《高级财务管理(P4)》课程教学大纲 一、课程基本信息 课程代码:16004803 课程名称:高级财务管理 英文名称:Advanced Financial Management 课程类别:专业课 学 时:48 学 分:2 适用对象:ACCA专业 考核方式:考试 先修课程:F9-Financial Management;F2-Management Accounting 二、课程简介 Advanced Financial Management(P4):this paper builds upon the skills and knowledge examined in the F9 Financial Management paper.At this stage candidates will be expected to demonstrate an integrated knowledge of the subject and an ability to relate their technical understanding of the subject to issues of strategic importance to the organisation. The study guide specifies the wide range of contextual understanding that is required to achieve a satisfactory standard at this level. The course starts by exploring the role and responsibility of a senior executive or advisor in meeting competing needs of stakehokders within the business of multinationals.The course then re-examines investment and financing decisions,with the emphasis moving towards the strategic consequences of making such decisions in a 0 domestic,as well as international,context.Students are then expected to develop further advisory skills in planning strategic acquisitions and mergers and corporate re-organisations. 三、课程性质与教学目的 This course develops upon the core financial management knowledge and skills covered in the F9 Financial Management,syllabus at the Fundamentals level and prepares candidates to advise management and/or clients on complex strategic financial management issues facing an organisation. 本课程强调课程思政的嵌入,让学生把握财务管理在经济社会中的角色,通过课 堂的讲授和互动,将财务管理知识体系中蕴含的思想价值和精神内涵传递给学生,更

1 《高级财务管理(P4)》课程教学大纲 一、课程基本信息 课程代码:16004803 课程名称:高级财务管理 英文名称:Advanced Financial Management 课程类别:专业课 学 时:48 学 分:2 适用对象: ACCA 专业 考核方式:考试 先修课程:F9-Financial Management; F2-Management Accounting 二、课程简介 Advanced Financial Management(P4): this paper builds upon the skills and knowledge examined in the F9, Financial Management , paper. At this stage candidates will be expected to demonstrate an integrated knowledge of the subject and an ability to relate their technical understanding of the subject to issues of strategic importance to the organisation. The study guide specifies the wide range of contextual understanding that is required to achieve a satisfactory standard at this level. The course starts by exploring the role and responsibility of a senior exe cutive or advisor in meeting competing needs of stakeholders within the business environment of multinationals. The course then re-examines investment and financing decisions, with the emphasis moving towards the strategic consequences of making such decisions in a domestic, as well as international, context. Students are then expected to develop further advisory skills in planning strategic acquisitions and mergers and corporate re-organisations. 三、课程性质与教学目的 This course develops upon the core financial management knowledge and skills covered in the F9, Financial Management, syllabus at the Fundamentals level and prepares candidates to advise management and/or clients on complex strategic financial management issues facing an organisation. 本课程强调课程思政的嵌入,让学生把握财务管理在经济社会中的角色,通过课 堂的讲授和互动,将财务管理知识体系中蕴含的思想价值和精神内涵传递给学生,更

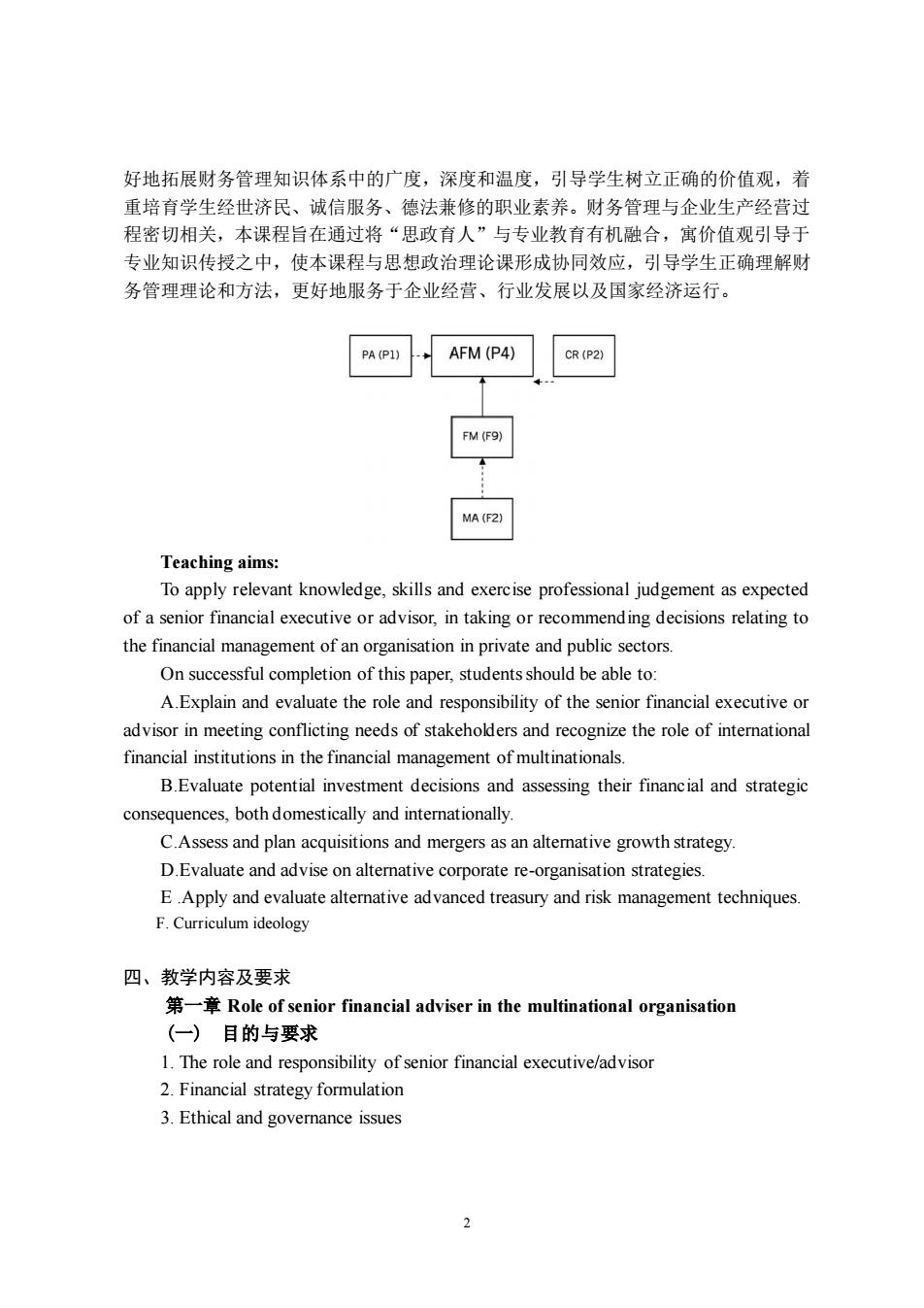

好地拓展财务管理知识体系中的广度,深度和温度,引导学生树立正确的价值观,着 重培育学生经世济民、诚信服务、德法兼修的职业素养。财务管理与企业生产经营过 程密切相关,本课程旨在通过将“思政育人”与专业教育有机融合,寓价值观引导于 专业知识传授之中,使本课程与思想政治理论课形成协同效应,引导学生正确理解财 务管理理论和方法,更好地服务于企业经营、行业发展以及国家经济运行。 PA(P1)AFM (P4) CR (P2) FM (F9) MA (F2) Teaching aims: To apply relevant knowledge,skills and exercise professional judgement as expected of a senior financial executive or advisor,in taking or recommending decisions relating to the financial management of an organisation in private and public sectors On successful completion of this paper.students should be able to: a Explain and evaluate the role and responsibility of the senior financial executive or advisor in meeting conflicting needs of stakehokders and recognize the role of international financial institutions in the financial management of multinationals. B.Evaluate potential investment decisions and assessing their financial and strategic consequences,bothdomestically and internationally. C.Assess and plan acquisitions and mergers as an altemative growth strategy. D.Evaluate and advise onaltemative corporate re-organisation strategies. EApply and evaluate altemative advanced treasury and risk management techniques. F.Curriculum ideology 四、教学内容及要求 Role of senior financial adviser in the multinational organisation (一)目的与要求 1.The role and responsibility of senior financial executive/advisor 2.Financial strategy formulation 3.Ethical and governance issues

2 好地拓展财务管理知识体系中的广度,深度和温度,引导学生树立正确的价值观,着 重培育学生经世济民、诚信服务、德法兼修的职业素养。财务管理与企业生产经营过 程密切相关,本课程旨在通过将“思政育人”与专业教育有机融合,寓价值观引导于 专业知识传授之中,使本课程与思想政治理论课形成协同效应,引导学生正确理解财 务管理理论和方法,更好地服务于企业经营、行业发展以及国家经济运行。 Teaching aims: To apply relevant knowledge, skills and exercise professional judgement as expected of a senior financial executive or advisor, in taking or recommending decisions relating to the financial management of an organisation in private and public sectors. On successful completion of this paper, students should be able to: A.Explain and evaluate the role and responsibility of the senior financial executive or advisor in meeting conflicting needs of stakeholders and recognize the role of international financial institutions in the financial management of multinationals. B.Evaluate potential investment decisions and assessing their financial and strategic consequences, both domestically and internationally. C.Assess and plan acquisitions and mergers as an alternative growth strategy. D.Evaluate and advise on alternative corporate re-organisation strategies. E .Apply and evaluate alternative advanced treasury and risk management techniques. F. Curriculum ideology 四、教学内容及要求 第一章 Role of senior financial adviser in the multinational organisation (一) 目的与要求 1. The role and responsibility of senior financial executive/advisor 2. Financial strategy formulation 3. Ethical and governance issues

4.Management of international trade and finance 5.Strategic business and financial planning for multinational organisations 6.Dividend policy in multinationals and transfer pricing (二)教学内容 第一节 1.主要内容 The role and responsibility of senior financial executive/advisor 2.基本概念和知识点 a)Develop strategies for the achievement of the organisational goals in line with its agreed policy framework. b)Recommend strategies for the management of the financial resources of the organisation such that they are utilised in an efficient,effective and transparent way. c)Advise the board of directors or management of the organisation in setting the financial goals of the business and in its financial policy development particular reference to: i)Investment selection and capital resource allocation ii)Minimising the cost of capital iii)Distribution and retention policy iv)Communicating financial policy and corporate goals to internal and external stakeholders v)Financial planning and control vi)The management of risk. 3.问题与应用 a)What is capital resource allocation? b)How to minimising the cost of capital? 第二者 1.主要内容 financial strate formulation 2.基本概念和知识点 a)Assess organisational performance using methods such as ratios and trends b)Recommend the optimum capital mix and structure within a specified business context and capital asset structure. c)Recommend appropriate distribution and retention policy

3 4. Management of international trade and finance 5. Strategic business and financial planning for multinational organisations 6. Dividend policy in multinationals and transfer pricing (二)教学内容 第一节 1. 主要内容 The role and responsibility of senior financial executive/advisor 2.基本概念和知识点 a) Develop strategies for the achievement of the organisational goals in line with its agreed policy framework. b) Recommend strategies for the management of the financial resources of the organisation such that they are utilised in an efficient, effective and transparent way. c) Advise the board of directors or management of the organisation in setting the financial goals of the business and in its financial policy development particular reference to: i) Investment selection and capital resource allocation ii) Minimising the cost of capital iii) Distribution and retention policy iv) Communicating financial policy and corporate goals to internal and external stakeholders v) Financial planning and control vi) The management of risk. 3. 问题与应用 a)What is capital resource allocation? b)How to minimising the cost of capital? 第二节 1.主要内容 Financial strategy formulation 2.基本概念和知识点 a) Assess organisational performance using methods such as ratios and trends b) Recommend the optimum capital mix and structure within a specified business context and capital asset structure. c) Recommend appropriate distribution and retention policy

d)Explain the theoretical and practical rationale for the management of risk. e)Assess the organisation's exposure to business and financial risk including operational,reputational,political,economic,regulatory and fiscal risk f)Develop a framework for risk management,comparing and contrasting risk mitigation,hedging and diversification strategies. g)Establish capital investment monitoring and risk management systems. h)Advise on the impact of behavioural finance on financial strategies securities prices and why they may not follow the conventional financial theories. 3.问题与应用 a)Take an example of using ratios to assess organizational performance. b)What does the risk include? 第三节 1.主要内容 a)Assess the ethical dimension within business issues and decisions and advise on best practice in the financial management of the organisation. b)Demonstrate an understanding of the interconnectedness of the ethics of good business practice between all of the functional areas of the organisation. c)Recommend,within specified problem domains,appropriate strategies for the resolution of stakeholder conflict and advise on alternative approaches that may be adopted. d)Recommend an ethical framework for the development of an organisation' s financial policies and a system for the assessment of its ethical impact upon the financial management of the organisation. e)Explore the areas within the ethical framework of the organisation which may be undermined by agency effects and/or stakeholder conflicts and establish strategies for dealing with them. f)Establish an ethical financial policy for the financial management of the organisation which is grounded in good governance,the highest standards of probity and is fully aligned with the ethical principles of the Association. 4

4 d) Explain the theoretical and practical rationale for the management of risk. e) Assess the organisation’s exposure to business and financial risk including operational, reputational, political, economic, regulatory and fiscal risk f) Develop a framework for risk management, comparing and contrasting risk mitigation, hedging and diversification strategies. g) Establish capital investment monitoring and risk management systems. h) Advise on the impact of behavioural finance on financial strategies / securities prices and why they may not follow the conventional financial theories. 3. 问题与应用 a)Take an example of using ratios to assess organizational performance. b)What does the risk include? 第三节 1. 主要内容 Ethical and governance issues 2.基本概念和知识点 a) Assess the ethical dimension within business issues and decisions and advise on best practice in the financial management of the organisation. b) Demonstrate an understanding of the interconnectedness of the ethics of good business practice between all of the functional areas of the organisation. c) Recommend, within specified problem domains, appropriate strategies for the resolution of stakeholder conflict and advise on alternative approaches that may be adopted. d) Recommend an ethical framework for the development of an organisation’ s financial policies and a system for the assessment of its ethical impact upon the financial management of the organisation. e) Explore the areas within the ethical framework of the organisation which may be undermined by agency effects and/or stakeholder conflicts and establish strategies for dealing with them. f) Establish an ethical financial policy for the financial management of the organisation which is grounded in good governance, the highest standards of probity and is fully aligned with the ethical principles of the Association

g)Assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions. h)Assess and advise on the impact of investment and financing strategies and decisions on the organisation's stakeholders,from an integrated reporting and governance perspective 3.问题与应用 a)What is the conflict between stakeholders? b)How to assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions? 第四节 1.主要内容 Management of international trade and finance 2.基本概念和知识点 a)Advise on the theory and practice of free trade and the management of barriers to trade. b)Demonstrate an up to date understanding of the major trade agreements and common markets and,on the basis of contemporary circumstances,advise on their policies and strategic implications for a given business. c)Discuss how the actions of the World Trade Organisation,the International Monetary Fund,The World Bank and Central Banks can affect a multinational organisation. d)Discuss the role of international financial institutions within the context of a globalised economy.with particular attention to (the fed.Bank of England,European Central Bank and the Bank of Japan). e)Discuss the role of the international financial markets with respect to the management of global debt,the financial development of the emerging economies and the maintenance of global financial stability. f)Discuss the significance to the organisation,of latest developments in the world financial markets such as the causes and impact of the recent financial crisis:growth and impact of dark pool trading systems;the removal of barriers to the free movement of capital;and the international regulations on money laundering. g)Demonstrate an awareness of new developments in the macroeconomic environment,assessing their impact upon the organisation,and advising on the appropriate response to those developments both internally and externally. 5

5 g) Assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions. h) Assess and advise on the impact of investment and financing strategies and decisions on the organisation’s stakeholders, from an integrated reporting and governance perspective 3. 问题与应用 a)What is the conflict between stakeholders? b)How to assess the impact on sustainability and environmental issues arising from alternative organisational business and financial decisions? 第四节 1. 主要内容 Management of international trade and finance 2.基本概念和知识点 a) Advise on the theory and practice of free trade and the management of barriers to trade. b) Demonstrate an up to date understanding of the major trade agreements and common markets and, on the basis of contemporary circumstances, advise on their policies and strategic implications for a given business. c) Discuss how the actions of the World Trade Organisation, the International Monetary Fund, The World Bank and Central Banks can affect a multinational organisation. d) Discuss the role of international financial institutions within the context of a globalised economy, with particular attention to (the Fed, Bank of England, European Central Bank and the Bank of Japan). e) Discuss the role of the international financial markets with respect to the management of global debt, the financial development of the emerging economies and the maintenance of global financial stability. f) Discuss the significance to the organisation, of latest developments in the world financial markets such as the causes and impact of the recent financial crisis; growth and impact of dark pool trading systems; the removal of barriers to the free movement of capital; and the international regulations on money laundering. g) Demonstrate an awareness of new developments in the macroeconomic environment, assessing their impact upon the organisation, and advising on the appropriate response to those developments both internally and externally

3.问题与应用 a)What is the role of international financial institutions within the context of a globalised economy b)What are the causes and impacts of the financial crisis? 第五节 1.主要内容 Strategic business and financial planning for multinationals 2.基本概念和知识点 a)Advise on the development of a financial planning framework for a multinational organisation taking into account: i)Compliance with national regulatory requirements (for example the London Stock Exchange admission requirements) ii)The mobility of capital across borders and national limitations on remittances and transfer pricing iii)The pattern of economic and other risk exposures in the different national markets iv)Agency issues in the central coordination of overseas operations and the balancing of local financial autonomy with effective central control. 3.基本概念和知识点 a)What are the patterns of economic and other risk exposures in the different national markets? b)What are the limitations of transfer pricing? 第六节 1.主要内容 Dividend policy in multinationals and transfer pricing 2.基本概念和知识点 a)Determine a corporation's dividend capacity and its policy given i)The corporation's short-and long-term reinvestment strategy ii)The impact of capital reconstruction programmes such as share repurchase agreements and new capital issues on free cash flow to equity iii)The availability and timing of central remittances iv)The corporate tax regime within the host jurisdiction. b)Advise,in the context of a specified capital investment programme, on an organisation's current and projected dividend capacity. 6

6 3. 问题与应用 a)What is the role of international financial institutions within the context of a globalised economy b)What are the causes and impacts of the financial crisis? 第五节 1.主要内容 Strategic business and financial planning for multinationals 2.基本概念和知识点 a) Advise on the development of a financial planning framework for a multinational organisation taking into account: i) Compliance with national regulatory requirements (for example the London Stock Exchange admission requirements) ii) The mobility of capital across borders and national limitations on remittances and transfer pricing iii) The pattern of economic and other risk exposures in the different national markets iv) Agency issues in the central coordination of overseas operations and the balancing of local financial autonomy with effective central control. 3. 基本概念和知识点 a)What are the patterns of economic and other risk exposures in the different national markets? b)What are the limitations of transfer pricing? 第六节 1.主要内容 Dividend policy in multinationals and transfer pricing 2.基本概念和知识点 a) Determine a corporation’s dividend capacity and its policy given : i) The corporation’s short- and long-term reinvestment strategy ii) The impact of capital reconstruction programmes such as share repurchase agreements and new capital issues on free cash flow to equity. iii) The availability and timing of central remittances iv) The corporate tax regime within the host jurisdiction. b) Advise, in the context of a specified capital investment programme, on an organisation’s current and projected dividend capacity

c)Develop organisational policy on the transfer pricing of goods and services across international borders and be able to determine the most appropriate transfer pricing strategy in a given situation reflecting local regulations and tax regimes. 3.问题与应用 a)What impact will the capital reconstruction programmes? b)What is the availability of central remittances? (三)思考与实践 Mezza Co is a large food manufacturing and wholesale company.It imports fruit and vegetables from countries in South America,Africa and Asia,and ns,plastic tubs and as frozen foods,for sale to rkets around Europe suppliers ange dual farmers to Government run cooperatives,and farms run by its own subsidiary companies. In the past,Mezza Co has been very successful in its activities,and has an excellent corporate image with its customers,suppliers and employees.Indeed Mezza Co prides itself on how it has supported local farming communities around the world and has consistently highligh ted these activities in its reports. However,in spite of buoyant stock markets over the last couple of years. Mezza Co's share price has emained static.It is thought that this is be there is little scope for future growth in its products As a result the company s directors are considering diversifying into new areas.One possibility is to commercialise a product developed by a recently acquired subsidiary company.The subsidiary company is engaged in researching solutions to carbon emissions and global warming,and has developed a high carbon absorbing v ety can be grown in wa bio-fuel. widely used,is expected to lower carbon production levels. Currently there is a lot of interest among the world's governments in finding solutions to climate change.Mezza Co's directors feel that this venture could enhance its reputation and result in a rise in its share price. They believe that the company's expertise would be ideally suited to commercialising the product.On a personal level.they feel that the venture s success would enhar e their emuneration package which includes share options.It is hoped that the resulting increase in the share price would enable the options to be exercised in the future. Mezza Co has identified the coast of Maienar,a small country in Asia, as an ideal location,as it has a large area of warm,shallow waters.Mezza 7

7 c) Develop organisational policy on the transfer pricing of goods and services across international borders and be able to determine the most appropriate transfer pricing strategy in a given situation reflecting local regulations and tax regimes. 3. 问题与应用 a)What impact will the capital reconstruction programmes? b)What is the availability of central remittances? (三) 思考与实践 Mezza Co is a large food manufacturing and wholesale company. It imports fruit and vegetables from countries in South America, Africa and Asia, and packages them in steel cans, plastic tubs and as frozen foods, for sale to supermarkets around Europe. Its suppliers range from individual farmers to Government run cooperatives, and farms run by its own subsidiary companies. In the past, Mezza Co has been very successful in its activities, and has an excellent corporate image with its customers, suppliers and employees. Indeed Mezza Co prides itself on how it has supported local farming communities around the world and has consistently highlighted these activities in its annual reports. However, in spite of buoyant stock markets over the last couple of years, Mezza Co’s share price has remained static. It is thought that this is because there is little scope for future growth in its products. As a result the company ’ s directors are considering diversifying into new areas. One possibility is to commercialise a product developed by a recently acquired subsidiary company. The subsidiary company is engaged in researching solutions to carbon emissions and global warming, and has developed a high carbon absorbing variety of plant that can be grown in warm, shallow sea water. The plant would then be harvested into carbon-neutral bio-fuel. This fuel, if widely used, is expected to lower carbon production levels. Currently there is a lot of interest among the world’s governments in finding solutions to climate change. Mezza Co’s directors feel that this venture could enhance its reputation and result in a rise in its share price. They believe that the company ’ s expertise would be ideally suited to commercialising the product. On a personal level, they feel that the venture’ s success would enhance their generous remuneration package which includes share options. It is hoped that the resulting increase in the share price would enable the options to be exercised in the future. Mezza Co has identified the coast of Maienar, a small country in Asia, as an ideal location, as it has a large area of warm, shallow waters. Mezza

Co has been operating in Maienar for many years and as a result,has a well developed infrastructure to enable it to plant,monitor and harvest the crop. Mezza Co's directors have strong ties with senior government officials in Maienar and the country's politicians are keen to develop new industries, especially ones with a long-term future The area identified by Mezza Co is a rich fishing ground for local fishermen, who have been fishing there for many generations.However.the fishermen are poor and have little political influence.The general perception is that the fishermen contribute little to Maienar's economic development.The coastal area.although naturally beautiful.has not been well developed for tourism. is thought that the high carbon absorbing plant, ifg own on a scale,may have a negative area.The resulting decline in fish stocks may make it impossible for the fishermen to continue with their traditional way of life. Required: Discuss the key issues that the directors of Mezza Co should consider when making the decision about whether or not to commercialise the new product, and suggest how these issues may be mitigated or resolved. (四) 教学方法与手段 Teaching methods in this chapter mainly use classroom teaching,group discussion,class discussion,etc. This chapter teaching methods mainly use network-assisted teaching multimedia teaching. (五)课程思政内容和方式:通过国内上市公司以及跨因组织经营热点案例融入 方式:从高级财务主管/顾问的角色和责任、财务战略制定过程中的道德问题培养学 生社会责任感和正确的价值观:从国际贸易和金融管理、跨因组织的战略业务和财务 计划、跨国公司的股息政策和转让定价等讲解中让学生了解在不同文化中交流的差异 比较,遵守当地法律法规、合法经营,着重融入职业道德、法治意识:帮助学生树立 正确的世界观及民族文化自信:坚定诚实守信、遵纪守法的核心价值观。 第二章Advanced investment appraisal (一)目的与要求 1.Discounted cash flow techniques 2.Application of option pricing theory in investment decisions 3.Impact of financing on investment decisions and adjusted present values 4.Valuation and the use of free cash flows 8

8 Co has been operating in Maienar for many years and as a result, has a well developed infrastructure to enable it to plant, monitor and harvest the crop. Mezza Co’s directors have strong ties with senior government officials in Maienar and the country’s politicians are keen to develop new industries, especially ones with a long-term future. The area identified by Mezza Co is a rich fishing ground for local fishermen, who have been fishing there for many generations. However, the fishermen are poor and have little political influence. The general perception is that the fishermen contribute little to Maienar’s economic development. The coastal area, although naturally beautiful, has not been well developed for tourism. It is thought that the high carbon absorbing plant, if grown on a commercial scale, may have a negative impact on fish stocks and other wildlife in the area. The resulting decline in fish stocks may make it impossible for the fishermen to continue with their traditional way of life. Required: Discuss the key issues that the directors of Mezza Co should consider when making the decision about whether or not to commercialise the new product, and suggest how these issues may be mitigated or resolved. (四) 教学方法与手段 Teaching methods in this chapter mainly use classroom teaching, group discussion, class discussion, etc. This chapter teaching methods mainly use network-assisted teaching, multimedia teaching. (五)课程思政内容和方式:通过国内上市公司以及跨国组织经营热点案例融入 方式;从高级财务主管/顾问的角色和责任、财务战略制定过程中的道德问题培养学 生社会责任感和正确的价值观;从国际贸易和金融管理、跨国组织的战略业务和财务 计划、跨国公司的股息政策和转让定价等讲解中让学生了解在不同文化中交流的差异 比较,遵守当地法律法规、合法经营,着重融入职业道德、法治意识;帮助学生树立 正确的世界观及民族文化自信;坚定诚实守信、遵纪守法的核心价值观。 第二章 Advanced investment appraisal (一)目的与要求 1. Discounted cash flow techniques 2. Application of option pricing theory in investment decisions 3. Impact of financing on investment decisions and adjusted present values 4. Valuation and the use of free cash flows

5.International investment and financing decisions (二)教学内容 第一节 1.主要内容 Discounted cash flow techniques 2.基本概今和知识点 a)Evaluate the potential value added to an organisation arising from a specified capital investment project or portfolio using the net present value (NPV))model Project modelling should include explicit treatment and discussion of: i)Inflation and specific price variation ii)Taxation including tax allowable depreciation and tax exhaustion iii)Single period and multi-period capital rationing.Multi-period capital rationing to include the formulation of programming methods and the interpretation of their output iv)Probability analysis and sensitivity analysis when adjusting for risk and uncertainty in investment appraisal v)Risk adjusted discount rates vi)Project duration as a measure of risk. b)Outline the application of Monte Carlo simulation to investment appraisal.Candidates will not be expected to undertake simulations in an examination context but will be expected to demonstrate an understanding of: i)The significance of the simulation output and the assessment of the likelihood of project success ii)The measurement and interpretation of project value at risk. c)Establish the potential economic return (using internal rate of return (IRR)and modified internal rate of return)and advise on a project's return margin.Discuss the relative merits of NPV and IRR. 3.问题与应用 a)What is NPV? b)What is IRR? c)Compare NPV and IRR. 第二节 1.主要内容 Application of option pricing theory in investment decisions

9 5. International investment and financing decisions (二)教学内容 第一节 1.主要内容 Discounted cash flow techniques 2.基本概念和知识点 a) Evaluate the potential value added to an organisation arising from a specified capital investment project or portfolio using the net present value (NPV) model. Project modelling should include explicit treatment and discussion of: i) Inflation and specific price variation ii) Taxation including tax allowable depreciation and tax exhaustion iii) Single period and multi-period capital rationing. Multi-period capital rationing to include the formulation of programming methods and the interpretation of their output iv) Probability analysis and sensitivity analysis when adjusting for risk and uncertainty in investment appraisal v) Risk adjusted discount rates vi) Project duration as a measure of risk. b) Outline the application of Monte Carlo simulation to investment appraisal. Candidates will not be expected to undertake simulations in an examination context but will be expected to demonstrate an understanding of: i) The significance of the simulation output and the assessment of the likelihood of project success ii) The measurement and interpretation of project value at risk. c) Establish the potential economic return (using internal rate of return (IRR) and modified internal rate of return) and advise on a project’s return margin. Discuss the relative merits of NPV and IRR. 3. 问题与应用 a) What is NPV? b) What is IRR? c) Compare NPV and IRR. 第二节 1.主要内容 Application of option pricing theory in investment decisions

2.基本概念和知识点 a)Apply the Black-Scholes Option Pricing (BSOP)model to financial product valuation and to asset valuation: i)Determine and discuss,using published data,the five principal drivers of option value (value of the underlying,exercise price,time to expiry, volatility and the risk-free rate) ii)Discuss the underlying assumptions,structure,application and limitations of the BSOP model. b)Evaluate embedded real options within a project,classifying them into one of the real option archetypes. c)Assess,calculate and advise on the value of options to delay,expand, redeploy and withdraw using the BSOP model. 3.问题与应用 a)What is basic assumption of BSOP model? b)What is application of BSOP model? 第三节 1.主要内容 Impact of financing on investment decisions and adjusted present values 2.基本概念和知识点 a)Identify and assess the appropriateness of the range of sources of finance available to an organisation including equity,debt,hybrids,lease finance,venture capital,business angel finance,private equity,asset securitisation and sale and Islamic finance.Including assessment on the financial position,financial risk and the value of an organisation. b)Discuss the role of,and developments in,Islamic financing as a growing source of finance for organisations:explaining the rationale for its use, and identifying its benefits and deficiencies. c)Calculate the cost of capital of an organisation,including the cost of equity and cost of debt,based on the range of equity and debt sources of finance.Discuss the appropriateness of using the cost of capital to establish project and organisational value,and discuss its relationship to such value. d)Calculate and evaluate project specific cost of equity and cost of capital,including their impact on the overall cost of capital of an organisation.Demonstrate detailed knowledge of business and financial risk, 10

10 2.基本概念和知识点 a) Apply the Black-Scholes Option Pricing (BSOP) model to financial product valuation and to asset valuation: i) Determine and discuss, using published data, the five principal drivers of option value (value of the underlying, exercise price, time to expiry, volatility and the risk-free rate) ii) Discuss the underlying assumptions, structure, application and limitations of the BSOP model. b) Evaluate embedded real options within a project, classifying them into one of the real option archetypes. c) Assess, calculate and advise on the value of options to delay, expand, redeploy and withdraw using the BSOP model. 3. 问题与应用 a) What is basic assumption of BSOP model? b) What is application of BSOP model? 第三节 1.主要内容 Impact of financing on investment decisions and adjusted present values 2.基本概念和知识点 a) Identify and assess the appropriateness of the range of sources of finance available to an organisation including equity, debt, hybrids, lease finance, venture capital, business angel finance, private equity, asset securitisation and sale and Islamic finance. Including assessment on the financial position, financial risk and the value of an organisation. b) Discuss the role of, and developments in, Islamic financing as a growing source of finance for organisations; explaining the rationale for its use, and identifying its benefits and deficiencies. c) Calculate the cost of capital of an organisation, including the cost of equity and cost of debt, based on the range of equity and debt sources of finance. Discuss the appropriateness of using the cost of capital to establish project and organisational value, and discuss its relationship to such value. d) Calculate and evaluate project specific cost of equity and cost of capital, including their impact on the overall cost of capital of an organisation. Demonstrate detailed knowledge of business and financial risk