The Global History of Corporate Governance An Introduction Randall K.Morck and Lloyd Steier Zhu Guangyao

The Global History of Corporate Governance An Introduction Randall K. Morck and Lloyd Steier Zhu Guangyao

Structure To Whom Dare We Entrust Corporate Governance? Capitalism is a variegated collection of economics systems Purpose of this volume Two features of corporate governance Does It Matter? Shareholder Capitalism 。Family Capitalism 。Bank Capitalism ·State Capitalism Hoarding gold and silver coins 。Conclusion Two Emerging Points Further Reading

To Whom Dare We Entrust Corporate Governance? • Capitalism is a variegated collection of economics systems • Purpose of this volume • Two features of corporate governance Does It Matter? • Shareholder Capitalism • Family Capitalism • Bank Capitalism • State Capitalism • Hoarding gold and silver coins • Conclusion Two Emerging Points & Further Reading Structure

To Whom Dare We Entrust Corporate Governance? A general overview of Capitalism a variegated collection of economic system In America In much of the rest of the world What is capitalism Independent corporations Immensely wealthy families control compete for customers great corporations,even gov. Competition Monopolies are illegal Competition is a mirage Equity Structure 1)Dispersed,2)most 1)concentrated,2)wealthy families are shareholders are disorganized powerful and control great corporation, and powerless,3)institutional 3)few firms are genuinely independent investors give them voice louder Management CEO(use or abuse their Professional management(hired to help, considerable powers in subservient to family dynasties that accordance with their individual jealously safeguard their power)high political social and economic cost beliefs)

• A general overview of Capitalism a variegated collection of economic system In America In much of the rest of the world What is capitalism Independent corporations compete for customers Immensely wealthy families control great corporations, even gov. Competition Monopolies are illegal Competition is a mirage Equity Structure 1)Dispersed, 2)most shareholders are disorganized and powerless, 3)institutional investors give them voice louder 1)concentrated, 2) wealthy families are powerful and control great corporation, 3) few firms are genuinely independent Management CEO (use or abuse their considerable powers in accordance with their individual political social and economic beliefs) Professional management (hired to help, subservient to family dynasties that jealously safeguard their power) high cost To Whom Dare We Entrust Corporate Governance?

To Whom Dare We Entrust Corporate Governance? Purposes of this volume:Two Questions how capitalism came to mean,and to be,such How did some economies come different things in different to entrust the governance to a parts of the world handful of old moneyed families, while others place their faith in professional CEOs?

• Purposes of this volume: Two Questions To Whom Dare We Entrust Corporate Governance? how capitalism came to mean, and to be, such different things in different parts of the world How did some economies come to entrust the governance to a handful of old moneyed families, while others place their faith in professional CEOs?

To Whom Dare We Entrust Corporate Governance? Two features of corporate governance 1.corporate governance is entrusted to very different sorts of people and constrained by very different institutions THE RISE OF STATE CAPITALISM THE EMERGING WORLD'S NEW MODEL Mellon INVESTORS One Mellon Center Individual Wealthy Family Bank State

To Whom Dare We Entrust Corporate Governance? • Two features of corporate governance 1. corporate governance is entrusted to very different sorts of people and constrained by very different institutions Individual Wealthy Family Bank State

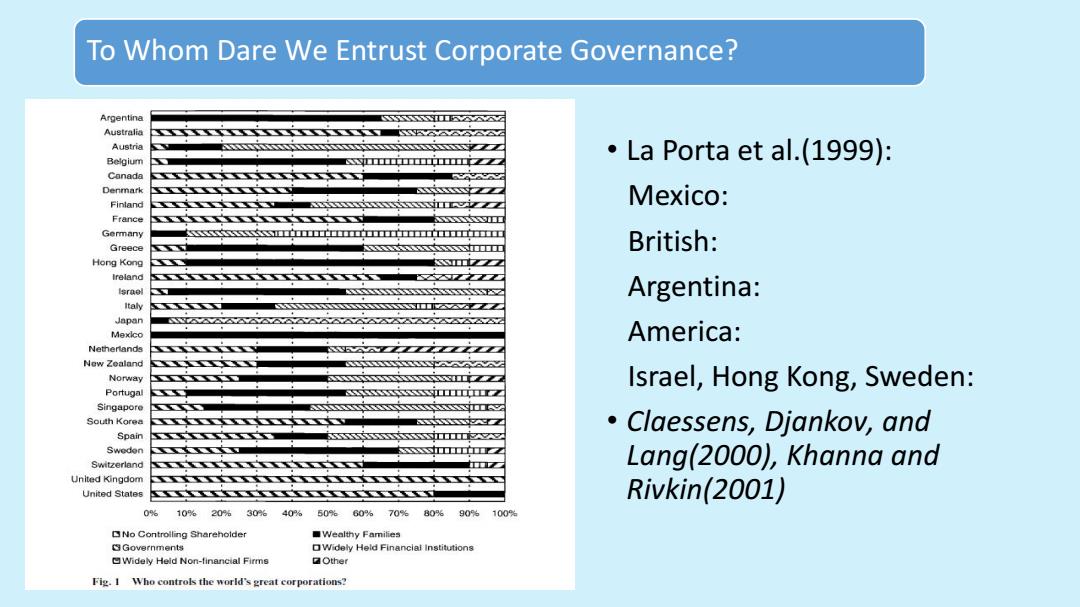

To Whom Dare We Entrust Corporate Governance? Argentina Australia Austria Belgium 。La Porta et al..(1999: Conada Denmark Finland Mexico: France Germany Greece British: Hong Kong Ireland tsrael Argentina: Italy Japan Mexlco America: Nethertands New Zealand Norway Israel,Hong Kong,Sweden: Portugal Singapore South Korea Claessens,Djankov,and Spain ■■■ Swedon ■■■■■■ Switzerland Z Lang(2000),Khanna and United Kingdom United States Rivkin(2001) 0% 10%20%30%40%50% 60%70%80%90%100% No Controlling Shareholder ■Wealthy Families Governments Widely Held Financial Institutions Widely Heid Non-financial Firms ☑Other Fig.I Who controls the world's great corporations?

• La Porta et al.(1999): Mexico: British: Argentina: America: Israel, Hong Kong, Sweden: • Claessens, Djankov, and Lang(2000), Khanna and Rivkin(2001) To Whom Dare We Entrust Corporate Governance?

To Whom Dare We Entrust Corporate Governance? Two features of corporate governance 2.the pyramidal business group magnifies the economic importance of this difference Single enough to create genuinely Co. different economic systems Listed structures that permit tiny Listed Co. Co. elites to control the greater parts of the corporate sectors

• Two features of corporate governance 2. the pyramidal business group magnifies the economic importance of this difference enough to create genuinely different economic systems structures that permit tiny elites to control the greater parts of the corporate sectors Single Co. Apex shareholder(wealthy family) Listed Co. Listed Co. …… To Whom Dare We Entrust Corporate Governance?

Does It Matter? Shareholder Capitalism Family Capitalism conclusion Bank Capitalism State Capitalism Hoarding gold and silver coins

Does It Matter? Shareholder Capitalism Family Capitalism Bank Capitalism State Capitalism Hoarding gold and silver coins conclusion

Does It Matter? Shareholder Capitalism Capital is allocated to firms that can use it well and is kept away from firms that are likely to waste it Practiced in the United Kingdom and United States Entrusted to CEOs and other professional managers Cost:monitoring cost.How to solve:disclosure,management pay,prohibitions Problems:good managers are penalized and poor ones rewarded if investors get things wrong,and this seems to happen with some regularity

• Capital is allocated to firms that can use it well and is kept away from firms that are likely to waste it • Practiced in the United Kingdom and United States • Entrusted to CEOs and other professional managers • Cost: monitoring cost. How to solve: disclosure, management pay, prohibitions • Problems: good managers are penalized and poor ones rewarded if investors get things wrong, and this seems to happen with some regularity. Shareholder Capitalism Does It Matter?

Does It Matter? Family Capitalism investors are deeply mistrustful of most companies and prefer to invest to persons of good reputation The most common system (Japan,Korea etc.) Entrusted to wealthiest few families provide investors with fewer legal rights Problems:governance can deteriorate if the families grows inept, conservative.So they tend to keep the status,keep shareholder rights weak so that the upstarts cannot compete for public investors'saving

• investors are deeply mistrustful of most companies and prefer to invest to persons of good reputation • The most common system (Japan, Korea etc.) • Entrusted to wealthiest few families • provide investors with fewer legal rights • Problems: governance can deteriorate if the families grows inept, conservative. So they tend to keep the status, keep shareholder rights weak so that the upstarts cannot compete for public investors’ saving. Family Capitalism Does It Matter?