的根基。 This part involves the information about marketing strategies and business knowledge about marketing. During this lesson, by introducing Red ocean strategy Compete in existing market space. Beat the competition. Exploit existing demand. Make the value/cost trad-off. Align the whole system of a company’s activities with its strategic choice of differentiation or low cost. Blue ocean strategy Create uncontested market space. Make the competition irrelevant. Create and capture new demand. Break the value/cost trade-of. Align the whole system of a company ’ s activities in pursuit of differentiation and low cost

the constructions of China's substantial economy,lectures can guide students to understand that the substantial economy is the foundation of China's economic development and it plays an essential role in winning initiative in the international economic competition. (二)教学内容 1.主要内容 About the study Foreword by Sylvia lagnado-Global Brand Director,Dove Foreword by DR.Nancy Etcoff-Harvard university Forward by DR.Susie Orbach-The London school of economics Study methodology Women's relationship to their own beauty Perceptions of how beauty is Portrayed in popular culture What make women feel beautiful? Beauty,physical attractiveness and the role of grooming and cosmetic surgery. Telling the real truth about beauty. What women want:the media and truth talking about beauty Conclusion and implications 2.基本概念和知识点 What is marketing Marketers job is dealing with customers. Marketing is the delivery of customer satisfaction at a profit. Two goals of marketing:attracting new customer:keeping current customer. Marketing is the most important job in an organization. Marketing defined Marketing is not only selling and advertising The old sense of marketing is "telling and selling";at the present, the only way to do the marketing is satisfying customer needs. A detailed definition:A social and managerial process whereby individuals and group obtain what they need and want through creating and exchanging products and value with others. Several important concepts in the definition (1)Needs,wants,and demands. 6

6 the constructions of China’s substantial economy, lectures can guide students to understand that the substantial economy is the foundation of China’s economic development and it plays an essential role in winning initiative in the international economic competition. (二) 教学内容 1.主要内容 About the study Foreword by Sylvia Lagnado-Global Brand Director, Dove Foreword by DR.Nancy Etcoff-Harvard university Forward by DR. Susie Orbach-The London school of economics Study methodology Women’s relationship to their own beauty Perceptions of how beauty is Portrayed in popular culture What make women feel beautiful? Beauty, physical attractiveness and the role of grooming and cosmetic surgery. Telling the real truth about beauty. What women want: the media and truth talking about beauty Conclusion and implications. 2. 基本概念和知识点 What is marketing Marketers job is dealing with customers. Marketing is the delivery of customer satisfaction at a profit. Two goals of marketing: attracting new customer; keeping current customer. Marketing is the most important job in an organization. Marketing defined Marketing is not only selling and advertising. The old sense of marketing is “telling and selling”; at the present, the only way to do the marketing is satisfying customer needs. A detailed definition: A social and managerial process whereby individuals and group obtain what they need and want through creating and exchanging products and value with others. Several important concepts in the definition (1) Needs, wants, and demands

Needs:the basic human requirement. Want:the form taken by a human need as shaped by culture and individual personality. Demands:human wants that are backed by buying power (2)Products and services Products:Anything that can be offered to market for attention, acquisition,use,or consumption that might satisfy a want or need. Products include physical objects,services,persons,places, organizations,and ideas. Products can be referred as satisfier,resource,or marketing offer. (3)Value,satisfaction,quality Customer value:The difference between the values the customer gains from owning and using a product and the costs of obtaining the product. Customer satisfaction:The extent to which a product's perceived performance matches a buyer's expectation. Quality:The totality of features and characteristic of a product or service that bear on its ability to satisfy customer needs. (4)Exchange,Transactions,and Relationships Exchange:the act of obtaining a desired object from someone by offering something in return Transaction:A trade between two parties that involves at least two things of value,agreed-upon conditions,a time of agreement,and a place of agreement. Relationship marketing:The process of creating,maintaining,and enhancing strong,value-laden relationships with customer and other stakeholders. 3.问题与应用(能力要求) Do you think the campaign is inspiring or just a way to get women to buy products? () 思考与实践 Is the company just using "real"women to gain more profit? (四) 教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教 学、分组讨论、课堂讨论等。 7

7 Needs: the basic human requirement. Want: the form taken by a human need as shaped by culture and individual personality. Demands: human wants that are backed by buying power (2) Products and services Products: Anything that can be offered to market for attention, acquisition, use, or consumption that might satisfy a want or need. Products include physical objects, services, persons, places, organizations, and ideas. Products can be referred as satisfier, resource, or marketing offer. (3) Value, satisfaction, quality Customer value: The difference between the values the customer gains from owning and using a product and the costs of obtaining the product. Customer satisfaction: The extent to which a product’s perceived performance matches a buyer’s expectation. Quality: The totality of features and characteristic of a product or service that bear on its ability to satisfy customer needs. (4) Exchange, Transactions, and Relationships Exchange: the act of obtaining a desired object from someone by offering something in return. Transaction: A trade between two parties that involves at least two things of value, agreed-upon conditions, a time of agreement, and a place of agreement. Relationship marketing: The process of creating, maintaining, and enhancing strong, value-laden relationships with customer and other stakeholders. 3. 问题与应用(能力要求) Do you think the campaign is inspiring or just a way to get women to buy products? (三) 思考与实践 Is the company just using “real” women to gain more profit? (四) 教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教 学、分组讨论、课堂讨论等

Topic Two:UK Taxation 1 Briof introduction to UK Taxation (一)目的与要求 Understanding the function and purpose of tax Knowing tax environment Knowing the structure of UK tax system Knowing Tax avoidance and tax evasion 思政元素:本部分介绍了税收相关知识,以及具体讲解了英国税收体系制度。 讲解时,可引导学生了解我国情以及基于国情所设计的税收制度的背景,增强 学生对我国税收体系制度的认可和自信。 This part introduces the relevant knowledge of taxation and explains the structure of UK tax system in detail.During the lesson,students can be guided to know about China's national conditions and the background of the tax system designed based on the condition,so as to enhance students'recognition and confidence in China tax system. (二)教学内容 1.主要内容 Function and purpose of tax Economic factors: Used to encourage and discourage certain types of activity. Social factors Redistribution of income and wealth. Environmental factors: To deal with environmental concerns like global warming Tax environment Types of taxes: (1)Individual Income tax Corporation tax Chargeable gains tax Inheritance tax Value added tax (2)Indirect tax direct tax (3)Revenue tax capital tax (4)progressive tax&non-progressive tax Structure of UK tax system

8 Topic Two: UK Taxation 1 Brief introduction to UK Taxation (一) 目的与要求 Understanding the function and purpose of tax Knowing tax environment Knowing the structure of UK tax system Knowing Tax avoidance and tax evasion 思政元素:本部分介绍了税收相关知识,以及具体讲解了英国税收体系制度。 讲解时,可引导学生了解我国情以及基于国情所设计的税收制度的背景,增强 学生对我国税收体系制度的认可和自信。 This part introduces the relevant knowledge of taxation and explains the structure of UK tax system in detail. During the lesson, students can be guided to know about China's national conditions and the background of the tax system designed based on the condition, so as to enhance students' recognition and confidence in China tax system. (二) 教学内容 1.主要内容 Function and purpose of tax Economic factors: Used to encourage and discourage certain types of activity. Social factors: Redistribution of income and wealth. Environmental factors: To deal with environmental concerns like global warming. Tax environment Types of taxes: (1) Individual Income tax Corporation tax Chargeable gains tax Inheritance tax Value added tax (2) Indirect tax & direct tax (3) Revenue tax & capital tax (4) progressive tax & non-progressive tax Structure of UK tax system

Her Majesty's Treasury formally imposes and collects taxation. Her Majesty's Revenue and Customs (HMRC)administers the collection of tax: Officers of HMRC agree tax liabilities. Receivable Management Officers collect unpaid tax. Revenue and Customs Prosecutions office provides legal advice and institutes and conducts criminal prosecutions. Reviews and appeals: Internal review by HMRc officer Appeal to tax tribunal. Tax tribunal: First tier tribunal deals with most cases Upper tier deals with complex cases. Tax avoidance and tax evasion Tax evasion: Misleading HMRC by suppressing information or deliberately providing false information. Illegal. Tax avoidance Using the legislation to reduce your tax burden. Legal 2.基本概念和知识点 Individual Income tax Corporation tax Chargeable gains tax Inheritance tax Value added tax Indirect tax direct tax Revenue tax capital tax progressive tax non-progressive tax Tax evasion Tax avoidance 3.问题与应用(能力要求) (1)What is the difference between a direct and an indirect tax? (2)How might a double taxation agreement benefit a UK taxpayer who has 9

9 Her Majesty’s Treasury formally imposes and collects taxation. Her Majesty’s Revenue and Customs (HMRC) administers the collection of tax: Officers of HMRC agree tax liabilities. Receivable Management Officers collect unpaid tax. Revenue and Customs Prosecutions office provides legal advice and institutes and conducts criminal prosecutions. Reviews and appeals: Internal review by HMRC officer. Appeal to tax tribunal. Tax tribunal: First tier tribunal deals with most cases. Upper tier deals with complex cases. Tax avoidance and tax evasion Tax evasion: Misleading HMRC by suppressing information or deliberately providing false information. Illegal. Tax avoidance: Using the legislation to reduce your tax burden. Legal. 2.基本概念和知识点 Individual Income tax Corporation tax Chargeable gains tax Inheritance tax Value added tax Indirect tax & direct tax Revenue tax & capital tax progressive tax & non-progressive tax Tax evasion Tax avoidance 3.问题与应用(能力要求) (1) What is the difference between a direct and an indirect tax? (2) How might a double taxation agreement benefit a UK taxpayer who has

income arising in a country which has such an agreement with the UK? (三)思考与实践 1.Tax avoidance is legal.True/False? (四)教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教 学、分组讨论、课堂讨论等。 Topic Two:UK Taxation 2 Scope of income tax (一)目的与要求 1.Reading business article about taxation. 2.Explain how the residence of an individual is determined. 3.思政元素:本部分涉及税务的相关知识以及如何在英国确定个人住所。讲解 时,可引导学生将相关内容与中华人民共和国住房保障法、住房制度做比较 从而引导学生进一步了解国内住房市场的发展。 This part deals with information about taxation and explain how the residence of an individual is determined in UK.During this lesson, students can be guided to compare relevant knowledge with the Law of Housing Security of the People's Republic of China as well as the housing system in China,so as to understand the development of the domestic housing market (仁) 教学内容 1.主要内容 1.1 Residence 1.1.I Statutory residence test 1.1.2 Automatic overseas tests 1.1.3 Automatic UK tests 1.1.4 Sufficient UK ties tests 1.1.5 Day spend in UK 1.1.6 Examples 2.基本概念和知识点 Automatic overseas tests Automatic UK tests Sufficient UK ties tests 3.问题与应用(能力要求) 1.If an individual meets none of the automatic overseas tests and 10

10 income arising in a country which has such an agreement with the UK? (三)思考与实践 1.Tax avoidance is legal. True/False? (四)教学方法与手段 介绍本章教学主要采用的方法和手段为课堂讲授、多媒体教学、网络辅助教 学、分组讨论、课堂讨论等。 Topic Two: UK Taxation 2 Scope of income tax (一) 目的与要求 1.Reading business article about taxation. 2.Explain how the residence of an individual is determined. 3.思政元素:本部分涉及税务的相关知识以及如何在英国确定个人住所。讲解 时,可引导学生将相关内容与中华人民共和国住房保障法、住房制度做比较, 从而引导学生进一步了解国内住房市场的发展。 This part deals with information about taxation and explain how the residence of an individual is determined in UK. During this lesson, students can be guided to compare relevant knowledge with the Law of Housing Security of the People's Republic of China as well as the housing system in China, so as to understand the development of the domestic housing market. (二) 教学内容 1.主要内容 1.1 Residence 1.1.1 Statutory residence test 1.1.2 Automatic overseas tests 1.1.3 Automatic UK tests 1.1.4 Sufficient UK ties tests 1.1.5 Day spend in UK 1.1.6 Examples 2.基本概念和知识点 Automatic overseas tests Automatic UK tests Sufficient UK ties tests 3.问题与应用(能力要求) 1.If an individual meets none of the automatic overseas tests and