《投资估值》课程教学大纲 一、课程基本信息 课程代码:20030012 课程名称:投资估值 英文名称:Investment Valuation 课程类别:专业洗题课 时:32 学 分:2 适用对象:资产评估专业,金融学专业 考核方式:考试 先修课程:财务会计学、资产评估概论 二、课程简介 《投资估值》在本专业中是对专业知识的深化和重要补充,重在挖掘不同企 业类型的估值难点和决定因素,并提升到金融视角以解答常见的投资问题。课程 的学习不仅能丰富学生专业知识体系,也能拓宽学生往金融领域发展的就业前 景。课程采用中英双语教学方式,教材以英文原版教材为主,中文译本为辅。课 程主要讲授公司估值的难点、估值工具、宏观变量、生命周期各阶段的估值,从 估值问题、估值难点和解决方案三个方面帮助学生系统认识公司价值,掌握解决 估值问题的常用方案,能对估值参数做出正确的调整和估算,具备评估任何企业 价值的能力。 三、课程性质与教学目的 《投资估值》属于普通高等学校资产评估专业本科生专业选修课程,在资产 评估专业课程体系中属于专业方向限选课。通过本课程学习,要求学生了解资产 的价值以及是什么决定了该资产的价值,领会估值细节因资产而异,价值估算的 不确定性因资产而异,旧决定各类济立价值的基本原则是相同的。堂据解决估值 存在问题的具体方案,在估值操作中,能够正确搭建估值模型,选取科学的评估 参数,给企业做出合理的估值。在课程思政上,达到人如企业,鼓励学生为实现 自身价值而不断奋斗,为社会和国家贡献自己的力量。 四、教学内容及要求 第l章The Dark Side of Valuation (一)目的与要求 This chapter begins by describing the determinants of value for any company.Then it considers the estimation issues we face at each stage in the life cycle and for different types of companies. We close the chapter by looking at manifestations of the dark side of valuation

《投资估值》课程教学大纲 一、课程基本信息 课程代码:20030012 课程名称:投资估值 英文名称:Investment Valuation 课程类别:专业选题课 学 时:32 学 分:2 适用对象:资产评估专业,金融学专业 考核方式:考试 先修课程:财务会计学、资产评估概论 二、课程简介 《投资估值》在本专业中是对专业知识的深化和重要补充,重在挖掘不同企 业类型的估值难点和决定因素,并提升到金融视角以解答常见的投资问题。课程 的学习不仅能丰富学生专业知识体系,也能拓宽学生往金融领域发展的就业前 景。课程采用中英双语教学方式,教材以英文原版教材为主,中文译本为辅。课 程主要讲授公司估值的难点、估值工具、宏观变量、生命周期各阶段的估值,从 估值问题、估值难点和解决方案三个方面帮助学生系统认识公司价值,掌握解决 估值问题的常用方案,能对估值参数做出正确的调整和估算,具备评估任何企业 价值的能力。 三、课程性质与教学目的 《投资估值》属于普通高等学校资产评估专业本科生专业选修课程,在资产 评估专业课程体系中属于专业方向限选课。通过本课程学习,要求学生了解资产 的价值以及是什么决定了该资产的价值,领会估值细节因资产而异,价值估算的 不确定性因资产而异,但决定各类资产价值的基本原则是相同的。掌握解决估值 存在问题的具体方案,在估值操作中,能够正确搭建估值模型,选取科学的评估 参数,给企业做出合理的估值。在课程思政上,达到人如企业,鼓励学生为实现 自身价值而不断奋斗,为社会和国家贡献自己的力量。 四、教学内容及要求 第 1 章 The Dark Side of Valuation (一)目的与要求 This chapter begins by describing the determinants of value for any company. Then it considers the estimation issues we face at each stage in the life cycle and for different types of companies. We close the chapter by looking at manifestations of the dark side of valuation

(二)教学内容 ●Foundations of Value ●Intrinsic Valuation Determinants of Value o Valuation Across Time Valuation Across the Life Cycle Valuation Across the Business Spectrum .The Dark Side of Valuation Beckons ■Input Phase Base year fixation Outsourcing key inputs Trusting management forecasts ■Valuation phase Ignoring the scaling effect .Inconsistencies in valuation .Valuing for the exception √Mixing pricing and valuation √Paradigm shifts √B1ack-box models v·Rules of thumb (三)思老与实践 What Are the Cash Flows Generated by Existing Assets? How Much Value Will Be Added by Future Investments (Growth)? How Risky Are the Cash Flows,and What Are the Consequences for Discount Rates? When Will the Firm Become Mature? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值基础进行讨论,从现有资产价值和增长性资产价值引渡到个人价值增 值的途径,引导学生努力学习,增加自身投资,实现自身价值

(二)教学内容 ⚫ Foundations of Value ⚫ Intrinsic Valuation ⚫ Determinants of Value ⚫ Valuation Across Time ⚫ Valuation Across the Life Cycle ⚫ Valuation Across the Business Spectrum ⚫ The Dark Side of Valuation Beckons ◼ Input Phase ✓ Base year fixation ✓ Outsourcing key inputs ✓ Trusting management forecasts ◼ Valuation Phase ✓ Ignoring the scaling effect ✓ •Inconsistencies in valuation ✓ •Valuing for the exception ✓ •Mixing pricing and valuation ✓ •Paradigm shifts ✓ •Black-box models ✓ •Rules of thumb (三)思考与实践 ✓ What Are the Cash Flows Generated by Existing Assets? ✓ How Much Value Will Be Added by Future Investments (Growth)? ✓ How Risky Are the Cash Flows, and What Are the Consequences for Discount Rates? ✓ When Will the Firm Become Mature? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值基础进行讨论,从现有资产价值和增长性资产价值引渡到个人价值增 值的途径,引导学生努力学习,增加自身投资,实现自身价值

第2章Intrinsic Valuation (一)目的与要求 ●Cash Flow to the Firm Business Risk Versus Equity Risk ●The Cost of Debt ●Growth Rates ●Terminal Value (二)教学内容 Discounted Cash Flow Valuation The Essence of DCF Valuation Equity Versus Firm Valuation Inputs to a DCF Valuation Variations on DCF Valuation Certainty-Adjusted Cash Flow Models Adjusted Present-Value Models Excess-Return Models .What Do Intrinsic Valuation Models Tell Us? ●Conclusion (三)思考与实践 What is intrinsic value? The Dark Side of Valuation Beckons (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对DF模型核心参数进行讨论,从收益和风险引渡学生建立正确的认识观。 第3章Probabilistic Valuation: Scenario Analysis,Decision Trees,and Simulations (一)目的与要求 In the most extreme form of scenario analysis,you look at the value in the best-case and worst-case scenarios and contrast them with the expected value.A decision tree provides a complete assessment of risk.It can be used to determine the optimal course of action at each phase and an

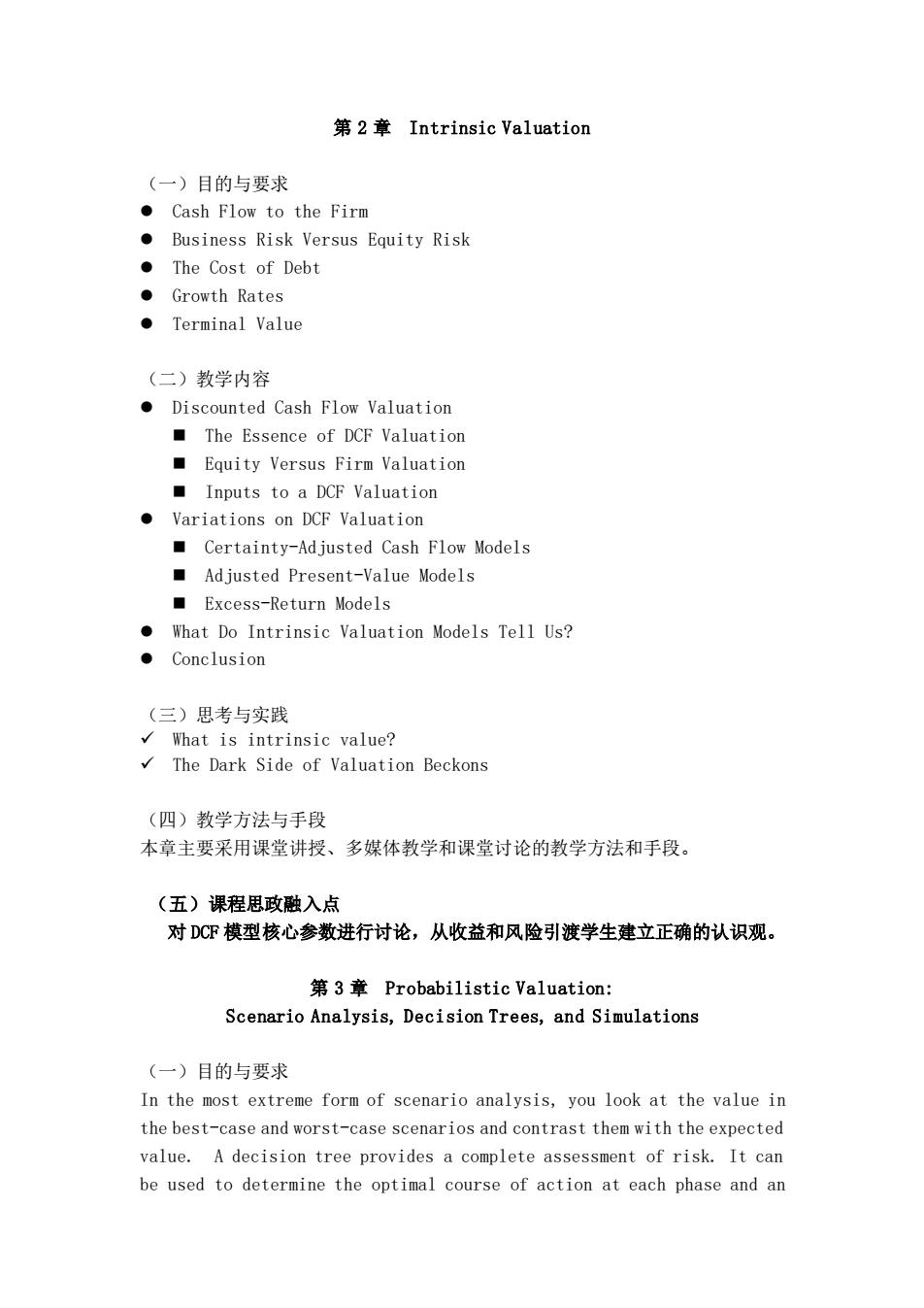

第 2 章 Intrinsic Valuation (一)目的与要求 ⚫ Cash Flow to the Firm ⚫ Business Risk Versus Equity Risk ⚫ The Cost of Debt ⚫ Growth Rates ⚫ Terminal Value (二)教学内容 ⚫ Discounted Cash Flow Valuation ◼ The Essence of DCF Valuation ◼ Equity Versus Firm Valuation ◼ Inputs to a DCF Valuation ⚫ Variations on DCF Valuation ◼ Certainty-Adjusted Cash Flow Models ◼ Adjusted Present-Value Models ◼ Excess-Return Models ⚫ What Do Intrinsic Valuation Models Tell Us? ⚫ Conclusion (三)思考与实践 ✓ What is intrinsic value? ✓ The Dark Side of Valuation Beckons (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对 DCF 模型核心参数进行讨论,从收益和风险引渡学生建立正确的认识观。 第 3 章 Probabilistic Valuation: Scenario Analysis, Decision Trees, and Simulations (一)目的与要求 In the most extreme form of scenario analysis, you look at the value in the best-case and worst-case scenarios and contrast them with the expected value. A decision tree provides a complete assessment of risk. It can be used to determine the optimal course of action at each phase and an

expected value for an asset today. (二)教学内容 ●Scenario Analysis √Best Case/Worst Case Multiple Scenario Analysis ·Decision Trees Steps in Decision Tree Analysis √Estimation Issues Risk-Adjusted Value and Decision Trees ●Simulations √Steps in Simulation Use in Decision Making Simulations with Constraints v Issues with Using simulations Risk-Adjusted Value and Simulations An Overall View of Probabilistic Risk Assessment Approaches Comparing the Approaches A Complement to or Replacement for Risk-Adjusted Value ●Conclusion (三)思考与实践 With all three approaches,the keys are to avoid double-counting risk(by using a risk-ad justed discount rate and considering the variability in estimated value as a risk measure)and to avoid making decisions based on the wrong types of risk. (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段

expected value for an asset today. (二)教学内容 ⚫ Scenario Analysis ✓ Best Case/Worst Case ✓ Multiple Scenario Analysis ⚫ Decision Trees ✓ Steps in Decision Tree Analysis ✓ Estimation Issues ✓ Risk-Adjusted Value and Decision Trees ⚫ Simulations ✓ Steps in Simulation ✓ Use in Decision Making ✓ Simulations with Constraints ✓ Issues with Using Simulations ✓ Risk-Adjusted Value and Simulations ⚫ An Overall View of Probabilistic Risk Assessment Approaches ✓ Comparing the Approaches ✓ A Complement to or Replacement for Risk-Adjusted Value ⚫ Conclusion (三)思考与实践 With all three approaches, the keys are to avoid double-counting risk (by using a risk-adjusted discount rate and considering the variability in estimated value as a risk measure) and to avoid making decisions based on the wrong types of risk. (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段

第4章Relative Valuation/,Pricing (一)目的与要求 While relative valuation is easy to use and intuitive,it is also easy to misuse.This chapter develops a four-step process for doing relative valuation.In the process,we will also develop a series of tests that can ensure that multiples are used correctly. (二)教学内容 The Ubiquity of Relative Valuation Reasons for Popularity and Potential Pitfalls Standardized Values and Multiples v Earnings Multiples Book Value or Replacement Value Multiples √Revenue Multiples Sector-Specific Multiples The Four Basic Steps of Using Multiples √Definitional Tests Descriptive Tests √Analytical Tests √Application Tests o Reconciling Relative and Intrinsic Valuations ●Conclusion (三)思考与实践 What Is Relative Valuation? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值倍数进行讨论,从价值倍数差异引渡到个人价值的差异,引导学生正 确认识事物间的差异和决定因素。 第5章Real0 ptions Valuation (一)目的与要求 Option Pricing Models The Black-Scholes Model

第4章 Relative Valuation/Pricing (一)目的与要求 While relative valuation is easy to use and intuitive, it is also easy to misuse. This chapter develops a four-step process for doing relative valuation. In the process, we will also develop a series of tests that can ensure that multiples are used correctly. (二)教学内容 ⚫ The Ubiquity of Relative Valuation ⚫ Reasons for Popularity and Potential Pitfalls ⚫ Standardized Values and Multiples ✓ Earnings Multiples ✓ Book Value or Replacement Value Multiples ✓ Revenue Multiples ✓ Sector-Specific Multiples ⚫ The Four Basic Steps of Using Multiples ✓ Definitional Tests ✓ Descriptive Tests ✓ Analytical Tests ✓ Application Tests ⚫ Reconciling Relative and Intrinsic Valuations ⚫ Conclusion (三)思考与实践 What Is Relative Valuation? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值倍数进行讨论,从价值倍数差异引渡到个人价值的差异,引导学生正 确认识事物间的差异和决定因素。 第5章 Real Options Valuation (一)目的与要求 ⚫ Option Pricing Models ⚫ The Black-Scholes Model

(二)教学内容 The Essence of Real Options Real Options,Risk-Adjusted Value,and Probabilistic Assessments Real Options Examples The Option to Delay an Investment The Option to Expand an Investment The Option to Abandon an Investment Caveats for Real Options ●Conclusion Appendix:Basics of Options and Option Pricing √0 ption Payoffs Determinants of Option Value Option Pricing Models Valuation Across the Business Spectrum .The Dark Side of Valuation Beckons ■Input Phase √Base year fixation Outsourcing key inputs Trusting management forecasts (三)思考与实践 The last section considers some of the potential pitfalls of using the real options argument and how it can be best incorporated into a portfolio of risk-assessment tools. (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 第6章A Shaky Base:A“Risky”Risk-Free Rate (一)目的与要求 What makes an asset risk-free?And how do we estimate a risk-free rate? We consider these questions in this chapter.In the process,we have to grapple with why risk-free rates might be different in different currencies and how to adapt discounted cash flow valuations to reflect these differences.We also look at cases where estimating a risk-free rate becomes difficult,and mechanisms that we can use to meet the challenges. Furthermore,we look at the dark side of valuation when it comes to risk-free rates,and the consequences for valuations

(二)教学内容 ⚫ The Essence of Real Options ⚫ Real Options, Risk-Adjusted Value, and Probabilistic Assessments ⚫ Real Options Examples ✓ The Option to Delay an Investment ✓ The Option to Expand an Investment ✓ The Option to Abandon an Investment ⚫ Caveats for Real Options ⚫ Conclusion ⚫ Appendix: Basics of Options and Option Pricing ✓ Option Payoffs ✓ Determinants of Option Value ✓ Option Pricing Models ⚫ Valuation Across the Business Spectrum ⚫ The Dark Side of Valuation Beckons ◼ Input Phase ✓ Base year fixation ✓ Outsourcing key inputs ✓ Trusting management forecasts (三)思考与实践 The last section considers some of the potential pitfalls of using the real options argument and how it can be best incorporated into a portfolio of risk-assessment tools. (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 第 6 章 A Shaky Base: A “Risky” Risk-Free Rate (一)目的与要求 What makes an asset risk-free? And how do we estimate a risk-free rate? We consider these questions in this chapter. In the process, we have to grapple with why risk-free rates might be different in different currencies and how to adapt discounted cash flow valuations to reflect these differences. We also look at cases where estimating a risk-free rate becomes difficult, and mechanisms that we can use to meet the challenges. Furthermore, we look at the dark side of valuation when it comes to risk-free rates, and the consequences for valuations

(四)教学内容 Estimating a Risk-Free Rate Requirements for an Investment to Be Risk-Free The Purist Solution A Practical Compromise √The Currency Effect Real Versus Nominal Risk-Free Rates Issues in Estimating Risk-Free Rates There Are No Long-Term Traded Government Bonds The Government Is Not Default-Free The Risk-Free Rate Might Change Over Time Closing Thoughts on Risk-Free Rates ●Conclusion (五)思考与实践 What Is a Risk-Free Asset? Why Do Risk-Free Rates Matter? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对无风险利率进行讨论,引导学生认识不稳定性的根源:“危险”的无风险 利率,加深对事物确定性与风险的认识。 Risky Ventures:Assessing the Price of Risk (一)目的与要求 This chapter considers two inputs that affect every valuation.The first is the equity risk premium-the premium that investors demand for investing in the average-risk equity investment.The second is default spreads,which lenders charge as premiums over the risk-free rate for lending money to a business.We begin by looking at why the price of risk matters across valuations,and we move on to consider the determinants of risk premiums and why they might change over time and across countries. We then look at conventional practices used to estimate these numbers and the potential problems in these practices.Finally,we look at scenarios where assessing a price for risk becomes difficult,how the dark side beckons,and some ways to avoid going over to the dark side

(四)教学内容 ⚫ Estimating a Risk-Free Rate ✓ Requirements for an Investment to Be Risk-Free ✓ The Purist Solution ✓ A Practical Compromise ✓ The Currency Effect ✓ Real Versus Nominal Risk-Free Rates ⚫ Issues in Estimating Risk-Free Rates ✓ There Are No Long-Term Traded Government Bonds ✓ The Government Is Not Default-Free ✓ The Risk-Free Rate Might Change Over Time ⚫ Closing Thoughts on Risk-Free Rates ⚫ Conclusion (五)思考与实践 ⚫ What Is a Risk-Free Asset? ⚫ Why Do Risk-Free Rates Matter? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对无风险利率进行讨论,引导学生认识不稳定性的根源:“危险”的无风险 利率,加深对事物确定性与风险的认识。 第 7 章 Risky Ventures: Assessing the Price of Risk (一)目的与要求 This chapter considers two inputs that affect every valuation. The first is the equity risk premium—the premium that investors demand for investing in the average-risk equity investment. The second is default spreads, which lenders charge as premiums over the risk-free rate for lending money to a business. We begin by looking at why the price of risk matters across valuations, and we move on to consider the determinants of risk premiums and why they might change over time and across countries. We then look at conventional practices used to estimate these numbers and the potential problems in these practices. Finally, we look at scenarios where assessing a price for risk becomes difficult, how the dark side beckons, and some ways to avoid going over to the dark side

(二)教学内容 Why Do Risk Premiums Matter? What Are the Determinants of Risk Premiums? √Equity Risk Premiums Default Spreads Standard Approaches for Estimating Risk Premiums √Equity Risk Premiums √Default Spreads √Problem Scenarios √The Dark side The Light Side The Dark Side √The Light Side √The Dark side √The Light Side ●Conclusion (六)思考与实践 Why Do Risk Premiums Matter? What Are the Determinants of Risk Premiums? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值基础进行讨论,从现有资产价值和增长性资产价值引渡到个人价值增 值的途径,引导学生努力学习,增加自身投资,实现自身价值。 第8章Macro Matters:The Real Economy (一)目的与要求 This chapter begins by looking at how changes in the real economy, inflation,and exchange rates affect valuation.It also looks at the historical behavior of each of these variables.With each of these variables,we also examine how analysts deal (or avoid dealing)with them, in the course of valuing companies.They often make implicit assumptions about growth and inflation that might be unrealistic or explicit assumptions that are internally inconsistent.We evaluate whether we should be building in views on the macroeconomic variables and,if so

(二)教学内容 ⚫ Why Do Risk Premiums Matter? ⚫ What Are the Determinants of Risk Premiums? ✓ Equity Risk Premiums ✓ Default Spreads ⚫ Standard Approaches for Estimating Risk Premiums ✓ Equity Risk Premiums ✓ Default Spreads ✓ Problem Scenarios ✓ The Dark Side ✓ The Light Side ✓ The Dark Side ✓ The Light Side ✓ The Dark Side ✓ The Light Side ⚫ Conclusion (六)思考与实践 ⚫ Why Do Risk Premiums Matter? ⚫ What Are the Determinants of Risk Premiums? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对价值基础进行讨论,从现有资产价值和增长性资产价值引渡到个人价值增 值的途径,引导学生努力学习,增加自身投资,实现自身价值。 第 8 章 Macro Matters: The Real Economy (一)目的与要求 This chapter begins by looking at how changes in the real economy, inflation, and exchange rates affect valuation. It also looks at the historical behavior of each of these variables. With each of these variables, we also examine how analysts deal (or avoid dealing) with them, in the course of valuing companies. They often make implicit assumptions about growth and inflation that might be unrealistic or explicit assumptions that are internally inconsistent. We evaluate whether we should be building in views on the macroeconomic variables and, if so

how best to do this. (二)教学内容 Growth in the Real Economy Why Does Real Economic Growth Matter? √Looking at History √The Dark side √The Light Side ●Expected Inflation Why Does Expected Inflation Matter? √Looking at History U.S.Inflation Rate Across Time The Dark side The Light Side ●Exchange Rates Why Do Exchange Rates Matter? √Looking at History √The Dark Side The Light Side ●Conclusion (三)思考与实践 Why Does Real Economic Growth Matter? Why Does Expected Inflation Matter? Why Do Exchange Rates Matter? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 第9章Baby Steps:Young and Start--Up Companies (一)目的与要求 This chapter looks at the challenges we face when valuing young companies and the shortcuts employed by many who have to estimate the value of these businesses to arrive at value.Whereas some of the rules that have developed over time for valuing young businesses make sense,other rules inevitably lead to erroneous and biased estimates of value. (二)教学内容 Young Companies in the Economy A Life Cycle View of Young Companies

how best to do this. (二)教学内容 ⚫ Growth in the Real Economy ✓ Why Does Real Economic Growth Matter? ✓ Looking at History ✓ The Dark Side ✓ The Light Side ⚫ Expected Inflation ✓ Why Does Expected Inflation Matter? ✓ Looking at History ✓ U.S. Inflation Rate Across Time ✓ The Dark Side ✓ The Light Side ⚫ Exchange Rates ✓ Why Do Exchange Rates Matter? ✓ Looking at History ✓ The Dark Side ✓ The Light Side ⚫ Conclusion (三)思考与实践 Why Does Real Economic Growth Matter? Why Does Expected Inflation Matter? Why Do Exchange Rates Matter? (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 第 9 章 Baby Steps: Young and Start-Up Companies (一)目的与要求 This chapter looks at the challenges we face when valuing young companies and the shortcuts employed by many who have to estimate the value of these businesses to arrive at value. Whereas some of the rules that have developed over time for valuing young businesses make sense, other rules inevitably lead to erroneous and biased estimates of value. (二)教学内容 ⚫ Young Companies in the Economy ✓ A Life Cycle View of Young Companies

Characteristics of Young Companies ●Valuation Issues Intrinsic (DCF)Valuation √Relative Valuation ●The Dark Side ●The Light Side Discounted Cash Flow Valuation √Relative Valuation √Real Options ●Conclusion (三)思考与实践 What are the most difficult estimation challenges in valuation of Young companies. ()教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对初创企业价值进行讨论,从初创企业价值特征拓展到在读大学生、研究生 的人生发展,引导学生努力学习,增加自身投资,实现自身价值。 10 Shooting Stars:Valuing Growth Companies (一)目的与要求 This chapter examines the issues we face when valuing growth companies. Many of the concerns we saw with young companies-short and volatile operating histories,uncertainty about future growth,and changing risk profiles-remain problems when we value growth companies,especially in their initial phases.However,the data and tools we use to deal with them do become better.The existing concerns are joined by new concerns about how growth rates might change as companies get larger and how access and exposure to public capital markets will change financing and investment decisions at the firm. (二)教学内容 ●Growth Companies A Life Cycle View of Growth Companies

✓ Characteristics of Young Companies ⚫ Valuation Issues ✓ Intrinsic (DCF) Valuation ✓ Relative Valuation ⚫ The Dark Side ⚫ The Light Side ✓ Discounted Cash Flow Valuation ✓ Relative Valuation ✓ Real Options ⚫ Conclusion (三)思考与实践 What are the most difficult estimation challenges in valuation of Young companies. (四)教学方法与手段 本章主要采用课堂讲授、多媒体教学和课堂讨论的教学方法和手段。 (五)课程思政融入点 对初创企业价值进行讨论,从初创企业价值特征拓展到在读大学生、研究生 的人生发展,引导学生努力学习,增加自身投资,实现自身价值。 第 10 章 Shooting Stars: Valuing Growth Companies (一)目的与要求 This chapter examines the issues we face when valuing growth companies. Many of the concerns we saw with young companies—short and volatile operating histories, uncertainty about future growth, and changing risk profiles—remain problems when we value growth companies, especially in their initial phases. However, the data and tools we use to deal with them do become better. The existing concerns are joined by new concerns about how growth rates might change as companies get larger and how access and exposure to public capital markets will change financing and investment decisions at the firm. (二)教学内容 ⚫ Growth Companies ⚫ A Life Cycle View of Growth Companies